Your 30s are an emotional and financial roller coaster.

You are trying to pay down student loans, manage an ever-growing list of responsibilities, and somehow tuck money away for the future. Just when your salary begins to look promising, big life moments — marriage, home ownership, starting a family — seem to take a huge bite out of your finances.

So your dreams of building wealth just keep getting pushed further and further away.

Fortunately, you don’t have to wait to become rich.

This article outlines how to build wealth in your 30s without sacrificing your life’s most meaningful moments. We’ll answer pressing questions like:

- How do you manage big expenses while wealth-building?

- What are the best investment ideas to build wealth in your 30s?

- Should you consider a side hustle or focus on your career?

So, if you’ve been feeling like your dreams of building wealth are drifting out of reach, keep reading. This action-packed guide will help you not just survive, but thrive during this challenging decade.

What Does It Mean To Build Wealth In Your 30s?

Wealth can mean different things to different people.

Some pursue FIRE and look forward to retiring as early as possible. They may want to ditch the rat race altogether and live life on their own terms.

Others are happy working until a traditional retirement age but expect to be rewarded accordingly. They may hope to accumulate enough assets to live a lavish lifestyle through their golden years.

No matter your definition of wealth, one thing is true. Money doesn’t solve all of your problems, but it sure solves your money problem.

Imagine not having to stress over medical bills or unexpected car repairs. Imagine being able to pay for that European vacation or the perfect kitchen makeover without stealing from your future.

Whether it’s achieving financial independence, enjoying a secure retirement, or realizing your dreams, wealth gives you the power to live your life without worrying about financial constraints.

What Should My Net Worth Be At 30?

Most experts recommend that your net worth at 30 should be at least 50% of your pre-tax annual income. For example, if your gross annual income is $70,000, you should have a net worth of $35,000+.

The Millionaire Next Door sets an even higher standard.

Author Thomas J. Stanley states that your net worth should be: Age x pre-tax income ÷ 10. Using the same $70,000 income, that would translate to a net worth of $225,000 (30 x 75,000 ÷ 10).

Despite these lofty targets, the reality is many 30-year-olds have a long way to go.

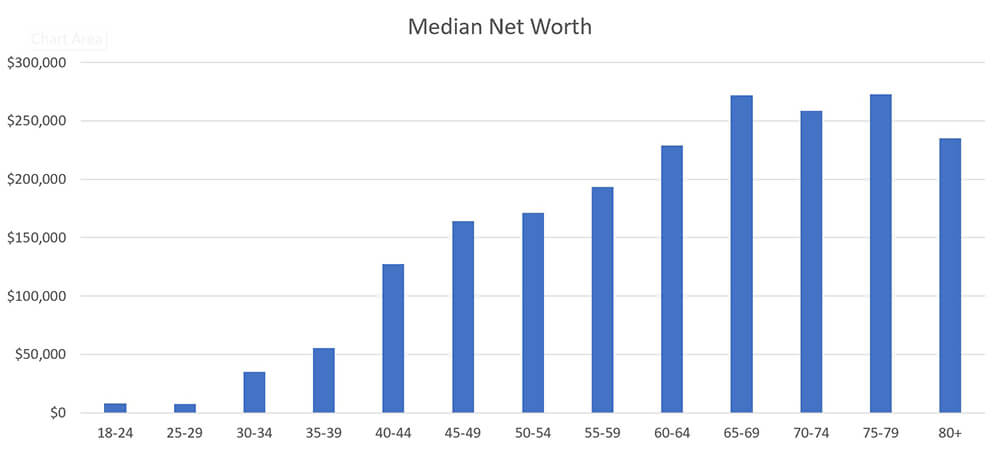

Smart Asset estimates (above) that Americans between the ages of 25 to 29 years have a median net worth of just $7,512. And Lexington Law reports that the median net worth for Americans under 35 years old is only $13,900.

So, most people enter their 30s with only a slightly positive net worth. And that’s okay! What’s important is that you don’t leave your 30s in the same shape.

How To Build Wealth In Your 30s: 6 Key Steps

You don’t need luck or a fancy degree to build wealth. The truth is anyone can become wealthy. You just need ambition and the right strategy.

The following six steps will show you how to build wealth in your 30s and beyond.

1) Set SMART Financial Goals

Have you ever thrown a dart with your eyes closed? You probably didn’t hit the bullseye, right?

Building wealth is no different. Without a clear destination in mind, who knows where you’ll end up?

Rather than taking a shot in the dark, SMART goals give you the laser focus you need to hit your target every time.

What are SMART goals?

- Specific

- Measurable

- Attainable

- Relevant

- Time-based

Let’s see how you turn a goal into a SMART goal:

Goal: “Save money for a better future.”

SMART Goal: “Save $500 every month for the next two years to build a $12,000+ emergency fund.”

See the difference? Unlike the regular goal, which is a vague hope for the future, the SMART goal sets a clear target, a plan of action, and a timeline.

Use SMART goals like the GPS for your wealth-building journey. They provide the specific action steps to reach your desired destination no matter what obstacles appear in your path.

2) Update Your Budget

The budget you had in your 20s probably won’t cut it in your 30s. Now’s the time to revamp your budget so that it aligns with your SMART financial goals.

Two popular options are the 50/30/20 budget and the 30/30/30/10 budget.

The 50/30/20 budget allocates 50% of your income to needs (including housing), 30% to wants, and 20% to savings and investments. This budget is good for people who want a balance between enjoying today and investing for tomorrow.

On the other hand, the 30/30/30/10 budget is for folks comfortable cutting back today to build wealth faster. It divides your income into 30% for housing, 30% for needs, 30% for savings and investments, and 10% for fun.

As you evaluate these options and revise your budget, pay special attention to the following points:

Build an emergency fund.

Don’t let unexpected expenses derail your financial goals. Experts recommend setting aside 3 to 6 months of living expenses, just in case. Keep these funds in an interest-bearing account like a high-yield savings or money market fund.

Plan for milestone expenses.

Don’t wait until the last minute to start saving for your first home or dream wedding. Plan for these events in advance by creating individual sinking funds. These are separate accounts designed to set aside money for specific future expenses or goals.

Max out any matched 401(k) contributions.

If your employer offers matching contributions, max out this benefit. After all, it is a 100% return on your money. Take advantage of the “free” money by contributing up to the cap. For example, if your employer offers a 50% match up to 6% of your income, make sure you contribute 6% of your income.

Avoid lifestyle creep.

Instead of buying the latest iPhone or upgrading your car every five years, embrace stealth wealth. This is the practice of investing heavily in your future without flaunting material possessions. So when you receive your next bonus or raise, sock 50% to 75% of that additional income into investments.

3) Ditch Your Debt (For Good)

The sooner you get rid of debt, the sooner you can focus your energy on investing. Your goal should be to eliminate all bad debt. In most cases, this means everything besides your mortgage.

The avalanche method of debt reduction involves targeting your most expensive debt first. Rather than spreading extra payments among all your debts, you concentrate on the one with the highest rate. When that’s paid off, you then tackle the next highest.

On the other hand, the snowball method is all about building momentum. Rather than the highest interest rate, you focus on the debt with the smallest balance first, and so on. This way, you will see results quickly and stay motivated.

Once you finally make your last debt payment, treat yourself to a scoop of Haagen Daaz. Then close the account or cut up the credit card to remove that temptation entirely. The last thing you want is to replace paid debt with more debt.

4) Best Investment Ideas To Build Wealth In Your 30s

Your 30s are the time to get serious about investing. With your career advancing and retirement on the radar, you can take advantage of decades of compound gains to multiply your wealth.

Remember, money invested in your 30s is worth a heck of a lot more than investments made later in life.

Don’t Be Conservative: Buy Stocks

How do you build wealth from nothing? By taking risks.

But that doesn’t mean gambling your life savings on the latest Reddit stock trend or a shiny new cryptocurrency. Instead, it’s about making sound investment decisions, taking calculated risks, and using time to your advantage.

And stocks are likely your best bet.

The stock market’s average annual return over the past 50 years is over 10%, making it the ideal investment to predictably grow your wealth.

At 10%, you only have to invest $500 per month (starting at 30) to become a millionaire before you turn 60. Bump that to $1,000 per month, and you can be a millionaire before 55!

For this reason, most experts recommend using stocks as the foundation for your investment portfolio. But contrary to popular belief, you don’t need to be an expert stock picker or market timing wizard to make money.

You can get rich by investing in stocks with just three simple strategies:

- ETFs: Exchange-traded funds offer diversification and flexibility. They can provide exposure to various markets and indices without the hassle of selecting individual stocks.

- Robo-Advisors: Apps like Betterment and Vanguard Digital Advisors help you create low-cost personalized investment portfolios tailored to your financial goals and risk tolerance.

- Dollar-Cost Averaging: Rather than trying to time the market, invest the same amount of money every single month. If you do this, you will end up buying more shares when prices are low and fewer shares when prices are high. This will naturally lower the overall average cost per share in your portfolio.

How To Build Wealth In Your 30s With Real Estate

More millionaires are made investing in real estate than any other asset. Sorry, Bitcoin.

Not only do rentals provide monthly cash flow, but they also tend to appreciate over time. According to the Federal Reserve, U.S. home prices increased 12.5% in 2022, substantially outpacing stocks during the same period.

Rental properties are also a great way to hedge against inflation. As prices rise, rents generally follow. This means the value of your rental property should increase too.

A simple way to get started in real estate is to buy a principal residence and live there for two years. Then, move out, rent the first house, and buy a new home.

In doing this, you can take advantage of the more favorable financing terms offered to owner-occupied properties. Plus, you will also get valuable tax deductions for any expenses associated with the property (mortgage interest, property taxes, insurance, maintenance, and depreciation).

By financing your properties, you can use leverage to juice your real estate returns. But be careful, because debt is a double-edged sword.

Although debt will boost your potential returns, it also introduces risk. Remember, you still have to make mortgage payments even if a tenant moves out and you don’t have any rental income.

The ultimate goal with this strategy is to eventually own your properties free and clear. Without any mortgage payments, you will have much more cash flow than when the property was encumbered with debt.

For example, let’s say you have five rental houses with an average rent of $2,000. That’s $10,000 per month in passive income once the mortgages are paid off!

If you want to get into real estate, but don’t yet have the funds to buy a physical property, you can still invest through REITS and crowd-funding apps.

REITs are companies that manage or finance income-producing real estate, like large commercial and retail properties. You can buy shares in these companies on the stock exchange and begin collecting dividend checks based on the REIT’s performance.

On the other hand, crowd-funding real estate apps let investors pool their funds together to invest in specific projects. They provide a way to diversify your real estate holdings without needing a lot of capital.

Consider Alternative Investments

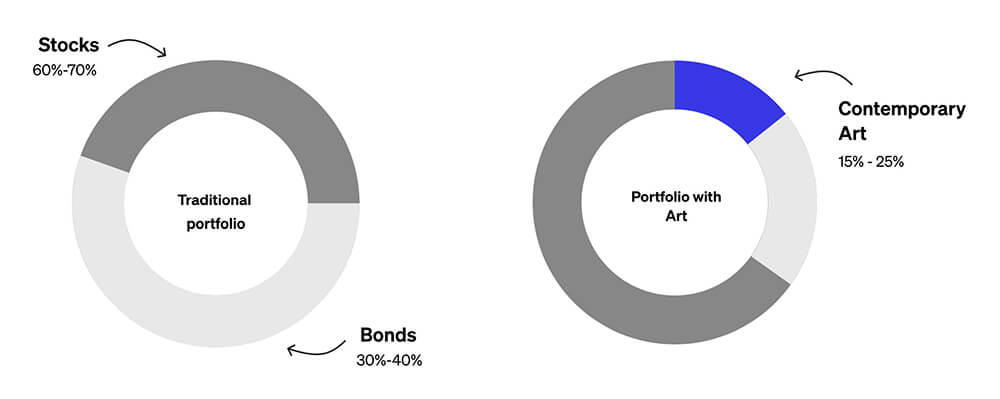

Looking to boost your returns? Alternative assets can provide that extra zing that takes your portfolio to the next level.

Whether you diversify with cryptocurrency, fine art, or precious metals, these assets can provide greater returns than stocks and real estate. Plus, their prices often move independently of conventional assets, adding an extra layer of protection against market fluctuations.

Cryptocurrency, for example, allows you to participate in the decentralization of the world’s money supply. Although the potential returns could outpace stock investments, this market is extremely volatile and not for the faint of heart.

Fine art is another popular alternative investment. Since 1995, contemporary and post-war art has returned 12.6%, outperforming the S&P 500.

Apps like Masterworks make it easy to get started. Their experts take care of buying, storing, insuring, and selling artwork that has significant appreciation potential. As an investor, you can buy shares in these paintings and then receive a portion of their eventual sales based on your ownership percentage.

Gold is one of the oldest alternative investments, with a proven track record of providing stability when markets turn south. Besides being a great store of value, gold tends to have an inverse relationship with stock prices during periods of financial unrest.

For example, while other asset classes took huge losses during the pandemic, gold prices surged by 25% in 2020.

Although they provide the opportunity for greater returns, alternative assets also come with higher risks and less liquidity. So don’t go overboard.

We recommend limiting your exposure to no more than 5% to 15% of your overall portfolio, depending on your risk tolerance.

Invest In Income

The ultimate goal of any portfolio is to provide income, whether that’s an extra $1,000 per month in spending money or enough to live off of in retirement. Your 30s are a great time to start building extra streams of income with assets like:

- Dividend-paying stocks

- Corporate bonds

- Government bonds

- CDs

- Franchise investing

- Farmland

The predictable income from these assets can help stabilize your portfolio from market volatility. Plus, you can use the income they produce to invest in more assets.

While there are a variety of income-producing assets available, the most widely accepted are dividend stocks and debt. The former includes companies like Coca-Cola, Walmart, and Johnson & Johnson, which have been paying dividends for decades.

But the latter is a very defensive investment. Debt investments offer predictable streams of income, with little to no risk. As a result, the long-term returns are typically much lower than stocks.

So in your 30s, keep any bond, CD, or cash holdings to no more than 20% of your portfolio. Otherwise, you could be missing out on gains from equity investments during the biggest growth years of your life.

5) The ONE Asset You Can’t Afford To Ignore

If you want to build wealth in your 30s, you need to invest in YOU! Ongoing education is the cornerstone of financial success.

At this age, it’s much better to focus on your earning capacity rather than your net worth.

Look for skills that can increase your income. Ideally, they will further your career and be used to build alternative income sources. Continue stacking these skills to open up even more wealth-generating opportunities.

Consider brushing up on your persuasive writing and sales and marketing. Or delve into project management and time optimization techniques. Not only will these skills serve you in your present job, but you can use them to launch new business ventures on the side.

This is crucial because many 30-somethings believe that the only way to wealth is through their careers. And if they work hard enough, they’ll be rewarded for their efforts.

However, over 15 million Americans lost their job in 2022. So if you’re counting on your current position to make you rich, you could be in for a rude awakening.

So use your new skills to launch a side hustle — anything you do to earn extra money outside of your 9-to-5 job.

Some popular options are:

- A YouTube channel

- A blog

- An e-commerce site

- Translation

- Freelance writing

- Social media management

- Virtual assistance

The most important asset to build wealth in your 30s isn’t stocks or real estate but your own potential. Spend time investing in personal growth and honing your skills. Because the more you learn, the more you earn.

6) Don’t Go At It Alone

We like to think of self-made millionaires as solitary mavericks who took risks that others wouldn’t. But nothing could be further from the truth.

Elon Musk would have never built Tesla without the help of J.B. Straubel. Steve Jobs’s visionary ideas only took flight due to the engineering genius of Steve “Woz” Wozniak. And Bill Gates may never have left Harvard Law to start Microsoft without Paul Allen’s support.

Building wealth isn’t about being a lone ranger, but surrounding yourself with people who have similar goals.

So if you’re in a relationship, be sure to include your partner in financial discussions.

For example, have a monthly budget date night. Over wine and snacks, review your finances in an open and supportive environment. You may find that this practice brings you closer and eliminates any money-related conflicts.

Or, consider joining a mastermind. These groups of like-minded individuals can provide ideas and keep you motivated.

A great place to start is with peers in your industry. You can meet once a month over lunch to discuss business challenges and brainstorm solutions.

Finally, don’t underestimate the power of a mentor.

What better way is there to become wealthy than to learn from someone who already did it? Their wisdom can save you years of trial and error.

The bottom line is that building wealth takes a team effort. And having the right people in your corner can make all the difference.

Final Thoughts

Building wealth has little to do with luck. You don’t need to pick the next Tesla or Microsoft to change your life.

Instead, wealth is created through discipline and the consistent application of these 6 strategies:

- Set SMART financial goals

- Update your budget

- Ditch your debt

- Invest in your future

- Invest in yourself

- Build a community

These steps show you how to build wealth in your 30s and create a foundation for a secure future. After all, the efforts you make today will compound for decades to come.

So take small, deliberate steps every day. Before long, you will have more than just money — you will have the freedom to live the life of your dreams.