Whether you’re building an emergency fund or saving up for a large expense, it is always best to keep some cash on hand. One of the best ways to grow and protect your money is to save inside accounts with compound interest.

Stowing your money in a compound-interest savings account will allow you to earn interest without having to jump through hoops to access your funds. Plus there are many options for high-interest savings accounts. You can go with a traditional FDIC-insured bank, an FDIC-insured online bank, or an NCUA-insured credit union.

To help you kick-start your savings goals and reach financial independence quicker, we’ve compiled a list of the best accounts with compounding interest.

How do you determine the best high-yield savings accounts?

When evaluating the best accounts for earning interest, look at the annual percentage yield (APY), fees, ease of use, and accessibility.

There are hundreds of savings accounts offered by credit unions, online banks, and brick-and-mortar banks. The question is, how do you choose the best account for your needs? Here are the factors to consider when selecting a savings account with compounding interest:

- APY: The higher the APY, the faster your money will grow. It’s important to be aware that APY, unlike APR, does take compounding into account. For this reason, it’s best to compare APYs when looking at accounts.

- Ease of use: The savings account you choose should be easy to navigate. The terms and conditions should be easily understandable as well.

- Fees: Some banks charge a monthly maintenance fee and other costs that could reduce your interest earnings, so pay close attention to the fees charged.

- Account accessibility: Your savings account should also be easily accessible. Scheduling your initial deposit, checking your balance, and even withdrawing the funds should be as seamless as possible and in sync with your personal preferences (e.g. online transfers versus in-person ATMs).

13 Best Accounts with Compound Interest

Here’s a list of the compound interest savings accounts you may want to consider:

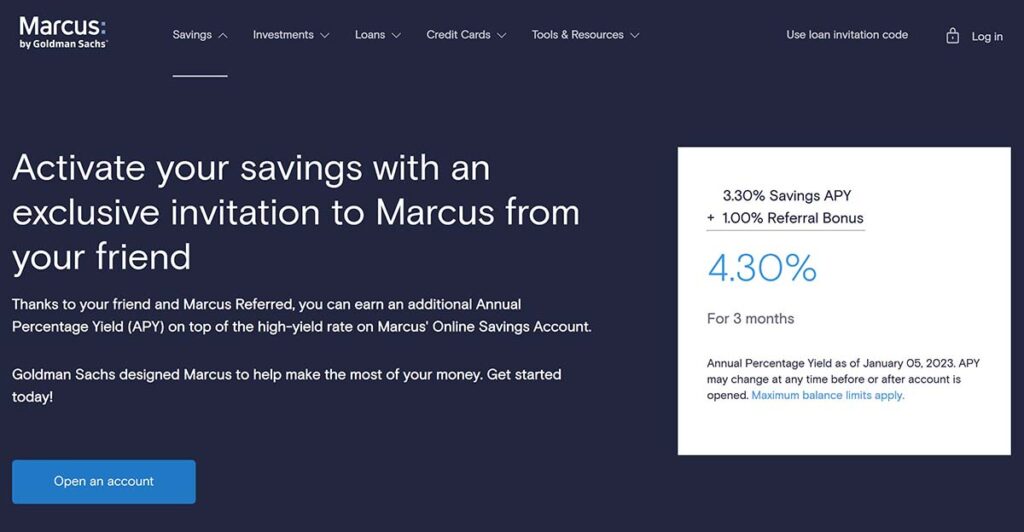

1. Marcus by Goldman Sachs

A household name for investment banking, Goldman Sachs now offers consumer banking services with Marcus by Goldman Sachs. Offerings by Marcus include high-yield savings accounts, high-yield certificates of deposit (CDs), and personal loans at no fee.

Marcus by Goldman Sachs is hailed for its above-average rates for all its products. The Marcus high-yield savings account’s annual percentage yield is well above the national average at 3.30% APY. Plus, if you sign up here, you’ll earn 4.30% APY for your first 3 months.

There is no requirement for a minimum deposit to open the account and no monthly fees or extra charges. And Marcus allows same-day electronic transfers from other financial institutions for up to $100,000. The bank also provides a mobile app with insight tools to help you monitor your savings progress.

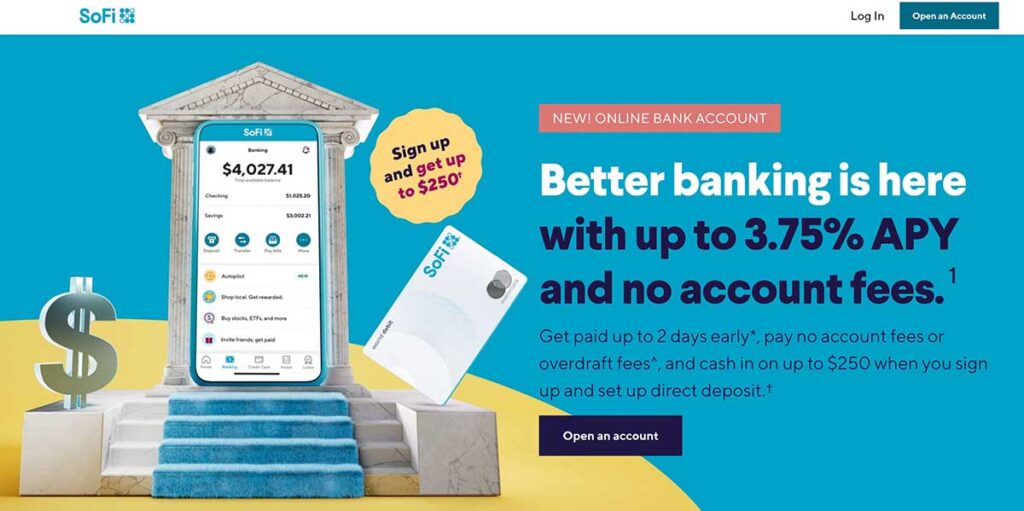

2. SoFi

Sofi’s checking and savings account, one of their latest offerings, is gaining popularity quickly. Why? The account currently offers a 3.75% APY if you set up direct deposit, and a 2.50% APY otherwise. This is one of the best savings accounts to consider if you’d like to earn a significant yield on any cash you have lying around.

The SoFi checking and savings account does not charge any overdraft and has no minimum balance or monthly fees. Additionally, account holders can access ATMs without fees through more than 55,000 Allpoint Network locations. Lastly, SoFi also offers a one-time $50 to $300 bonus to new account holders for qualifying direct deposits.

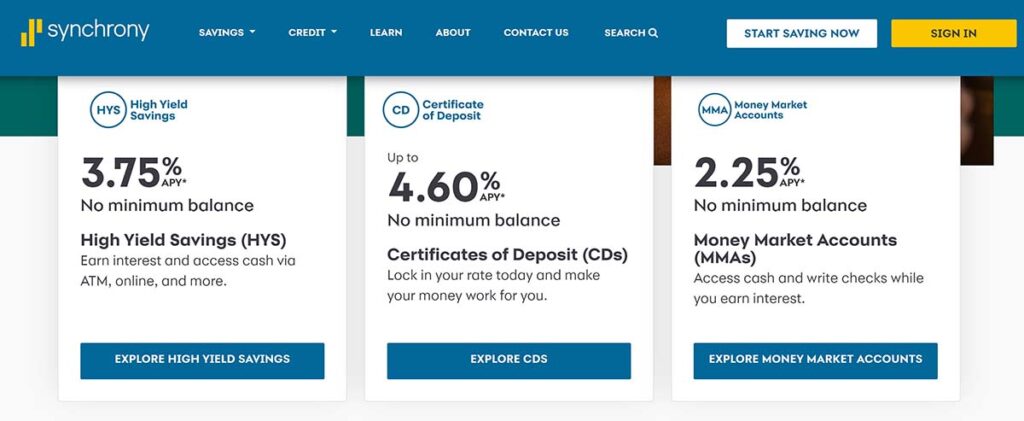

3. Synchrony

Synchrony Bank’s high-yield savings account is one of the best accounts with compound interest in terms of convenience. Synchrony makes it quick and easy to access and withdraw your money. There is no minimum balance requirement or monthly fees to be paid with this account. Additionally, it offers a competitive 3.75% APY.

Synchrony account holders get access to a wide variety of withdrawal options. You can access your money through the ATM, wire transfer, and electronic transfers to and from other bank accounts. You are limited to six free withdrawals or transfers in one statement cycle, but there is no limit on the transactions you can conduct via ATM. While Synchrony does not charge ATM fees, ATM operator fees still apply.

4. Varo

Varo Bank is a fully-online national bank, and the first fintech company to get a national bank charter. With the Varo online savings account, you don’t need to keep a minimum account balance or pay monthly maintenance fees. All you need is your government-issued ID, social security number, and a device to access the Varo mobile app.

The Varo savings account offers a 3.00% APY on all balances. Customers also get to earn a higher interest rate of up to 5.00% APY if they meet a number of monthly requirements:

- Direct deposits of $1,000 or more every month

- Have $0 at the end of every qualifying period

- Savings account balance not higher than $5,000 each business day

Varo Bank is perfect for those who are just starting out and need extra help saving their money.

5. Live Oak Bank

If you’re looking to save your money online in a high-yield account, you should consider opening a Live Oak Bank account. Live Oak Bank offers various savings options, including savings accounts and CDs, to customers across the country.

Live Oak offers a competitive interest rate, with a 3.50% APY on any balance. You do not need a minimum opening deposit for the savings account, and you won’t have to pay a monthly account maintenance fee either. The Live Oak mobile app allows users to manage external accounts from other accounts, a unique feature.

Additionally, money deposited in a Live Oak Bank savings account is FDIC-insured, meaning your funds are protected for up to $250,000 per account.

6. Ally Bank

If you’re looking for a one-stop shop for all your banking needs, consider Ally Bank. Their savings account is one of the best high-yield savings accounts, offering a solid 3.30% annual percentage yield.

Aside from the competitive APY, there’s no monthly maintenance or minimum account balance. The savings account is great on its own, but having an Ally checking account also opens you up to even more benefits. With Ally’s savings account, you can create multiple “buckets” within the same account to help you organize your saving goals, or take advantage of features like round-ups and recurring transfers.

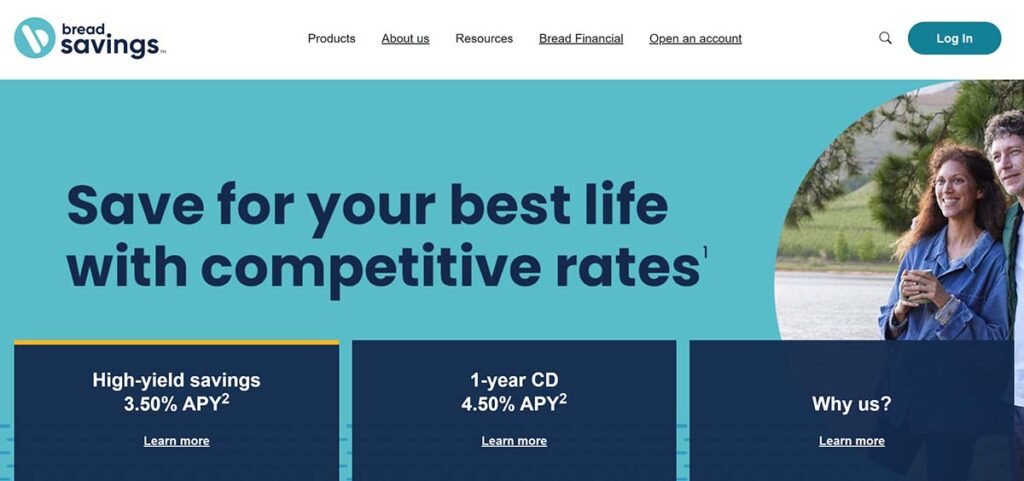

7. Bread Savings

Formerly Comenity Direct, Bread Savings is best for customers who enjoy online banking and would like to save their money in an account with competitive yields. Bread Savings offers a 3.50% interest rate, which is well above the national average.

For the account, you need a minimum deposit of just $100, and you won’t have to pay any monthly maintenance fees. However, the bank does not have physical branches or an ATM network, so you can only deposit money through the bank’s app or an ACH transfer.

8. Discover Bank

Discover Bank is a more prominent financial institution that offers services like personal loans, student loans, and credit cards. Their online savings account offers a competitive yield at 3.30% APY.

There is no minimum deposit to open an account, and there is no minimum balance requirement or monthly maintenance fee either. While you won’t get an ATM card for the account, the bank offers free official bank checks to all of its customers.

9. Sallie Mae

The Sallie Mae SmartyPig Account is ideal for individuals who are starting small. It offers a competitive high-yield savings account, with a 3.20% APY and daily compounding interest.

With the SmartyPig Account, you also get access to various savings tools to help you create and track financial goals. Sallie Mae’s high-yield savings account does not have a minimum balance requirement or monthly fee charges.

10. Vio

Vio Bank is the online division of MidFirst Bank, and it is one of the best accounts with compound interest. The bank offers a 1.10% APY and requires only a $100 minimum to open an account.

If you go paperless, there are no monthly charges for the account. For those who want to receive paper billing, there is a $5 monthly fee. Vio Bank has no checking or ATM network, but its savings account is excellent for people whose goal is to stash away their money and watch it grow.

11. American Express

If you’re already an AmEx credit card holder and looking for a high-yield savings account, you might want to consider American Express. This way, you get the convenience of visiting one website for all your financial accounts.

American Express offers an online savings account with a 3.30% APY. There is no minimum deposit required to open and no monthly service fee. Though there is also no ATM card for the savings account.

12. LendingClub

If you want an online bank with competitive yields, low fees, and unlimited access to ATMs, then LendingClub bank is an ideal option. Its high-yield savings account offers up to a 3.60% APY, and you only need $100 to open an account.

The APY does depend on your account balance though, and you will need a balance of at least $2,500 to earn the highest APY, which could act as your incentive to save more. LendingClub charges no monthly maintenance fees and includes a free ATM card.

13. Citibank

Citibank, one of the world’s largest financial institutions, has a wide range of deposit and lending products all across the globe. The Citi Accelerate savings account pays a competitive rate of 3.40% APY. However, this account is only available in select markets.

There’s no minimum opening deposit for this account, but you’re required to maintain an average monthly balance of $500 or pay a $4.50 monthly service fee. If you have both checking and savings accounts, you can avoid the service fees altogether.

What is compound interest?

Put simply, compound interest is the interest earned on interest. With compound interest, you earn interest on both the principal (initial deposit you saved) and the interest that you have already accumulated over time.

Whenever you deposit money in a savings account or any other similar account, you earn interest based on that contribution. For instance, if you save $1,000 in an account that pays 1% interest per annum, you would earn $10 in simple interest at the end of that year.

With compound interest, in year two you will earn 1% of $1,010 一 the initial amount plus the interest accrued during year one. Your interest earnings grow more quickly with compounding interest, and so do your savings in the long run.

Different accounts compound interest on different schedules; some compound daily, and others weekly or monthly. In general, the shorter the compounding period the better – and this is something you must account for when using APRs. APYs, on the other hand, account for differences in compounding schedules, making them a simpler measure for comparison.

Why is a compound interest account important?

You don’t just need a checking or savings account, you need a compounding interest account. Why is that? The simple reason is that compound interest gives you the chance to grow your money faster. How much interest you earn will depend on several factors, including how much you save in the first place. The nature of your savings account is another key determinant.

A compound interest account pays interest on both the money you invest and the interest you already accrued at the end of every compounding period. This will help your money grow faster, and allow you to reach your financial goals much quicker.

Accounts with compound interest are among the best ways to protect yourself against inflation, the rising cost of living, reduced purchasing power, and other financial challenges.

Compound Interest Topics

Simple interest or compound interest?

As an investor, it’s important to understand the underlying principles of both simple interest and compound interest. Simple interest is calculated differently from compound interest.

With simple interest, the interest earned is based on the principal amount only. The interest you have already accrued is not taken into account in the simple interest calculation.

Using the previous $1,000 example, if you were earning 1% in annual simple interest, all you would be entitled to is $10 of interest each year. This $10 is not added to the principal and thus does not increase the amount of your interest earnings over time.

For your interest-earning accounts, you want them to be calculated with compound interest. This enables your savings account balance to grow faster as you earn interest on an increasingly larger balance.

Simple interest is mostly used when calculating interest on short-term consumer loans such as personal loans and auto loans. Credit card companies, on the other hand, charge compound interest which is why credit card debts can grow so easily.

What is the compound interest formula?

To understand how compound interest works, it’s important to know the compound interest formula. Several key factors go into calculating compound interest, and the variables drastically affect your returns. The compound interest formula is:

A = P(1 + [r/n]) ^ nt

A – this is the amount of money that accumulates after n years, including the interest from the previous compounding period.

P – The starting principal amount you deposited or borrowed. The more money you deposit, the faster your savings accelerate.

r – This is the annual interest rate, expressed as a decimal. The higher the interest rate, the more money you stand to earn.

n – This is the frequency of compounding, i.e., how many times the interest is compounded in a year. If interest is compounded often, like daily or monthly, your balance can grow rapidly.

t – The time or number of years the money compounds in the account. The longer you leave your money in the account, the more it compounds and the more money you earn.

Other examples of accounts with compound interest

Join a credit union

Credit unions are financial institutions owned by the members of the union. They are mostly non-profit entities looking to serve the aims of their members. They typically offer lower loan rates and better savings account rates. Joining a credit union can be an effective way to access accounts with compound interest.

There is a catch, though. To join a credit union, you must meet certain requirements. These requirements depend on the credit union and how it’s organized. Most of them will require you to be part of a specific group such as a labor union, live in a particular area, or work for a particular employer.

Money market accounts

A money market account is a special type of savings account at a bank or credit union. Money market accounts typically pay higher interest rates compared to traditional savings accounts. They also come with check-writing and debit card privileges, but you have limited access to your money.

The bank or credit union pays you a high-interest rate, but you must deposit a certain amount and keep your account balance above a certain level. If the balance falls below the minimum, a monthly fee is imposed. Money market accounts should be among your options, but ultimately the decision depends on your short-term cash needs, savings timeline, and deposit amount.

How else can I earn compound interest?

Build a CD ladder

Building a CD ladder involves investing in many certificates of deposit with staggered maturities. This way, you benefit from the high rates on longer-term CDs while keeping some of your money accessible in short-term CDs. These staggered maturities give you the potential to make more money by reinvesting in longer-term CDs.

Buy dividend-paying stocks

Dividend stocks are publicly traded companies that share their profits with shareholders via regular dividends. To earn dividends on a stock, you must own shares in that company, either through a brokerage account or a retirement account such as Roth IRA. By reinvesting your dividends, which many brokers enable automatically, you can effectively gain compound interest on the company’s dividend schedule.

Zero-coupon bonds

A zero-coupon bond is a type of bond that doesn’t pay interest. Instead, they trade at a discount to their face value. These savings are realized over the lifetime of the bond, as the “coupons” are effectively reinvested instead of paid out as interest.

Zero-coupon bonds are based on the time value of money. This concept illustrates that money is worth more now than an identical amount in the future. Most zero-coupon bonds are compounded semi-annually.