Investing has changed a lot in recent decades.

Gone are the days when only giant institutions and the fabulously wealthy could access exciting, niche opportunities. Nowadays, regular investors (like me and you) can get in on the action too!

And one category worth exploring is alternative investments.

Unlike the well-known asset classes, like stocks and bonds, alternative investments are much more unique. But they can be powerful additions to a portfolio!

In fact, allocating up to 30% of your portfolio to alternative investments can improve your diversification, help you manage risk better, and generate higher risk-adjusted returns (giving you extra bang for your buck).

In this article, we will discuss 10 of the best alternative investments you should consider for your portfolio. From private equity to collectibles, we will look at how each of these “alts” work and how they can benefit your portfolio. Let’s get started!

What Is Alternative Investing?

Alternative investing is about expanding your investment universe outside of the traditional asset classes.

These types of investments usually require more active management than passive investing (where you buy and hold a basket of stocks, for example). They also often involve higher transaction costs and illiquidity (meaning it can take time to liquidate an investment).

But they offer the potential to generate outperformance in your portfolio over the long term — if you know what you are doing.

These alternative investments may include:

- Hedge funds

- Private equity

- Venture capital

- Fine wine

- Premium art

- And more!

Alternative investing can even refer to more advanced investment methods, like hedging, leverage, arbitrage, or adding long-short strategies to traditional assets.

Overall, alternative investments offer the potential to diversify your portfolio and access new opportunities that traditional asset classes can’t provide. So if you are a savvy investor looking for a unique angle, these “alts” might be just what you need.

3 Reasons To Own Alternative Investments

Broadening your holdings beyond stocks, bonds, and cash to include alternative strategies can be a game-changer for your portfolio. Here’s why:

Diversification

Alternative investments help diversify your portfolio by offering different risks and rewards than equities, debt investments, and CDs or cash.

Because these investments face different kinds of risk, the returns from alts aren’t as closely tied to each other or the overall market. In other words, these investments have historically shown a low to moderate correlation with market indices.

This means that if one type of asset loses value (stocks, for instance), “alts” in your portfolio may not be affected by the dip — or they may even increase in value.

Risk Management

Given the unique characteristics of certain alternative investments, their returns can be less volatile. As a result, including them in a diversified portfolio can help produce more stable and reliable returns, while reducing overall risk.

This is a highly desirable feature when traditional stock and bond markets experience a sudden decline (like in 2020 and 2022). And it is especially important for those nearing retirement, in retirement, or prone to emotional investing.

Better Risk-Adjusted Returns (or “More Bang For Your Buck”)

Alternative investing opens the door to unique investment opportunities not found in traditional markets. These assets have the potential to generate higher returns per unit of risk.

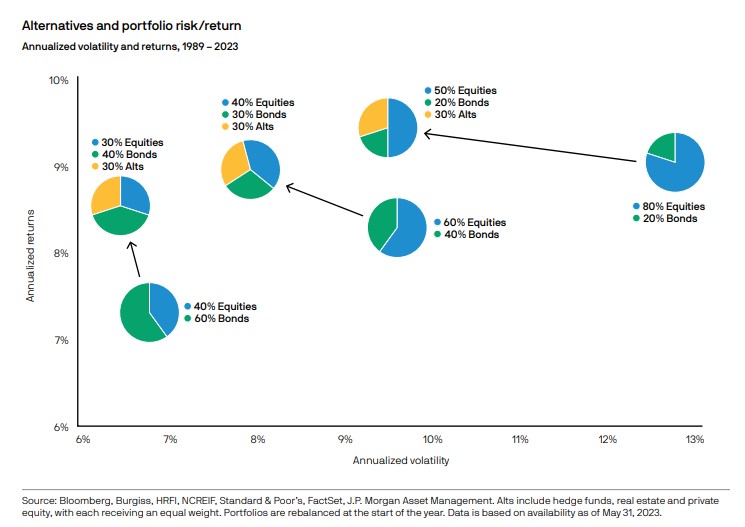

To illustrate this point, here are a few different portfolios, charted based on their returns and overall volatility from 1989 to 2023.

The graph below shows that including a mix of 30% alternatives would have resulted in better risk/return profiles when compared to portfolios with allocations of:

- 40% stocks and 60% bonds

- 60% stocks and 40% bonds

- 80% stocks and 20% bonds

Source: J.P. Morgan Asset Management

Here we can see that the best overall returns were accomplished through a mix of 50% equities, 20% bonds, and 30% alts.

But even more importantly, this data makes it clear that investors could have earned more money while experiencing less market volatility by owning alternative investments.

Key Takeaway: Decreasing exposure to the traditional stock and bond portfolio and allocating some funds to alternative investments may produce more bang for your buck.

Potential Risks To Be Aware Of

“If alternative investments are so great, why isn’t everyone piling in?” – Probably you.

Well, alts come with their fair share of risks too:

- Less regulation: They’re not as closely monitored by regulatory agencies.

- Less liquidity: Fewer buyers and sellers means that it can take longer to liquidate an investment.

- Limited price discovery: Due to the reduced frequency of trades and deals, it is more difficult to understand what a “fair” price is.

- Less transparency: Some investment funds may not offer complete transparency regarding their underlying holdings.

- Higher costs: There can be significant fees and commissions associated with alternative investments, including management expenses and fund charges.

- Strict terms: The sponsoring fund may limit your ability to access funds or dictate when you can buy and sell.

Investors must understand all of the risks they face when considering alts. Investment decisions should always be made “eyes wide open”, and alts are no exception.

Unfortunately, the U.S. government’s primary way of regulating alternative investments is through limitation. And they use wealth as a proxy for sophistication. So certain alternative investments are limited to accredited investors. This means you must meet income or net worth requirements to be able to invest.

Luckily, these barriers are slowly coming down and alts are becoming more accessible to all investors.

10 Best Alternative Investments To Consider

Hedge funds, private equity, venture capital, and fine wine are just a few examples of alternative investments. Here’s a list of ten of the best options to consider:

1) Investment Funds

Investment funds are an investment vehicle that collects money from a group of individuals and invests on their behalf. They often come with the benefit of professional management. So they can be a great choice for regular investors looking to diversify their portfolios without any additional work.

- Mutual funds: Funds that invest in alternative strategies or assets (like hedge funds or private equity), often in a “fund-of-funds” format.

- ETFs: Funds that trade on stock exchanges and track a specific index or asset class, like the S&P 500, gold, or commercial real estate.

- Hedge funds: Private investment partnerships that gather funds from accredited investors and use advanced trading strategies, like derivatives and leverage, in an effort to generate higher risk-adjusted returns.

Pros & cons:

- Mutual funds and ETFs: Have abundant liquidity, so investors can buy and sell shares freely at market prices. This is why they are frequently referred to as “liquid alts.”

- Hedge funds: Have the potential for higher returns, but that comes at the cost of limited liquidity. Also, they charge much higher fees than other investment funds and they often require significant minimum investments.

How to invest:

- Mutual funds and ETFs: You can open an investment account with a brokerage firm and purchase shares directly.

- Hedge funds: You typically have to meet eligibility criteria, including accreditation and high net worth. Interested investors should contact hedge fund managers directly to learn about investment opportunities.

2) Private Equity

Private equity refers to investments made in private companies, or those not listed on a public exchange. Typically these investments are made by institutional investors or private equity firms.

Pros & cons:

Private equity involves investing in undervalued businesses with the hope of generating cash flow and potentially reselling assets down the line.

One advantage of this asset class is that investors can influence the operation and strategic direction of the companies they buy. As a result, strong executors can have a significant impact on the company’s ultimate success.

However, these investments often have limited liquidity, including extended “lock-up” periods where you may be unable to access your capital for years.

How to invest:

The most common way to invest is through a private equity (PE) firm. But these firms generally require investors to be accredited.

You can also access private equity via funds-of-funds and ETFs that track the performance of private equity firms (as previously mentioned).

Finally, new platforms like Fundable, Wefunder, SeedInvest, and Linqto have given rise to private equity crowdfunding. In other words, smaller dollar investors can now pool their assets together to invest in private companies.

3) Venture Capital

Venture capital (VC) is another form of private equity. VCs are typically interested in maximizing their returns by funding early-stage startups with high growth potential.

These high-risk, high-return investments are typically made via specialized partnerships managed by venture capital firms. These firms focus on sourcing and vetting deals and providing capital to cash-strapped startups in exchange for equity.

Pros & cons:

Venture capital investments follow a power law. This means that a few successful investments can potentially generate massive returns. But the vast majority of investments go to zero and generate no return.

Of course, these returns are dependent on if the underlying startups succeed and experience rapid growth. So careful selection is key.

Other considerations include the potential lack of liquidity and long-term commitment to a particular venture. Additionally, most VCs charge a performance fee in addition to fund management fees.

How to invest:

Like private equity, venture capital investments are typically made through venture capital firms. And these firms are generally limited to accredited or institutional investors.

However, retail investors can explore opportunities through angel investor networks, equity crowdfunding, or start-up platforms like Sweater. Liquidity is still a concern with these alternatives, but at least they provide a way to get into the game.

4) Private Credit

Private credit is a class of alternative investments in which capital is lent to private businesses rather than public companies. Private credit investments typically carry higher returns (and higher risk) than more traditional fixed-income investments.

Pros & cons:

Investors issuing private credit have more control over the terms and structure of the loans. This allows for greater customization and better risk-adjusted returns.

However, private credit investments are frequently illiquid, carry higher default risk, and require specialized knowledge to evaluate the creditworthiness of loans.

How to invest:

You can explore opportunities through private credit funds, feeder funds, interval funds, closed-end funds, and platforms like Yieldstreet, Percent, and OurCrowd.

5) Structured Products

Structured products include a wide range of derivatives such as options, futures contracts, and other complex strategies.

Pros & cons:

These products offer many benefits:

- Exposure to specific asset classes or market themes

- The ability to combine the performances of multiple assets

- Boosted investment yield (via covered calls)

- Downside protection (via hedging strategies)

However, structured products can be quite complex. They can introduce counterparty risk and require specialized knowledge to evaluate the risks associated with each product. Plus, they may involve higher fees (which are not always totally transparent).

How to invest:

Financial engineering has become quite popular among retail investors in recent years. From Robinhood and SoFi to more traditional Broker-Dealers, you can now access a variety of structured products through online platforms.

6) Real Estate

Real estate is the most widely held alternative investment. Investors can purchase entire properties or shares in real estate syndications of commercial buildings, multifamily properties, or farmland. Real estate investment trusts (REITs), which are publicly traded companies that own and manage real estate, are also a passive way to invest in real estate.

Pros & cons:

Real estate is popular for a reason. This asset class provides:

- Cash flow from rental income

- Potential appreciation

- Tax benefits

Real estate can also be a hedge against inflation as rents typically follow inflationary trends.

On the other hand, investing in real estate requires a significant amount of capital and time to manage properties. There are costs such as property taxes, maintenance, and possible tenant turnover.

Plus, there is a default risk if tenants fail to pay rent on time or abandon the property. And the entire asset class is fairly illiquid. Transactions can take months to complete and may involve expensive closing costs.

How to invest:

You can buy properties from the MLS, where you have complete control. Or you can invest in real estate funds, as a low-effort way to access lucrative deals. Or you can buy shares of REITs to maintain maximum liquidity. Finally, there are real estate crowdfunding platforms such as Here, Fundrise, CityVest, LEX Markets, Honeybricks, and AcreTrader.

7) Commodities

Commodities refer to natural resources such as gold, silver, oil, gas, and agricultural products. These products are often used as inputs in other industries. And these physical assets can be accessed directly or through derivatives such as futures contracts.

Pros & cons:

These assets can provide diversification benefits as their prices tend to move independently from the stock and bond markets. Historically, they have also served as an effective hedge against inflation.

However, commodity prices can be especially volatile. And much of this volatility is driven by unpredictable factors like geopolitical events, weather conditions, and supply-demand imbalances.

How to invest:

You can purchase and store physical raw commodities (such as precious metals). Or you can invest through futures contracts or ETFs that directly track a specific commodity index. Finally, you can invest through mutual funds that own commodity or energy-related businesses.

8) Green Energy

Investments in green energy include renewable energy projects such as solar, wind, and hydroelectric power. These investments are attractive for their environmental benefits, innovative technologies, and potential returns.

Pros & cons:

These investments meet the increasing demand for sustainable energy solutions and positive social impact investing. Plus, they are on the cutting edge of technology.

Not only could a scientific breakthrough mean life-changing returns, but green energy investments also qualify for tax breaks and government incentives.

On the other hand, these projects come with significant capital requirements, long-term payback periods, and project-specific risks. And there is no guarantee that the technology will remain within budget or perform as expected.

How to invest:

You can invest directly in green energy projects, shares of renewable energy companies, green bonds, or green energy ETFs.

9) Collectibles

Collectibles refer to investments in items such as art, wine, classic cars, coins, stamps, sports cards, comic books, sneakers, toys, games, etc. Any commercial or residential item that can appreciate over time can be considered a collectible.

Pros & cons:

Collectibles tend to follow boom and bust cycles that are completely uncorrelated with stocks and bonds. As fads come and go, these investments can offer both diversification and tremendous upside.

Collectibles can also provide personal enjoyment and cultural value.

However, they come with a unique set of risks. Collectibles are illiquid and can be difficult to evaluate or trade. They often require deep knowledge of the market, and they can be highly influenced by ever-changing trends and tastes.

How to invest:

You can acquire collectibles from almost anywhere. Auctions, galleries, dealers, and even garage sales may offer valuable collectibles (even unknowingly).

Some specialized funds and platforms allow investors to buy shares of high-value collectibles. Check out Masterworks, Investables, Vinovest, Cult Wines, Vint, BrightCellars, Collectable, and Rally depending on the exact asset you are interested in.

10) Digital Assets

Digital asset investments include cryptocurrencies like Bitcoin and Ethereum, Non-Fungible Tokens (NFTs) that represent unique digital or physical assets, and virtual real estate.

Pros & cons:

Cryptocurrencies provide a decentralized form of money and hedge against traditional financial systems. These assets can offer high returns depending on their adoption curve, value proposition, and network effects. They are also highly liquid and have relatively low fees for trading and custody.

But, digital assets are still in their early stages of development. They involve high risk, wild volatility, and regulatory uncertainties. And unfortunately, fraud is prevalent in the crypto-sphere.

How to invest:

You can buy cryptocurrencies through exchanges like Coinbase, Binance, Kraken, and Gemini. You can find NFTs on platforms like OpenSea and Rarible, and virtual real estate on Decentraland or Sandbox.

Note: Cryptocurrency and digital assets are the most unproven of all of these alternative investments. Invest with caution and only allocate a small percentage of your portfolio to these more speculative opportunities.

The Bottom Line

While they may seem strange at first, alternative investments deserve a real spot in your portfolio. Historical data indicates that the right alts can offer diversification, higher returns, and risk mitigation when appropriately managed.

But there are a wide range of alternative investments available. So it’s important to determine what asset class best aligns with your risk tolerance, investing timeline, and long-term goals.

Whether it’s venture capital, real estate, or collectibles, select 2-3 alternative investments that make sense for you. If you diversify across a few, you should be able to reach your financial goals faster and enjoy a smoother ride along the way.

Just keep an eye on the changing macro environment, know when to take profits, and revise your portfolio as needed!