Options are a powerful way to turn small stock market moves into big profits – without a lot of upfront investment. The problem is, for many beginners, understanding calls vs puts can feel like learning a second language.

Fortunately, options trading is more straightforward than it seems.

In this article, we will dive into the differences between calls vs puts. We will cover what options are, what terminology you need to know, how to trade them, and what kinds of risks you should be aware of.

By the time you finish reading, you will have a much clearer understanding of how calls and puts fit into your portfolio and how to use them to your advantage.

What Are Options? Understanding Call and Put Options

An option is a contract that gives the owner the right, but not the obligation, to buy or sell an asset at a specific price by a specified date. The asset in question can be anything from a stock or commodity to a currency or even a house.

Options are considered derivatives because they derive their value from the underlying asset.

But before we get into the differences between calls vs puts, four key terms are important to understand:

- Underlying security: The asset the option contract gives the owner the right to buy or sell. For example, if we purchase options on XYZ stock, then XYZ is the underlying security. The price of the underlying security at expiration will determine whether we make a profit or loss on our options contract.

- Strike price: The price at which we can buy or sell the underlying security. Also known as the exercise price, the strike price represents our right to buy or sell the underlying stock in the market at a pre-determined price (no matter the current price of the stock).

- Expiration date: The date by which we must exercise our option. If we don’t exercise our option by the expiration date, our options contract will expire worthless.

- Option premium: The price we pay for an option. It is the amount of money that changes hands when we buy or sell an options contract. Keep in mind that option premiums are quoted per share but sold in lots of 100. So if an option is quoted at $2, that means you will pay $200 for the option contract.

| Call Options | Put Options |

|---|---|

| Right to buy a security at a specific price up until the date of the option | Right to sell a security at a specific price up until the date of the option |

| Never obligated to exercise the option | Never obligated to exercise the option |

| Unlimited gain potential | Limited gain potential (prices can’t fall below zero) |

| Limited loss potential (the cost of the option) | Unlimited loss potential |

| Investors are betting on prices to rise | Investors are betting on prices to fall |

What Is A Call Option?

When you buy a call option, you are buying the right to purchase a stock at a specific price within a certain time frame. If on the expiration date, the stock’s price is greater than the strike price, you will exercise the option.

Call options are a bet that the underlying security’s price will rise.

Buying Call Options

Buying a call option means purchasing the right, but not the obligation, to buy a stock at a predetermined price before a specified date.

Let’s say you buy a call option for stock XYZ, with a strike price of $50, that expires in two months. Your bet is that XYZ’s price will rise above $50 before the option’s expiration.

If this option costs $2 when the stock price is at $45, your premium would cost $200 ($2 x 100).

If the XYZ trades above $50, the option can be exercised. Whereas if the price fails to reach the $50 strike price, the option will expire worthless.

Exercising Call Options

Continuing the previous example, imagine that one month after purchasing the call option, the XYZ stock price moves to $51. Your call option is now “in the money”!

Because the stock price moved in your favor, you can now sell the call option for more than the initial premium you paid. Alternatively, you can wait another month until the expiration date in hopes of realizing some of the “time value” yourself.

If you decide to wait it out, two potential scenarios could unfold:

Scenario A: The XYZ stock price rises further – to $57 per share – so you exercise the option at expiration.

Mechanically, this means using your call option to purchase 100 shares of the underlying asset XYZ at the agreed-upon strike price of $50. Because the market value of XYZ is currently $57, most investors immediately sell these 100 shares of XYZ to lock in a $7 per share profit.

In this case, your total earnings on the trade are $500. You made $5,700 selling 100 shares of XYZ, but purchasing those shares cost you $5,000. Plus, you can’t overlook the $200 premium paid for the options contract on day one.

Scenario B: The XYZ stock price falls to $43 per share.

In this case, remember that you are not obligated to buy the underlying asset. Your call option is “out of the money,” so it simply expires worthless.

Your option allows you to purchase 100 shares of XYZ at the $50 strike price, but there is no reason to do so. If you still want to own XYZ, you can simply buy it on the open market for $43 per share.

A buyer should not exercise their option here. This trade simply results in a $200 loss due to the original premium paid for the option.

What Is A Put Option?

A put option is the opposite of a call option– it gives the buyer the right to sell a stock at a specific price within a certain time frame.

Put options are a bet that the underlying security’s price will fall.

Buying Put Options

Buying a put option means purchasing the right, but not the obligation, to sell a stock at a predetermined price before the option expires.

Suppose you purchase a put option on XYZ with an expiration date that is two months from now. Perhaps the stock price is $55 today, the strike price is $50, and the option costs $0.50 per share (or $50 total).

Note: That option may be cheap because its only value is derived from the possibility that its price may fall in the next two months.

Exercising Put Options

Like our previous example, assume the trade initially goes in your favor. The stock’s price suddenly plummets to $40 per share. You now have $10 per share in profits!

At this point, most traders will either hold in expectation of a further decline or sell the option to lock in their gain.

To exercise your put option, first purchase 100 shares of XYZ on the open market. In this case, that transaction will cost $4,000. Then, use your option contract to sell those shares of XYZ at the strike price of $50 per share.

Your bottom line on this transaction is $950. You net $1,000 on the final trade and paid $50 to purchase the option.

If, on the other hand, the stock price had not fallen below the strike price, your option would expire worthless. You would not exercise the option because you could always sell the underlying stock at the market price instead.

How Do Put Options Work As A Hedging Strategy?

When markets are volatile and uncertain, experienced investors will often buy put options to limit their risk. This is known as a hedge.

By buying a put option, an investor secures the right to sell their shares at a set price. This limits potential losses if the market value of their shares suddenly drops significantly.

For example, let’s say you own 100 shares of Company ABC, currently valued at $100 per share.

You find yourself concerned about some potentially bad news, the state of the economy, or other external factors, so you decide to buy a put option with a strike price of $90 and an expiration date three months from now.

If Company X’s stock falls below $90, your put option allows you to limit your losses to $10 per share (plus the cost of the option). If the stock price stays above $90, your option will expire worthless.

Think of hedging as buying insurance where the insurance cost is equal to the option premium.

Calls Vs. Puts: Advanced Options Trading Terminology

Now that we have covered the basics between calls vs. puts, let’s review some more advanced option terminology:

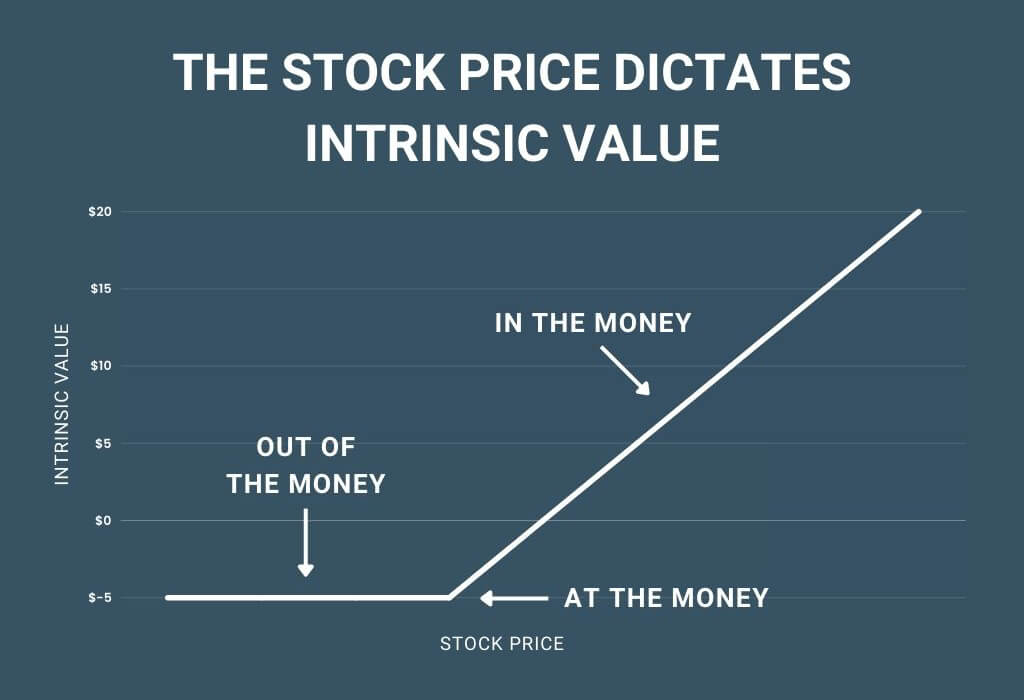

Intrinsic value

The intrinsic value is the difference between the strike price and the current price of the underlying security. This is how much we would make (or lose) if we exercised our option right now.

For example, let’s say that XYZ stock is trading at $57 and we own call options with a strike price of $50. In this case, the intrinsic value is $7 per share ($57 – $50).

Intrinsic value is commonly expressed using the following terms:

- In the money: If the intrinsic value of an option is positive, then the option is said to be “in the money.” This means that if we exercised our option now, we would make money.

- Out of the money: If the intrinsic value of an option is negative, then the option is said to be “out of the money.” This means that if we exercised our option now, we would lose money. Or rather, we would not choose to exercise our option right now.

- At the money: If the intrinsic value of an option is zero, then the option is said to be “at the money.” This means that the current stock price is approximately equal to the strike price of our option.

Extrinsic Value (or Time Value)

The extrinsic value of an options contract is the difference between its premium (market value) and its intrinsic value. Extrinsic value comes from the possibility that the underlying security’s price might move before expiration.

This is also known as time value because the longer the time until expiration, the greater the chance the underlying security’s price could move in your favor.

On the other hand, as an option approaches its expiration date, time value slowly erodes. This phenomenon is known as time decay.

Calls vs. Puts: What Are “The Greeks”?

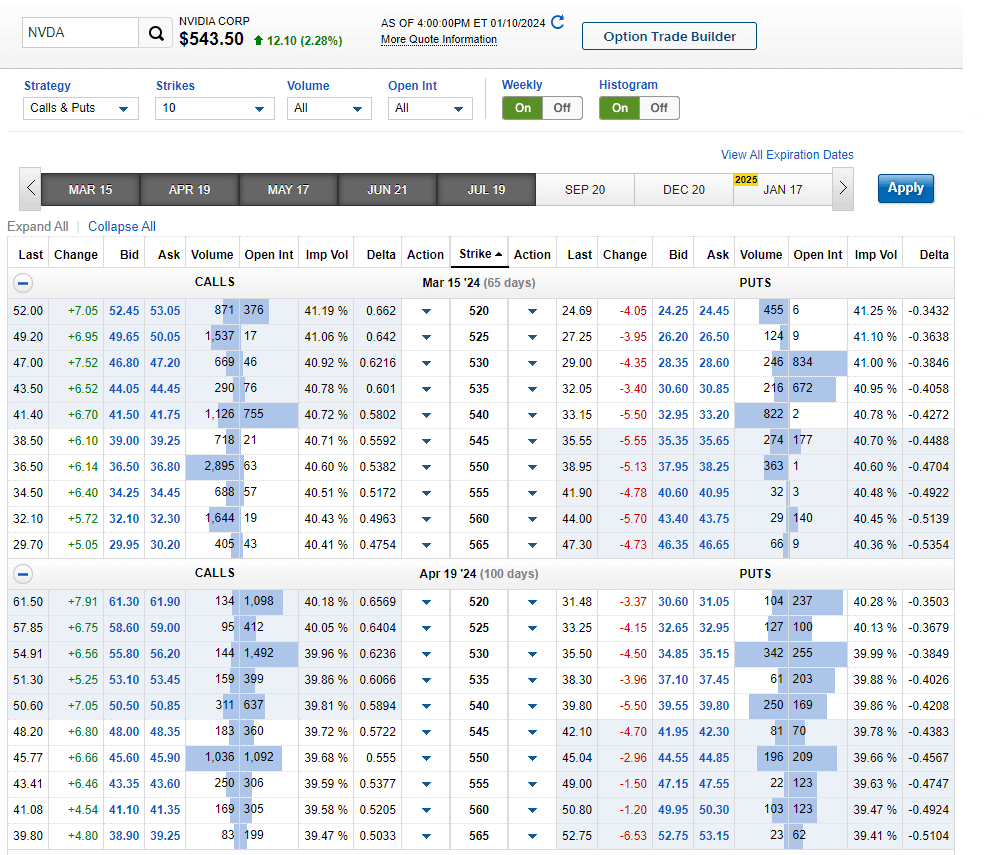

“The Greeks” is a term used to describe the various factors that can affect the price of an options contract. These factors are represented by the Greek letters delta, gamma, vega, and theta.

- Delta: An options pricing term that measures how much the price of an option contract will change due to a 1-point move in the underlying stock’s price. This can help investors understand the sensitivity of their options contract.

- Gamma: The rate of change of the delta of an options contract. In other words, it’s a measure of how the delta will change due to a 1-point move in the underlying stock’s price. This indicates how volatile the price of the option is.

- Vega: This measures how much an option’s price will change in response to changes in volatility. In the context of options, volatility is a measure of the amount and speed by which an asset’s price fluctuates.

So, more specifically, vega tells us how much the option price would change if implied volatility increased by 1%. This means high-vega options are especially susceptible to volatility, and low-vega options are more stable. - Theta: Theta is an important concept in options trading because it represents time decay. Time decay is the amount by which the extrinsic value of an options contract decreases over time.

In other words, as we move closer to expiration, theta slowly eats away at the time value of our options contract. It is measured as a percentage and is typically expressed as a negative number.

Check out this video by Brad Finn on how you can use the Greeks to improve your options trading.

Spreads

A spread is an options strategy that involves buying and selling two different options contracts at the same time. There are many different types of spreads and each one has a different risk/reward profile.

Spreads can be either bullish or bearish in nature. Bullish spreads generally profit if the underlying stock’s price goes up, whereas bearish spreads profit if the stock price goes down.

What Are The Risks Of Trading Calls Vs Puts?

While options trading can be lucrative, it can also be quite risky, especially if you don’t know what you’re doing.

When buying call options and put options, the biggest risk is that you lose all of your money on premiums. This happens when the stock doesn’t move in your favor before the expiration date.

While the exact percentage of options that expire worthless is heavily debated – one thing is certain. Far more options go to $0 than stocks or ETFs do. Because they are so volatile, buying options is much riskier than buying stocks.

That being said, selling call options and put options is even more risky.

What’s riskier than losing all the money you invested? Losing more than your initial investment!

This article has focused on buying options, which limits your risk. However, we have not covered the dynamic of selling options, which has the potential for unlimited risk.

Until you are an options veteran, we recommend staying far away from selling options. And even then, stick to covered strategies.

Why Trade Options?

Investors trade options for a few key reasons:

- To leverage: Because each option contract represents 100 shares of stock, investors can double or triple their initial investment with relatively small price movements in the stock price (without having to buy the underlying security).

- To speculate: Rather than buying stock, investors can profit from the stock market with options. When an investor thinks the price of an asset is going to go up, they will buy a call option. If they think the price is going to go down, they will buy a put option. These bets are often placed due to technical indicators or broader momentum strategies.

- To hedge: When investors want to protect their portfolio from downside risk, they might buy put options. This is known as hedging.

- To generate income: Investors can also sell options or “write” options to generate income from the premiums. However, this strategy introduces additional risks and should be avoided by beginners.

3 Common Pitfalls in Options Trading and How to Avoid Them

As you look into trading calls vs puts, avoid these common mistakes to minimize your risk:

- Going way out-of-the-money: When you purchase a far out-of-the-money option, your odds of making a profit are very low. These options may look cheap and attractive, but they are essentially lottery tickets. Unless something unexpected happens, you are likely to lose your entire premium. A better bet is to stick to options that are in the money or slightly out of the money.

- Not diversifying your portfolio: Trading options is risky enough, but if you put all your eggs in one basket, the risks are amplified. When diversifying your portfolio, be sure to look for uncorrelated assets. For example, don’t go all in on one sector of the S&P 500. Instead, consider a more defensive consumer staples stock along with that more aggressive technology bet.

- Trading with emotion: With money on the line, it can be difficult to not let fear or greed get the best of you. But this is exactly how the best traders win. They control their emotions, make a plan, and stick to it!

Final Thoughts: Smart Trading for Better Outcomes

Whether you want to protect your portfolio from market downturns or profit from short-term price movements, every investor should understand the basic dynamics of call and put options.

Although it may seem challenging at first, the rewards and risks of calls vs puts are relatively straightforward.

Just as stock buyers study the fundamentals of a business before investing, experienced options traders look to The Greeks. These tools offer valuable insights into an option’s sensitivity to time decay, changes in implied volatility, and the underlying asset price.

If after reading this article, you decide that options trading feels too risky, no worries. You can always stick to Warren Buffett’s ways of value investing.

Frequently Asked Questions

A covered call is an options strategy where an investor owns the underlying stock and sells call options on it to earn premium income. It’s typically used when investors expect the stock price to remain stable or slightly decline.

This approach generates immediate income but limits the upside if the stock price rises sharply.

Option spreads involve simultaneously buying and selling options of the same class (calls or puts) with different strike prices and/or expiration dates.

For example, a common spread is the bull call spread. This is where an investor buys a call option at a lower strike price and sells another one at a higher strike price.

This strategy allows the investor to capitalize on a moderate rise in the asset’s price up to the higher strike. The maximum loss is limited to the net premium paid, and the maximum gain is capped at the difference between the two strike prices (minus the net premium).

The bull call spread is ideal when a moderate upward price movement is expected.

Yes, options trading is considered more risky than stock investing because of the expiration date. If prices don’t move as expected within the specified time frame, you risk losing your entire investment. However, that loss is limited to the premium paid.

The main difference between American and European options is when you can exercise the option.

American options can be exercised at any time before their expiration date. However, European options can only be exercised on the expiration date.