Inflation is raging on, business is slowing, and stocks have come crashing down from their all-time highs. Welcome to a recession. Are you nervous?

If so, you’re not alone. Seeing nothing but red on your investment statements can be unsettling. But there’s a silver lining to every dark cloud. Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” In other words, recessions present opportunities.

Savvy investors should lick their lips when there is blood in the streets. But beware! Not every fallen stock is a bargain. Recessions create real challenges and reasons to believe that past performance may not be indicative of a company’s future.

If you want to learn how to find undervalued stocks, you have come to the right place. This article covers everything you need to know to spot deals. From stock screeners to fundamental analysis, let’s dive into the art of value investing!

What Is An Undervalued Stock?

An undervalued stock is an equity that is trading below its intrinsic value or true value. The key to finding undervalued stocks is recognizing that the stock market is an imperfect pricing mechanism. In other words, just because a stock is trading at a certain price doesn’t mean that it is actually worth that much.

Now, this position lies in stark contrast with the Efficient Market Hypothesis (EMH). According to the EMH, the stock market always immediately prices in all public information about a company. This means that all news about a company (either positive or negative) is already reflected in its current stock price. In practice, this is clearly not the case.

Famed value investors like Benjamin Graham and Warren Buffett cut their teeth by finding stocks that the market was undervaluing. With patient, long-term investing strategies, they were able to buy companies at significant discounts and either hold them for cash flow or sell them at a profit.

Why Do Stocks Become Undervalued?

There are many reasons why a stock may become disconnected from its intrinsic value. Here are a few common explanations:

Market downturn

When markets begin to show signs of a correction or bear market, investors often flee for the exits. To avoid the potential pain or a pullback, they may dump their stocks en masse regardless of the individual fundamentals. This indiscriminate selling can create opportunities for smart investors.

Industry headwinds

When certain sectors or industries start to experience problems like government regulation or slowing demand, the market often sells first and asks questions later. As a result, strong companies may see their stock prices drop sharply even if their businesses remain healthy.

In time, analysts and investors tend to suss out the real winners and losers, but short-term market noise can produce undervalued stocks.

Missed earnings

A company’s share price can be pulled down by the market, its industry, and… its own results. If a business misses its earnings estimates, the stock almost always takes a beating. Occasionally, this can cause an overreaction and produce an undervalued stock.

To make your own assessment, determine what this period’s results indicate about the future. Are they a harbinger of things to come, or did a one-off event impact the bottom line?

Bad news cycle

No company is perfect, and even the best-managed organizations can find themselves in the crosshairs of unfavorable media coverage. This can take the form of everything from a social media scandal to an SEC investigation.

If you have reason to believe the matter will be resolved quickly or is overblown, you may be able to scoop up the company’s stock at a discount.

How To Find Undervalued Stocks In 6 Easy Steps

Now that we have a handle on what they are and how they come to be, it’s time to discuss how to find undervalued stocks. Follow these 6 steps to get started:

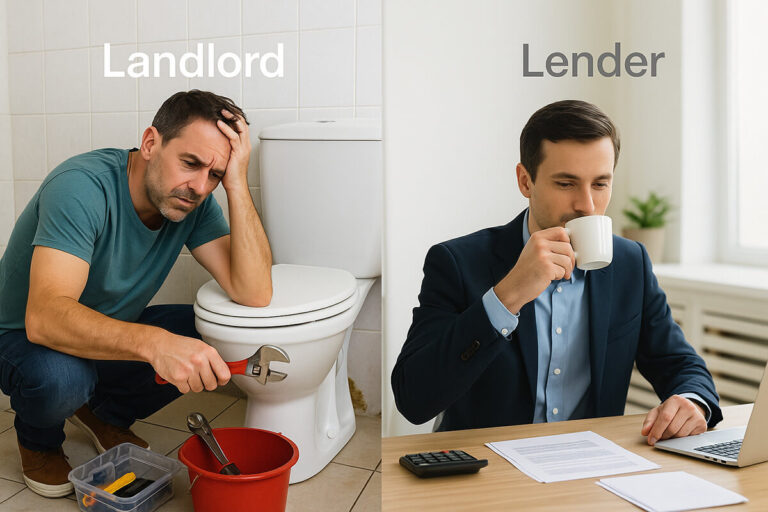

1) Select a stock screener

There are many online platforms that offer stock screening capabilities. Most stockbrokers, like Fidelity and T.D. Ameritrade, allow customers to sift through equities and create watchlists of promising companies.

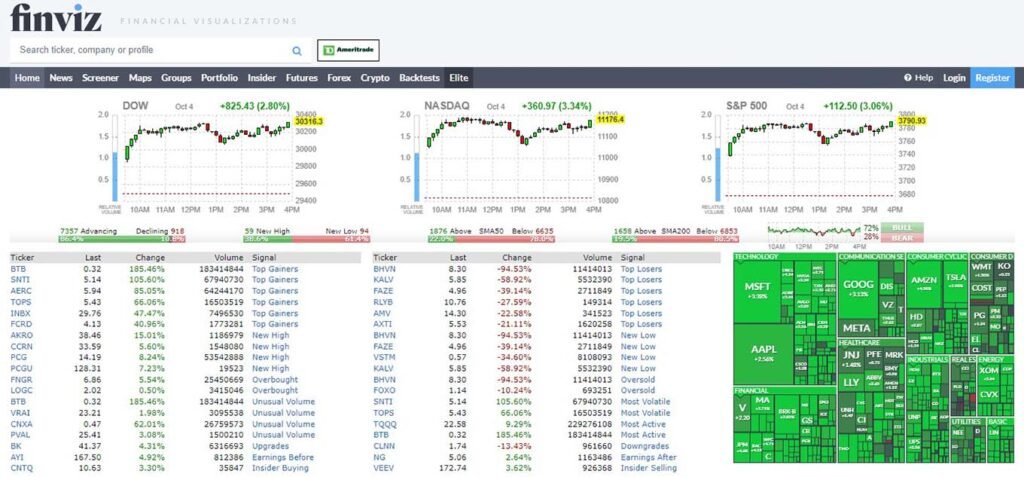

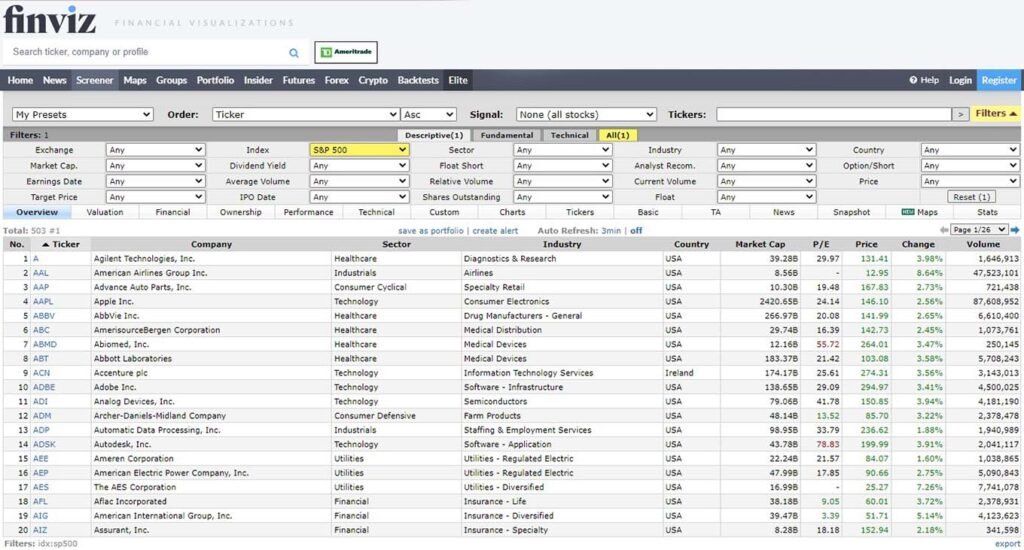

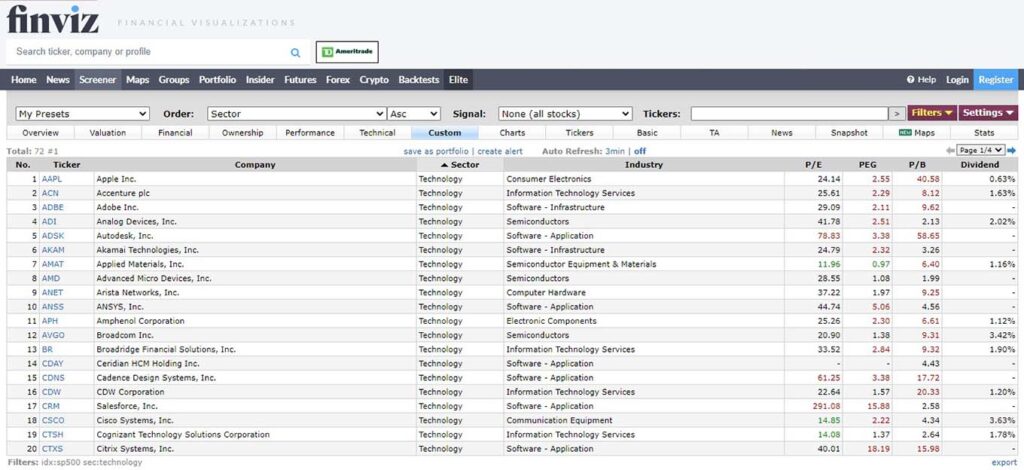

There are also free stock screeners like Yahoo Finance and Finviz that anyone can use, even without signing up for an account. For the purposes of this article, I’ll use Finviz to demonstrate how to identify stocks that may be undervalued.

Other popular screening platforms include Zacks, Trade Ideas, TradingView, and TC2000. It’s not particularly important which one you use, as long as you can screen, search, and sort by the investment metrics below.

2) Choose an investing universe

Before we can invest in undervalued stocks, consider where you are willing to trade. If you are a U.S. citizen, perhaps the S&P 500 is a safe place to start. To expand your search you could add in the S&P 400 (mid-caps) and the S&P 600 (small-caps).

Are you interested in investing in overseas companies? If so, you may want to look at international indices like HSI (Hong Kong), FTSE (United Kingdom), or DAX (Germany).

Another approach to finding undervalued stocks is fishing where others aren’t. This may mean targeting emerging countries, or sectors that have fallen out of favor. If you venture out in this way, however, be sure to DYOR (do your own research), and bear in mind that not every penny stock is a hidden gem. Oftentimes, stock screeners surface “undervalued” stocks that are actually just junk.

3) Filter by valuation metrics

This is where the magic happens. To identify undervalued stocks, we will start with our investing universe and narrow it down to only the stocks that meet certain criteria.

Price To Earnings Ratio

The price-to-earnings ratio (P/E ratio) calls for diving a company’s market capitalization by its profit. Or equivalently, it can be calculated by dividing its share price by its EPS (or earnings per share).

The P/E ratio indicates how much it costs to buy one dollar of a company’s earnings. For example, a P/E ratio of 15 implies that an investor must pay $15 to “own” $1 of underlying earnings. Therefore cheap companies tend to have a low P/E ratio, and expensive stocks have a high P/E ratio.

Earnings Yield

Earnings yield is simply the inverse of the P/E ratio. Instead of taking a company’s market cap and dividing it by earnings, you take earnings and divide it by market cap. In other words, a 5% earnings yield is equivalent to a 20x P/E.

You may think of earnings yield as telling you how much “bang for your buck” you get as an investor. So, all else being equal, a higher earnings yield is better than a lower one. And companies with relatively high earnings yields may be undervalued.

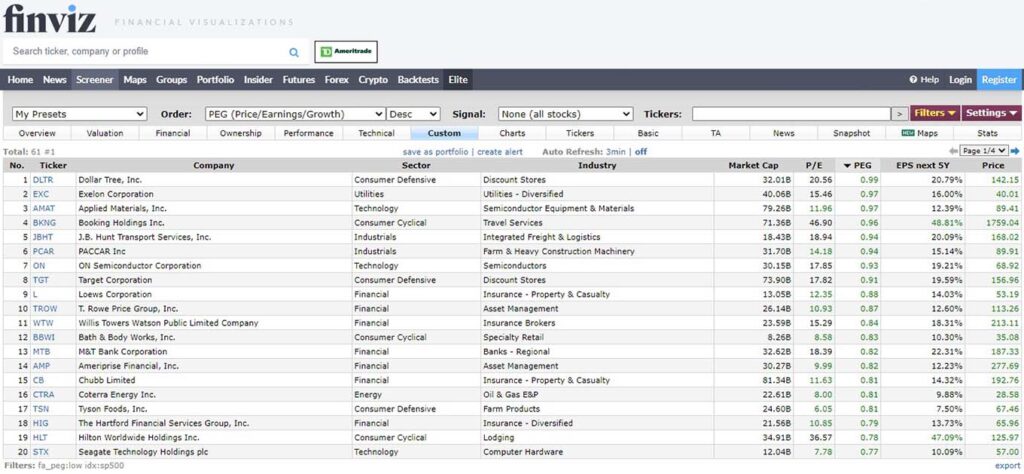

Price To Earnings Growth Ratio

The price-to-earnings growth ratio (PEG ratio) is calculated by dividing a company’s P/E ratio by its earnings growth rate. This metric is particularly effective in accounting for high-growth stocks.

To illustrate how this works, let’s say you’re looking at two companies. Company A has a P/E ratio of 30 and is expected to grow earnings at 10%, whereas Company B has a P/E ratio of 40 and is expected to grow at 20%. Which stock may be undervalued?

Well, in fairness, either could be. To make a real determination, we would have to perform fundamental analysis and compare the stock’s market price to its “true” value. But given this limited information, Company B is the better buy.

Company A has a PEG ratio of 3 (30 / 10 = 3), and Company B has a PEG ratio of 2 (40 / 20 = 2). To wrap your head around this, remember that the stock market is forward-looking. The PEG ratio takes into account expected future growth. And after factoring in this growth, Company B appears to be the more undervalued stock.

Price To Book Ratio

The price-to-book ratio (P/B ratio) is an entirely different way of determining if a stock is undervalued. In this analysis, we consider the market value of a company to its book value. “Book” refers to the company’s accounting books, as book value is derived from several figures on the balance sheet.

The objective of book value is to highlight the liquidation value of a business in the event of bankruptcy. The calculation involves subtracting total liabilities (debt), intangible assets (not necessarily sellable), and preferred stock (when applicable) from total assets.

While you should not need to compute this by hand, it is helpful to understand that the idea is to determine a worst-case scenario of sorts for shareholders. In general, a low P/B ratio is often indicative of an undervalued stock. And a P/B ratio below 1 means that the share price is trading below its theoretical liquidation value.

Return on Equity

Return on equity (ROE) represents a company’s net income divided by its average shareholder equity. At a high level, the idea is to compare how much profit a company generates with the amount of money that shareholders have invested.

A high ROE may help to identify undervalued stocks by flagging companies that use equity financing efficiently. However, keep in mind that the denominator is shareholder equity – not price. This means that a stock can have a very high ROE, but still be expensive if its share price has run up too much.

Dividend Yield

Dividend yield is the percentage of a company’s current stock price that is paid out in dividends per year. For example, if a company is trading at $100 per share and pays out $2 in dividends per year, then its dividend yield is 2%.

A high dividend yield is generally a sign of either an unsustainable payout ratio or an undervalued stock. After using your stock screener to filter for desirable dividend yields, dig into the individual stocks to determine which category each company falls into.

Look at the company’s payout ratio to see what percentage of its cash flow is currently devoted to the dividend payment. Look at debt levels to see if the company can safely meet its obligations without cutting the dividend. And look at the consistency of its cash flows to see if the dividend is likely to grow.

Finally, check if the company is a Dividend Aristocrat or a Dividend King. These companies have a track record of consistently raising their dividends over the long term, which indicates that the stock could be undervalued.

4) Perform a competitive analysis

After combing through your investing universe for companies that meet one or multiple of your target valuation metrics, it is very important to compare each candidate to its peers.

Because of variation in capital structures, growth rates, and other factors, a company may look like a bargain based on one metric but be relatively expensive when compared to its competitors.

To perform a competitive analysis, use your stock screener to populate the following columns:

- Company name

- Sector

- Industry

- P/E ratio

- PEG ratio

- P/B ratio

- Dividend yield

Once you have this data, compare each potential investment to its peers within the same industry. This should help account for many structural differences and provide a clearer view of if a given stock is undervalued.

5) Consider the fundamentals

Lastly, before investing in any company, always perform a fundamental analysis of its past performance. While this is obviously not a promise of future performance, simply completing the exercise will give you a deeper understanding of the business and its financial prospects.

To begin, evaluate a company’s revenue, cash flow, margins, earnings, growth rate, and more. Read the company’s latest earnings call, as well as a few analyst reports. Even if you are excited about an investment, actively seek out counterarguments. Try to form a balanced view of both the bull case and the bear case. Then, come to your own conclusions about their relative likelihood.

If by the end of your research, you feel the stock is undervalued – that its share price is not justified by its underlying fundamentals – then move on to the final step.

6) Pull the trigger

Congrats! You have done all of the hard work to become a value investor. Now comes the fun part.

Gather up all of the undervalued stocks you identified in your search, whether by a low P/E ratio or an attractive dividend yield, and sign up for a stock trading platform. While there are many to choose from, I personally invest through the following apps:

- Fidelity

- Charles Schwab

- T.D. Ameritrade

- Robinhood

All of these stockbrokers offer no minimum balance fee and no transaction fees, so the choice largely comes down to personal preference.

Two Simple Alternatives Worth Considering

If you are exhausted just reading this guide and all of the work to find undervalued stocks sounds daunting, you have two options.

First, you could simply invest in a value fund. Value funds are generally structured as mutual funds or ETFs, and they target equities that have been identified as having low valuations.

Value fund investing is an easy and relatively passive way to employ the value investing strategy. However, because you are entrusting your capital to a fund manager, there are a few key questions to ask yourself:

- Is the fund actively or passively managed?

- How does the fund identify undervalued stocks?

- What is the expense ratio?

- What is the historical performance of the fund?

- What stocks is the fund currently holding?

The other option is to subscribe to a stock-picking service. Much like investing in a fund, this removes the burden of filtering through all of the potential investments. Plus, you have more control over the individual stocks you choose to invest in, which allows for more personalized risk management and diversification.

Before you select a stock-picking service, here are some questions to consider:

- What is the reputation of the service?

- How much does it cost?

- What kind of support and education do they offer?

- What is their investment strategy?

- How often do they make recommendations?

Both options — value funds and stock-picking services — can take a lot of the work out of value investing. But keep in mind that even though you are outsourcing the stock selection, it’s still crucial to do your own due diligence and make sure the choices align with your financial goals and risk tolerance.

Final Thoughts

Learning how to find undervalued stocks is a multi-step process, and probably closer to an art than a science. With a bit of experience, however, you can be on your way to identifying bargains in the market and value investing.

But if you find that undervalued stocks aren’t for you, here is a list of 18 other income-generating assets worth considering. After all, every portfolio is different. As long as your accounts are compounding, you are on your way to the pearly gates of financial freedom.