If compromise feels like settling and ambition is your middle name, fat FIRE may be the perfect retirement plan for you. You will get to live large without sacrificing the things you love. Exotic trips, high-end homes, and luxury cars — nothing is off limits with fat FIRE.

The trick is, of course, getting there. This article covers how much money fat FIRE takes, what sacrifices are required, and how to pull it off. (Hint: The answer is NOT to save more)

What Is Fat FIRE?

Fat FIRE (financial independence retire early) puts a luxurious spin on the FIRE movement. Instead of minimizing expenses and retiring as early as possible, those pursuing fat FIRE prefer to accumulate more wealth in hopes of greater financial flexibility.

This approach allows fat FIRE-seekers to enjoy travel, hobbies, and expensive experiences that lean FIRE (or even regular FIRE) wouldn’t allow for.

Fat FIRE also provides greater wiggle room in the event of unexpected expenses, an economic downturn, or a longer-than-anticipated retirement. By budgeting for extra discretionary spending, fat FIRE ensures that changes in circumstances won’t interrupt a comfortable retirement lifestyle.

How Much Money Is Enough For Fat FIRE?

Fat FIRE is often defined as a retirement budget of $100,000 or more in annual spending. Using the popular 4% withdrawal rate, this spend would require a $2.5 million nest egg.

But in reality, that FIRE number is probably on the low side.

For one, $100,000 isn’t what it was just a few years ago. Due to the inflationary environment of late, $100,000 today is equivalent to just over $86,000 in 2020.

Further, a $100,000 budget can look very different depending on your location, lifestyle, and age.

In Mississippi, the state with the lowest cost of living, $100,000 of passive income can easily support an entire family in a lovely home and still allow for dining, travel, hobbies, and other entertainment.

But in New York City, where the average rent for a 1-bedroom is nearly $4,000, $100,000 can go quickly for a young couple. And if you factor in children, that “fat FIRE” budget might start looking pretty lean.

So the bottom line is… fat FIRE takes anywhere from $2.5 million to $5 million in investable net worth, at minimum. Where you fall in that range is up to your own preferences and what you consider financial freedom.

Your Fat FIRE Number

Although $100,000 is broadly considered fat FIRE, take a moment to reflect on what wealth looks like to you. If the answer is Prada, summers in the Hamptons, and private school for the kids, your FIRE number might be in the tens of millions.

But if your focus is on early retirement, perhaps you aspire to a 4-bedroom house in the suburbs, a new car every 5 to 6 years, and dining out a few times per week. In this case, a few million likely does the trick.

The key is to map out exactly what your “fat” lifestyle looks like. Ask yourself the following questions about your financial future:

- Where do you want to live?

- What do you want your house or apartment to look like?

- What brand of car do you want to drive?

- How often do you want to travel?

- What hotels do you want to stay at?

- What kind of restaurants do you want to visit?

- What hobbies and activities do you hope to pursue?

- How many children do you want?

- Where do you want them to go to school?

The list could go on and on. But the point is, the clearer you can get about your projected annual expenses, the more accurate your fat FIRE number will be.

So create a future budget and multiply the total spend by 25 to determine the amount of money you need to reach financial independence. This is your fat FIRE number.

If invested properly, it will generate enough annual income for you to live exactly the way you wish. (Just don’t fall victim to lifestyle inflation.)

Comparing Lifestyles: Lean FIRE Vs Fat FIRE

If your objective is to become financially independent, lean FIRE is clearly the more accessible goal. But for many people, retiring early isn’t quite as appealing if they have to live frugally.

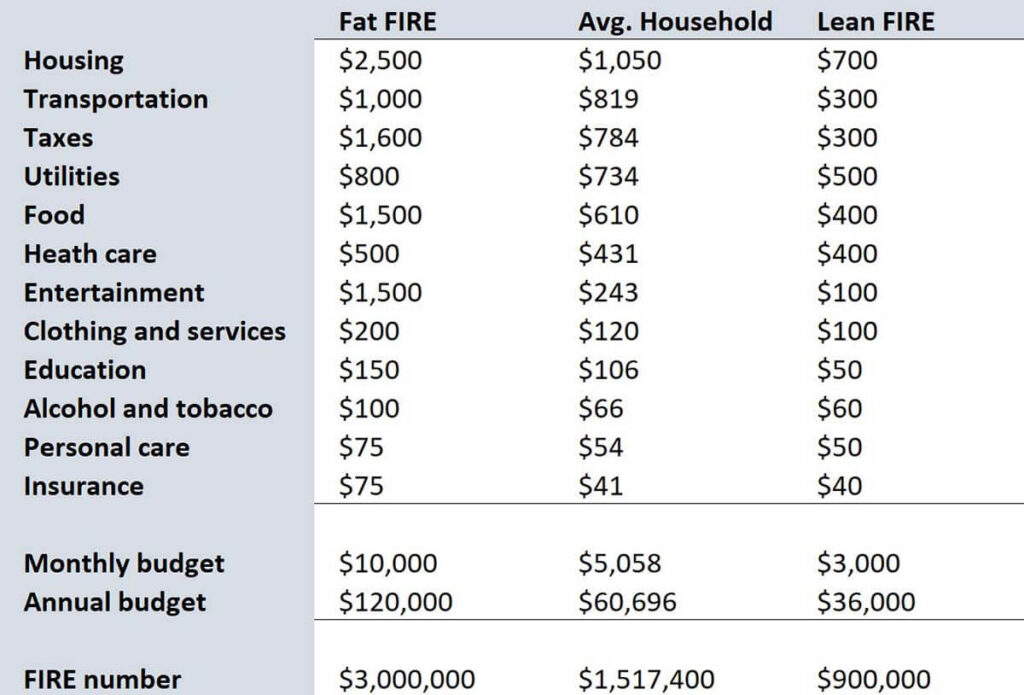

The tradeoff often comes down to lifestyle, and how much you are willing to sacrifice for a little more spending money. To make the comparison more tangible, below is a sample fat FIRE vs. lean FIRE budget breakdown.

The middle column demonstrates average household expenditures, according to real data from the Bureau of Labor Statistics. We used this as a baseline to create realistic budget scenarios.

For fat FIRE, we have inflated spending to allow for:

- A nicer home and car

- More traveling and eating out

- Less restrictive budgets on utilities, clothing, etc.

And for lean FIRE, we made cuts to:

- Housing: Opt for function over form. Get only the space you need and be willing to commute a little further.

- Transportation: Share a car, buy used, and drive it as long as it runs.

- Food and entertainment: Cook affordable home meals and stick to free activities and events.

Here are what the sample budgets look like:

Clearly, the lean FIRE budget is much more strict. The average person would have to tighten their belt and reduce their annual spending substantially to make it work. But it does provide just enough money to retire early, cover expenses, and enjoy financial independence.

On the other hand, fat FIRE looks like a cushy way of life. But in this example, it takes more than 3x the investable net worth to get there! That means both FI (financial independence) and RE (retire early) are much more difficult to accomplish.

So is the delay and the extra stress worth it? Let’s go through the pros and cons of chasing fat FIRE.

Benefits of Fat FIRE

If you can reach fat FIRE, you will have much more money at your disposal during retirement. Here are a handful of the benefits of that feat:

- Greater freedom: You can choose to work on projects you are passionate about, travel more frequently, or pursue hobbies you enjoy without worrying about money.

- Higher standard of living: You can afford to live a more comfortable lifestyle. This may include living in a bigger house, driving a luxury car, and eating out when you please.

- Less stress: Achieving financial independence can also reduce stress and anxiety associated with financial uncertainty. With a meaningful financial cushion, you can feel more secure and relaxed about your future.

- Ability to give back: With your necessities covered, you can also consider giving back to causes or charities that you care about. This allows you to share your blessings with others, have a greater impact on the world, or build a legacy.

Drawbacks of Fat FIRE

The advantages of fat FIRE appeal to almost everyone, so it is important to evaluate the tradeoffs that may come with it as well. Before embarking on an ambitious financial path, consider these drawbacks:

- Requires significant sacrifice: Pursuing fat FIRE usually involves a lot of stress and sacrifice in the short term. To retire early with a large nest egg, fat FIRE hopefuls may find themselves working more and spending less. This lack of balance and focus on saving money can become a genuine burden.

- Delayed gratification: The FIRE movement revolves around delayed gratification, but fat FIRE requires an even greater degree of patience. You may find yourself waiting decades and decades to live your best life and enjoy a more carefree mindset.

- Uncertainty: Reaching your fat FIRE number and enjoying an early retirement requires a long-term commitment. As you build your bank account, you will find that you are subject to many unpredictable variables, like market performance, tax laws, and changes in personal circumstances. Unexpected or adverse events can potentially delay or derail your retirement plans.

How Do You Achieve Fat FIRE?

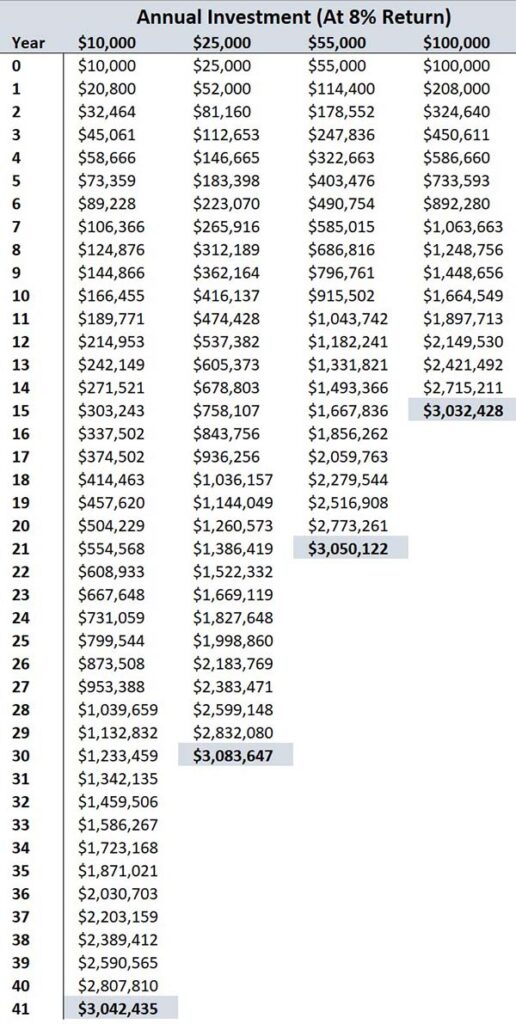

Unlike other variations of the FIRE movement, it’s very difficult to reach fat FIRE by reducing expenses alone. To illustrate this point, the chart below shows how a retirement account compounds at an 8% annual rate of return.

We see that with $10,000 invested per year, it would take 41 years to accumulate a net worth of $3,000,000. Even if you were to start saving at the ripe age of 22, this would imply you couldn’t retire until 63. And that’s without taking inflation into account!

To save the same amount of money in half the time, you would have to invest more than $50,000 per year instead. Cutting an extra $40,000 per year in expenses is not possible for most people — the key is to look on the other side of the equation.

Rather than reducing spending, the typical way to reach fat FIRE is by increasing your income. This can involve moving to a higher-paying job, picking up new high-income skills, taking on more freelance or consulting gigs, or starting your own business.

Here at The Money Maniac, we are partial to launching businesses because they allow you to increase your earning potential while also building equity over time. That’s why we have created so many guides on everything from side hustle ideas to SaaS ideas.

And even if you miss the mark on your savings goal one year, you may be able to make up the difference by selling your business or turning it into semi-passive income down the line. By hiring a manager or CEO, you could reduce your active involvement in the business without sacrificing all of the profit it generates.

It’s worth highlighting that even in our most aggressive scenario, it still requires $100,000 in annual savings for 15 years to fat FIRE with $3,000,000. You probably need to make at least $250,000 per year for a decade and a half to make that happen.

Outside of a handful of jobs like doctors, lawyers, and tech execs, there are very few people that can maintain such an income level from a W-2 alone. So it is important to assess your situation honestly, determine if fat FIRE is a realistic goal, and take a long-term view if it is.

Fat FIRE Alternatives

Fat FIRE is not the only path to financial independence. For those who are not willing or able to achieve fat FIRE, there are a variety of alternatives worth pursuing. Here are two popular hybrids:

Barista FIRE

Barista FIRE is often used as a middle ground between lean FIRE and regular FIRE. With this approach, you would exit the traditional workforce but take on a part-time position (hence barista) for supplemental income or healthcare benefits.

This enables you to exit the 9 to 5 grind sooner, without having to save quite as much money. You would continue generating some income and have the time to explore your passions and hobbies.

Alternatively, if you have already retired early, you may opt to barista FIRE to improve your lifestyle, keep busy, or maintain some of the perks that come with a job.

Coast FIRE

Coast FIRE is yet another variation of FIRE (financial independence retire early). Typically, those interested in regular FIRE will save money until they reach their net worth goal, at which point they retire.

Coast FIRE, on the other hand, involves aggressively saving in the early years of your career and then “coasting” later on. The idea is to start investing as soon as possible in order to reap the benefits of compound interest.

Then, by the second half of your career, you can stop contributing to retirement accounts and instead live a weather lifestyle. This may delay your retirement to a certain extent, but it allows you to enjoy the fruits of your labor a bit sooner.

Related reading: 13 Best FIRE Blogs For Financial Education And Inspiration

Final Thoughts

Fat FIRE makes it possible to reach financial independence without sacrificing your lifestyle. Unfortunately, it is far less accessible than other forms of retirement.

To amass an investable net worth of $2.5 to $5 million takes around 4 decades of saving $10,000 per year. And to achieve this goal any faster, you need a well above-average income.

But if you are willing to put in the dedication and hard work that fat FIRE calls for, the rewards can be immense. You will have great freedom and flexibility in life. And you will enjoy the peace of mind that comes with having a lifetime of financial security.

Fat FIRE FAQs

What does FIRE stand for?FIRE stands for Financial Independence Retire Early. The FIRE movement is a group of people who discuss how to generate enough passive income to quit their jobs. The goal is to save money until they reach a target FIRE number and then live off of the dividends, interest, or rental income.

What is a safe withdrawal rate?The FIRE movement generally considers 4% a safe withdrawal rate over the long run. However, it is important to keep in mind the cyclical nature of the stock market. While U.S. equities have historically generated real returns (after accounting for inflation) in excess of 4%, the future is never guaranteed. So it is best to err on the side of caution and leave some margin of safety, especially if you plan to retire early.

How do I find my fat FIRE number?To find your fat FIRE number, determine your desired annual income in retirement and divide it by your withdrawal rate. In most cases, this means dividing by 4% (or multiplying by 25). For example, if your fat living expenses are $100,000, your fat FIRE number would be $2.5 million. And at $200,000 in annual spending, that figure would be $5 million.