Disclosure: The Money Maniac is an Amazon Associate that earns from qualifying purchases at no cost to you. However, all opinions are our own. We stand by every recommendation we make, and provide only objective and independent reviews.

Credit cards were meant to be a convenient way to transact, but for many people, they’ve become a budget-busting habit. Unless you keep a close eye on your bills, it’s easy to lose sight of how much you’re really spending each month – and that’s where cash envelopes can help.

Cash envelopes turn back the hands of time, and force you to budget like it’s 1999. Oh, the first credit card was used in 1985? Well, you get the point…

By allocating cash to specific categories like groceries, entertainment, and gas, you can keep track of where your money goes and how much you have left. This process makes saving money and reaching your financial goals easier. So, how do you get started? Let’s dive in!

What Is The Cash Envelope System?

The cash envelope system is a budgeting technique that involves using cash instead of credit or debit cards to make purchases. After dividing your monthly expenses into a handful of categories, place cash into envelopes to limit your spending beyond predetermined budgets. All purchases must be paid for with cash from their corresponding envelope.

Many people find that this approach helps them stay mindful of their spending. Rather than reviewing a month’s worth of bills at a time, you can see exactly how your budget evolves in real-time. This system also eliminates accidental overspending. When an envelope runs dry, you know it’s time to stop spending in that category until next month.

Related reading: 13 Fun Budget Challenges To Supercharge Your Savings

How To Implement The Cash Envelope System

1) Review Your Expenses

To create a realistic budget, you first must review your past expenses. For the most accurate picture of your current spending, look over the past 3 to 6 months of bank statements and credit card bills.

If you recently experienced any major life changes or large one-time expenses, remove those from your financial review. If you have received a raise in the past year or altered your spending habits, analyze your spending only after these changes.

The goal at this stage is simply to understand your finances. By stripping out uncommon costs and looking at current income and spending patterns, we can better project where money should be allocated each month.

2) Choose Spending Categories

After pulling together all of your spending information, it’s time to start categorizing your expenses. Don’t worry about cash and non-cash expenses just yet. For now, focus on identifying where your money is spent. Here are some of the most popular categories to consider:

- Housing: Mortgage or rent payments, property taxes, home insurance, repairs, and renovations

- Transportation: Car payments, gas, public transit, parking, and tolls

- Debt Repayments: Credit card bills, student loans, personal loans

- Utilities: Electricity, water, trash, internet, and cable

- Subscriptions: Streaming services, gym memberships, magazines

- Entertainment: Nights out, dates, restaurant meals, tickets to shows or movies

- Groceries: Food and household supplies

- Clothing: New clothes, dry cleaning, alterations

- Personal care: Haircuts, cosmetics, grooming supplies

- Gifts: Presents for holidays and birthdays, charitable donations

- Savings: Retirement contributions, emergency fund contributions

While these are commonly used budget categories in the envelope system, feel free to customize them according to your personal life. If you love shopping or eating out, or if you make a daily Starbucks run, you may want to create specific categories for those expenses. The beauty of the cash envelope system is how flexible it can be to your unique needs.

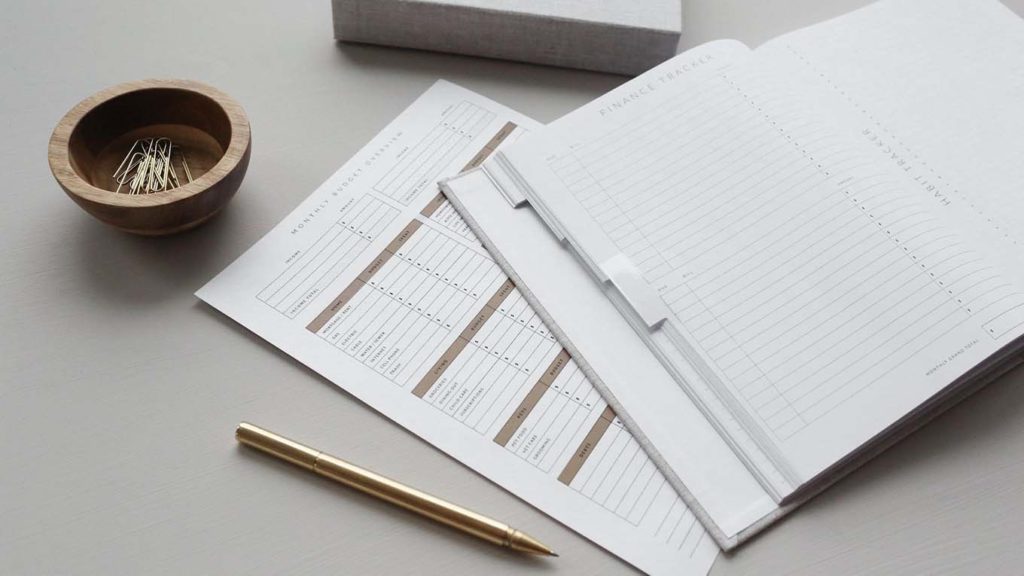

3) Create A Budget

With all of your typical expenses grouped into categories, your financial picture should begin to look pretty clear. Now is your opportunity to review how you spend money and decide where to make adjustments.

Start by evaluating your income, regular bills, and any debt. How much money do you have coming in each month, and how much is already accounted for? These categories won’t be involved in the envelope system, so it’s best to start with your net (after-tax) income after these fixed expenditures have been deducted.

From this point, you can begin assigning dollar amounts to each of your major spending categories. For each future envelope, look at what you have spent historically and decide whether you want to reduce your spend or keep it flat. When making these decisions, keep in mind your overall saving goals but also keep things realistic. Nothing kills momentum like an impossible-to-follow budget.

4) Fill Your Cash Envelopes

Once you’ve determined how much money to allocate to each category, it’s time to start filling your cash envelopes. Whether you are paid weekly, bi-weekly or twice per month, the easiest way to break down your envelope budget is by dividing your monthly goals in two.

For the bi-weekly folks, this does impose a slightly more restrictive budget. However, if you have the wiggle room to pull it off, it’s well worth the challenge. Two months per year, those incredible 3 paycheck months, you will have extra money on hand to shop, gift, save, or have fun.

With the final figures calculated, head to the bank every payday and withdraw your total spending money for all cash (i.e. non-bill) expenses. Take this lump sum of money and divvy it up into each cash envelope according to your budget. These funds represent all of the money you are free to spend in the corresponding category until your next payday.

5) Perform Monthly Reviews

Throughout the month, there may be a temptation to pull from other envelopes when one runs low. But don’t give in. Remember, your spending is not a slush fund. The goal is to learn to control each category independently.

With your mid-month paycheck, replenish your cash envelopes and let any remaining money roll over. With your end-of-month paycheck, however, review your past month’s performance. Before restocking the envelopes this time, add up any remaining funds you may have and add this to your savings accounts.

Now, if you need to reallocate your budgets, this is the time to do so. If you find yourself barely scraping by in one category and flush with extra money in another, feel free to make adjustments for future months. But in general, try to limit the number of changes you make and only tinker with your budget during review periods.

6) Stick To The System

Here is the real challenge – maintaining your new all-cash lifestyle. When it comes to planning for financial freedom, budgeting is a necessary evil. And the cash envelope system is a surefire way to stick to your goals.

But there will be tests of your determination. When your entertainment envelope hits zero a week before your next paycheck, will you stay in or pull out a credit card? If you have to Venmo a friend to split a lunch bill, will you adjust your cash envelope accordingly?

The point is… these cash envelopes only control our spending if we allow them to. For most people, overspending happens by accident and as a result of not paying close enough attention. The cash envelope system will fix that. But if you deliberately circumvent the cash envelope system, your budgeting goals will never be met.

So don’t cheat. When the cash is gone, it’s gone. Hang in there and fight the good fight – your savings will thank you!

Where To Get Cash Envelopes

If you are ready to take advantage of the cash envelope system and start saving money, there are a few different ways to get cash envelopes. For those who are crafty and artistic, you can always make your own and a personal touch to your envelopes.

And for everyone else, there are a number of affordable sets in-store and on Amazon. Here are our top recommendations for cash envelope kits:

Three Way Cut’s All-In-One Wallet

Best Overall System

Three Way Cut’s all-in-one cash envelope system is conveniently housed in a sleek black leather wallet. The wallet includes identification and credit card slots, a zipper enclosure, and a binder for holding the 12 tabbed and laminated envelopes. We love that this handy wallet makes the cash envelope system approachable, by integrating it with everything else we need to carry on a daily basis.

Clever Fox Cash Envelopes

Most Durable Envelopes

Clever Fox ensures that your money is always safe with this 12-pack of water, stretch, and tear-resistant envelopes. This color-coded set has space for a category name and monthly reporting on the outside of each envelope. At a glance, you can review how your actual spending has compared to your target for up to a year. Plus, this cash envelope kit includes monthly budget sheets, an annual summary sheet, and a premium carrying pouch.

Eleger Budget Binder

Best Value

The Eleger Budget Binder offers much of the same functionality as the Three Way Cut system, at a slightly more affordable price. Instead of a zipper-enclosure and PU leather, this binder is made of premium crocodile leather and uses a hidden snap buckle. The money organizer features multiple card holders and pockets, a central binder, 8 zipper envelopes, and monthly budget sheets.

Juvale White Money Envelopes

Best No-Frills Solution

Juvale’s plain white money envelopes are functional, affordable, and effective. If you mean business when it comes to budgeting, why not start saving now? This 100-pack of cash envelopes offers just what you need and nothing more. The envelopes are sealable, cash-sized, and easy to label with a pen or marker.

Lamare Money Saving System

Most Stylish Cash Envelopes

If you want to keep it simple but need something a little more aesthetically pleasing than the all-white Juvale envelopes, consider the Lamare Money Saving System. This set includes 12 thick, reusable envelopes that are beautifully designed, as well as 12 budget sheets and 12 pages of blank labels. The envelopes also have a protective coating that adds durability and allows labels to peel on and off as needed.

Limitations Of The Cash Envelope System

The cash envelope system does pose several limitations, which you should be aware of before getting started. However, if you keep your focus on the bigger picture and use a little creativity, all of these challenges can be overcome.

Inconvenient

Paying with cash requires ATM trips and sometimes means fumbling through bills at the cash register. Incorporate an occasional ATM stop into your weekly routine to minimize the inconvenience.

Risky

Carrying too much cash can be dangerous and leave you vulnerable to theft. Instead of carrying your entire budget with you, consider holding only what you need for a 1 to 2 day period at any given time.

Opportunity Cost

Paying with cash means you miss out on credit card reward points. However, this small opportunity cost is typically outweighed by the savings achieved through the envelope system.

Challenging

For couples and families, it can be difficult to implement the cash envelope system across multiple parties. But with some advance planning, and sharing as needed, it can be done. Some envelopes can be split evenly and others can be allocated based on individual spending habits. Plus, at the end of each month, you can reconcile together and discuss any adjustments that need to be made.

Final Thoughts

Once you embark on the journey to financial freedom, the first step is deciding how much money to save each month. The budgeting process takes time and requires reflection, but really, it’s the easiest part. Sticking to that plan and finding creative ways to save money is what takes true determination and discipline.

For those who struggle with budgeting, the cash envelope system is a simple way to stay on track. With a little bit of planning and a few bucks for quality envelopes, you can easily limit your spending and get a better handle on your finances.

Just remember, cash envelopes aren’t magic – they won’t stop you from spending if you’re truly determined to do so. But for those who find it helpful to have a visual representation of their spending, cash envelopes can be a game-changer.

Cash Envelopes FAQ

Cash envelopes are a great idea for anyone looking to save money and reduce their spending. The cash envelope system can help you adhere to your budget and avoid any surprises at the end of the month.

Cash envelopes are labeled envelopes that help you better keep track of your monthly budgets. Each envelope corresponds to a spending category and contains a set amount of cash for the entire month’s expenses. Using physical cash in this way prevents you from accidentally incurring credit card debt.

Cash envelope stuffing is designed to help you visualize your spending throughout the month. When an envelope starts to run low, it’s a clear sign that you need to start cutting back in that category. Because few people are this attentive with their credit cards, implementing this system is an easy way to stick to a budget.

Making cash envelopes is easy. If you buy pre-made envelopes, simply label each one with a key spending category such as “groceries” or “fun”. To make the entire envelope from scratch, start with thick paper or cardstock. Cut out a rectangle, then fold the edges to approximately 6.5″ by 3″. Finally, seal the envelope with tape or glue to create a small pouch.