When investments are down badly, as many were at the end of 2022, investors often look for a silver lining.

One such benefit is tax loss harvesting, which involves selling assets that have lost value for future tax benefits. You may be familiar with this concept of harvesting losses. But did you know that you can also harvest gains?

When done strategically, tax gain harvesting can save you money, reduce your taxes, and help manage risk in your portfolio.

In this step-by-step guide, we will look under the hood at what tax gain harvesting is, how it works, the pros and cons, and when it makes sense to consider.

Let’s jump in!

What Is Tax Gain Harvesting?

Taxes are among the most significant expenses for most Americans.

As a result, harvesting tax gains and losses is a popular strategy. Savvy investors use these moves to optimize tax costs, grow their wealth, and preserve their capital.

Pro Tip: Other important deductions for side hustlers and small business owners include claiming the ERC Tax Credit and QBI Tax Deduction.

Tax gain harvesting requires you to sell investments that have increased in value before repurchasing the investments. The idea is to maximize your total return by lowering the taxes you will have to pay on future investment returns.

Clearly, there are parallels between tax gain and tax loss harvesting.

Both strategies involve sifting through your investments to identify candidates, liquidating those positions, harvesting the tax benefits, and then (potentially) repurchasing the shares.

However, there are also some key differences.

Tax Loss Harvesting

With tax loss harvesting, you sell an investment that has declined in value since you purchased it. This allows you to reduce your cost basis and realize the loss.

Then, you can use this realized loss to offset any taxable income or capital gains from other parts of your portfolio. Ultimately, you get to minimize your taxes in the current tax year. And any additional losses that you cannot claim in the current year are carried forward into future tax years.

The downside of this strategy is that it can disrupt your current asset allocation and lead to a larger capital gains tax bill down the road. In other words, tax loss harvesting provides short-term benefits and possible long-term consequences.

Tax Gain Harvesting

Tax gain harvesting, on the other hand, calls for selling investments that have increased in value to incur the taxable consequences in the current year. This approach minimizes your future capital gains tax bill.

So, it provides the opposite experience — short-term consequences and possible long-term benefits.

How Tax Gain Harvesting Works

Investment values constantly fluctuate. At any given moment, they may be in a state of gain or loss relative to the original purchase price.

Tax-gain harvesting is the process of turning unrealized gains into realized gains by selling an investment that has increased in value.

When selecting investments with gains to harvest, it is important to understand the difference in tax treatment between short-term and long-term capital gains.

Short-Term Capital Gains

Short-term capital gains are profits from selling an asset held for one year or less. These gains are added to your income and taxed at your marginal income tax rate.

Here are your potential marginal tax rates for 2023, depending on your filing status and income level.

| Tax Rate | Single | Married, filing jointly | Married, filing separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $11,000 | $0 to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $11,001 to $44,725 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $44,726 to $95,375 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,376 to $182,100 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,101 to $231,250 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,251 to $346,875 | $231,250 to $578,100 |

| 37% | $578,125 or more | $693,750 or more | $346,876 or more | $578,100 or more |

Long-Term Capital Gains

Long-term capital gains are profits from selling an asset owned for more than one year. The long-term capital gains tax rate is 0%, 15%, or 20%, based on your taxable income and filing status (see chart below). As you can see, long-term capital gains tax rates are typically lower than short-term rates.

| Tax Rate | Single | Married, filing jointly | Married, filing separately | Head of Household |

|---|---|---|---|---|

| 0% | $0 to $44,625 | $0 to $89,250 | $0 to $44,625 | $0 to $59,750 |

| 15% | $44,626 to $492,300 | $89,251 to $553,850 | $44,626 to $276,900 | $59,751 to $523,050 |

| 20% | $492,301 or higher | $553,851 or higher | $276,901 or more | $523,051 or more |

The Wash-Sale Rule

Tax gain harvesting is often used to divide and convert long-term capital gains tax into smaller and nearer-term tax bites.

After realizing the gain, investors who want to maintain their asset allocation (especially if the investment still has upside potential) can immediately turn around and rebuy the asset they sold.

“Isn’t that a wash sale?”

No! In this case, it’s not.

Investors who are interested in tax loss harvesting need to be aware of the wash-sale rule.

A wash sale occurs when you sell a security and then repurchase it (or another security that is “substantially identical”) within 30 days. In this event, the tax loss can no longer be claimed for tax purposes.

Example: Tim sells the S&P 500 ETF managed by State Street (ticker: SPY). One week later, he purchases the iShares Core S&P 500 ETF (ticker: IVV). This is a wash sale. Tim’s losses can not be deducted from his taxes.

However, the wash-sale rule does not apply to tax gain harvesting. Gain harvesters can immediately repurchase the same investment(s).

Why?

Uncle Sam is more than happy to receive a tax payment from you sooner than later!

After all, when you realize a capital gain, you may accelerate your tax payments. And if you reinvest the proceeds, you may still owe him another tax payment down the line.

“If that’s the case, why bother harvesting gains?” – You, probably.

Well, tax gain harvesting offers several attractive benefits.

Benefits Of Tax Gain Harvesting

Tax gain harvesting can help you reduce the impact of taxes in the future and increase your overall investment returns.

For example, let’s say you fall into the “married and filing jointly” category. You expect annual earnings of $75,000 this year, and the NVIDIA stock you bought in your taxable portfolio is up ~$10,000.

You might be concerned that the good times won’t last forever. But you are also hesitant to sell because of the significant unrealized capital gains associated with those investments.

If you owned the asset for less than one year, you will face a 12% tax on your gains for an extra $1,200 on your taxes.

If you owned the assets for more than a year, you can sell your entire position and still stay within the 0% capital gains tax bracket. That means more money in your pocket and no taxes — what a deal!

Here’s another example.

Perhaps you love everything about Apple – Apple TVs, Apple Watches, iPads, iPhones, strong R&D, good management, etc. So you bought 100 shares of AAPL several years ago when it was trading at ~$60 per share. Since then, it’s had a nice run, and the price has appreciated to $175 per share.

Your $6,000 investment has grown to $17,500. Given your filing status and income level, you can sell now and harvest the long-term capital gain of $11,500. That money can go straight into your pocket at the 0% tax rate.

Or, you can choose to repurchase all 100 shares of AAPL. Doing so would reset the cost basis from $60 to $175.

Fast forward another decade, and your ongoing passion for Apple has been rewarded as they continue to dominate the market with new and exciting products. More “iProducts” equal more “iProfits”, and the share price has grown to $300 per share.

Had you held onto the original cost basis of $60, you would be looking at a potential capital gain of $24,000. But by resetting the cost basis to $175, your capital gains are now only $12,500. That’s only half the capital gains exposure and you didn’t even have to sacrifice any upside in the investment!

Potential Downsides Of Tax Gain Harvesting

Like any financial strategy, tax gain harvesting isn’t without risk. Market volatility can affect the timing and effectiveness of the maneuver.

You could be harvesting gains during a bubble (when the market is on an upswing), only to have valuations fall for an extended period. Just imagine harvesting gains during the dot com boom in 2000, only to see the price of your shares collapse for nearly a decade.

Additionally, a change in tax laws or a shift into a higher tax bracket could make tax gain harvesting less beneficial.

Finally, while this strategy can minimize capital gains taxes at the federal level, you may still be subject to taxes at the state level.

Harvesting gains may even trigger an alternative minimum tax (AMT) or the net investment income tax (NIIT). If you find that you are subject to these considerations, speak with a tax professional to make sure you don’t end up facing any unexpected consequences.

When To Consider Harvesting Tax Gains

Tax gain harvesting may make sense in a few specific scenarios, including:

- When you are in the 0% long-term capital gains tax bracket

- If you anticipate being in a higher tax bracket in the future

- If you’ve seen significant growth in an investment or asset class and want to rebalance your portfolio

- If you have capital losses to offset gains

- If you have held investments for more than one year

Keep in mind that tax-gain harvesting only works for investments in taxable accounts. Your IRA or 401k is not the right place for this strategy. These accounts are tax-deferred and therefore ineligible.

Pro Tip: The best time to consider harvesting gains is at year-end. This way, you know how much your taxable income will be for the year (including dividends from investments).

How To Harvest Tax Gains In 4 Steps

The most effective approach to tax gain harvesting involves tracking your investments, understanding the tax implications, and making informed decisions about when to sell.

For the best results, monitor the cost basis of all of your shares so you can identify which ones to sell for the optimal tax benefit. This will give you more precise control than if you use an average cost basis or a first-in-first-out (FIFO) approach.

Fortunately, most online brokers offer various tools and resources that can assist with this process.

How To Tax Harvest

- List all of the investments in your portfolio that have appreciated in value.

- Select specific assets to sell in order to realize those capital gains.

- Reinvest the proceeds into the same or similar assets.

- Pay your taxes (if any are due).

That’s it!

Once you have picked the assets worth harvesting and reviewed the tax consequences, it’s just a matter of executing a sell transaction and a buy transaction (if you want).

The Bottom Line

When markets have had an exceptional year or an investment in your taxable account has grown significantly, you have the opportunity to harvest gains.

When the circumstances are right, tax gain harvesting is a powerful strategy that enables you to maximize your returns and minimize your tax liabilities. Although it does require careful planning and consideration, it can be a simple way to keep more of what you earn without sacrificing upside.

So don’t miss out on the opportunity to put the power of tax gain harvesting to work in your portfolio!

Frequently Asked Questions

Tax gain harvesting is the process of selling investments that have increased in value to realize a gain and lock in the profit. Depending on your income level and filing status, this can be a simple way to lower your overall tax liability without giving up investment returns in the future.

An investor can harvest a capital gain by selling an investment owned for more than one year. Let’s say the cost basis is $30,000 and the market value rises to $55,000. The investor can sell the investment and then immediately repurchase it.

The sale triggers a capital gain of $25,000 ($55,000 minus the cost basis of $30,000), which will be taxable at 0%, 12%, or 20%, depending on the investor’s tax bracket. Now, the investor owns the investment at a new (higher) cost basis of $55,000.

This strategy works especially well if the investor can lock in a lower capital gains rate today than they expect to be able to in the future.

Tax loss harvesting involves selling an investment that has declined in value from its original cost basis. This allows you to use the realized loss to offset any taxable income or capital gains.

Tax gain harvesting involves selling investments that have increased in value. This allows you to accelerate the taxable consequences now and minimize them in the future.

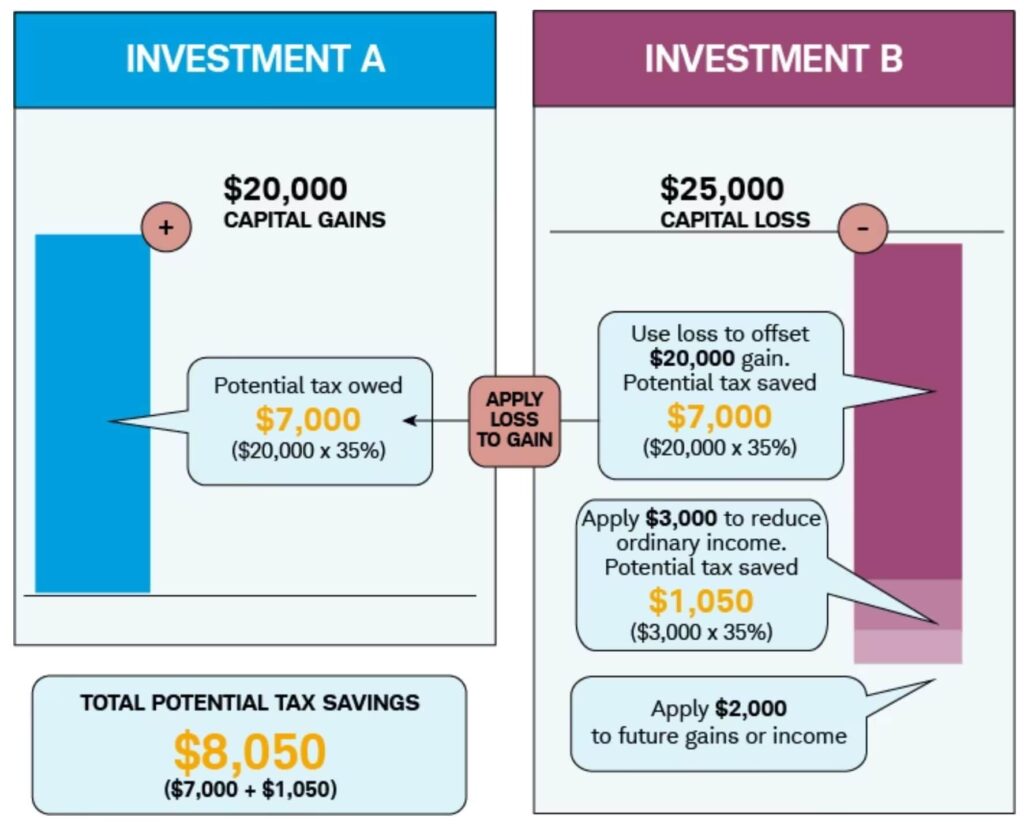

Yes. You can use capital losses to offset your capital gains and reduce your total taxable income, subject to certain limits. Long-term capital losses can be used to offset long-term capital gains. Short-term capital losses can offset short-term capital gains.

Losses that exceed gains can be used to offset up to $3,000 of ordinary income. Unused losses can be carried forward to offset future gains or regular income.

For more information, the IRS offers a Capital Loss Carryover Worksheet in Publication 550 that outlines what investment income is taxable and what investment expenses are deductible.