Between statutes, regulations, and case law, the U.S. tax code is now almost 80,000 pages long. For small business owners, the sheer magnitude of the tax code can be daunting. But it also presents many, almost hidden opportunities for tax savings.

This is especially true for owners of pass-through entities like:

- Sole proprietorships

- Partnerships

- Limited liability companies (LLCs)

- S corporations

In these businesses, income isn’t taxed at the corporate level. Instead, it is “passed through” to the owner’s personal tax return. And historically, that was a win because corporate tax rates were significantly higher than individual rates.

But that changed in 2017.

The passage of the Tax Cuts and Jobs Act (TCJA) lowered corporate tax rates, with the high end dropping from 35% to just 21%. As a result, pass-through entities became less appealing almost overnight.

In response, Congress added a new deduction for pass-through businesses under Internal Revenue Code (IRC) Section 199A. And just like that, the QBI Tax Deduction was born.

If you have a pass-through business, this powerful deduction can help you save up to $30,000 per year! In this article, we will discuss what the QBI tax deduction is, who is eligible, and how you can claim your savings in just 7 steps.

Now let’s talk taxes!

What is QBI, and Who Qualifies for a Deduction?

Not all businesses earn qualified business income. In fact, the rules and definitions outlining who can claim the QBI deduction are very specific.

So before you start filling out any tax forms, let’s quickly cover the basics.

Related reading: How To Claim The ERC Tax Credit

What is QBI?

According to the IRS, qualified business income (QBI) refers to “the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business.”

In short, only business income is relevant. So capital gains, losses, certain dividends and interest income are all out.

Other sources of income that are not counted:

- W-2 salary

- “Reasonable” compensation from an S corporation

- Guaranteed payments from a partnership

- Business income from outside of the U.S.

Who Qualifies for a QBI Tax Deduction?

The QBI deduction is available to anyone who meets all three of the following tests.

1) They receive income in one of these ways:

- From a pass-through business entity (sole proprietorship, partnership, S corporation, or LLC)

- From publicly traded partnerships (PTPs)

- From real estate investment trusts (REITs) in the form of qualified dividends

2) They have taxable income that falls below the designated threshold for their filing status. (We will discuss this shortly.)

3) They are not ineligible due to IRS limits on specific types of businesses.

How To Claim The QBI Deduction: 7 Simple Steps

The QBI deduction is a powerful tax break for eligible businesses. If you want to maximize your benefits, follow these 7 steps.

Step 1: Identify Your Eligible Business Income

Remember that your eligible income is your net business income.

This is the total amount of business profits attributable to you after deducting all business expenses, including:

- Business interest expense

- Unreimbursed expenses

- Self-employment tax (the deductible part)

- Premiums for self-employed health insurance

- Contributions to qualified retirement plans (SEP IRAs, SIMPLE IRAs, Solo 401Ks)

And again, this should not include the following:

- Capital gains or losses

- Interest income or unqualified dividends

- Income from business done outside the U.S.

- Wages or guaranteed payments

If you own multiple businesses, QBI must be calculated separately for each eligible entity. Unless, you meet a few additional conditions, in which case you can aggregate businesses together and potentially take a larger deduction.

Step 2: Determine If You Own An SSTB

The IRS outlines special rules for income derived from a specified service trade or business (SSTB).

An SSTB is defined as a service-based business where the principal asset is its employees’ or owners’ reputation or skill. These types of businesses can include:

- Medical or dental practices

- Law, accounting, or financial services

- Actuarial sciences

- Consulting

- Performing arts

- Athletics

- And more

For these types of businesses, the QBI deduction can be limited or disappear entirely depending on your taxable income level. For a full rundown on what exactly an SSTB is, see this list of QBI FAQs by the IRS.

Step 3: Calculate Your Taxable Income Amount

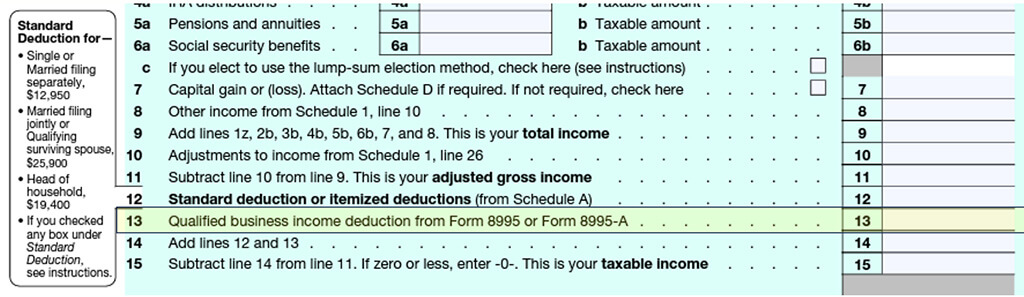

The QBI deduction does not reduce your Adjusted Gross Income (AGI).

Instead, it is considered a “below-the-line” deduction, and it can be claimed regardless of whether the taxpayer itemizes or claims the standard deduction.

So, you will first need to determine your business income and expenses. This appears on a:

- Schedule C for a sole proprietorship or single-member LLC

- Form 1120S for an S corporation

- Form 1065 for a partnership or multi-owner LLC

Then, you must calculate your AGI on Form 1040. This will be used as an input in Step 4.

Step 4: Calculate Your QBI Deduction

It is important to note that QBI, like many deductions, is subject to certain income limits. And there are four key thresholds to be aware of.

| Single Filer | Married, Filing Jointly | Not SSTB | SSTB |

|---|---|---|---|

| <$182,100 | <$364,200 | 20% | 20% |

| $182,100 to $232,100 | $364,200 to $464,200 | 20% | Limited deduction |

| >$232,100 | >$464,200 | Limited deduction | No deduction |

1) If your 2023 taxable income is less than $182,100 ($364,200 if married and filing jointly), then you can take the full 20% QBI deduction.

Here’s an example:

Let’s say you are a single filer with a taxable income of $180,000 and a QBI of $140,000. At this income, you may claim the full QBI tax deduction. That would be the lesser of $36,000 (20% of taxable income) and $28,000 (20% of QBI). So your final QBI tax deduction is $28,000.

With a marginal federal tax rate of 24%, this one deduction alone could put nearly $7,000 back into your pocket!

2) If your business is not an SSTB, and your income is between $182,100 and $232,100 (or $364,200 and $464,200 if married and filing jointly), you can still take the full 20% deduction.

Now here is where things get tricky.

3) If your business is not an SSTB, and your income is greater than $232,100 (or $464,200 if married and filing jointly), you can take a limited QBI deduction.

Your QBI deduction will be limited to the greater of:

- 50% of your share of the W-2 wages paid by the business

- 25% of your share of those W-2 wages, plus 2.5% of qualified depreciable property

4) But if your business is an SSTB, and your income is between $182,100 and $232,100 (or $364,200 and $464,200 if married and filing jointly), you can take a limited deduction.

Your QBI deduction will be limited to the greater of:

- 50% of your share of the W-2 wages paid by the business

- 25% of your share of those W-2 wages, plus 2.5% of qualified depreciable property

Here’s an example:

Let’s say you are a single filer with a taxable income of $250,000 and a QBI of $190,000. Your business paid $50,000 in W-2 wages and owns an office building worth $480,000.

Using the limitations above, option “A” gives you a slightly higher deduction:

- $50,000 x 50% = $25,000

- ($50,000 x 25%) + ($480,000 x 2.5%) = $12,500 + $12,000 = $24,500

5) And finally, if your business is an SSTB and your income exceeds $232,100 (or $464,200 if married and filing jointly), you cannot claim a QBI deduction at all.

If you get a little lost along the way, the IRS provides worksheets you can use to calculate the deduction. Two handy resources are Form 1040 Instructions and IRS Publication 535.

Also, the Congressional Research Service published a report that outlines how the deduction works with illustrative examples that you may find helpful.

Step 5: Calculate Your Other Income Deduction

Step 5 is only relevant if you also receive income from publicly traded partnerships (PTP) and/or Qualified REIT dividends. And this deduction is worth up to 20% of that ‘other’ income.

This second component is subject to different limitations than the business income component, which is why we recommend running the numbers separately for each part.

After calculating your QBI deduction (Step 4) and your additional income deduction (Step 5), add them up.

From here, the maximum deduction is equal to the lesser of the following:

- The deduction from Step 4 + the deduction from Step 5

- 20% of your taxable income, after subtracting any net capital gains

Step 6: Claim the Deduction on Your Return

To claim your QBI tax deduction, there are two forms you should be familiar with Form 8995 and Form Form 8995-A.

Use form 8995 if your taxable income is below the lower income threshold. And use form 8995-A if your taxable income is above the lower income threshold.

Fill out the relevant form, include it alongside your tax return, and input the deduction onto your 1040.

Step 7: Keep Accurate Records

As with all things tax-related, keep a copy of any documentation that supports your tax return and substantiates your QBI deduction.

This includes recording and storing:

- Gross receipts for all sources of income

- Expense receipts

- Documents that show ownership in the business

- Copies of Form 8995 or Form 8995-A

You should also keep detailed notes about your withholding, estimated tax payments, and any wages earned from self-employment. All of these items may need to be confirmed with the IRS in the event of an audit

Most accounting software should make this easy. But it’s still not a bad idea to have a backup (or two) in place to avoid any tax return delays in the event of data loss.

Related reading: Simple IRA vs 401k: Choose The Right Plan For Your Business

4 Tips for Maximizing the QBI Deduction

Tip 1: Reduce Taxable Income Before Year-End

Because of the QBI income thresholds, there could be an advantage to lowering your taxable income. If you find that is the case, consider the following strategies to temporarily reduce it:

- Make additional retirement plan contributions

- Defer income into the next year (postpone bonuses or certain invoices, if you use cash accounting)

- Accelerate deductions (pull forward next year’s deductible expenses, if you use cash accounting)

Tip 2: Separating the SSTB

If you own a specified service trade or business (SSTB) and are subject to the income phase-out provisions, consider separating non-professional services from the core business.

Keep in mind that the IRS frowns on this tactic — especially if done solely for tax avoidance — and there are rules in place to constrain this approach. But if there is a legitimate business purpose for doing so, it can provide both managerial and tax benefits.

In this case, you would want to streamline and separate non-professional services like IT, property management, and administrative functions, from the service business. This would allow the pass-through income derived from the newly created non-professional entity to qualify for the QBI deduction.

Tip 3: Increase W-2 Wages

If your taxable income exceeds the lower income threshold, your QBI deduction is partly limited by the amount of W-2 wages paid by the business.

This means that increasing W-2 wages can translate to a larger deduction. But to save money overall, make sure the increase in costs does not outweigh the increased tax benefit.

In order to increase W-2 wages, you could:

- Convert contractors to W-2 employees

- Employ your spouse or children (in family-run businesses, they may be contributing anyway)

- Convert your business to an S corporation and draw a salary yourself

Tip 4: Get Professional Advice When Needed

There are many helpful resources for understanding the QBI tax deduction.

However, the rules can get quite complicated. Especially if you own an SSTB or your income falls between the lower and upper income thresholds.

In that event, hiring an accountant who specializes in working with small business owners may be well worth the investment. This can help you:

- Save time, money, and frustration

- Avoid an audit

- Maximize your QBI deduction

- Get the most out of other applicable deductions and credits

Related reading: Tax Gain Harvesting: Your Step-By-Step Guide To Tax Savings

Final Thoughts On The QBI Tax Deduction

Whether you are an aspiring SAAS entrepreneur, a masterful side hustler, or a small business owner, the qualified business income (QBI) tax deduction can offer you a significant tax break — one you don’t want to miss out on.

In fact, the dedication can amount to more than $30,000 per year in savings!

So don’t hesitate to brush on the specifics of the QBI deduction. Get informed, get creative, and start planning for your next tax return. With careful preparation, you can save a sizable bag come Tax Day.

Disclaimer: The content provided in this article is for informational purposes only and is not professional tax advice. While every effort has been made to ensure the accuracy of the information, it may not apply to everyone’s individual tax situation, and it should not be relied upon for making tax-related decisions. Readers are encouraged to consult with a qualified tax professional or CPA before making any financial decisions related to tax issues. Any reliance you place on such information is therefore strictly at your own risk. The author of this blog is not liable for any inaccuracies, errors, or omissions, or for any actions taken in reliance on the information provided here. Tax laws are complex and constantly changing. The author of this blog does not claim to have the most current or complete understanding of these laws, and the content of this blog may be outdated at the time of reading. Always seek the advice of a qualified professional for any questions regarding your own taxes.