Most people spend more than 10 hours a week worrying about money.

Sound familiar?

Thankfully, investment planning can help.

With an actionable roadmap, you can put your money to work for you.

In other words, you’ll build long-term financial security without sacrificing your quality of life.

Curious to learn more?

Let’s take a closer look at how to plan for long-term wealth and security. We’ll dig into the best hands-on strategies for investment planning and the various asset classes you can invest in.

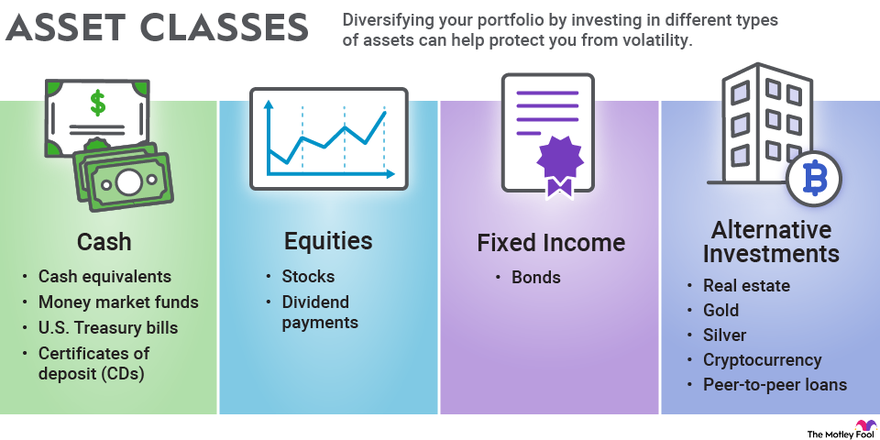

The Basics: What Are Asset Classes And Why Care?

If you want to begin planning for the long term, you need to understand asset classes.

Asset classes are distinct investment categories. Each category has its own characteristics, risks, and potential returns.

By investing in multiple asset classes, you can diversify your portfolio by spreading risk around.

In other words, you can avoid putting all your investment eggs in one asset basket.

Understanding these investment options helps you align your investments with your financial goals.

Types Of Assets

Let’s talk about the main asset classes you’re likely to invest in:

1) Equities (Stocks)

These are investments in company shares.

You can buy and sell your shares on stock exchanges like the Nasdaq and New York Stock Exchange.

Equities offer growth, sometimes dividends, and the potential for high returns. Equities in the S&P 500 have seen an average return of more than 10% over the last decade.

Remember, though, that stocks are subject to market volatility.

2) Fixed Income (Bonds)

These are a type of debt investment that pays out regular interest. Think government securities and corporate bonds.

Bonds offer a steady income stream and lower risk than stocks. However, in return, you typically see lower returns. Plus, bonds are very sensitive to interest rate changes.

3) Cash and Cash Equivalents:

Assets like money market funds, treasury bills, and savings accounts are highly liquid.

They can be quickly converted into a known amount of cash with little impact on their value. They are very low-risk, so they don’t offer the greatest returns.

4) Real Estate

This asset class deals with property investments, like residential homes, apartment buildings, office buildings, storage units, and more.

With real estate, you benefit from value appreciation and there’s the potential for rental income. But your capital isn’t liquid, and there are high transaction and high entry costs.

5) Commodities

Tradable physical goods, like gold, corn, and oil, are commodities.

This is a great asset class for diversifying your investment portfolio or hedging against inflation.

However, commodities are volatile due to weather, geopolitics, market demand, and in some cases, storage costs.

6) Venture Capital

This type of investing is designed to provide start-ups with initial funding in exchange for equity.

Investing in non-public companies gives you the potential for high returns, but it’s also high risk.

Essentially, you’re taking the chance that a new business will grow enough to be acquired, go public, or generate enough profit to provide a return.

7) Hedge Funds

Hedge funds employ highly skilled investors to actively manage pooled funds. These experts employ complex strategies to bet on market rises and protect investors against market declines.

Hedge funds are not accessible to most investors because they often require very large ($1,000,000+) capital commitments. Performance varies from fund to fund, but there is the potential for market-beating returns.

8) Cryptocurrencies

Digital currencies operating on the blockchain, like Bitcoin and Ethereum, use cutting-edge technology to provide an alternative financial platform.

It’s decentralized, and there is high growth potential if adoption grows. But, crypto assets are very risky, and ridden with scams. The market is super volatile, and there’s a lot of uncertainty around regulations.

Now, with these asset classes in mind, let’s discuss 9 important investment planning tips.

9 Investment Planning Tips To Build Yourself a Wealthier Future

Use the following 9 tips to upgrade your investment planning approach and create a wealthier future for you and your family.

1. Assess Your Personal Risk Tolerance

To start, review your current financial assets and cash management habits. Reflect on how market volatility affects your peace of mind.

After all, there’s no point in choosing high-risk investments if you’re sensitive to stress.

Use online risk assessment tools and financial fitness tests to get a picture of your financial situation and how you think about investment risks. This way, you can find your comfort zone on the investment spectrum.

Remember, a well-aligned risk strategy is key to long-term financial success.

2. Learn To Manage Risk

Once you know your risks, you can create a plan to mitigate them. This helps you safeguard your financial future against ups and downs.

Start by learning the common risks of investing, like market volatility, company performance, interest rate changes, and inflation.

Then, consider your own personal risks, like emotional investing, lack of diversification, and bad market timing.

Develop strategies to reduce these risks.

These could include…

- Adding new asset classes to your portfolio

- Setting stop-loss orders to limit potential losses

- Tracking your discretionary spending

- Regularly reflecting on current market conditions

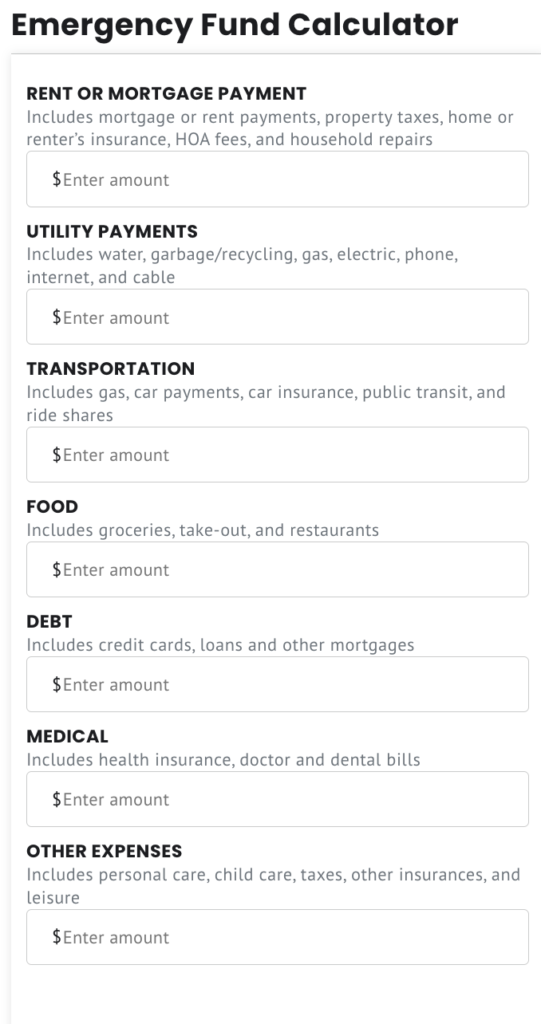

3. Build A Robust Emergency Fund

Before you even consider investing, you need a solid emergency fund.

This financial safety net is crucial for handling unexpected expenses, like medical bills or job loss.

When planning your fund, consider:

- Saving enough: Typically 3 to 6 months of basic living expenses

- Accessibility: Make sure it’s easily accessible without significant capital loss

- Purpose: Reserve it for genuine emergencies, not general spending

Here are a few strategies to help you build your nest egg:

- Start small: Begin with a modest goal and gradually increase it

- Automate savings: Set up automatic transfers to your emergency fund

- Cut back on costs: Consider where you can reduce non-essential spending

- Use an emergency fund calculator: Tools like The Motley Fool’s Emergency Fund Calculator (above) can help you figure out what you need to save

4. Manage Debts & Cash Flow

If you don’t manage your debt and cash flow effectively, you’ll struggle to have money available when you need it.

When you’re not handling debts properly, you limit your ability to deploy cash into investments. Plus, you could find yourself needing to liquidate investments to pay back what you owe.

In essence, debt holds you back from growing long-term wealth.

More than 70% of millennials admit that credit card debt prevents them from saving for retirement.

If you’re struggling with debt, start by drafting an actionable debt reduction plan.

Try using debt management apps that track and strategize repayments.

Tools like budgeting software can help track income and expenses for cash flow. This makes it easier to live within your means.

Regularly review and adjust your budget to stay on top of your financial game. This helps you avoid the risk of excessive, spiraling debt.

5. Create An Investment Strategy

Your investment strategy is your ultimate game plan for how to align your assets with your financial goals.

Create a detailed plan that aims to minimize investment risks and optimize cash management.

To start, evaluate your financial life and determine your objectives.

Educate yourself on the types of investment and financial vehicles available. Consider how these align with your goals.

Do they provide enough liquidity? Are the expected returns high enough? Can you stomach the risk involved?

Build a systematic investment plan to automate and structure your investments.

Your investment plan maps out how you will:

- Set goals

- Assess risk

- Make regular contributions

- Diversify your portfolio

- Review financial performance

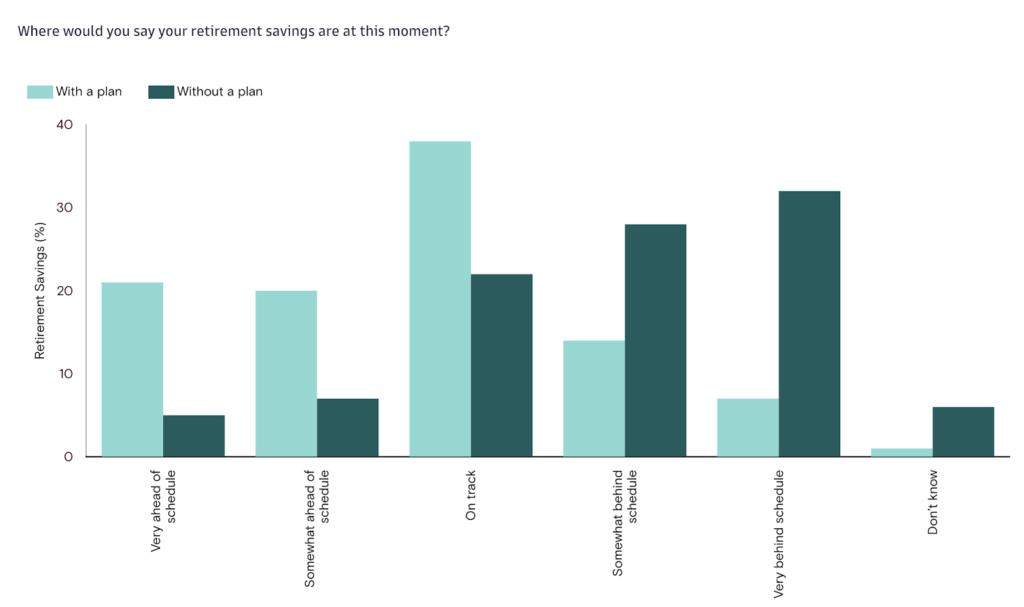

6. Prepare For Retirement

Retirement planning is a non-negotiable for long-term financial health. After all, you don’t want to work forever.

Unsurprisingly, those with a retirement plan are far more likely to be on track or surpass their retirement goal than those who don’t.

Unfortunately, 45% of Gen Xs have not planned for retirement, despite being worried that they will be short of their retirement goals.

To prepare for retirement, educate yourself on different retirement accounts and the tax advantages they provide.

For instance:

- Employers offer 401(k) plans that often come with matching contributions

- IRAs (Individual Retirement Accounts), both traditional and Roth, offer unique tax advantages for retirement savings

- For self-employed people, SEP IRAs and Solo 401(k)s are valuable ways to reduce your taxable income

7. Improve Your Money Management With An App

Nobody expects you to know how to plan your finances like a professional. So, simplify your investment planning with a personal finance app.

These tools can streamline your budgeting and savings efforts.

With intuitive, user-friendly designs, these apps offer a convenient way to track your expenses, set financial goals, and monitor your progress toward long-term wealth and security.

Plus, if you link all your financial information in one place, it’s much easier to make informed decisions and stay on top of your finances.

8. Diversify Your Investment Portfolio

Diversification is the key to a resilient investment portfolio.

When you spread risk across various asset types, there’s a much lower chance that any one loss, risk, or event can tank your entire portfolio.

Index funds play a vital role in this. They offer a mix of assets in a single investment.

You can also consider alternative investments to enhance diversification.

For instance:

- Nearly a quarter of professional investors are putting money into private equity funds

- Around 20% are opting for structured products

- More than 15% are exploring opportunities in non-traded REITs

Remember, these alternatives also come with unique benefits and risks.

While they can help contribute to a well-rounded investment approach, be sure to research each investment before taking the plunge.

9. Employ Passive Management Techniques

It takes time and effort to learn about different assets, pick individual investments, and oversee progress manually.

Passive wealth management reduces this manual work. If done right, it can save time while also taking advantage of market expertise (to make even better choices).

Most investors combine active and passive strategies to reduce overwhelm and balance growth.

Passive financial strategies include…

- Investing in a mutual fund or ETF

- Using a broker

- Robo-investing

Never go full passive though! Depending on how you automate your investing process, be mindful of capital gains tax and passive management fees. These can significantly impact your overall returns.

The Benefits Of Investment Planning To Secure Long-Term Wealth

More than 50% of people worry that financial stress will impact their health.

Investment planning helps alleviate this anxiety by creating a roadmap to a more secure and prosperous future.

Here are the key benefits of mapping out your path:

1. Upgrade Your Current Financial Situation: Investment planning helps you identify opportunities for immediate financial improvement.

2. Maximize Your Financial Resources: Make sure every dollar is put to work effectively to maximize returns without unnecessary risks.

3. Meet Short-Term Goals: Whether it’s saving for a vacation or paying off debt, investment planning makes these goals achievable.

4. Reach Long-Term Goals: Map out a clear path to reach significant milestones, such as buying a home or paying for college.

5. Foster Long-Term Security: Planning helps you establish a stable financial base for the future, allowing you to enjoy more peace of mind.

6. Grow Generational Wealth: Effective planning nurtures wealth so you can pass it down to help future generations prosper.

7. Make Better Investment Decisions: Make fewer impulsive or uninformed choices. With a better financial education, you’ll understand how to maximize your capital growth.

Springboard Your Journey To Financial Security

Building for your financial future is about more than just saving. It’s about smart planning and strategy.

Remember, a one-size-fits-all approach rarely works. It’s your future and your choices, so you’re in total control.