TikTok is full of wacky and creative challenges that range from dance routines to hilarious skits. But this latest money-saving challenge is blowing people’s minds and putting serious money in their pockets.

The ‘100 Envelope Challenge’ has a simple premise, but it delivers big results. The challenge has taken the internet by storm for helping participants save more than $5,000 in just over 3 months. Yes, you read that right — more than $5,000!

If you could use an effective way to boost your savings, join us in giving this 100-day challenge a try. Here is the simple 3-step process to get started:

Setting Up The 100 Envelope Challenge

1) Gather Your Supplies

All you need to get started is 100 envelopes, a marker, and some cash. More creatively-inclined savers may want to decorate the cash envelopes or bedazzle a storage box, but that is purely optional.

However, if getting artsy makes the challenge more fun for you — do it! The more you enjoy the process, the more likely you are to complete it.

2) Number The Envelopes

Next, number the envelopes from 1 to 100. The number on the envelope indicates how much money you will be putting in that envelope during the budgeting challenge. For example, envelope number 1 will hold $1 and 100 will $100.

Keep these envelopes in a safe, discreet place to keep your saving plan on track. By the end of the 100 Envelope Challenge, you will have a serious amount of cash on hand. So be sure that your envelopes are secure! Otherwise, you may want to break the challenge into smaller increments and make periodic bank deposits.

3) Start Stuffing

There are four primary ways to complete the challenge. Each one varies based on the order in which you fill the envelopes:

- Chronological: The first (and most common) method is to stuff the 100 envelopes in order from 1 to 100. In this case, you will put $1 in the #1 envelope on the first day, $2 in the #2 envelope on the second day, and so on. An important benefit of this method is that you can see how much money is left to budget as you go. But on the flip side, it grows increasingly difficult over time. Some participants find the beginning too easy and the end too hard.

- Reverse Chronological: Instead of saving from $1 up to $100, you could flip the order and save from $100 down to $1. This is still an unbalanced approach, but it puts the largest amounts upfront. So even if you don’t finish, you still get to save a meaningful amount of money.

- Random: If you choose to stuff the envelopes randomly, mix them up and, without looking, pick one from the stack. Whatever this envelope is numbered, put that amount of cash inside. For example, if you chose #60, put $60 in the envelope. If you chose #13, put $13 in the envelope. Repeat this 100 times until all the envelopes are filled.

- Balanced: A balanced approach to the 100 Envelope Challenge is to pre-sort the envelopes in a way that you can easily budget for. The simplest way to do this is to alternate between the highest and lowest remaining envelope until you end in the middle. For example, you could start with $1 on day 1, and then do $100 on day 2, then $2, then $99, and so on until you end at $51. This strategy removes the surprise element, which can make the challenge fun and unexpected. However, the stability of this method may also provide the highest likelihood of success.

Troubleshooting The 100 Envelope Challenge

The challenge is pretty straightforward to understand. But the logistics of saving money every single day can pose some common roadblocks.

For instance, what if you only get paid once a month? What happens if you run short one day? Is the challenge over or can you still participate?

In short, the 100 Envelope Challenge is quite flexible. And that is one of the beauties of this system — it can be tweaked and adjusted to suit your lifestyle. So if you run into a snag, don’t give up! Here are our recommendations on how to overcome some of the most frequent obstacles:

What If I Don’t Get Paid Bi-Weekly?

No matter when you get paid, you can take part in the 100 Envelope Challenge. However, the more irregular or infrequent your paycheck, the more advanced planning you should do.

If you get paid once a month, for example, you should plan your next 30 or so envelopes around that time. Budget for your necessary expenses first and then determine how much wiggle room you have.

If you use a chronological or balanced approach, you should be able to determine exactly how much money you need to stay in the challenge for another month. Whereas if you use the random method, you should be prepared with a little extra cash in case you experience a difficult run.

What If I Can’t Fulfill The Challenge In 100 Days?

Life happens. Bills need to be paid, unexpected expenses come up, and 100 days may not always fit your timeline.

So if you come up short a day or two before your next paycheck, that’s okay. Of course, do whatever you can (within reason) to keep the streak alive. But don’t be afraid to give yourself a little grace along the way — just don’t get permanently derailed.

If the delay is more significant, consider spacing the envelopes out. This way, you can continue the challenge, just over a longer time horizon. You could stuff four envelopes per week for 25 weeks or two envelopes per week for 50 weeks.

What If I Don’t Have Extra Money?

It’s hard to join the challenge if you don’t have the extra cash to do it. If that’s the case, review your spending habits and monthly expenses and see what you can cut out.

Look at the biggest line items in your budget first because those are often the easiest places to save a few bucks. Then look at costs that are a matter of convenience — like coffees and lunches on the go, streaming services, and online shopping. If they’re not absolutely necessary, cut them out for at least a few months.

These changes should give you enough money to kick off the 100 Envelope Challenge. And once you’re in it, your savings will start to compound over time. This is the key to escaping the paycheck-to-paycheck cycle and achieving financial freedom.

I’m Near The End Of The Challenge And I Ran Out Of Money. What Can I Do?

Let’s say you are taking a chronological approach to the challenge and you’re on #75… but you only have $10 available. Here are a few options:

- Patience Until Payday: If you are just a few days away from payday, you could choose to skip these in-between days. Either make up for lost time on payday or just end the challenge a few days later.

- Split Your Stuffing: Put the $10 you have available in #75 for now. Tomorrow and the next few days, do the same until you reach $75. Then move on to #76. Again, you can play catch-up down the line or just delay your completion date a bit.

- Jump The Money Line: If you have completed the challenge chronologically, take the money out of the first 11 envelopes which totals $66. With this money and your current $10, you can now fill #75. With the spare $1, fill #1 as well. (Always be sure not to extract any money from the challenge!) Tomorrow, if you are still struggling with cash, start back at #2. This trick helps you fulfill the commitment of stuffing an envelope a day, and it also buys you a few more “easy” days so you can save up for #76.

Unstuffing The Envelopes

Congratulations! You made it to day 100 and the moment you have been waiting for is here.

Remove all of the cash from the envelopes and deposit your $5,050 in newfound savings. If you don’t have an emergency fund yet, this is an incredible start! Put the money in a high-yield savings account to protect yourself against surprises like job loss, medical bills, and car repairs.

And if you already have some financial security, set this money aside to treat yourself — you earned it! You demonstrated the willpower to save for over three months straight and more than likely built a new habit in the process.

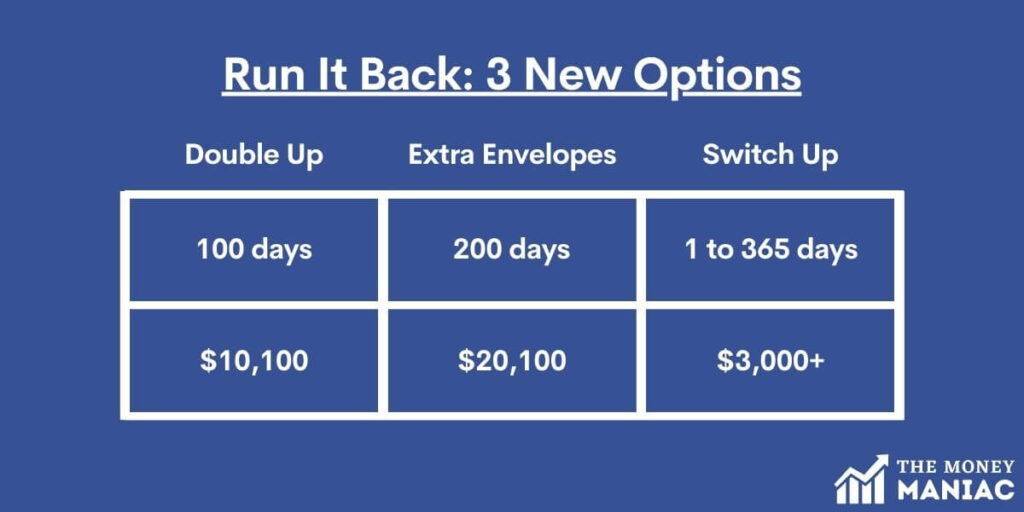

Run It Back: 3 New Options

If you’ve made it this far, you may want to consider completing the challenge again. But this time let’s twist it up a little bit:

- Double Up: This go around, double the amount of money you put into each envelope. Start with $2 and work your way up to $200! This challenge does require some serious income though, as the average weekly savings are more than $700.

- Extra Envelopes: If you can’t double the money, double the time. Stuff 200 envelopes instead of 100. This challenge actually saves even more than the “Double Up” — at more than $20,000! If you choose this approach, you may consider spacing the envelopes out and doing between 2 and 5 per week. This works out to between $200 and $500 in weekly savings.

- Switch Up: Perhaps you’re ready for a new challenge entirely. Try one of these 13 fun budget challenges instead.

Why The 100 Envelope Challenge Works

The 100 Envelope Challenge was created as a fun way to help you stick to a money-saving plan, but does it work? Absolutely! And here are a few of the key reasons why:

- Provides A Tangible Goal: By physically filling up 100 envelopes with cash, the challenge provides a tangible and visual representation of your progress toward your savings goal. This can be a powerful motivator to keep going and reach the end.

- Promotes Accountability: The act of filling up the envelopes and tracking your progress also creates a sense of accountability. You are more likely to stick to the challenge when you have a clear view of your progress over time.

- Builds A New Habit: The act of regularly setting aside money can help build a new habit of saving. As you continue to do it, it becomes easier and more natural to prioritize saving money in your daily life. This can lead to long-term financial benefits and a more stable financial future.

- Customizable: The 100 Envelope Challenge is also customizable to fit your personal financial circumstances. Whether you want to save a specific amount of money, pay off debt, or just create better spending habits, you can adjust the challenge to meet your needs. This flexibility can make it easier to see the challenge through.

Related reading: How To Save $10,000 In A Year On Any Income

Final Thoughts

The 100 Envelope Challenge is a powerful way to make strides toward your financial goals. It can help you accelerate your path to financial independence, establish a meaningful safety net, or simply keep budgeting fun.

In only 100 days, you will not only set aside a huge chunk of change but you will also create a positive new habit. These benefits are more than worth the effort, so why not join the fun? Get your 100 envelopes ready and let’s get to saving!