Do your everyday expenses keep pushing back your dreams of an early retirement? Would you like a plan that anyone can use to reach financial independence? Lean FIRE may just be the solution you are looking for.

Let’s face it — the harsh reality is that many people don’t know when (or if) they will ever have enough money to retire fully. According to the Federal Reserve, the average American family has a meager $65,000 saved.

And 25% have no savings at all!

Lean FIRE is your escape from this uncertainty. This strategy offers a way to reshape your financial habits and turn what may seem impossible into reality.

This guide will arm you with everything you need to Lean FIRE — from budgeting and planning to avoiding the most common pitfalls. Now get ready to discover how you can reach financial independence sooner than you ever thought possible!

What Is Lean FIRE?

Lean FIRE is part of the FIRE (Financial Independence, Retire Early) movement, but with a minimalist twist. This strategy aims to achieve financial freedom much earlier than traditional retirement by living a more frugal lifestyle and saving a significant portion of your income.

Unlike other variants within the FIRE movement, such as Fat FIRE or Coast FIRE, Lean FIRE requires a more rigorous approach to cost-cutting and a willingness to embrace a simpler lifestyle.

It’s designed for those who are committed to the idea of early financial independence and are ready to make significant short-term sacrifices for long-term freedom.

Lean FIRE vs. Traditional Retirement

We are all familiar with the traditional retirement model:

- Work until you are 65 or older

- Diligently contribute to 401(k)s and IRAs

- Hope to live comfortably off those savings and Social Security

If you are lucky, you should have another 10 good years to enjoy your independence after a lifetime of working.

Lean FIRE flips this idea on its head. It advocates for much earlier retirement, often in your 40s, by embracing delayed gratification, frugal living, and aggressively saving.

Lean FIRE adherents prioritize financial independence over material possessions. They are willing to live a more frugal lifestyle today to enjoy financial freedom during their prime years.

Your Lean FIRE Number

Achieving financial freedom is based on saving and investing enough to hit your FIRE number. This is the amount of money needed to generate enough passive income to cover all of your expenses (for the rest of your life). It is a number unique to you, based on your lifestyle and consumption habits.

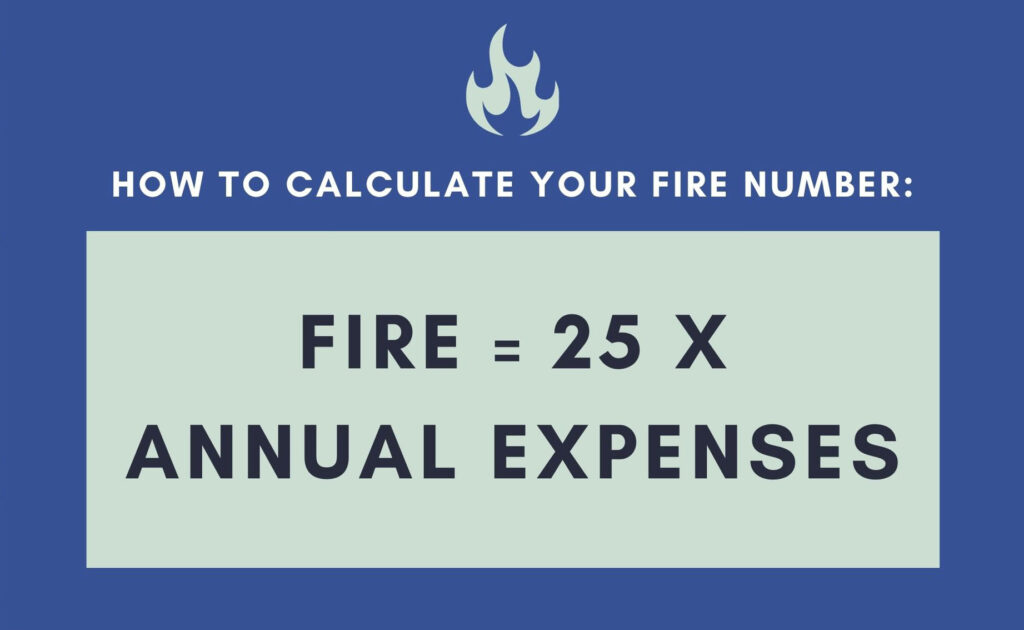

Here are two quick and dirty ways you can calculate your FIRE number:

- Method #1: Multiply your monthly expenses by 12, and then divide that total by 4%.

- Method #2: Multiply your annual expenses by 25.

Both methods assume a withdrawal rate of 4% from your investments to cover your expenses.

Why 4%?

The “4% Rule” is the safe withdrawal rate published in an influential study by professors from Trinity University in 1998. Frequently referred to as “the Trinity Study,” this research paper discovered that “withdrawal rates of 4% are extremely unlikely to exhaust any portfolio of stocks and bonds during any payout periods… in those cases, portfolio success seems close to being assured.”

Since that finding, the 4% rule has become a foundational assumption for retirement planning.

However, it is not a perfect number. There have been some legitimate academic critiques of using it. But it does offer a simple way to determine your FIRE number. (Just be sure to recognize that it is a general target and not a magic threshold.)

Lean FIRE Example

Let’s say you take home $6,000 per month and you can comfortably live on half of that. At $3,000 per month, your annual expenses come out to $36,000.

So your Lean FIRE number is: $36,000 x 25 = $900,000

By investing the remainder of your income, or $3,000 per month, at a 6% inflation-adjusted rate of return, you could amass $900,000 in less than 16 years.

7 Key Benefits Of Lean FIRE

The benefits of embracing Lean FIRE vary from person to person. But here are 7 key benefits that all advocates tend to enjoy:

1) Freedom and flexibility

Financial independence means having the freedom to choose what to do with the rest of your life. That could mean taking on a more fulfilling career, starting a business, pursuing hobbies, or tackling a lifelong dream. Go ahead and choose your own adventure!

2) Increased quality of life

Having more control over how you spend your time allows you to improve your health with better sleep, healthier meals, and more exercise. Plus, you can participate in hobbies and activities that enhance your happiness and satisfaction.

3) Travel the world

Most people spend their working lives dreaming of the exotic destinations they will visit once they retire. Sadly, many don’t have the money or health to travel once they get there. That’s why having the freedom to explore the world’s wonders while in their prime is a significant benefit of Lean FIRE.

4) Time with family and friends

The Lean FIRE lifestyle means making sacrifices in some areas, but it comes with the freedom to control your time. For many, the hustle and bustle of the rat race come at a real cost — not enough time to spend with our loved ones.

So remember, time is the one asset you can never get back. And financial freedom means having more of that precious asset.

5) Reduced stress

The American Psychological Association (APA) has found that money is the top cause of stress in the United States. At the same time, research from the CDC suggests that 26% of people report being burnt out by work and that work stress is a significant source of health-related conditions. That’s why preventing burnout and enjoying financial freedom are such substantial benefits.

6) Giving back

Another benefit of financial freedom is having the time to give back through volunteering or charitable work. Many people find purpose in helping others. Studies have even shown that retirees who volunteer frequently tend to have healthier hearts and a lower risk of dementia.

7) Living simply

Keeping up with the Joneses comes at an enormous cost, both financially and psychologically. In this pursuit, we often move away from doing things for ourselves, working with our hands, growing our own food, and making our own furniture. Yet, sometimes these simple things are the most satisfying and meaningful. If you’ve ever tasted a homegrown strawberry, you know the feeling!

Related reading: 13 Best FIRE Blogs For Financial Education And Inspiration

How To Prepare For Lean FIRE

If you are considering adopting Lean FIRE, here are 5 tips and strategies to help you get started:

1) Evaluate your current financial situation

Get a handle on where your money comes from and where it is currently going. Track all your cash flows (in and out) to develop a realistic picture of your current lifestyle.

2) Create a budget

Build a spending plan that will allow you to cover all your current expenses. Then, track it closely. Was it realistic? If so, bravo, you are on your way. If not, keep adjusting until you find the budget that works for you. To simplify the process, consider using a budgeting app so you can stay on top of your expenses in real time.

3) Reduce costs

Once you find a workable budget that will allow you to cover your current costs, determine how to aggressively cut back on them and save the difference. Our most significant expenses tend to be student loans, homes, cars, children, and travel. If you are serious about pursuing Lean FIRE, you will want to take a long hard look at each of these.

For example, if you work remotely, consider geographic arbitrage to significantly cut your living expenses. Moving to an area with a lower cost of living and cheaper real estate can really boost your savings. Plus, if you no longer have to commute, you might not even need a car!

4) Make smart investments

While adopters of Lean FIRE are serious savers, getting to your FIRE number as quickly as possible requires investing wisely too. First and foremost, you should have an emergency fund to cover life’s surprises (medical bills, layoffs, and more). This will prevent you from getting derailed on your long-term game plan.

Then, look into buying stocks and bonds — ideally in tax-deferred (401k, IRA) and tax-free (Roth IRA) savings vehicles.

5) Increase your income

If you are doing all you can to cut costs, save, and invest, adding more fuel (income) to the fire will make it burn even hotter. Of course, you can always ask for a raise and look for opportunities at work to take on new responsibilities. But if you can’t increase your income at work, seek out a side hustle or find ways to create passive income streams.

Common Lean Fire Challenges

Lean FIRE is a unique and challenging journey. Here are some specific hurdles you might face and strategies for how you can overcome them:

1) Tackling high debt levels

Perhaps you are starting Lean FIRE with a hefty student loan or significant credit card debt. If so, prioritize paying off these high-interest debts before anything else.

You may also consider refinancing or consolidating debt to reduce your interest payments. Both of these strategies will free up more income to pay down debt and beef up your savings.

2) Avoiding money traps

- Education: Before investing in any further education, assess the potential return on investment. Then, look for scholarships, grants, and employer-sponsored programs to avoid paying out of pocket and accumulating more debt.

- New cars: Instead of buying a new car that depreciates quickly, look for a reliable used vehicle. Not only will this lower your monthly payment, it will also lower your insurance and maintenance costs.

- Extravagant spending: Rethink your vacations, wedding, and dining choices. Find budget-friendly alternatives that allow you to meet your Lean FIRE goals, without sacrificing the quality of the experience.

3) Resisting social pressure

It’s easy to fall into the trap of trying to keep up with the Joneses. Instead, focus on your long-term financial freedom rather than any short-term social validation.

4) Curbing lifestyle creep

It’s natural to want to splurge as your paycheck grows. However, a better strategy is to treat salary increases as opportunities to boost your savings rate, not your spending habits. Remember, every luxury or upgrade you forgo now brings you one step closer to early retirement and a lifetime of freedom.

How Does Lean FIRE Stack Up With Other FIRE?

Lean FIRE is just one approach to the early retirement movement. Depending on your goals and your willingness to embrace lifestyle change, there are a few kinds of FIRE.

Here’s a quick overview of each one compares to Lean FIRE:

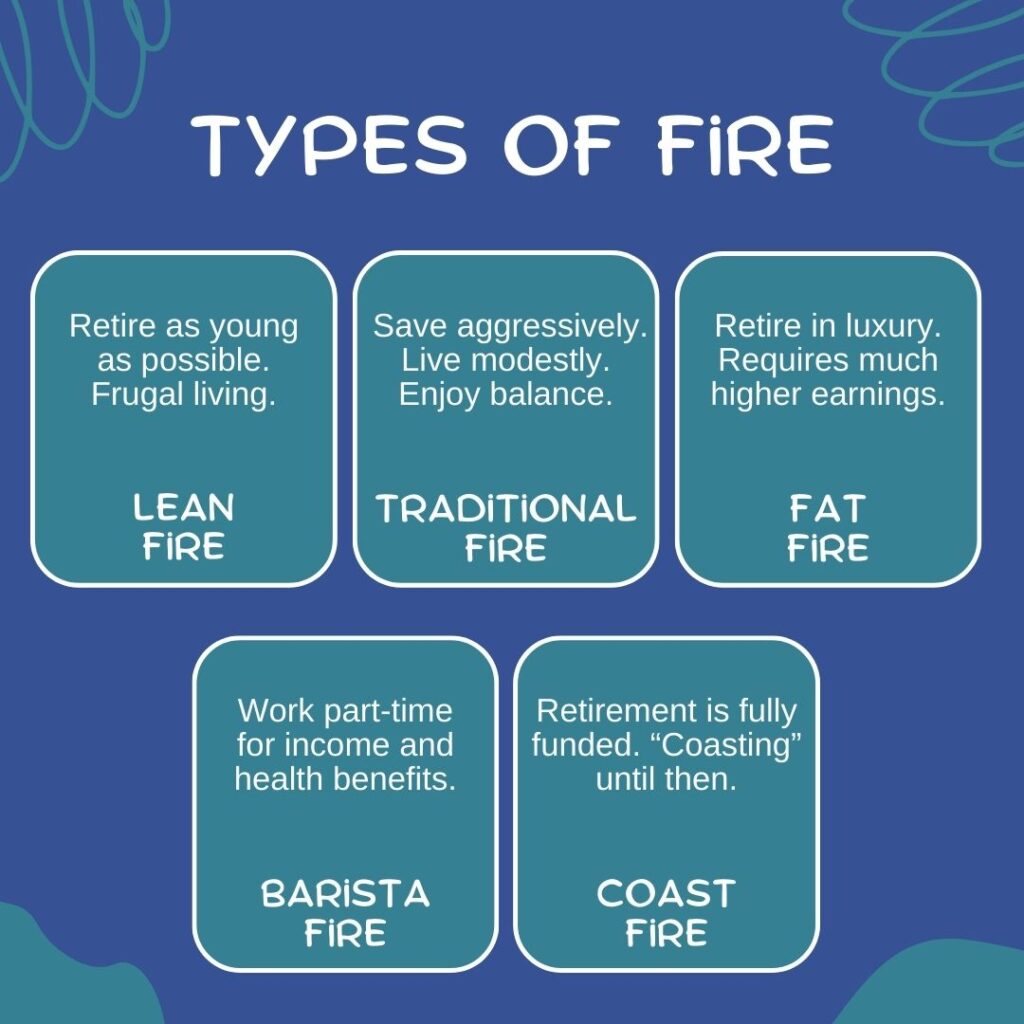

Lean FIRE vs. Fat FIRE

Lean FIRE prioritizes financial freedom. Followers opt to minimize their expenses to retire as early as possible.

Fat FIRE, on the other hand, appeals to those striving for a luxurious retirement. It requires a higher income, a lot more savings, and a multi-million dollar net worth at the time of retirement. It’s suitable for those who are willing to sacrifice time and effort in exchange for a higher standard of living in retirement.

Lean FIRE vs. Barista FIRE

Lean FIRE is all about aggressive saving and living minimally to retire as soon as possible. It’s ideal for those who can drastically cut expenses.

In contrast, Barista FIRE involves working a part-time job after reaching a certain level of financial independence. This approach reduces the need for such a large net worth due to the ongoing income and benefits (like health insurance).

Plus, Barista FIRE provides a healthy balance between work and leisure, even if you aren’t 100% fully retired.

Lean FIRE vs. Coast FIRE

Coast FIRE is for those who have saved enough to fund their retirement but continue to work to cover their current living expenses. Essentially, they’re “coasting” through without the pressure to save aggressively.

Lean FIRE, on the other hand, is for the motivated few who want to achieve financial independence the fastest way possible. Instead of coasting, they continue to save aggressively up until retirement.

Final Thoughts

Traditionally, early retirement was reserved for only the highest earners. But now, Lean FIRE is a realistic option for anyone willing to put in the hard work and make the required lifestyle changes.

With careful planning and smart investments, you can escape your 9-to-5 and reap the rewards of FIRE, well before retirement age.

You will be able to enjoy your days however you please. You could get involved with hobbies you are passionate about, immerse yourself in new cultures, or take some time for yourself!

More importantly, by implementing frugal spending habits and finding creative ways to supplement your income, you won’t have to skimp on the quality of your life.

So get started on the Lean FIRE journey today, and make sure that your dreams of early retirement come true!