So you saved up some money and now you’re ready to invest. There’s just one problem — where do you begin? With stocks, options, bonds, ETFs, mutual funds, and more all available… the number of different choices can be overwhelming.

To start, brush up on the basic principles of stocks and bonds. This article will cover what these two traditional options are, how they differ, and how you can decide which investment is right for you. Let’s jump in!

Stocks and bonds: An overview

Stocks and bonds are two of the most common investment vehicles. Here is a quick rundown on exactly what they are and what they entitle you to:

What is a stock?

A stock is a share of equity ownership in a company. When you purchase common stock on an exchange like the New York Stock Exchange or Nasdaq, you become a partial owner of that company which entitles you to certain voting and economic rights.

These rights allow you to:

- Receive regular dividend payments

- Participate in the company’s profits

- Vote on certain corporate matters

Stock investors seek out companies with strong financial metrics and promising growth prospects. Apple (AAPL), for example, has been a darling in the eyes of most investors due to the company’s success in gaining market share in the phone, computer, headphone, app, and cloud storage verticals.

Apple originally offered its stock to individual investors via an IPO (initial public offering) on December 12, 1980, at $22.00 per share, or $0.10 when adjusted for stock splits. By selling an ownership stake to the public, Apple raised funds for its long-term investment strategy.

If you purchase Apple stock on the open market today, you become an Apple shareholder. Each share of Apple’s stock pays a quarterly dividend and entitles you to now vote at annual shareholder meetings.

And although you are a partial owner of the business, you are not legally liable for the company’s decisions, lawsuits, or losses (beyond your initial investment).

What is a bond?

Bonds are debt investments, which means they have very different risk and reward profiles as compared to stocks. And unlike stocks, bonds can be issued by companies, municipalities, states, and federal governments to finance projects and operations.

On a mechanical level, bonds work by loaning money to a corporation (or government entity) for a certain period of time at an agreed-upon interest rate. This interest rate is generally a reflection of the riskiness of the bond issuer.

For example, the safest bonds are United States treasury bonds. Just below that are investment-grade bonds — these are corporate bonds from the most well-known and creditworthy companies in the world. And non-investment grade bonds are known as high-yield bonds or junk bonds.

Bond investors do not own any equity in the underlying company. Instead, they receive regular interest payments over the life of the loan. And at maturity, the issuer repays the loan to the investor.

As an example, let’s say you buy a 10-year government bond at its face value of $10,000 with a 5% interest rate. This indicates that the government will then pay you $500 in interest per year, and at the end of the term (the maturity date), it will repay you the $10,000 principal.

Although bonds are generally thought of as low-risk investments, there is always some risk that the issuer defaults. This is known as credit risk and could happen if the company files for bankruptcy before repaying its obligations.

Related reading: 10 Best Alternative Investments To Diversify Your Portfolio

7 key differences between stocks and bonds

Now that you know the basics of stocks and bonds, let’s take a look at the key differences between the two types of investments.

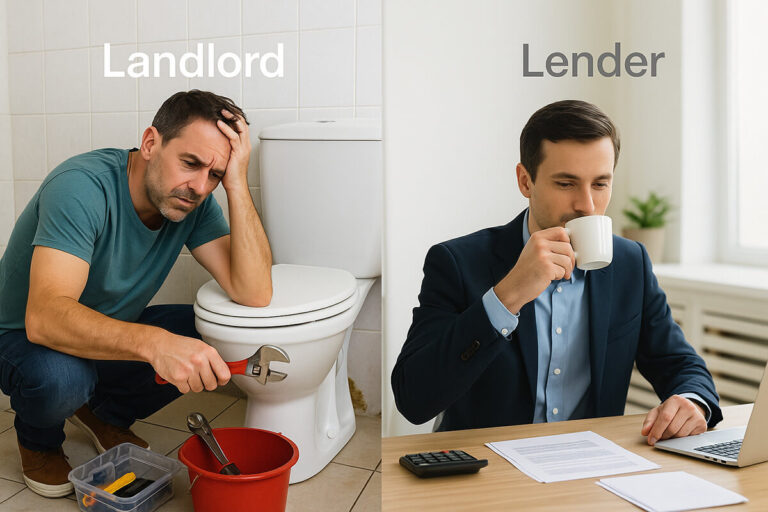

1. Ownership

As an investor in equity securities, you are a bonafide owner of the company. This means that shareholders have a legal claim to the company’s profits and assets — they also have the right to vote on important company matters like governance, mergers and acquisitions, and distributions.

Bondholders, however, have no ownership stake in the company. And holders of government bonds have no say in the operational or political decisions made by their country of issue. Instead, these fixed-income securities entitle lenders to regular interest payments and the return of their principal at the maturity date.

2. Risk

Another key difference between stocks and bonds is the risk that the purchaser takes on. These risks mainly boil down to liquidation preference and market volatility — we will address the latter in the next point.

Liquidation preference refers to the order in which creditors are paid back if the company were to file for bankruptcy. In that event, all assets are liquidated and used to repay creditors. If, and only if, there are any remaining assets, shareholders are entitled to their proportional share of the remaining funds.

Because of this liquidation preference, bondholders almost never experience a total loss of capital. And while total loss is not common amongst stock investors either, it does happen much more often on a relative basis.

3. Volatility

Stock prices are much more volatile than bond prices — and this is a natural consequence of stocks having more risk than bonds.

Because stable companies (and governments) rarely default on their bonds, the bond market as a whole is much more steady. Plus, bonds are generally purchased for their yield and held until maturity, again making them less susceptible to speculation and market conditions.

But stocks have a very different relationship with the market. Because the risk is inherently higher and most participants buy stocks for appreciation, market psychology can swing stock prices quickly and frequently.

4. Liquidity

Stocks and bonds also have different levels of liquidity in the market. Most equities, especially those on major exchanges, are very liquid and can be bought and sold easily during trading hours.

Bonds have more limited liquidity, mainly due to the vast number of fixed-income investments available across different credit ratings, maturities, and coupons. Plus, because their prices are more stable, there is much less incentive to trade in and out of them.

5. Cash flow

Both stocks and bonds have the potential to cash flow, but not all stocks actually do.

When you invest in bonds or bond exchange-traded funds (ETFs), you will receive periodic interest payments from the issuer. These coupon payments are agreed upon in advance and largely dependent on the prevailing interest rates when you first invested.

On the other hand, only some stocks pay dividends. Dividends are regular payments (usually quarterly) issued on a per-share basis and often in the range of 0.5% to 3.0% of the stock’s current value. However, it is important to be aware that dividends are discretionary, not mandatory. And that means companies can increase, decrease, or completely eliminate them at any time.

6. Tax implications

The income you generate from stocks and bonds can be taxed differently, depending on a few factors.

Most dividends are taxed as ordinary income, but some “qualified” dividends are taxed at a lower capital gains rate. To be treated as a qualified dividend, the payment must be made from a U.S. company and you must meet the required holding period. (Plus a few exceptions.)

The taxation of interest payments is much more complicated to summarize. Treasury securities, municipal bonds, and corporate bonds can all be treated differently in the eyes of the IRS. Some bonds are exempt from state, local, and even federal taxes, others are taxable at capital gains rates, and others as ordinary income.

For tax advice on income generated from individual bonds, consider consulting a certified financial planner.

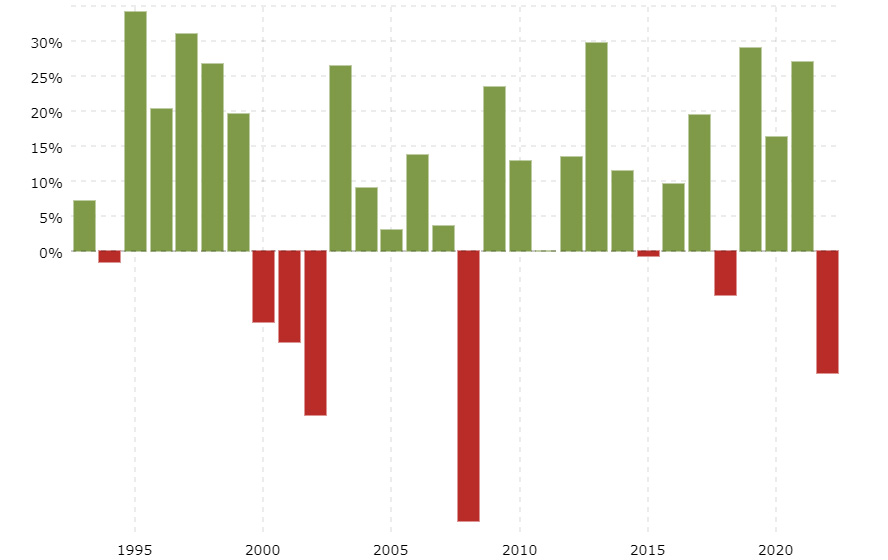

7. Appreciation

Another major difference between stocks and bonds is the potential for appreciation. Generally, when you buy stock in a company, you do so with the expectation that the price will rise over the long term.

For reference, the S&P 500 has returned an average of 7.31% over the past 30 years after adjusting for inflation. But it is important to note that past performance is not indicative of future performance — always keep this in mind before applying any technical analysis predictions.

Bonds, however, do not typically appreciate like stocks. Bond prices can fluctuate due to changes in interest rates, credit ratings, and inflation, but these variations tend to be more subtle. And because bond investors typically hold the securities until maturity, these factors are less consequential.

How to choose the right investment

There are a handful of tradeoffs when choosing between stocks and bonds. Here are a few helpful questions you can ask yourself to determine which investment is right for you:

1. What is my time horizon?

Understanding your investment time horizon is key when evaluating stocks and bonds. If you are investing for the long term, the stock market may be a better option as it has the potential to generate higher total returns over time.

Taking a long-term view also allows for volatility to sort itself out — inevitable corrections and bear markets will have the chance to resolve themselves before you sell.

Conversely, if you’re looking for a short-term investment or more immediate income, bonds are less susceptible to market fluctuations. Plus, they provide reliable interest payments for the life of the investment.

A popular rule of thumb is to stick with bonds if you have a three to five-year time horizon and to consider stocks if you can hold them for at least five years.

2. How much risk am I willing to take?

Bonds carry lower risk than stocks because of their reduced volatility and their higher liquidation preference in the event of bankruptcy. So if your priority is to minimize risk and lock in a rate or return, bonds are the way to go.

Stock investors, on the other hand, must have greater risk tolerance — they need to accept that the prospect of higher returns only comes with higher risk.

Typically, your risk tolerance will vary based on your age and level of financial security. For example, if you have a nest egg of liquid savings, then you may be comfortable taking on additional risk. Or, if you are younger in age, you may be more willing to accept risks as you have longer to recover from potential losses.

3. Do I want a fixed income stream?

If you’re looking for a dependable income stream, bonds are the safer asset class. While stocks can generate income, dividends are not contractually guaranteed.

That being said, the dividend aristocrats are a set of companies that have paid and increased their dividends for at least 25 consecutive years. These stocks may also be a good place to begin building a cash-flowing investment portfolio.

4. Do I want capital appreciation?

If your goal is to maximize your total return on investment, owning stocks is the way to go. However, all investments carry risk. So to mitigate this, shareholders are encouraged to take a long-term view and, of course, do proper due diligence.

5. How important is liquidity to me?

If there is any chance you will need to sell (i.e. liquidate) your stocks and bonds in the short term, liquidity is an important consideration. Stocks are highly liquid assets, meaning you can trade in and out of them cheaply and easily. Bonds, on the other hand, may require a greater discount to sell quickly.

So if you may need to access your funds in the event of a financial emergency, stocks get the slight edge here.

6. What ratio of stocks and bonds is right for my portfolio?

As with most things in life, your decision in buying stocks and bonds isn’t all black and white. In fact, investors tend to allocate a portion of their portfolio to both asset classes.

In general, this split depends on age and risk tolerance. Younger individuals often allocate a greater percentage (or all) of their funds toward individual stocks.

Over time, this balance shifts more and more toward bonds. These fixed-income securities reduce the overall volatility of the portfolio and generate income that can be used for living expenses in retirement.

Related reading: How To Learn The Art Of Top-Down Investing: 3 Key Principles

Final thoughts

As you can see, the decision to invest in stocks and bonds comes down to a number of personal preferences. Stocks have the potential for higher returns but also expose you to a higher degree of risk. Bonds offer more stability but also tend to provide lower returns than stocks.

Ultimately, the right choice for you will depend on your risk tolerance, time horizon, and financial goals. If you have settled on buying stocks, follow this guide to learn how to identify undervalued equities. Or, if you just want to continue your financial education, here is a quick overview of options trading for beginners.