Top-down investing is one of the most popular investment strategies today. Used by short-term traders and long-term buy-and-hold investors alike, it focuses on the big picture and helps investors identify attractive trends.

Although top-down investing may seem complicated at first, this article breaks down the basics to help you get started. Let’s discuss the what, why, and how of top-down investing!

What Is Top-Down Investing?

Top-down investing is like finding a good house by first identifying a great neighborhood.

It’s an investment strategy that takes a big-picture view, starting at the highest level of the economy. Then, it calls for further refining the search by geography, industry, or sector. And finally, it zooms in by selecting individual investments.

Top-down investors seek to understand what is driving markets before delving into specific assets. They observe macroeconomic trends across entire regions or markets, and then look for undervalued or overlooked opportunities based on their analysis.

Related reading: How To Supercharge Your Portfolio With Factor Investing

What Are The Benefits Of A Top-Down Approach?

Top-down investing offers several potential benefits to investors. Here are three of the most important:

- Trend-spotting: It encourages investors to identify the most pertinent trends in the market. This is particularly helpful during periods of high volatility when most people are responding reactively.

- Structured analysis: It helps investors apply insights across multiple markets and sectors with a consistent, disciplined strategy. This reduces the potential for personal bias, which can arise when selecting individual stocks in an unstructured manner.

- Diversification: It allows investors to spread their risk by investing in different markets, industries, and assets. This can provide more stability in an otherwise turbulent market environment.

Top-down investing has its challenges. For example, the big-picture approach can overlook lucrative opportunities within lagging sectors or industries. However, with a bit of practice, investors can learn to use top-down investing to increase their hit rate on investments of all kinds.

3 Must-Know Top-Down Investing Principles

Successful investing is about more than watching prices go up — it’s about making informed decisions systematically. In other words, being right once isn’t enough. You need to be right repeatedly.

If you’re looking for a reliable way to achieve this and evaluate investments, here are three key principles of top-down investing that you should keep in mind:

Principle 1: Start With Your Goals

The first principle of top-down investing success is having clearly defined goals. And this is not some cliche — it’s essential.

You need to know exactly what you want from your investments in order to determine where you should invest. Do you want to become financially independent, or save up for a major purchase? Either way, goals help you evaluate your progress and ensure you are on track for success.

Follow these two steps to start setting appropriate financial goals:

Step 1: Analyze Your Financial Situation & Make Projections

To start, ensure you understand how much money you have, where it is coming from, and what your short-term needs are. You should have a surplus of income after budgeting for your regular expenses if you want to invest.

Because no matter how safe the opportunity is, you should never invest money you cannot afford to lose. Always take care of the necessities like putting food on the table and keeping the lights on first.

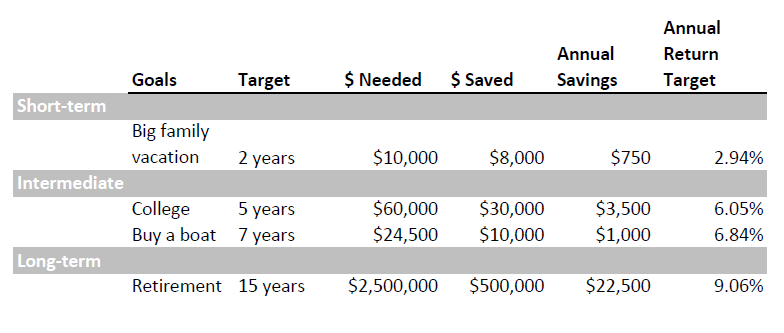

However, if you do have some discretionary savings, this is the capital you can put to work. So identify what you are saving for and when you may need to access the funds. For example, you may dream of a big family vacation next summer, sending a child to college in five years, buying a fishing boat in seven years, or retiring in fifteen years.

Step 2: Determine Your Investment Time Horizon & Risk Tolerance

Once you have articulated specific goals and have a good handle on the amount of money you have to save and invest, the next step is to plot those goals on an investing timeline.

Assign each goal to one of three buckets: short-term, intermediate, or long-term. Then, determine appropriate time horizons and realistic savings rates. With these numbers filled out, you can calculate the necessary return rate to reach your investment goal.

Based on the “hurdle rate”, or return target, you can choose the risk profile that is most likely to help you hit your goal. But remember, higher returns generally come with higher risk. And higher risk means more volatility and greater potential for losses.

Here’s an illustrative time-segment example:

Step 3: Reflect On Risk

As you review your return targets, it’s important to reflect on your capacity and tolerance for risk.

What is the difference?

Risk capacity is your ability to accept risk. For example, your capacity is high if you can lose most of your investment yet still achieve your goal. This may be because of out-of-pocket cash flow or other assets. Whereas if you have no surplus cash flow or savings, your risk capacity is low. This means you will not be able to achieve one or more of your goals if you lose money on an investment.

Risk tolerance, on the other hand, is your willingness to accept risk. Or, more precisely, your willingness to miss your return targets and not achieve your goals.

Your risk tolerance might be high, for this specific goal, if delaying the purchase of a fishing boat is not that big of a deal. But if sending your child to college is non-negotiable, then your risk tolerance would be lower for this goal.

If your risk capacity and tolerance are both low, consider more secure and predictable investments such as U.S. Treasuries. And if your capacity and tolerance are high, you may consider more volatile investments with higher expected returns such as cryptocurrency or small-cap stocks.

It’s worth assessing your current financial picture, desired targets, timeframes, and risk appetite before starting any investing journey. That way, when the ups and downs arrive (as they certainly will), you will have reliable benchmarks to guide your decisions.

Principle 2: Research Market Conditions And Select Sectors

Taking a top-down approach is a great way to understand the forest before thinking about the trees. There are two steps to researching market conditions and selecting sectors in this way:

Step 1: Analyze Macro Trends And Identify Attractive Investment Opportunities

Macro trends are directional shifts that last for extended periods of time and impact large groups of people. A few examples include demographic changes like the baby boom, technological advances like the rise of the internet, and shifts in consumer behavior like the move away from fossil fuels.

Identifying these trends (especially early on) can be a challenge. Still, a few places to look for clues are global economic growth rates, inflation data, currency exchange rates, changes in fiscal and monetary policy, geopolitical turmoil, and changes in consumption patterns.

A thorough macro trend analysis should focus on significant demographic, environmental, economic, technological, political, and cultural shifts. Often, these macro trends will reflect the interconnectivity of the global economy and point to investment opportunities.

Macro trend example:

Between 1947 and 1962, the U.S. population grew at twice the speed of the previous three decades. This sudden spike in the birthrate was called the “baby boom.”

Now, roughly 10,000 Baby Boomers are turning 65 every day — and this massive generation is beginning to transition out of the workforce. This change in demographics and spending patterns creates significant economic and social impacts that ripple through the economy. Here are a few of the most notable shifts:

- Social security: The CBO projects OASDI trust funds will run out in 2033

- Labor: Since 2020, workforce participation has dropped, and there are now 4 million more open jobs than job seekers

- Consumer spending: Retirees spend less on certain goods and services and more on others, like healthcare

Given the changes in consumption associated with this trend, there might be attractive investment opportunities that benefit from second and third-order effects. For example, retirement-related travel, technology solutions for an aging population, or healthcare products and services targeted to seniors could see spikes in demand.

Step 2: Understand The Sectors Of The Market

The broader economy can be segmented into categories based on the goods and services they produce. These categories are known as “sectors.”

Since economic variables and business cycles impact segments of the economy in different ways, top-down investors often use sector-based investment strategies that align with their macro trend analysis.

Most market participants have adopted the Global Industry Classification Standard (GICS) structure, which consists of 11 sectors, 25 industry groups, 74 industries, and 163 sub-industries.

The 11 sectors of the market are:

- Energy: Companies engaged in producing, refining, and transporting oil and gas. Examples: Exxon Mobil, Chevron, and BP.

- Materials: Companies that manufacture chemicals, paper products, glass, construction materials, and metals, including minerals and mining companies. Examples: BHP, Rio Tinto, and Freeport-McMoRan.

- Industrials: Companies that manufacture and distribute capital goods like aerospace, defense, electrical equipment, or machinery. And providers of commercial and professional services like security, employment, or transportation. Examples: Honeywell, Lockheed, Boeing, and Caterpillar.

- Consumer discretionary: Companies that sell household goods, leisure products, and services. Examples: Toyota, Amazon, and Nike.

- Consumer staples: Companies that manufacture and distribute food, beverages, tobacco, and personal products. Examples: Anheuser-Busch, Walmart, Coca-Cola, and Colgate-Palmolive.

- Health care: Companies that provide services, or create health care technology, equipment, and supplies. Examples: Johnson & Johnson, Pfizer, and Abbott Labs.

- Financials: Companies involved in banking, insurance, financial services, and mortgages. Examples: JPMorgan Chase, Visa, Wells Fargo, and Berkshire Hathaway.

- Information technology: Companies that develop technology hardware, equipment, software, and information services. Examples: Apple, Microsoft, Cisco, Texas Instruments, and Adobe.

- Communication services: Companies involved in telecommunications, media, entertainment, wireless services, and interactive gaming. Examples: Disney, Comcast, AT&T, Verizon, and Netflix.

- Utilities: Companies that generate and distribute electric, gas, and water utilities. Examples: Eversource, Pacific Gas & Electric, and Duke Energy.

- Real estate: Companies engaged in developing and operating real estate, including Real Estate Investment Trusts (REITs). Examples: CBRE, Public Storage, and Weyerhaeuser.

Macro trend example (revisited):

Based on our previous analysis of the Baby Boomer trend, sectors that might see increased demand in the coming years include Consumer Discretionary (especially hotels & travel), Information Technology (senior-focused tech), and Health Care (geriatric services).

Principle 3: Select Investments That Fit Your Criteria

Before selecting investments that reflect your top-down analysis, choose an investment vehicle that meets your expectations in terms of liquidity, volatility, returns, and risk-to-reward ratio.

To accomplish this, top-down investors generally gravitate toward using exchange-traded funds (ETFs) and individual company securities.

Here are a few tips for finding the right investment vehicle:

Selecting The Right ETF(s)

1) Determine the index methodology and underlying exposures of the ETF.

ETFs are baskets of stocks or bonds that are designed to track a specific index, sector, or investment theme. They make it easier for investors to gain exposure to a group of assets without having to buy each one individually.

ETFs follow a rules-based approach to replicating a specific market or segment of the market. And depending on how these rules are written, there can be subtle differences even between ETFs that track the same index (like the S&P 500).

These nuances can affect the holdings, performance, and fees of an ETF. So it’s important for investors to understand the methodology used by a given ETF before investing in it.

2) Evaluate how well the ETF delivers your desired exposure.

Once you have found the right index based on its stated methodology and underlying holdings, you may still see a deviation from the performance of the index and the ETF over time. This is known as “tracking error.”

To minimize the cost of running an ETF, fund managers will often buy a select group of some of the stocks or bonds in an index but not all of them. It can be expensive to transact across all 500 stocks in the S&P 500, for example.

Instead, these managers will use a statistical technique known as “sampling” that aims to replicate an index as closely as possible. However, because the underlying holdings aren’t exact, differences in performance can pop up from time to time.

You have to decide for yourself how much tracking error you are willing to accept while pursuing your investment objectives.

3) Pay attention to the ETF’s liquidity and expense ratio.

Two crucial details to be aware of with ETFs are liquidity and expense ratios. Liquidity refers to the daily trading volume of the security. This is important in the event you need to suddenly exit your position. If there are not enough buyers in the market, you may experience slippage and lose a portion of your returns or be unable to exit the position at all.

The expense ratio is the amount of money you have to pay as a percentage of total assets to own the ETF. These costs are assessed at the fund level and are passed on to you, the investor, in the form of lower performance or tracking error. Generally speaking, the lower this number is, the better for investors.

Selecting The Right Stocks

One of the main differences between taking a top-down investing approach and a more bottom-up fundamental analysis approach is stock selection.

With a top-down approach, the main emphasis is on identifying a significant trend in the market. Then, you select stocks that capture this trend and have the potential to outperform the broader market.

Bottom-up investors, on the other hand, analyze individual stocks and look for ones with attractive fundamentals that can be held for long-term capital appreciation.

This difference can be thought of as picking a good house in a great neighborhood instead of trying to pick the very best home regardless of its neighborhood.

When selecting stocks to execute a top-down approach, the emphasis is on capturing the economic theme with as few surprises related to the individual stocks (unpleasant earnings surprises, management changes, abrupt shifts in strategy, etc.) as possible.

Focus on those securities that will give you maximum exposure to your investment thesis, are reasonably priced, and run predictably by management. In this case, consistency of exposure to your investment theme is most important. Simply let the rising tide lift all boats.

Final Thoughts On The Art Of Top-Down Investing

Top-down investing is a great way to capitalize on big-picture shifts in the market while still retaining an element of stock selection. To successfully execute this strategy, investors should focus on these three key principles: start with a goal, identify macro trends, and select assets that align with the trend.

With a disciplined approach, this strategy can greatly improve your odds of achieving your long-term investment objectives. So, get out there and start capitalizing on the power of top-down investing! Good luck.