Crypto is still the wild west of investing. With incredible highs and equally low lows, it can be hard to figure out which cryptocurrency has the best chance of success. Fortunately, we can draw on investing principles from the stock market to help guide our hands. Blue chip stocks have been the hallmark of a balanced portfolio since the early days of investing, and blue chip crypto projects are no different.

This article will highlight 7 blue-chip cryptos that have distinguished themselves as promising investments in the future of decentralized finance. If you want to learn more about the cryptocurrency space, these blue-chip crypto projects are the best place to start. Let’s go!

What Does Blue Chip Mean?

‘Blue chip’ is a term used to describe large, well-established, and financially sound companies. Blue chip stocks are often industry leaders with a long history of profitability and low volatility. Because of their steady returns and potential for income generation, blue chip stocks are regarded as a safe haven for investors and a great way to diversify portfolios.

Here are a handful of popular blue-chip companies:

- Amazon

- Apple

- Berkshire Hathaway

- Coca-Cola

- Costco

- Disney

- Home Depot

- JPMorgan Chase

- McDonald’s

- Microsoft

- Nike

- Starbucks

- Walmart

What Is Blue Chip Crypto?

Blue chip crypto refers to a group of digital assets that have proven themselves as reliable investments with strong performances over time. In a highly volatile and uncertain market, investing in blue-chip cryptocurrencies can help investors avoid the risks associated with more speculative tokens.

To determine whether a cryptocurrency may be considered a blue chip asset, consider the following criteria:

- Stability: Relative to other cryptocurrencies, blue chip cryptos should have lower volatility and be less susceptible to sudden price fluctuations. This nascent technology still faces periodic bull runs and bear markets, but blue chip crypto tokens should be able to weather these storms better than comparable investments.

- Long-term performance: To qualify as blue chip crypto, a token must not only exist for years but also consistently show positive returns. Because of the increased volatility that crypto investors experience, these returns should exceed those of safer investment choices.

- Liquidity: Liquidity is important for any asset class, and crypto is no exception. Blue chip cryptos should therefore have enough trading volume to make it easy for investors to enter and exit the market without too much slippage or price manipulation.

- Market capitalization: Market cap indicates the total value of a crypto asset’s supply. Blue chip cryptos should have a high market cap, reflecting their desirability and popularity among investors.

Blue Chip Crypto Tokens To Invest In

At present, the only two cryptocurrencies that clearly meet the blue-chip criteria are Bitcoin and Ethereum. Let’s dive into why these two financial assets are beloved by the crypto market and a great place to start investing in crypto.

Bitcoin (BTC)

Bitcoin is the original and most popular digital currency. It was created in 2009 by an anonymous programmer (or group of programmers) under the pseudonym Satoshi Nakamoto. The cryptocurrency’s original white paper outlined a decentralized, permissionless system that allows users to transfer value without the need for intermediaries.

This revolutionary system is powered by blockchain technology and secured by cryptography. Blockchain is a distributed ledger technology that records all transactions in an immutable, permanent way. And cryptography is used to keep these transactions secure and prevent double-spending, which would open the door to fraud.

In the wake of the U.S. financial crisis, the idea of eliminating counterparty risk — or the risk that comes with relying on a third party to fulfill a financial promise — resonated deeply with investors. And as the Federal Reserve stimulated the U.S. economy with quantitative easing and near-zero interest rates, Bitcoin provided an alternative to the endless devaluation of fiat currencies. The blue chip crypto has a fixed supply and no central authority that can manipulate its value.

These features propelled Bitcoin to become the first mainstream cryptocurrency — and it remains the world’s flagship crypto today. The promise of a decentralized, open-source cryptocurrency has captivated the world, and Bitcoin is the token that kickstarted this new asset class.

As a result, Bitcoin has dramatically outperformed traditional markets since its inception. And even with the proliferation of alt-coins like Ethereum and BNB, Bitcoin still dominates the crypto industry, with approximately 40 percent of the total crypto market cap.

The cryptocurrency’s longstanding existence has led to the creation of various supporting financial tools, such as Bitcoin-specific custodial services and exchange-traded funds. These make it simpler for first-time crypto investors to invest in Bitcoin and other blue-chip crypto options.

Ethereum (ETH)

Launched in July 2015, Ethereum is the second-largest cryptocurrency. The project was created by Vitalik Buterin, a Thiel Fellow and former cryptography research assistant.

After co-founding Bitcoin Magazine, Buterin authored a white paper for a blockchain-based platform that could support smart contracts and decentralized applications (dApps). Smart contracts are programs that execute an agreement by carrying out predefined actions when certain conditions are met. And dApps are apps that utilize smart contracts to support peer-to-peer networks.

And less than two years after Buterin envisioned this decentralized network, Ethereum was born. Now, as the basis for over 3,000 crypto projects, the Ethereum blockchain serves as the backbone for crypto payment processors, NFTs, DAOs, and other decentralized financial applications.

In addition to its utility, Ethereum has a few more benefits that make it a blue-chip crypto project. First, the network was built with scalability in mind. This allows developers to process more transactions, enabling larger user bases and faster transaction times.

Second, fees on Ethereum have decreased over time. Most recently, the network upgraded from its proof-of-work consensus protocol to a more efficient proof-of-stake protocol. This shift has greatly reduced the cost of transactions, making it an even more attractive option for users. Plus, it made the project more eco-friendly by reducing its energy usage.

And third, Ethereum has a larger network effect than most projects in the crypto space. This means more users, merchants, and developers are familiar with the network and trust it — further boosting its value.

Semi-Blue Chip Cryptocurrencies To Consider

As proven cryptocurrencies with real-world applications and devout communities, Bitcoin and Ethereum stand in a class of their own.

However, new projects with viable use cases and the potential for significant upside are emerging every day. Those that have shown the most promise but have not yet demonstrated long-term staying power are commonly known as semi-blue chips.

Here are a few of the best projects to consider in this category:

Binance Coin (BNB)

Binance Coin is the native cryptocurrency of Binance, the world’s largest crypto exchange.

Launched in 2017, BNB was created as a utility token that allows Binance users to pay discounted fees when trading on the exchange. Since then, Binance has expanded the role of its native token on its platform — allowing users to invest in the market, buy gift cards, book travel, and accept payments with BNB.

Binance Coin was originally developed as an ERC-20 token (meaning it was built on the Ethereum blockchain) and sold through an ICO or initial coin offering. Then in 2019, Binance built out its own blockchain, known as BNB Beacon Chain, to combat Ethereum’s network congestion. After swapping with previous token holders at a 1:1 exchange rate, BNB now runs on its own blockchain.

As a result, BNB has become a central part of Binance’s ecosystem. This utility has fueled its rally to become the third most valuable cryptocurrency, excluding stablecoins. And BNB’s performance and liquidity have attracted investors who are looking for semi-blue chip cryptos with remaining upside potential.

Cardano (ADA)

Named after the renowned mathematician Gerolamo Cardano, Cardano is an open-source blockchain project branded as a “third-generation” platform. The network’s ticker symbol of ADA is also a nod to an early pioneer in computer science, Ada Lovelace.

In 2015, Charles Hoskinson (co-founder of Ethereum) began developing Cardano as an answer to the scalability and performance issues of the “second-generation” Ethereum blockchain. By 2017, the Cardano network was running on its mainnet and introduced a new consensus protocol — known as Ouroboros.

Ouroboros is a proof-of-stake algorithm that relies on users staking their ADA tokens to participate in validating the blockchain. This staking system helps maintain network security, reduces energy consumption, and allows users to earn yield for participating. Before Ethereum’s switch to proof-of-stake, Cardano was the first major crypto project to use this type of algorithm.

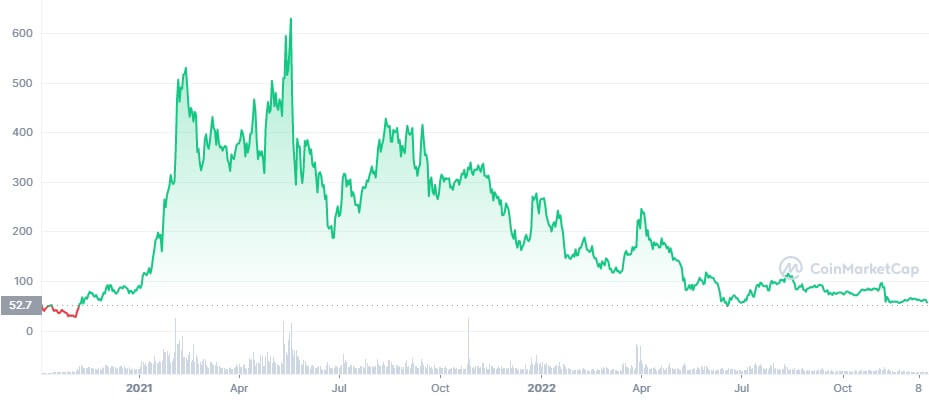

Like much of the cryptocurrency market, Cardano saw impressive growth throughout 2020 and 2021 as cheap capital flooded the market, sparking both speculation and mainstream adoption. Since then, however, ADA has experienced the same fate as most other semi-blue chip cryptocurrencies.

Solana (SOL)

Solana is a blockchain platform specifically designed to make decentralized applications (dApps) more efficient and cost-effective. After proposing the concept in a white paper in 2017, Anatoly Yakovenko deployed the blockchain in 2020 and then raised $314 million from Andreessen Horowitz in 2021 to improve its scalability, energy efficiency, and transaction speeds.

Today, Solana is similar to Ethereum in that it hosts smart contracts. However, SOL relies on its own proof-of-history mechanism, rather than the more widespread proof-of-stake, to process transactions at low fees.

Proof-of-history layers in the concept of timestamping to help the network operate faster. Because every node in the network references the same clock, verification can be done much more efficiently. As a result, the Solana network can process more than 3,000 transactions per second, while Ethereum can only handle about 15.

That being said, Solana has faced criticism for its periodic outages. Plagued with bugs in its code and bots on its network, SOL has crashed five times since its launch in 2020. While these issues appear to be smoothing out, Solana’s growing pains remain a concern for would-be investors.

In spite of these issues, Solana has maintained a strong presence in the market as a top 20 cryptocurrency. While its utility is still being tested, Solana’s impressive growth in just two years may qualify it as a semi-blue chip crypto.

Chainlink (LINK)

Chainlink was established by Sergey Nazarov and Steve Ellis in 2019. It is an ERC-20 token, so it runs on top of the Ethereum platform and uses the proof-of-stake protocol.

Chainlink is a blockchain abstraction layer that allows different blockchains to communicate with each other. The open-source project pioneered the concept of hybrid smart contracts — meaning it can securely compute data both on and off the chain.

People typically use Chainlink to connect non-blockchain data sources with blockchain platforms. Chainlink acts as the ‘middleman’ or ‘oracle’, connecting smart contracts to external data like sports scores, stock prices, or weather outcomes.

Chainlink network operators are compensated with LINK tokens for:

- Collecting data from non-blockchain sources

- Making that data compatible with blockchains

- Performing necessary calculations

The Chainlink network can be used to complement Ethereum and other cryptocurrencies. By securely connecting Ethereum projects with external data, Chainlink can bridge the gap between smart contracts and the real world.

Aave (AAVE)

Aave is a decentralized lending protocol that allows users to borrow and lend tokens via smart contracts. It was founded in 2017 by Stani Kulechov and launched on the Ethereum mainnet in January of 2020.

Aave operates as a non-custodial lender, meaning users never have to relinquish control of their assets to Aave. Instead, the platform relies on smart contracts that are programmed with rules and conditions, based on the lenders’ terms.

Aave is built on top of a liquidity pool, which allows users to stake their tokens in order to earn interest. Lenders can also borrow money from Aave’s liquidity pool, paying back with interest over time.

Aave also offers flash loans, which don’t require collateral and allow borrowers to take out loans in a matter of seconds. In fact, as soon as the next Ethereum block is processed — within twelve seconds — the loan will be reflected in the user’s digital wallet. This means flash loans can be used to fund arbitrage opportunities, with Aave acting as the middleman.

All of Aave’s powerful DeFi (decentralized finance) features are accessed via its native token, AAVE. AAVE has quickly become the most popular emerging DeFi asset for its utility and potential to generate income.

Using AAVE to access Aave’s lending protocols reduces fees, provides early access to new products, and enables yield farming. The Aave team also introduced the Safety Module (SM), where members can invest their AAVE to work as insurance against a liquidity deficit. In return for acting as coverage, stakers are rewarded with AAVE tokens in addition to a portion of the protocol’s fees.

AAVE is too young to be considered a blue-chip crypto project, but thanks to its strong foundation and growing user base, it’s well on its way. As the DeFi market continues to evolve, AAVE could be a lucrative long-term investment.

Final Thoughts

If you are interested in learning more about blue chip cryptos, consider checking out these crypto newsletters or crypto podcasts. They will help you stay informed, learn about new developments, and make better decisions when it comes to investing in the crypto space.

But remember, even blue-chip crypto investing is risky. The past year has been brutal for crypto as fraud, Ponzi schemes, and insolvent projects have been wiped out one by one. That’s why, as with any investment, it is critical to understand the bet that you are making and to accept all of the risks and rewards.

Beginning your personal journey with time-tested assets like Bitcoin and Ethereum can be a great way to learn more about blockchain and cryptocurrency while minimizing risk. Then, if you feel more adventurous or have some extra capital to spare, you can begin to explore semi-blue chip crypto projects like Binance Coin, Cardano, Chainlink, and more.