Interest rates on savings accounts almost never exceed inflation. That means the value of the cash in your bank account is steadily declining.

But your net worth doesn’t have to follow the same fate!

This article covers 9 powerful investment models used by top investors. So instead of watching your savings slowly shrink, you can:

- Grow your net worth

- Maximize your returns over time

- Make sure you are getting ahead

If you’re ready to make your money work as hard as you do, stick around as we break down these must-know investment strategies.

Why Investing Is Necessary

Do you know what that Bank of America or Chase savings account pays you? In most cases, the answer is less than 1% of interest.

With inflation hovering around 3%, your savings are actually losing ~2% of purchasing power every year. This means if you’re not investing, you could be falling behind!

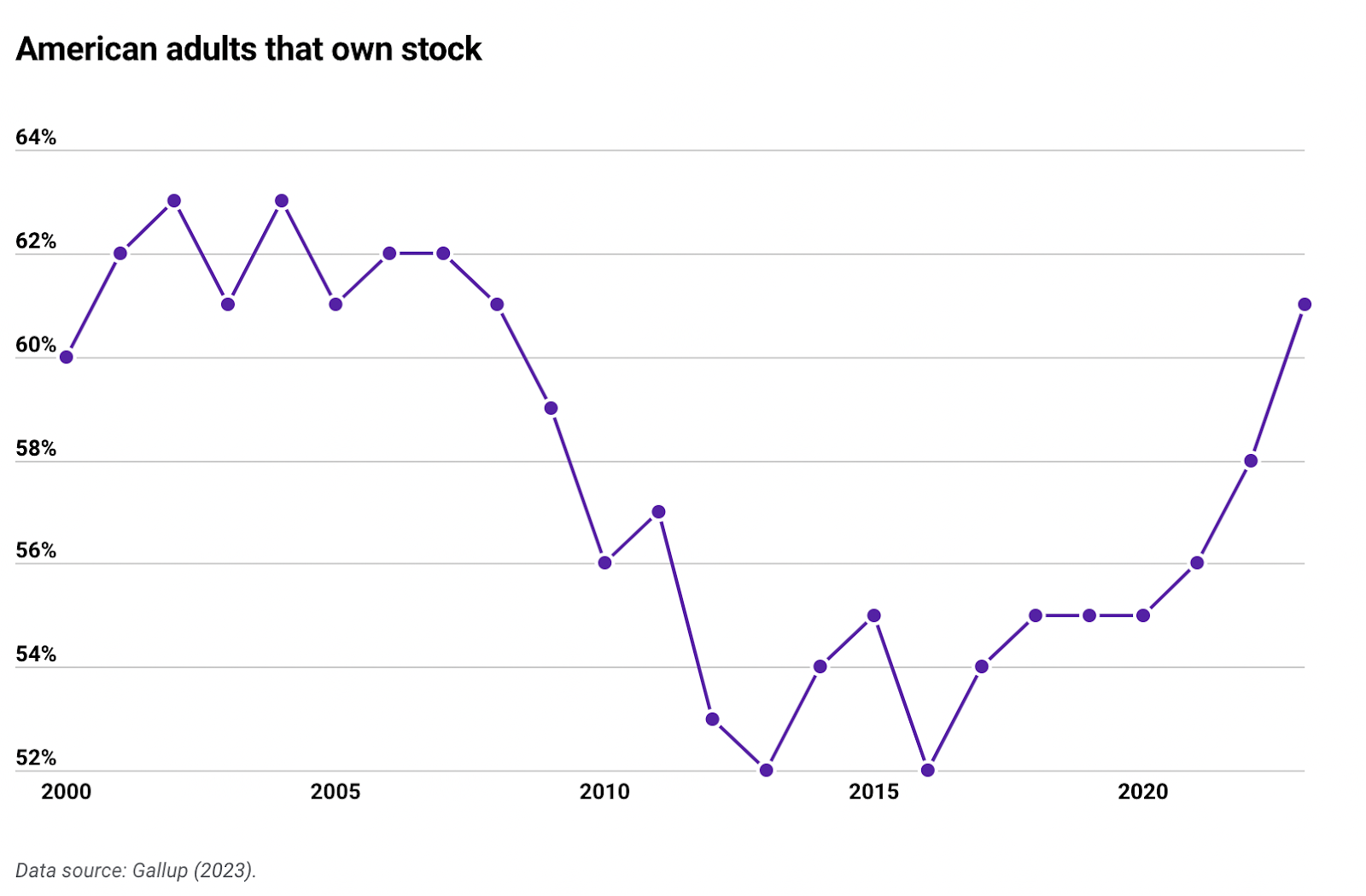

According to a recent Gallup poll (below), Americans are starting to get the message. Now, more than 158 million Americans own stock – which is a great move in the right direction.

Investing is important because:

- You don’t have to work to make more money. Your money multiplies for you.

- Over time, you can achieve your financial goals and escape the rat race.

- Investing offers tax advantages, such as tax gain harvesting.

- Certain investments can protect you from inflation.

Unfortunately, many would-be investors avoid investing out of fear. Luckily, there are two simple ways to protect yourself as a beginner.

The first is dollar cost averaging (DCA).

Dollar-cost averaging means investing a fixed amount of money into a particular asset or market at regular intervals, regardless of the asset’s price and performance. The idea is to reduce the impact of market volatility on your purchases.

For example, if you invest $100 every month regardless of the economic conditions, over time you will buy more shares when prices are low and fewer shares when prices are high. This can smooth your cost per share. Investors with a long-term view tend to favor this strategy.

The second way to protect yourself as a beginner is to follow a tried and true investment model. Don’t buy and sell at random. Instead, adopt a strategy widely used by professional investors.

What strategies, you ask?

Here are the 9 most popular investment models today.

9 Powerful Investment Models To Grow Your Wealth

Ready to make the most of your assets and grow your wealth? The following 9 strategies are key to maximizing your returns for years to come.

1) Value Investing

Value investing is like going to a garage sale. You’re looking for an item that’s high in quality yet low in price.

You feel comfortable investing because you know that the business retains its intrinsic value, even if it has temporarily lost its market value.

A classic example is Warren Buffett’s investment in Coca-Cola in the late 1980s. Buffett believed that despite the stock market crash of 1987, Coca-Cola had strong brand value and a market presence, making it undervalued. His $1bn value investment is now worth more than $23 bn.

More recently, the COVID-19 pandemic created a window of opportunity for this investment model. After stock prices plummeted, value investors carefully identified companies with sound fundamentals that were likely to recover post-pandemic.

Understanding why a stock is undervalued is key to making a successful value investment.

If a stock has declined due to internal circumstances, such as operational inefficiencies or leadership turmoil, it may not qualify as a value play. But if the decline is due to external circumstances like market psychology, the company could be worth a deeper analysis.

2) Growth Investing

Growth investing focuses on identifying companies with significant potential for rapid growth, often within sectors on the cutting edge of innovation. Lately, this may include artificial intelligence, renewable energy, biotechnology, and more.

These companies are typically characterized by their innovative products, services, or business models that promise substantial future returns. Think Microsoft, Nvidia, and Apple before their trillion-dollar market caps.

One key aspect of growth investing is its inherent risk, as many of these companies may not yet be profitable or as well established as their competitors. This uncertainty can lead to greater volatility and the potential for loss, making it crucial for investors to conduct thorough research and have a high tolerance for risk.

To mitigate these risks, many growth investors adopt a diversified portfolio approach guided by the power law principle. This strategy acknowledges that a small number of investments are likely to generate the majority of returns, making the performance of the rest of the portfolio less critical.

The massive success of a few high-growth companies can offset the underperformance or loss of dozens of others. This is why identifying winners is much more important than avoiding losers.

3) Income Investing

The strategy behind income investing is simple. Invest in mature companies that pay regular dividends. This is one of the most popular investment models among those who value stability and want a regular income.

Retirees, for example, may choose to live off of dividend income so they do not have to sell the underlying stock to cover living expenses. In this way, they can reduce their tax burden and enjoy continued appreciation.

Typically, income investments don’t promise astronomical returns. But as mature companies, the stock may be somewhat de-risked and less susceptible to volatility.

Dividend stocks aren’t the only game in town though! These investments provide income too:

Real Estate Investment Trusts (REITs): REITs offer investors a way to invest in real estate without having to buy physical properties themselves. REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. These can include commercial real estate like office buildings, shopping centers, apartments, and hotels.

Most REITs operate along a straightforward model: lease space and collect rents on the properties, then distribute that income as dividends to shareholders. This structure makes REITs a popular choice for income investing, as they are required by law to distribute at least 90% of their taxable income to shareholders annually in the form of dividends.

Bonds: These are debt securities issued by corporations or governments. Investors lend money for a fixed period at a fixed interest rate. Bonds are considered a more stable investment compared to stocks, making them an attractive option for income investors.

Annuities: Financial products sold by insurance companies that pay out a fixed stream of payments to individuals, typically used as an income stream for retirees. Annuities can provide a steady income, but terms and conditions vary widely.

If you choose to invest in an income-producing asset and don’t need the income, consider enrolling in a dividend reinvestment plan (DRIP). When you enroll in a DRIP, the dividends you would normally receive as cash are instead automatically used to purchase additional shares of the company’s stock

This process occurs automatically each time a dividend is paid, facilitating the compounding of your investment over time.

4) Momentum Investing

Momentum investing is like surfing a wave in the stock market. It’s all about picking stocks that are already going up and riding that wave to more gains. Think of it as following the rule “The trend is your friend.”

Momentum or “momo” investors look for stocks that have shown strong performance recently and buy them, hoping they will keep rising.

This strategy relies on the idea that what goes up tends to keep going up, at least for a while. Momentum investors aren’t too worried about why a stock is doing well. They focus on the fact that it is doing well.

Fundamentals like growth, profitability, and efficiency aren’t of concern. Instead, these investors focus on how the stock’s price is moving.

But remember, momentum investing can be risky. Just like a wave, stocks can come crashing down suddenly.

This approach requires you to be very active in managing your investments. You have to keep an eye on the market and be ready to act quickly. It’s not for everyone, especially if you don’t like taking risks or watching the market closely.

5) Index Investing

Index investing is a good starting place for beginners. It doesn’t require researching and analyzing specific companies or sectors because you simply invest in an index comprised of dozens, or even hundreds, of companies.

A few prominent index funds include:

S&P 500: One of the most widely followed indexes, it represents the performance of 500 large companies listed on stock exchanges in the United States. It’s a good indicator of the overall U.S. stock market.

Dow Jones Industrial Average (DJIA): Another major U.S. index, the DJIA consists of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. It’s one of the oldest and most well-known indexes.

NASDAQ: This index includes all the stocks listed on the NASDAQ stock exchange, making it a strong indicator of the performance of technology and internet-related companies.

Russell 2000: Focused on small-cap companies, the Russell 2000 is a benchmark for the performance of smaller businesses in the United States. It’s a good choice for investors looking to diversify into smaller, potentially faster-growing companies.

Index investing is popular because:

- Your investment is immediately diversified among many companies

- It’s simpler and less time-consuming than other strategies

- Investors can “set it and forget it”

6) ETF Investing

Exchange-traded fund (ETF) investing is versatile, allowing investors to buy shares of funds that track the performance of a specific index, sector, commodity, or other assets.

Similar to index investing, ETFs offer immediate diversification. A single ETF can hold a range of stocks or bonds, mirroring the performance of indexes like the S&P 500, Dow Jones Industrial Average, NASDAQ, or Russell 2000, among others.

The main similarity between ETF investing and index investing is the ability to gain broad market exposure, which reduces the risk compared to investing in individual stocks.

ETFs can be index funds, meaning they track a specific index. However, they also offer options beyond traditional indexes, such as funds focused on specific industries, investment styles, or geographic regions.

Benefits of ETF investing include:

- Diversification: Like index funds, ETFs spread out investments across various assets, reducing the impact of any single asset’s poor performance.

- Flexibility: ETFs are traded on stock exchanges, so you can buy and sell shares throughout the trading day at market prices.

- Accessibility: Investors can start with a small amount of money, making it easier to invest in a diversified portfolio.

- Transparency: ETFs typically disclose their holdings daily, providing clear insight into where your money is invested.

ETF investing stands out for its adaptability and ease of use, catering to both novice and experienced investors who seek exposure to various market segments or desire a more hands-on approach to their investment strategy.

7) Private Company Investing

Private company investing involves putting money into businesses that aren’t available on public stock markets. This type of investment is primarily done through private equity (PE) and venture capital (VC), each targeting different stages of a company’s life.

Private Equity (PE) focuses on more mature companies needing restructuring or growth capital.

PE firms buy these companies, aim to improve their value through operational and financial strategies, and eventually sell them for a profit. These investments are usually large and require a longer time to mature.

Venture Capital (VC) is aimed at younger, high-potential startups that might be too risky for traditional loans. VCs provide the capital these startups need to grow in exchange for equity. If the startup succeeds, the returns can be significant.

Both PE and VC are high-risk but potentially high-reward investment models. They require significant amounts of capital and patience, as returns may take years to materialize. Investors often get directly involved in company operations, influencing decisions to ensure their investment grows.

Private company investing offers the chance to be part of the next big thing or turn around a struggling company. However, it’s not for everyone due to its illiquid nature, high entry costs, and risk level. It’s an exciting area for those with the resources, expertise, and appetite for risk.

8) Quantitative Investing

Quantitative investing uses mathematical models to make investment decisions. These complex algorithms scan through vast amounts of market data, looking for patterns or signals that indicate potential profitable investments.

One of the key benefits of quantitative investing is its objective nature. This strategy minimizes the emotional and subjective biases that often affect investment decisions. Plus, this method can quickly adjust to changing market conditions, making it highly dynamic and responsive.

Quantitative investing encompasses various strategies, including statistical arbitrage, high-frequency trading, and factor investing, among others. These strategies can be applied across different asset classes, such as stocks, bonds, commodities, and derivatives.

Despite its advantages, quantitative investing requires advanced technology that most investors don’t have access to. It’s typically reserved for hedge funds, investment banks, and institutional investors. However, some aspects of quantitative analysis are becoming more accessible to retail investors through advanced trading platforms and robo-advisors.

9) Alternative Investing

Alternative investing is often used to layer on top of other investment models. It offers opportunities to diversify beyond traditional stocks and bonds.

This approach explores assets and strategies that can provide unique benefits and risks. Here’s a brief overview of some alternative investment options:

Real Estate: Investing in properties can offer income through rent, potential appreciation in value, and diversification from the stock market. Real estate investment trusts (REITs) allow for real estate investment without needing to manage properties directly.

Commodities: This includes investing in physical goods like gold, oil, or agricultural products. Commodities can act as a hedge against inflation and have a low correlation with stock market performance.

Hedge Funds: These are pooled investment funds that employ different strategies to earn active returns for their investors. Hedge funds are accessible mostly to accredited investors and can invest in a wide range of assets.

Cryptocurrency: Digital currencies like Bitcoin and Ethereum offer a modern approach to investing, with the potential for high returns alongside high volatility and risk. If you are interested in venturing into cryptocurrency investment, ensure you have up-to-date information on the latest cryptocurrency regulations, as well as tax guides, crypto tax calculators, and other relevant tools.

Collectibles: Investing in art, wine, vintage cars, or other collectibles can provide aesthetic enjoyment as well as financial returns, though this market can be highly speculative and illiquid.

Unconventional Options: Even more unconventional options exist, like investing in used RVs. These vehicles can generate mostly passive income upwards of $50,000 per year. With the right purchase, returns can be significant.

Final Thoughts

Understanding these 9 investment models opens up a world of possibilities for growing your wealth.

Whether you’re a beginner looking to dip your toes into index investing or an experienced investor considering the high-reward world of private company investing, there’s a strategy for every risk appetite and goal.

Remember, diversifying your portfolio across different investment models can help manage risk and capitalize on opportunities. Doing so will protect you from inflation and potentially increase your returns over the long term.

Keep learning and stay adaptable. The world of investing is always changing, but with the right attitude, anyone can navigate it successfully. Let these investment models be your guide to making your money work as hard as you do.