Statistically speaking, Norway is one of the happiest countries in the world. With tuition-free education through college, nearly free health care, and a robust social support network… what’s not to love?

Norway can pay for these incredible benefits thanks to one of the world’s largest investors — the Norway Government Pension Fund. In fact, over 20% of Norway’s fiscal budget is covered by this pension fund.

So when the fund lost nearly a quarter of its value in the Great Financial Crisis, the country’s prosperity was jeopardized. And unsurprisingly, Norwegians wanted answers.

The country turned to a group of well-respected academics to explain what happened and to prevent it from happening again. Their findings were summarized in the Professors’ Report, and their recommendation was simple:

“Norway should adopt a factor investing approach.”

The fund listened, and most large institutional investors and sovereign wealth funds followed suit. Before long, positive returns and positive vibes were restored. And investors around the world took note.

So if you want to embrace the same institutional-grade strategy that the Norway Government Pension Fund used to supercharge its portfolio, factor investing is for you. This article will teach you what factor investing is, why it is so effective, and how to implement it in your own portfolio. Let’s dive in!

What Is Factor Investing?

Factor investing is a systematic approach to investing that seeks to capture market returns through exposure to specific characteristics known as risk factors.

A large body of evidence, taken from both practical investing experience and academic research, has shown that this approach can consistently generate higher returns than the broad market index.

Related reading: How To Learn The Art Of Top-Down Investing: 3 Key Principles

What Are Risk Factors?

Every investment represents some level of risk that an investor should be aware of. This risk is usually dependent on one or more underlying factors. And the return generated by the investment is your reward for being exposed to these factors.

Take Company A’s stock, for instance. It’s got a variety of risks — some that affect all stocks (like inflation, interest rates, and trade policy) and some that are unique to the company itself (like the quality of management, research projects, and product mix).

The return you get from that holding stock exists to compensate you for being willing to take both the general market and specific company risks.

Risk factors are a simple way of classifying and categorizing the specific characteristics present in an investment.

A few of the most widely accepted risk factors are:

- Value: Historically, cheaper securities tend to outperform more expensive ones.

- Size: Stocks of smaller companies tend to outperform the stocks of larger companies.

- Momentum: Stocks with strong recent performance tend to outperform stocks with weak performance.

- Quality: Stocks of companies with solid earnings and a stronger balance sheet tend to outperform companies with weaker earnings and balance sheets.

- Low volatility: Stocks that have demonstrated lower volatility tend to generate better risk-adjusted returns (i.e. more bang for your buck) than stocks with higher volatility.

- Dividend yield: Stocks with above-average dividend yields tend to outperform the market.

- Growth: Stocks that are growing their sales, earnings, or margins faster than average tend to outperform their peers.

- Liquidity: Less liquid (or tradeable) investments tend to command higher returns.

- Carry: Generating returns by buying securities with higher expected returns while selling similar securities with lower expected returns (usually more of a hedge fund approach).

Related reading: Debt Investments: The Low-Risk Way To Compound Your Wealth

Why Do Risk Factors Matter?

As the Norwegians learned, it is hard to construct an investment portfolio that is not impacted by risk factors. After all, every investment falls somewhere on the value spectrum (from cheap to expensive), the size spectrum (small to large), the momentum spectrum (from flatlining to ripping), and so on.

So portfolio optimization is not about eliminating risk factors. On the contrary, it’s about selecting and capturing those that tend to generate above-average returns.

Factor Investing Example

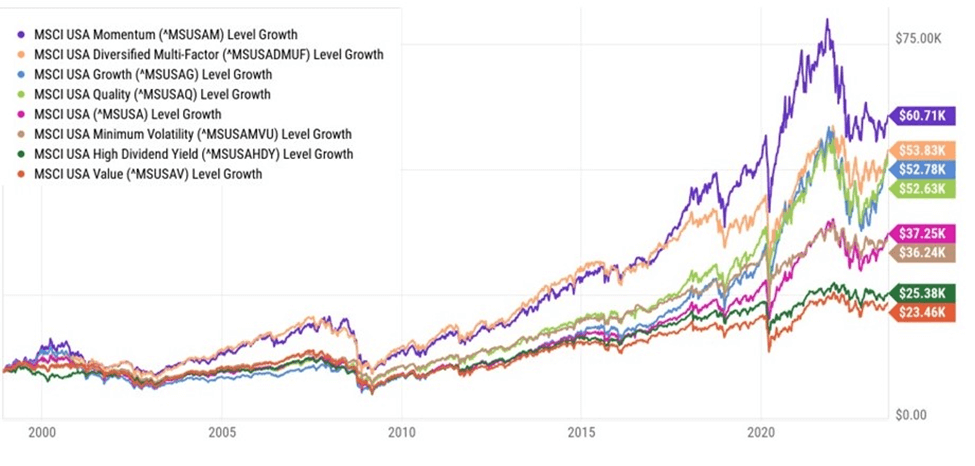

As you can see in the chart below, the following risk factors have outperformed the broad market (as represented by the MSCI USA index) over 20+ years:

- Momentum: Represented by the MSCI USA Momentum Index

- Multi-factor: Represented by the MSCI USA Diversified Multi-Factor Index

- Growth: Represented by the MSCI USA Growth Index

- Quality: Represented by the MSCI USA Quality Index

Source: YCharts. The total return of a $10,000 initial investment into each of the 8 shown MSCI indices.

If we analyze different 20-year periods, other factors, such as Value and Size, would jump to the top. This highlights one challenge of factor investing: It’s difficult to predict which factors will outperform over a given timeframe.

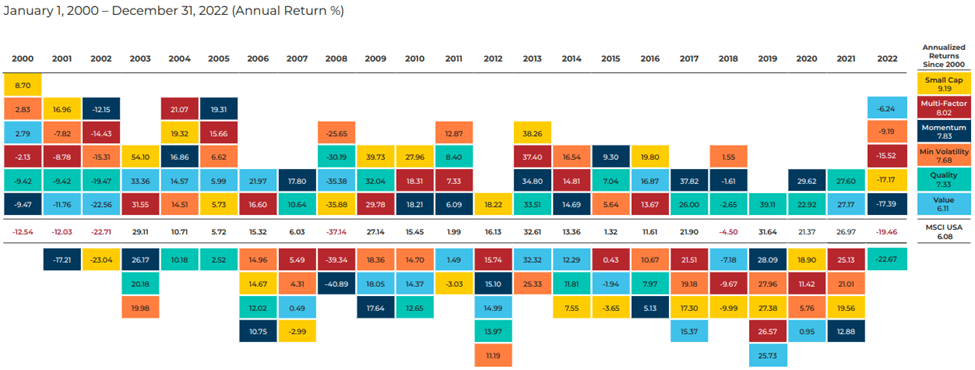

Another challenge is the variation of outcomes from year to year (as the chart below shows).

To combat this volatility, many investors blend several risk exposures into a “multi-factor” approach. This can smooth out some of the highs and lows associated with individual factors, without sacrificing performance.

Source: Symmetry Partners. All returns from Morningstar. Annualized returns show geometric averages to account for compounding.

3 Noteworthy Factor Investors

If you are interested in factor investing, you’re not alone. In fact, some of the biggest names on Wall Street have been applying these concepts for years. These famous investors include:

Warren Buffett

Few investors in the modern age are as notorious as Warren Buffett, the Oracle of Omaha. For decades and decades, he has had unbelievable success in generating market-beating returns.

But how does he do it?

A group of investment managers from AQR Capital Management published a study explaining that Buffett’s secret to success is investing in “cheap, safe stocks with quality earnings” (with a dose of leverage).

These are risk factors. “Cheap” means Value, “Safe” means Low Volatility, and “High Quality” speaks for itself.

Bill Gross

Buffett is not alone. Bill Gross rose to prominence as the lead portfolio manager of the Pimco Total Return Fund from 1987 to 2014. Pursuing a strategy of selling volatility while earning carry (both factors identified above), the fund posted legendary results. And, at one point, it grew to the largest bond fund in the world.

Peter Lynch

Peter Lynch was the lead portfolio manager of the Fidelity Magellan Fund from 1977 to 1990. The fund routinely outperformed the market by double digits, and investors took notice, investing so much money that the fund became the largest mutual fund in the world.

A regression of the fund’s returns shows that small cap, momentum, value, and a small dose of quality all contributed to Lynch’s success.

Related reading: 15 Best Investment Metrics To Find Undervalued Stocks

How To Get Started With Factor Investing

Most information about factor investing comes to us from academia. So, it can take time to sift through the jargon and the math (so much math) to understand the theory. But fear not; in practice, it can be relatively easy to apply.

Here are a few tips to help you get started:

Tip #1: Set realistic expectations

Investing is about accepting certain risks to reap the potential rewards.

When investing in risk factors, it’s important to understand that the rewards don’t always show up for an extended period of time. And in the meantime, the performance of the investment can swing wildly up and down. This means the results of factor investing often differ from what “the market” is doing.

For many new factor investors, this can be uncomfortable.

Watching some part of the market rip and hearing about “everyone else” jumping on the bandwagon can be emotionally challenging. So factor investors must be okay with taking the road less traveled.

Time is the most critical element in making factor investing work. Wild swings, long periods of drought, and returns that differ from the markets can make it challenging for most investors to stick with a factor investing strategy long enough to see market outperformance.

You must be willing to be patient… otherwise, this strategy is not for you.

Tip #2: Diversify with a multi-factor strategy

Single-factor strategies focus on capturing the long-term rewards associated with one specific risk characteristic.

For example, some investors pursue a value-based approach. Others gravitate toward a momentum-based approach where the “trend is your friend” (as determined by technical analysis). And others try to “get in early” by picking winning small-cap stocks.

However, it can be risky to adopt such a hyper-focused investing approach.

So most investors choose to diversify their portfolios. And this can be accomplished with a multi-factor approach that blends exposure to a number of risk factors.

The power of a multi-factor approach lies in its ability to lean into different risk characteristics during different economic environments and parts of the business cycle. And because many of these factors are uncorrelated, a multi-factor approach can smooth out performance and increase the odds of long-term outperformance. For example, if the value factor is struggling in a bull market, the momentum component of the portfolio will likely step in and provide support.

The end result of a multi-factor approach is an easier ride for investors over time, which helps prevent emotional decision-making or falling victim to market psychology.

Tip #3: Utilize a range of low-fee investment vehicles

Investors interested in factor-based investment vehicles have a wide range of choices to consider:

- Individual securities, such as stocks and bonds, chosen for specific factor criteria have historically been the way investors pursue factor strategies. If you prefer to get under the hood and enjoy filtering and researching investments yourself, this approach may appeal to you.

- ETFs have become a very popular investment tool, and most of the large index and ETF providers have launched both single and multi-factor (or “smart beta”) products. This includes Vanguard, BlackRock, Fidelity, State Street, and more. This option is perfect for those who don’t want to filter, identify, and buy individual securities, but do want to select specific risk factors.

- Single factor ETF example: iShares MSCI USA Quality Factor ETF (QUAL)

- Multi-factor ETF example: Vanguard US Multifactor ETF (VFMF)

- Mutual funds are a standard investment vehicle for investors who prefer hiring a professional manager to select securities. There are several well-known mutual fund families with successful factor-based strategies to choose from, such as Dimensional, AQR, and Vanguard. However, these funds typically underperform ETFs after accounting for their higher fees.

Tip #4: Additional tools and resources

Many free tools and data resources exist for those interested in learning more and digging deeper into risk factors. Here are a few worth investigating:

- Alpha Architect’s tools include a stock screener, fund screener, and factor backtests

- Finominal provides several analysis tools, including the Alpha Analyzer and Know Your Factors.

- Portfolio Visualizer provides a Factor Regression Analysis tool that will run a regression on the returns of mutual funds or ETFs. This analysis determines how much of their returns were explained by factor exposures. (This one is a bit technical, but it is quite useful if you are comfortable running a multiple regression.)

- If you are looking for more data, Prof. Ken French, one of the leading academics in factor research, hosts an incredible data library.

- And both the Historical Data Library at Investor Amnesia and the International Center for Finance at Yale have quite extensive data sets as well.

Related reading: The Beginner’s Guide To Passive Real Estate Investing

Final Thoughts

Factor investing is the practice of consciously targeting specific risk factors in an attempt to increase returns, manage risk, and stay ahead of changing market conditions.

It’s an approach to investing that anyone can adopt — it doesn’t require a significant amount of money or special access to limited investment opportunities. In fact, most investors currently have some concentration of risk factors in their portfolio without even realizing it.

Getting started with factor investing boils down to 3 key steps:

- Setting realistic expectations for the duration and nature of the ride.

- Developing an understanding of which factors to target and how.

- Picking the right investment vehicles.

So if you’re ready to become a more advanced investor, determine which risk factors you want to target, and supercharge your portfolio with factor investing. In doing so, you will join the ranks of the Norway Government Pension Fund, Warren Buffett, and some of the most successful funds in the world. Good luck!