So you’ve heard the rumblings of the FIRE movement. And maybe this whole “financial independence retire early” concept doesn’t sound so bad. But if you’re not a financial wiz and you don’t want to hire a certified financial planner, how do you get started?

The first step is to calculate your FIRE number. This one figure is what stands between you and financial freedom. While that may sound far-fetched, it’s true.

Once you reach this benchmark, you can live life on your own terms and choose how to spend your time. Work, play, travel, whatever you choose!

So how do you determine your FIRE number? This article covers the simple yet important calculation and explains how you can become financially independent.

What Is A FIRE Number?

Your FIRE number is your personal calculation of how much money you need to reach financial freedom. The FIRE movement uses this figure to simplify the discussion around retirement.

When measuring your progress toward this goal, take the sum of all of your investable assets. Think retirement accounts, savings accounts, CDs, annuities, etc. But do not include assets like your home, vehicles, or collectibles.

The idea is that when the total value of your investable assets surpasses your financial independent number, you can live on the earnings from your investments rather than your job. Without a need to work, you are free to retire early, pursue your passions, or explore the world.

This is what it means to achieve financial independence. You have unlocked the ability to live a life of your own design. Work is now an option rather than a necessity.

How To Calculate Your FIRE Number

Calculating this benchmark number is relatively straightforward and can be broken down into 3 easy steps. Here’s how:

1) Determine Your Annual Expenses

First, take a moment to analyze your current budget. You can either look at your monthly expenses (if they are pretty consistent) and multiply by twelve, or look at your total spending over the past year.

The easiest way to approach this is to export all of your transactions and summarize them in one spreadsheet or budget planner. Be sure to pull all of the following together:

- Credit card statements

- Bank statements

- Cash transactions

- Peer-to-peer payments (Venmo, Paypal, etc)

Remove any one-time items that aren’t representative of your normal lifestyle. But also leave room for miscellaneous expenses that are bound to happen from time to time. The objective is to smooth out your expense profile and arrive at a realistic annual cost of living.

Next, ask yourself if this financial picture is how you wish to continue living. In other words, if this budget were to represent your lifestyle in retirement, would you be content?

If so, you’ve completed step one! If not, decide which annual expenses need to be adjusted. For example, if your home is almost paid off, you may be able to adjust your housing expense down. And if you hope to travel more when you retire, you might wish to bump your travel account up.

Remember that every decision here is a tradeoff. If you are willing to live frugally, you can increase your savings rate and retire earlier. And if you prefer to spend more freely, you will need a larger nest egg and more time to become financially independent.

There’s no right answer here! In fact, most people change their minds over time. So for now, choose what feels right and move on to the next step. This will help you find an illustrative FIRE number, and you can always tweak your calculations down the road.

2) Select A Withdrawal Rate

Your withdrawal rate represents the percentage of your investable assets that you will cash out each year to cover your living expenses. Much like in the previous step, there is also a balancing act in choosing your withdrawal rate.

If you take too much out, you will reduce your compound interest and begin cutting into your investments. That can lead to a scary situation in which you run out of money late in retirement. On the other hand, if you plan for a super safe and extremely low withdrawal rate, you may never feel financially independent.

So where is the middle ground? Most people in the FIRE movement settle on a withdrawal rate between 3% and 4%.

The 4% rule was originally popularized by the Trinity Study, out of Trinity University. Three finance professors found that in 99% of their simulations, investors were able to withdraw 4% from their stock and bond portfolios every year without running out of money.

This study caught fire on Reddit forums and seems to be the de facto withdrawal rate for most of the FIRE movement.

However, times may have changed. Flash forward to today and the 10-year treasury hasn’t stayed above 4% for more than a month since 2007. That means bonds haven’t been a viable way to generate much income in more than 15 years.

For most retirees, that just leaves stocks. But investing in individual names is tricky, so buying and holding an index fund is almost always the right choice.

For reference, the S&P 500 has returned an average of about 8% per year since 1990. Not bad, right? Except that doesn’t account for inflation. Once you make that adjustment, the annual return is closer to 4.6%. So over the past three decades, you could have safely withdrawn 4% per year.

But again, the more conservative segment of the FIRE movement will point out that historical conditions may not be representative of the current investing environment. And experts agree. In fact, Morningstar explicitly recommended changing the “standard rule of thumb” from 4% to 3.3%.

So depending on your investing style, risk tolerance, and target retirement age, you can probably justify any withdrawal rate between 3% and 4%.

Those planning around a lower rate will have more built-in cushion for recessions, stagflation, or unfortunate timing. Whereas the more “hopeful” planners will have an easier time reaching early retirement, but could have to tighten their belts if economic conditions worsen.

3) Find Your FIRE Number

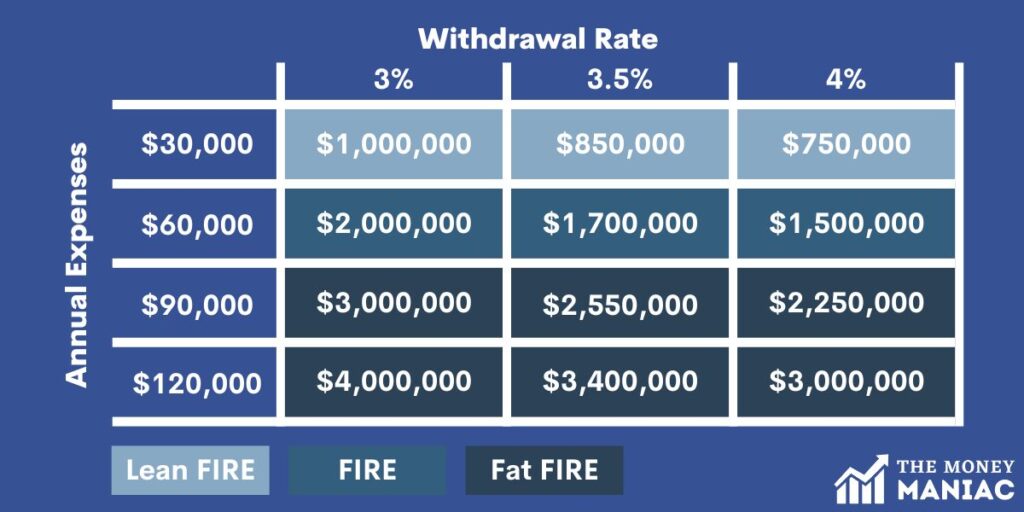

Now is the simple part! To calculate your FIRE number, just divide your annual expenses by your withdrawal rate.

Or, you can multiply your annual expenses by the inverse of your yield. For example, the inverse of a 4% yield is 25x. So the widespread “4% rule” is the same as the “25x rule”. Similarly, the inverse of a 3% withdrawal rate is a 33.3x multiple.

As you can see in the chart below, if you want to retire early and escape the rat race, it is easiest to minimize your expenses and increase your yield.

And on the flip side, if you want to be as safe as possible, you will need to plan for a lower yield. This, of course, drives your financial independent number up and pushes retirement further out.

How To Reach Your FIRE Number

If you aspire to FIRE, aka Financial Independence Retire Early, you understand how important it is to reach your FIRE number. To ensure you succeed and eventually enjoy financial freedom, follow these best practices:

Create A Budget

The key to becoming financially independent is mastering how you allocate your money. This begins with a budget. Even if you don’t implement any restrictions, simply visualizing the movement of your funds is a helpful start.

Track Your Expenses

To maximize your savings rate, keep a close eye on your expenses. Cancel any unused services. Pick the cheapest insurance providers. Take advantage of discounts and coupons. Find creative ways to save money. And whenever possible, look for strategies to reduce your taxes.

Create A Savings Plan

Based on your income and expenses, calculate how much money you can save each month. Then, automate these contributions with services like Acorns, Betterment, or Wealthfront. These companies ensure that your money is shifted into an investment account and out of reach.

Invest In Low-Cost Index Funds

Don’t try to be a hero. Outside of legendary investors like Warren Buffett, almost nobody can time the market or consistently pick stocks that outperform the indices. So keep it simple and park your money in low-cost index funds like VOO, the Vanguard S&P 500 ETF.

Avoid Lifestyle Inflation

It’s easy to fall into the trap of spending more as you earn more. Keeping up with the Joneses and modern “treat yourself” culture can be tempting. Instead, resolve to save at least 50% of all future raises. This way, you can enjoy life while still building the passive income streams that enable early retirement.

Stay Disciplined

Reaching your FIRE number takes discipline and patience. Know that your journey to financial freedom will likely take decades, so be sure that you leave room for life’s surprises along the way. As long as you commit to making wise money and investment choices, you will be able to retire early and enjoy the flexibility you desire.

Why Knowing Your Fire Number Is Important

Knowing your FIRE number isn’t vanity — it’s practical. Here are just a few of the advantages that the benchmark offers:

Clarity On Retirement Goals

This calculation provides a clear target for how much money you need to save to retire early. Although retirement is often about more than money, this framework helps you think through different financial scenarios and weigh the cost of your choices.

Better Financial Planning

Understanding this benchmark helps you work backward to plan your financial future. You can begin by establishing a savings goal and passive income target. After that, you may need to adjust your spending habits, increase your income, or think about your investments more closely.

Increased Savings

It’s much easier to stay motivated to save money when you see a light at the end of the tunnel. Your FIRE number provides a concrete retirement goal that you can keep in mind. From there, it’s up to you to set aside as much of your income as you can and celebrate your success along the way.

Peace Of Mind

Your savings goal may feel intimidating at first, but in time the benchmark will actually help you relax. Knowing that you have a clear path to reach financial independence will help you sleep better at night and shift your focus to more pressing matters.

Final Thoughts

Calculating your FIRE number is relatively straightforward, but there is some nuance to be aware of.

Selecting a withdrawal rate and honing in on an appropriate retirement budget are both important considerations. The most important part, however, is creating a realistic plan to reach your goal at an age you’re comfortable with.

So keep track of your progress and review your FIRE number periodically as your life circumstances change. Don’t be afraid to revise your plan or adjust your timeline as you see fit. After all, life is a journey — not a destination.

FIRE Number FAQs

To quickly calculate your FIRE number, multiply your annual cost of living by 25. For instance, if you spend $50,000 per year, you will need $1.25 million ($50,000 x 25) in investable assets to retire. This approach implies a 4% withdrawal rate, which is a common rule of thumb popularized by the Trinity Study.

To determine how much money you need to retire and achieve financial independence, follow this three-step process. First, add up all of your annual living expenses. Second, choose a withdrawal rate between 3% and 4%. Third, divide your expenses by your withdrawal rate to find your FIRE number. Finally, you can adjust this figure up or down based on factors like age, income, investment experience, and more.

There are three main types of FIRE: lean FIRE, FIRE, and fat FIRE. Lean FIRE folks want to hit a number that’s just enough to cover their basic needs, likely in the $400,000 to $500,000 range. A more traditional FIRE follower may strive to achieve an investable net worth of $1 million to $2 million. And fans of fat FIRE are aiming for much higher numbers, generally upwards of $3 million or more.

Yes, your 401(k) account is included in your financial independent number. This retirement account is an investable asset, meaning it can generate interest and dividend income. As a result, it is counted in the total figure you need to reach financial independence.