Stocks may make all the headlines, but debt can make you rich!

Banks have known this for centuries, but they’re not the only ones with access to debt investments. From corporate bonds to tax liens, you can also reap the benefits of these wealth-building secret weapons.

After all, debt investments provide:

- Reliable income

- Capital appreciation

- Tax benefits

- Stability

If that sounds like an attractive addition to your portfolio, you’re in the right place. In this comprehensive guide, you will learn everything you need to know about debt investments. We will cover the available options, their pros and cons, and how to manage risk.

So come along as we unlock the potential of these hidden gems and discuss how low risk does not have to mean low reward.

What Is A Debt Investment?

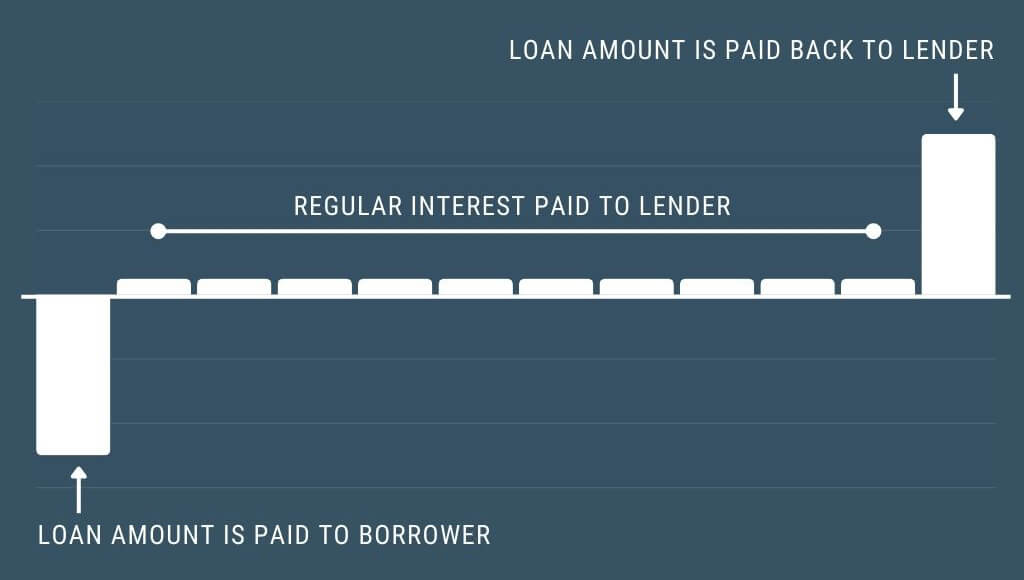

A debt investment is when you lend money to an entity in return for periodic interest payments. It’s a way for investors to earn consistent income while helping these entities meet their financial needs.

Governments, corporations, and individuals all use debt for various reasons — to fund new projects, grow their businesses, or even cover unexpected emergencies.

When you invest in debt, you become one of the lenders. You provide the money upfront, and in exchange, you receive regular and predictable interest payments.

Now, there are two primary forms of debt investments: secured and unsecured.

A secured loan is backed by collateral. Collateral is an asset used to guarantee a loan, which could be sold to repay the debt if the borrower fails to make timely payments. Car loans and mortgages are common examples of secured debt.

Unsecured debt, on the other hand, has no collateral. To convince the lender to take this greater level of risk, the borrower must pay a higher interest rate.

While debt investments can be a great source of passive income, they aren’t without risk. So it’s essential to ask the following questions before investing:

- Who is the borrower?

- Are they creditworthy?

- Why do they want the loan?

- How long will the loan last?

- What is the interest rate?

- What is my expected rate of return given the risk?

- Is there any security for the loan, and if so, how liquid is it?

Related reading: 10 Best Alternative Investments To Diversify Your Portfolio

Debt Investments Vs. Equity Investments

Companies can raise capital by giving up equity or taking on debt. For investors, each offers unique benefits and drawbacks.

Debt Pros

- Regular income payments are promised

- Less risky (in general) because it is backed by collateral or the borrower’s creditworthiness

- Higher priority in the event of default (see below)

If bankruptcy, corporate restructuring, or an asset sale occurs, all debt holders are paid in full before proceeds are released to stockholders. If there aren’t enough funds to go around, debt holders will receive a partial repayment on their original investment, while shareholders will suffer a 100% loss.

Debt Cons

- Debt investors have no input into the company’s decision-making

- Returns are capped to the interest paid

- Changes in interest rates and inflation can adversely affect your investment (if you sell before maturity)

Equity Pros

- Equity investors have input into the company’s direction and management decisions in the form of voting rights

- Equity investors are entitled to a portion of the company’s profits

- Returns are not capped

If you pick the right equity investment, your returns can be unlimited. Look no further than the financial success enjoyed by early Amazon, Tesla, and Google investors.

Equity Cons

- More risky (in general) due to market volatility and company performance

- No returns are promised

For every Spotify, there’s a Napster. For every Facebook, a Myspace. Investors lost hundreds of millions of dollars when these companies failed to live up to expectations.

So, debt investments may not be as sexy as high-flying stocks, but they don’t share the same level of risk either. You may sleep better at night knowing that your debt investments will keep producing income no matter what the market does.

Related reading: How To Learn The Art Of Top-Down Investing: 3 Key Principles

Why Should I Add Debt Investments To My Portfolio?

Debt investments offer benefits that could enhance your portfolio:

- Predictable income stream: Use interest income to cover living expenses, or reinvest your returns to grow your portfolio even faster.

- Less risk than equities: Debt is backed by collateral and/or the creditworthiness of the borrower. It also has a higher claim to the company’s assets in the event of bankruptcy.

- Mitigates volatility: Debt is less susceptible to market gyrations than stocks. This asset class can be a stabilizing force during market downturns.

For these reasons, many advisors recommend a 60/40 portfolio. That is a portfolio made of 60% equities and 40% bonds. This provides the best of both worlds — the growth potential of stocks and the stability of bonds.

Another benefit of owning some debt investments is that during market downturns, you can use your cash flow to buy stocks at bargain prices. Then, when the market rebounds, your gains will compound even faster.

8 Key Types of Debt Investments

With such a wide variety of debt investments to choose from, it can be difficult to narrow your search. To help you get started, let’s look at the most popular types and the pros and cons of each.

1) Corporate Bonds

When companies need to raise capital to fund operations, they have two options: issue debt or equity. For companies looking to raise money without giving up ownership, bonds provide an effective alternative.

When you buy a corporate bond, you are lending money to a company. In exchange, they agree to:

- Make regular interest payments for the duration of the bond

- Return your principal upon maturity

| Corporate Bond Pros | Corporate Bond Cons |

|---|---|

| Highly liquid and can be sold anytime on the large secondary market | Changes in demand can affect returns (if you sell before maturity) |

| Offer better returns than comparable government bonds | The borrower could default and put your principal investment at risk |

| Provide consistent and predictable income | |

| Paid before shareholders in the case of default | |

| Easy to diversify across industries | |

| Credit ratings make it relatively straightforward to evaluate your risk |

All corporate bonds are assigned ratings by credit agencies such as Standard & Poor’s or Moody’s, making it easier for investors to assess risk. These ratings range from Aaa/AAA (lowest risk) to C/D (highest risk).

As with any investment, risk and reward are highly correlated. So lower-rated bonds pay higher interest rates but carry a greater risk of default. And AAA-rated bonds pay lower interest rates but offer more security.

However, ratings don’t always tell the whole story. For example, Standard & Poor’s gave Lehman Brothers an A rating right up until the company filed for bankruptcy on September 15, 2008.

To avoid these kinds of surprises, there is no substitute for doing your own research. But ratings do provide a good place to start. Use them to filter out “junk bonds” — anything rated lower than BBB-. Then, you can begin your research process with “investment grade” bonds (BBB- to AAA).

| S&P | Moody’s | Risk | Grade |

|---|---|---|---|

| AAA | Aaa | Lowest risk | Investment grade |

| AA | Aa | Low risk | Investment grade |

| A | A | Low risk | Investment grade |

| BBB | Baa | Medium risk | Investment grade |

| BB, B | Ba, B | High risk | Junk bonds |

| CCC, CC, C | Caa, Ca, C | Highest risk | Junk bonds |

| D | C | In default | Junk bonds |

You can purchase corporate bonds from online brokers, banks, and discount brokers. Most charge a flat fee, with Fidelity Investments charging the lowest we’ve seen at just a $1 markup per bond.

Corporate bonds typically pay interest semi-annually, providing investors with payments twice per year. Zero-coupon bonds are an interesting exception, as they don’t make regular interest payments at all. Instead, they are sold at a discount and pay their full face value at maturity.

How To Calculate Current Yield

Bond yield is the rate of return an investor earns on their invested capital. To calculate this figure, you need to be familiar with the following terms:

- Par (or Face) Value: This is the value of the bond at maturity, and it is used to calculate the interest payments. The par (or face) value never changes.

- Market Value: The market price of a bond may fluctuate over time based on demand. A market value of 100 means the bond is selling at 100% of its face value, and a market value of 95 means the bond is trading at 95% of its face value. For example, a $1,000 bond with a market value of 90 would cost $900.

- Coupon: The interest rate paid on the bond. Interest payments are calculated by multiplying the coupon by the face value.

To determine the current yield on a particular bond, divide its coupon rate by the market value.

For example, let’s say ABC Corp needs to raise capital to build a new factory. They offer $30 million in corporate bonds maturing in five years. Bonds are issued with a face value of $1,000 at a market value of 100 and a coupon of 5. To calculate the current yield, divide 5 (coupon) by 100 (market value), and you get 5%.

However, a year into the project, interest rates have risen so demand for this bond has dropped. As a result, the market value is now 90.

If you purchase one of these bonds now, you would pay $900 instead of $1,000, and your current yield would be 5.56% (5 ÷ 90). Plus, if you hold the bond until maturity, you will still receive the $1,000 principal even though you only paid $900 upfront.

It’s important to understand that the market value does not affect the interest paid by the company. Regardless of your purchase price, the issuer will continue paying interest based on the face value of the bond.

2) Government Bonds

Just like corporations, governments issue bonds when they need to raise money. And if you’re looking for the safest debt in the world, look no further than U.S. Treasuries. Considered the king of all sovereign debt (another name for government-issued debt), these bonds are backed by the full faith and credit of the U.S. government.

The U.S. Treasury offers the following types of bonds:

- T-Bills: Bonds maturing in one year or less.

- T-Notes: Bonds maturing between 2 and 10 years.

- T-Bonds: Treasury bonds maturing in 20 or 30 years.

- TIPS: These treasuries are indexed to inflation. Their par values increase or decrease based on the CPI (Consumer Price Index). When the bond matures, you get either the inflation-adjusted price or the original price, whichever is greater.

T-Notes, T-Bonds, and TIPS pay interest every six months until maturity. T-Bills, on the other hand, are zero coupon bonds meaning they are sold at a discount in lieu of interest payments.

For example, a 9-month T-Bill with a $1,000 face value might sell for $960. At maturity, the investor receives the full face value, or $1,000. The $40 gain is considered the interest paid on the bond.

Just like corporate bonds, you calculate a government bond’s current yield by dividing the coupon by the market value. A T-Bond with a coupon of 4 and a market value of 95 would give you a current yield of 4.2% (4 ÷ 95).

U.S. Treasuries can be purchased through a brokerage, bank, or directly from the U.S. Treasury itself. And if you decide to trade before maturity, the U.S. Treasury market is one of the deepest and most liquid markets in the world, making it easy to liquidate at any time.

| Government Bond Pros | Government Bond Cons |

|---|---|

| U.S. Treasuries are secure, backed by the full faith and credit of the government. But be cautious if you venture outside the U.S. | U.S. Treasuries offer lower yields than corporate bonds |

| Provide a steady and predictable income stream | Changes in demand can affect returns (if you sell before maturity) |

| Highly liquid, making them easy to buy and sell | Returns from foreign bonds can be affected by changes in foreign exchange rates |

3) Municipal Bonds

These bonds are issued by local, county, or state governments when they need to raise money for public work projects, such as new bridges, roads, schools, and sewer systems.

The main advantage of “munis” is that the interest paid is often tax-free at the federal level. This makes them an attractive option for higher-income investors. Most are issued in $5,000 increments, and terms can range from 1 to 30 years.

One disadvantage of munis is that they generally come with call provisions. This means the issuing government retains the right to repay the loan before maturity. If rates drop meaningfully, localities may choose to issue new bonds at lower interest rates to pay off the higher interest rate bonds.

Also, it’s important to note that municipal bonds don’t have the same secondary market as U.S. Treasuries. So, they may be more difficult to sell before maturity.

| Municipal Bond Pros | Municipal Bond Cons |

|---|---|

| The interest paid is often tax-free at the federal level | Usually offer lower yields than other debt investments |

| Relatively low risk of default | Most have call provisions |

| Earn passive income while helping the local community. | Less liquid than U.S. Treasuries and corporate bonds |

4) Debentures

Debentures are long-term loans that are not backed by collateral. This means that, as an investor, you can only rely on the creditworthiness of the organization.

These debt instruments are used by both corporations and governments to raise capital. In fact, they are the most common type of corporate debt. Typically, debentures have 10+ year maturities and pay interest on an annual or semi-annual basis.

Some corporate debentures are even convertible. In other words, they can be converted to equity shares at a pre-determined price at some point in the future. Converts are an excellent way to gain ownership in a company without as much upfront risk.

Debentures come in two flavors: redeemable and irredeemable.

Redeemable debentures spell out the exact terms by which they must be repaid. Whereas, irredeemable debentures have no specific maturity date. For this reason, they are often referred to as perpetual debentures.

You can purchase debentures directly from a government or corporation. In addition, many are offered on the secondary market, just like bonds. However, prices can fluctuate depending on supply, demand, and the prevailing interest rates.

| Debenture Pros | Debenture Cons |

|---|---|

| Convertible debentures can be converted to stock | The borrower’s creditworthiness is critical |

| Have a higher priority than shareholders in the case of a company default | Have a lower priority than bondholders in the event of a company default |

| Provide a predictable income stream |

5) Debt Funds

If you are interested in bonds but the thought of hand-picking investments makes your head ache, debt funds are the perfect solution.

Debt funds are mutual funds that invest in fixed-income instruments, such as corporate and government bonds and corporate debt securities. They are also called Bond Mutual Funds.

With a debt fund, you can easily diversify your portfolio across different industries and bond issues. They are ideal for risk-averse investors who want a predictable income stream but don’t have the time or desire to do a lot of research.

In many cases, you can get started for as little as $250. This also makes them a great option for beginning investors.

| Debt Fund Pros | Debt Fund Cons |

|---|---|

| Offer greater diversification and lower risk | Less control over individual investment decisions |

| Highly liquid, making it easy to buy and sell shares | Management fees can reduce your overall returns |

| Provide a steady income stream | |

| Low minimum investment |

6) Peer-To-Peer Lending

Consumer lending is big business. According to LendingTree.com, Americans now owe over $222 billion in personal loan debt as of December 2022, up 33% increase year over year.

With peer-to-peer lending, you can take advantage of this growing trend. Online platforms, such as Kiva and Upstart, make it easy to get started. Simply decide how much you want to lend and let them set the rates and terms.

Peer-to-peer lending offers the chance to generate higher returns than other debt investments; however, the counterparty risk is also higher. This is because it is much more difficult to determine the creditworthiness of an individual than a corporation or government.

| Peer-To-Peer Lending Pros | Peer-To-Peer Lending Cons |

|---|---|

| Start with as little as $25 | Greater risk of default than most other debt investments |

| Generate higher yields than corporate or government bonds | Funds are completely tied up until the loan is repaid |

| Decide where your capital goes | |

| IRA-friendly |

7) Real Estate Contracts

Not every homebuyer can qualify for a traditional mortgage. And this creates a lucrative opportunity for debt investors.

Real estate contracts connect buyers with individuals, instead of banks or mortgage lenders. In exchange for loaning the money to purchase a home, investors receive a consistent monthly payment that is secured by the underlying property.

These contracts are often used as bridge loans, giving borrowers time to qualify for a conventional mortgage. As a result, the terms are usually short (from two to five years).

Real estate contracts often come with a two to five percent premium, depending on the borrower’s creditworthiness and the property’s condition. This creates a much better return profile than corporate or government bonds can offer.

For more details, check your local paper under the Financing section. Or speak directly with real estate agents or mortgage brokers specializing in private contracts.

However, there is one big caveat. You always want to be in a first-lien position. In the unlikely event of a default, this positioning ensures you are the first to be repaid after any taxes owed.

As a general rule of thumb, avoid 2nd or 3rd lien real estate contracts. Those positions run a greater risk of losing their principal investment in the event of foreclosure.

| Real Estate Contract Pros | Real Estate Contract Cons |

|---|---|

| Higher returns than corporate and government bonds | In the event of default, the foreclosure process can create extra costs |

| Provide consistent monthly income | Often require more capital than other options |

| Loan is secured by the underlying property | Difficult to sell before maturity |

8) Tax Liens

When a homeowner is unable to pay their property taxes, the local government creates a tax lien certificate that is auctioned off to investors.

If you acquire a tax lien certificate, you are responsible for paying the delinquent taxes. Then the owner is required to repay you. This creates two potential outcomes:

- In most cases, the owner will pay the delinquent taxes. You earn the difference between what you paid at the auction, plus interest and penalties.

- If the owner doesn’t pay the taxes, you can foreclose on the property. This allows you to acquire real estate at a significant discount. But you will incur additional legal fees and you must abide by strict timeframes.

(Note: Tax liens have a higher priority than a mortgage, meaning you will be paid before any other loans against the property.)

Currently, 25 states offer tax lien certificates. One of the most profitable is Florida, which charges 18% interest and penalties on delinquent taxes. The next highest is Arizona, at 16%. In either state, you can lock in better rates of return than most equity funds at a fraction of the risk.

To get started, check to see if your state offers tax lien certificates. Then watch the local paper for announcements. If done right, tax liens can provide above-market returns with minimal downside.

| Tax Liens Pros | Tax Liens Cons |

|---|---|

| Secured by real estate and give you a priority claim to the property | Not available in every state |

| You can determine your yield based on your bid at the auction | The bidding process is highly competitive |

| Most are repaid by the homeowner | You may need to go through legal proceedings if the owner doesn’t pay |

| You have the potential to obtain real estate at a significant discount |

Is Debt Investment Right For Me?

Whether you wish to boost your income, diversify your holdings, or add a layer of stability to your portfolio, debt investments are a strategic move.

For those looking to build passive income, they offer steady and predictable earnings. And even aggressive investors can benefit from the reduced volatility they provide without taking a big hit on their overall returns.

How To Choose The Right Debt Investment

All investment involves risk, and debt investments are no exception. However, by following these 4 strategies you can maximize your risk-adjusted returns.

1. Consider Your Timeframe: If less than three years, stick to shorter-term or more liquid options, like debt funds and T-Bills.

If you’re looking to lock in a steady source of income for years to come, long-term government bonds (T-Bonds and T-Notes) and corporate debentures may be a better fit.

2. Evaluate Your Risk Tolerance: Understanding your risk comfort level will prevent you from making emotional choices during downturns. Plus, peace of mind is much more valuable than a few percentage points.

Corporate bonds from well-established companies can be a good match if you are willing to take on slightly more risk for potentially higher returns. However, if safety is your primary concern, stick with U.S. Treasuries.

3. Get Aligned With Your Plan: Carefully consider how each investment fits with your long-term financial plan and how it can help you achieve your goals.

You may choose debt funds if you plan to make small, consistent contributions over time. Whereas if you have a significant amount to invest upfront, consider a real estate contract.

4. Diversify: Don’t keep all your eggs in one basket. Spread out your debt investments to avoid the risk that any one default ruins your portfolio.

5 Common Pitfalls To Avoid

Before you pull the trigger on your first bond, watch out for these common pitfalls! With the strategies above and these mistakes in mind, you will be ready to start putting your money to work.

1. Ignoring Credit Risk: Always check the creditworthiness of the borrower. Use the ratings provided by S&P and Moody’s as a first stop in evaluating the risk profile of a corporate or government bond investment.

2. Neglecting Interest Rate Risk: Be mindful of how interest rate changes can affect bond prices. This is particularly important for long-term bonds, where a rise in rates can significantly decrease their market value.

3. Trying to Time the Market: Waiting for the perfect interest rate could leave you waiting, well, forever. It’s better to find a consistent investment strategy than to try capturing short-term market moves.

4. Overlooking Your Liquidity Needs: Don’t allocate funds to long-term bonds without considering your short-term cash requirements. Instead, choose debt instruments that mature within your investment timeframe.

5. Failing to Diversify: Avoid going all-in on any one issuer or debt instrument. Instead, spread your investment across different types of debt instruments. Or, consider a debt fund that does it for you.

Final Thoughts

So, are you ready to put the power of debt investments to work for you?

No matter where you are in your financial journey, everyone can benefit from debt investments. Their predictable and consistent returns provide the perfect foundation for building a rock-solid passive income portfolio.

And the best thing is, you don’t need much money to get started.

Start by picking an option that appeals to you, whether a debt fund, government bond, or real estate contract. Then, do your diligence and start small.

As you gain experience, your passive income will grow. And you can use that extra money to fund new investments and kickstart the compounding process!

Debt Investment FAQs

Debt investments are excellent for investors looking to protect their capital while pursuing short-term financial goals. Since they often offer better returns than savings accounts, they are the perfect choice for those looking to boost their income without much additional risk.

The 3 classifications are trading, held-to-maturity, or available-for-sale. Each classification has specific accounting requirements under U.S. GAAP that can affect an organization’s financial obligations and tax reporting.

1) Trading: These are actively managed for short-term profit. They are marked to market, meaning their value on financial statements reflects current market prices. Gains or losses due to price fluctuations are recognized immediately rather than waiting until they are sold.

2) Held-to-Maturity: These investments are intended to be held until they mature. They are recorded at amortized cost, not their current market value. This classification reflects a long-term investment strategy focused on earning interest over time rather than capitalizing on market price movements.

3) Available-for-Sale: This category includes debt investments that may be sold before maturity but are not actively traded. They are also marked to market, but unlike trading securities, unrealized gains or losses don’t directly affect net income until they are sold.

People often invest in debt to bring stability and diversification to their portfolios. These instruments are valued for their steady and predictable returns. They are especially appealing to risk-averse and first-time investors.

Oftentimes, the goal is to reduce a portfolio’s volatility without significantly sacrificing potential returns.