Tired of living paycheck to paycheck? You don’t have to. If you want to take control of your finances and live life on your own terms, the key is financial independence.

But what exactly does it mean to achieve financial independence? And how do you know when you have arrived? Don’t worry — this guide will show you how to get there, step by step.

You will likely have to make basic lifestyle changes, brush up on your financial literacy, and test your own resolve. So don’t let anyone fool you into thinking it’s easy to reach financial freedom.

But if you can commit to the process, the rewards will be worth it. Without further ado… let’s get into it!

What Is Financial Independence?

Financial independence means that you are no longer dependent on a person or a job to afford your living expenses. Once you have saved and invested enough money that you could retire for the rest of your life, you are considered financially independent.

It’s important to recognize that achieving financial independence does not mean that you have to actually stop working. Many people find purpose, fulfillment, and happiness in their careers and choose to continue working even after they reach financial independence.

Financial independence is about

freedom and flexibility.

Rather, becoming financially independent gives you the freedom and the flexibility to choose how you want to live your life. You could change jobs, move to a new city, start traveling, or simply spend more time with your family and friends.

How Much Money Do You Need To Become Financially Independent?

Financial independence is personal because every financial situation is different. Depending on your income, spending habits, and financial goals, people may strive for vastly different wealth targets.

The FIRE movement, which stands for Financial Independence Retire Early, has become a popular way for individuals to discuss retirement planning. This approach revolves around determining, and eventually reaching, a FIRE number.

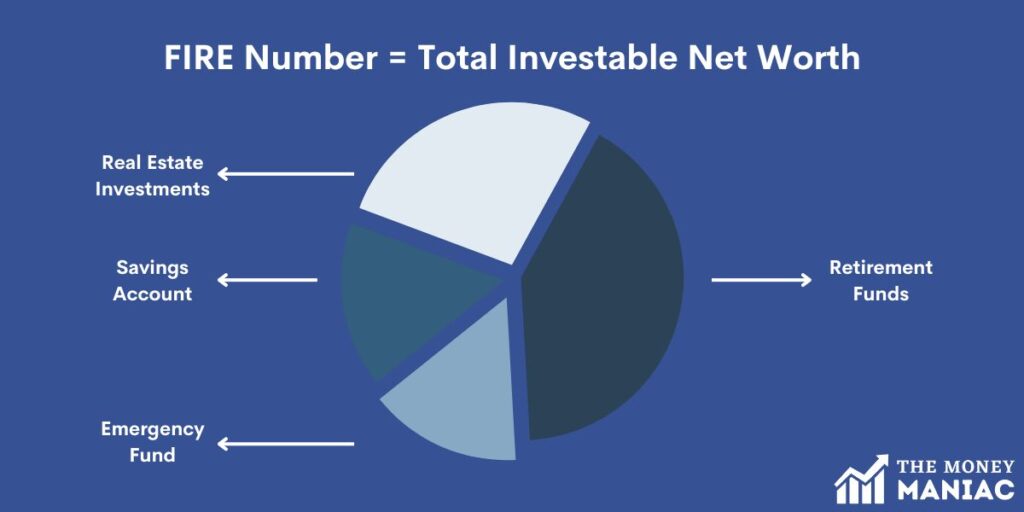

Your FIRE number is your total investable net worth — the sum of your investment portfolio, emergency fund, savings account, etc. And this target number separates people into three primary camps, depending on their desired retirement age and lifestyle.

- Lean FIRE: Those interested in Lean FIRE are generally optimizing for retirement age. They are willing to live a frugal lifestyle with a lower monthly income so they can ensure an early retirement.

- FIRE: This group intends on continuing their lifestyle “as-is” in retirement. Their financial plan requires their future income to surpass their current living expenses in order to feel financially independent.

- Fat FIRE: The Fat FIRE crowd has the most ambitious financial goals. These people want to live lavishly in retirement and are willing to work longer and save more aggressively to enjoy this financial cushion.

Regardless of what type of FIRE you are interested in, the framework is a great way to think about goals and financial mileposts. To calculate your FIRE number, we suggest understanding the following:

- The rule of 25

- The 4% rule

Calculating Your FIRE Number

To become financially independent, you need to save money until your assets can cover your living expenses for the rest of your life.

But how do you ensure that you don’t run out of money in retirement? That’s simple — never touch the principle. That’s right, at the core of the FIRE movement is the assumption that you will never withdraw your core assets.

Instead, you will live on the interest and dividend income that those assets generate. Some folks may even tap into the capital appreciation, but I’d strongly advise against planning on that ahead of time. This approach leaves little to no safety net, though it’s ultimately up to your risk tolerance and age.

The 4% rule assumes that your assets can generate a 4% yield on average every year. This could be achieved through interest with bonds, or dividends in the stock market. And because dividing by 4% is the same as multiplying by 25, the rule of 25 is the same exact calculation.

So, to determine your FIRE number, take all of your annual living expenses and multiply by 25. The result will tell you approximately how much money you need to save to gain financial independence.

How To Become Financially Independent

Becoming financially independent may feel daunting when you first lay eyes on your FIRE number. For most people, imagining a bank account with more than a million dollars is mind-boggling. Don’t let that fear stop you.

Financial stability is within reach. Just follow this 6-step guide and commit to the process. Before you know it, your dreams of financial freedom will be a reality!

1) Review Your Financial Health

Before embarking on a mission for financial independence, take stock of your current financial health. To get an accurate picture, gather all of the documentation you have about your income, expenses, debt, and savings.

Pull together your bills, bank statements, pay stubs, car loans, credit card statements, and student loans. Use this information to answer the following questions:

- How much money do you make?

- How much money do you spend?

- How much money do you save?

- How much debt do you have?

- What is the value of your assets?

- Do you have an emergency fund?

- Do you have any passive income?

- What is your net worth?

Until you can answer all of these questions with confidence, it will be difficult to create a plan for the future. So if you are not sure at the moment, bookmark this page and take a few hours one Saturday morning to sit down and sort it all out. And if you can’t do it yourself, consider working with a financial advisor as needed.

2) Set SMART Goals

Achieving financial independence is all about working backward. Before we focus on how you get there, ask yourself where you are going.

Look deep into your financial future and envision what it will look like.

- Do you live in the same city?

- Do you have any (more) children?

- How big is your house?

- What does your day-to-day life look like?

- Are your hobbies hiking and reading, or playing golf at the country club?

- Are you a millionaire?

The clearer you can get about what exactly you want, the easier it is to set reasonable goals for you to work toward. But remember that everything you want, you will have to sacrifice for in the coming years. So if you don’t really need that third car, don’t include it (at least not at this stage).

When setting financial goals, it’s best to follow the SMART framework. This acronym stands for:

- Specific: Be as precise as you can with your goals. Don’t leave any room for uncertainty or doubt about the financial destination. Get laser-focused on what is most important to you.

- Measurable: Make sure your goals are quantifiable, so you can track your progress over time. These can be related to your net worth, credit card debt, or total money saved.

- Achievable: Your goals should be ambitious enough that they make you nervous, but not so far-fetched that you can’t succeed. That uncomfortable middle ground is where true progress comes from.

- Relevant: Every financial picture looks different, so it’s okay to set goals that are personal to you. But be sure that they tie back to your ultimate objective to become financially independent.

- Time-bound: What good is your retirement fund if you never get the chance to enjoy it? In other words, don’t pursue financial health at the cost of your physical health. Put a time constraint on all of your goals so you can be sure to benefit from the fruits of your labor.

Use these suggestions to write down one to three goals that will guide your journey toward financial freedom. Put them above your desk at home, in the notes on your phone, or anywhere you’ll see them regularly. Use them to stay focused and to motivate yourself towards financial success.

3) Create A Budget

In step one, you looked at where you are. In step two, you looked at where you want to be. In step three, you can begin to connect these dots with a monthly budget.

You can make your budget in a physical budget planner, or on Excel or Google Sheets. The objective of the exercise will be to determine how much money you make, how much you need to get by, and what is left over for spending money, your debt strategy, and any investments.

At the top of your budget is your household’s monthly after-tax income. You can find this number on your most recent pay stub or direct deposit, but be sure to adjust for your pay cycle. For those on a bi-monthly pay schedule, this means multiplying by two.

Next, categorize and deduct all of your monthly expenses. This may include the following:

- Rent or mortgage

- Utilities

- Health insurance premiums

- Car payment

- Car insurance

- Phone bill

- Groceries

- Entertainment

- Unexpected expenses

Before adding all of these regular expenses up, take a moment to reflect on where your money is going. Are you comfortable with these spending levels, or are there any obvious opportunities for improvement? Because the more that you can reduce unnecessary expenses, the faster you can achieve financial independence.

Lastly, subtract your monthly spending from your monthly income. What remains is available for furthering your financial objectives. We will use this margin to repay debt and then begin generating passive income.

4) Pay Off Any Debt

If you have any credit card debt or high-interest debt, it is imperative to pay this off as soon as possible.

The interest rate that you pay on these loan amounts far exceeds the return you would be able to generate from investments, even if you have good credit. That’s why you should always pay down bad debt before investing or even saving (beyond a small safety net).

Here are a few simple ways to reduce your interest payments and accelerate your debt repayment:

Balance Transfer

Many credit cards offer an introductory promotion with a zero-interest period of 12 to 18 months. If you can get credit approval for one of these cards, take advantage of the opportunity.

Once the account is opened, transfer your existing balance from your old card to the new card. While you may have to pay a balance transfer fee (usually around 1% of the total) for the transaction, this usually pales in comparison to the 20% to 25% annual interest you could save.

Debt Consolidation

If you can’t make use of a balance transfer, your next best bet is debt consolidation. The concept is similar — transfer all of your existing debt to one loan or line of credit.

But in this case, identify the lowest interest rate loan from your existing creditors, and use that as your consolidation vehicle. The savings from this approach will be lower, but it still provides a significant reduction in interest charges and a streamlined payment process. This makes it easier to stay on top of your debt and avoid missing payments, late fees, or damaging your credit score.

Debt Avalanche

If you are unable to consolidate your debt into one account, the debt avalanche method can still help you save money. This strategy requires an ongoing commitment to paying off your high-interest debts first.

Continue to make minimum payments across all of your accounts, but allocate any remaining funds towards your most expensive debt. And once that balance is paid off, move on to the next most expensive debt and continue in this way until you are debt free.

The debt avalanche method takes careful planning, but it is a surefire way to accelerate your path to financial freedom. And if you make it this far, celebrate! You deserve it.

Conquering your debt is an incredible and empowering feeling. It enables your view of personal finance to shift from a stressful burden to an exciting and rewarding journey.

5) Start Investing

Once you have been liberated from debt, it’s important to set aside a small emergency fund. Try to save around six months’ worth of expenses in an account with compound interest. This should be readily accessible for unexpected events like:

- Job loss

- Health emergencies

- Natural disasters

- Home repairs

These savings will protect your downside, and enable you to start investing with confidence. After all, all investing carries some risk. And your job as an investor is to determine the right risk profile for your own personal goals.

Here are a handful of investment opportunities worth considering:

- Stock and bonds

- Call and put options

- Mutual funds

- Real estate

- Cryptocurrency

- Commodities

- Annuities

- Collectibles

Not only you do have to decide what to invest in, but you also have to decide where to invest. The subtle distinctions between account types can make a significant difference in your asset growth and tax burden.

To start, determine if your employer offers a 401k plan with matching contributions. If so, this is an unbeatable way to leverage the company’s resources and get your portfolio off to a strong start. Every dollar that you invest and the company matches is essentially free money.

Next, invest in any other tax-advantaged retirement accounts that you may have available. This could be a traditional IRA, Roth IRA, SEP IRA, or HSA. Money placed in these accounts receives special tax treatment and can help shelter income-generating assets.

Lastly, and only after making use of retirement accounts, you can invest any remaining funds in personal accounts. These accounts are much more flexible in nature but will also expose you to taxes on any income-producing assets. Fortunately, in most cases, interest and dividend income is taxed at a much lower rate than traditional W-2 income.

6) Enjoy The Process

The journey to financial freedom is a long one — often taking several decades. And if you’re searching for how to become financially independent, chances are you are anxious about the process. This could be because of your current financial status or your fear of the unknown.

However, you have to remember that investing and building wealth takes time, patience, and discipline. So you mine as well have fun with it!

Don’t trade your life away in the constant pursuit of some magic number. Sure, you may reach it, but what’s the point?

Instead, look for creative ways to save money. Strive to develop a career you are proud of, set up automatic savings, and build a manageable portfolio of investments.

Each of these accomplishments should instill a sense of pride. And in due time, they will all come together when you achieve financial independence. Yes, we would all rather see this day come sooner than later but make sure to smell the roses along the way.

Related reading: 21 Personal Finance Ratios That Will Boost Your Financial IQ

Final Thoughts

You don’t need to inherit millions or hit the lottery to become financially independent. You don’t need to be a lawyer or a doctor, or even a financial advisor.

Anyone can gain financial independence with the 6-part system laid out in this article. By taking intentional steps toward financial stability, you can secure your future and live the flexible life you desire. All it takes is a willingness to learn and a commitment to your goals.

Financial Independence FAQs

Being financially independent means having enough money saved and invested that you are no longer dependent on a job to meet your needs. This level of wealth gives you the freedom and flexibility to only work as long as you choose to.

The four steps to financial freedom are: create a budget, reduce your expenses, begin investing, and live a balanced life. The goal of financial freedom is to have the ability to do what you want to do when you want to do it. Even though this may require some sacrifice, it should not be so extreme that it prevents you from enjoying your day-to-day life.

To live the lean FIRE lifestyle, you could be financially independent with as little as $400,000 to $500,000 in assets. However, most retirees target an investable net worth of closer to $1,000,000 to $2,000,000. At a 4% withdrawal rate, this yields $40,000 to $80,000 in annual income.

One of the most straightforward ways to reduce your expenses is to live a healthier lifestyle. If you have poor health maintenance, you are more likely to experience medical issues and less likely to bank your limited sick days. And if you develop obesity or another dietary illness, you could even see your health insurance premiums skyrocket. All of these costs can eat into your monthly budget and make it more difficult to achieve financial independence.