Do your finances feel like a never-ending rollercoaster ride?

One month, your savings are up. The next, unexpected expenses have you reaching for your credit card. Sometimes you’re just scraping by, and other times you’re keeping up with the Joneses.

Without a way to stabilize all the ups and downs, managing money can feel like a stomach-churning ride around the amusement park.

Enter the 30-30-30-10 budget — a strategy designed to help you take control of your spending without giving up all of life’s pleasures.

This budget strikes the perfect balance between structure and flexibility. And with an emphasis on savings and investing, it’s designed to help you reach your financial goals FAST!

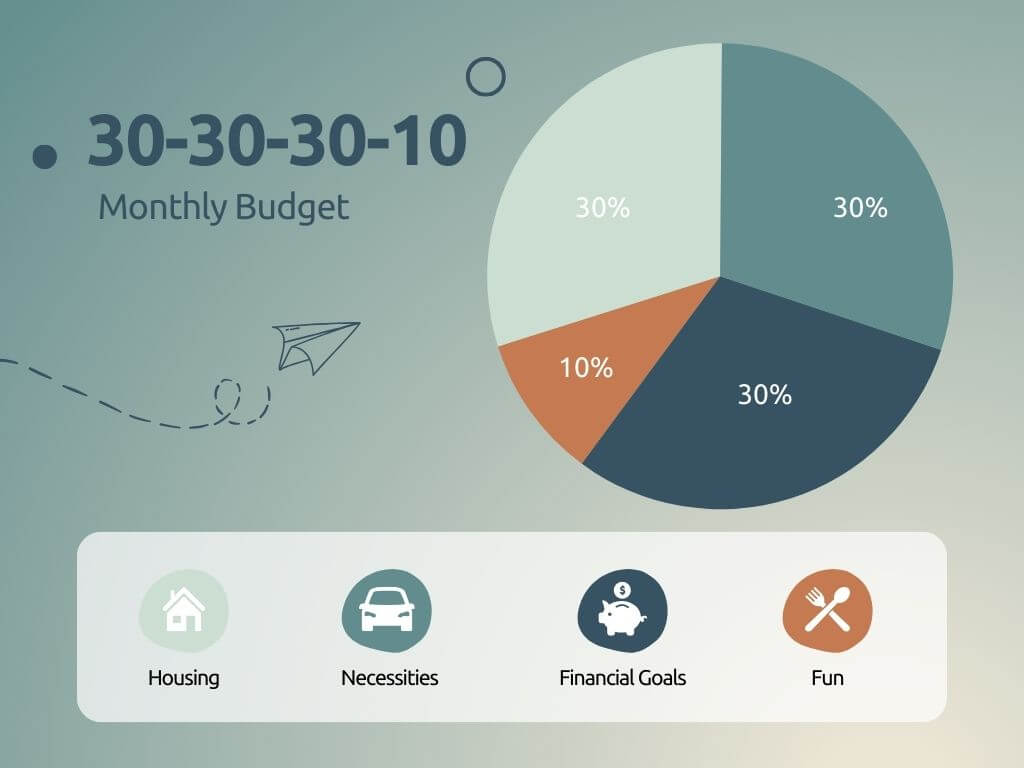

What Is The 30-30-30-10 Budget?

The 30-30-30-10 budget is an easy way to manage your finances. It’s a percentage-based budgeting plan that breaks down your income into four distinct categories — housing, necessities, financial goals, and wants. Here’s how it works:

- 30% for Housing: The first slice of your income goes towards your housing expenses. It covers rent or mortgage payments, insurance, property taxes, maintenance, and anything else related to your home.

- 30% for Necessities: The second 30% is allocated to life’s essentials. Think groceries, utility bills, internet, fuel, and monthly debt payments. These are the expenses you have to pay.

- 30% for Financial Goals: This next portion is your pathway to financial freedom. If you have debt, work on lowering your balances first. Then, once you are debt-free, focus on building your savings and investments.

- 10% for Having Fun: The final 10% is all about enjoying life guilt-free! Use it for dining out, travel, hobbies, and entertainment. This way, you can enjoy your hard-earned money without derailing your financial plan.

By dividing your income in this balanced way, the 30-30-30-10 budget encourages financial discipline while still giving you room to enjoy life along the way.

Related reading: 8 Sinking Fund Categories That Will Prevent Financial Distress

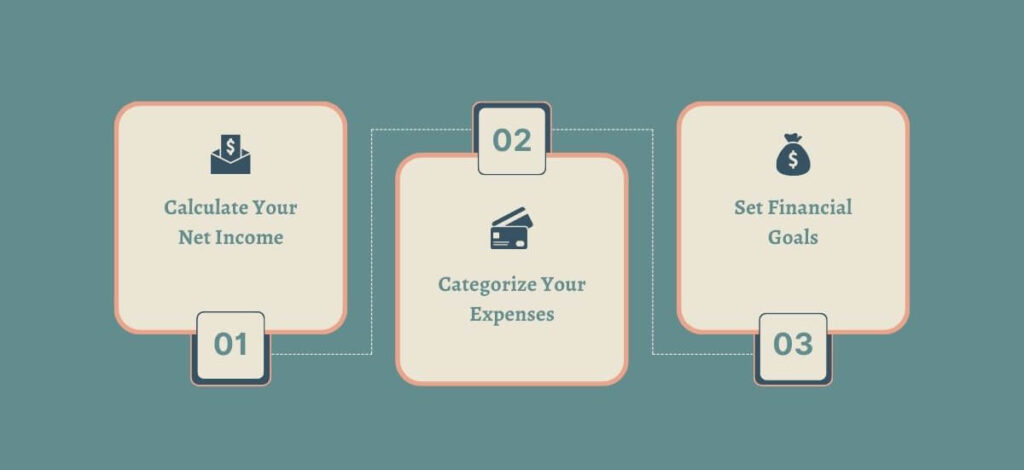

How To Set Up The 30-30-30-10 Budget In 3 Easy Steps

Setting up the 30-30-30-10 budget is simpler than you might think. Just follow these 3 easy steps to take control of your financial future.

Step 1: Calculate Your Net Income

The first step is determining what exactly you have to work with — your net income. This is the amount you bring home monthly after taxes and other deductions.

If you get a regular paycheck, just review your pay stubs to find the amount. But if some of your income comes from tips, bonuses, commissions, side gigs, or self-employment, you should find your average net income.

A simple method is to take what you earned last year and divide it by 12. This works well if your income is consistent, with only minor fluctuations throughout the year. If your income swings more wildly, you will need to set money aside during the better months to cover times when your income falls below the average.

An excellent way to do this and reduce the temptation to overspend is to transfer any excess to a separate high-yield bank account. Out of sight, out of mind!

Or, even simpler, you can use your lowest month in the past year to calculate your budget. That way, you should be covered no matter where your income falls. And during the higher months, you can allocate more to your needs, wants, and savings.

Step 2: Categorize Your Expenses

Next up, it’s time to review your spending. Some expenses, like rent and insurance, are consistent and easy to predict. However, variable expenses (those that can change each month) can be trickier. For these costs, like dining out and utility bills, it is best to have your credit card and bank statements for the past three to six months on hand.

Pro Tip: If you haven’t already, consider using budgeting apps like Pocketguard or YNAB (You Need a Budget) to quickly track your spending by category.

First up, housing.

This category includes your rent or mortgage payment. If you rent, don’t forget your renter’s insurance. If you own, be sure to include property taxes and homeowners’ insurance.

Next, break out the rest of your expenses as either needs or wants. We’ll get to financial goals shortly.

Needs

Needs are those things you can’t live without. And no, Starbucks doesn’t count. They can include the following:

- Insurance payments

- Utility bills (gas, electric, water)

- Cell phone bill

- Car and home maintenance

- Gasoline

- Groceries

- Clothing (within reason)

- Doctor visits

- Child care (if applicable)

Wants

Wants are what make life enjoyable. Spoiler alert: This is where your Starbucks fix fits in! Other wants include:

- Dinners out

- Entertainment

- Monthly subscriptions (like Netflix and Amazon Prime)

- Birthday and Christmas gifts

- Travel and vacations

- Any miscellaneous spending, like happy hours with co-workers

For any expenses that vary significantly from month to month, try to come up with a reasonable average.

Pay special attention to those expenses that can fall into both categories.

For example, we all need to eat, but not all of our grocery expenses may be necessary. And if your work requires a uniform or special clothing, that would fall into the needs category. However, designer jeans are definitely a want.

Be honest as you evaluate your expenses. But ultimately, it’s up to you to decide where each one goes.

Step 3: Set Financial Goals

Finally, set clear financial goals. One significant advantage of this budget is that it allocates nearly one-third of your after-tax income toward this end.

So whether it’s paying off debt, saving for a home, or building an emergency fund, you should always be making progress on this part of your budget.

Here are a few worthwhile goals to consider:

- Hitting a $100k net worth

- Planning a dream vacation

- Starting your own business

- Paying off your student loans

- Saving up for a down payment

- Maxing out retirement contributions to your IRAs or 401Ks

Pro Tip: Write down your goals and post them in a place where you will see them every day. This constant reminder will help keep you motivated and on track when things get tough.

Putting It All Together

After you have all of your expenses categorized, calculate how much you currently spend on each category as a percentage of your income.

Where do you fall?

If you are in line with the 30-30-30-10 budget, pat yourself on the back. You’re pretty much done!

However, if your current spending doesn’t quite fit your desired budget, this is your opportunity to do some adjusting. Typically, this means you have been falling short in the financial goals category. If that is the case, review your expenses more closely and see where you can make cuts.

You may not get there overnight. But with a few quick changes, you will be surprised how quickly you can reach your financial goals. Even without giving up all the fun!

Pro Tip: Instead of leading with your expenses, start with your financial goals and work backward. This means setting aside 30% of your net income for debt reduction, savings, or investments before allocating the rest to expenses. This keeps the focus on your financial goals rather than your day-to-day spending.

Related reading: How To Save $10,000 In A Year On Any Income

30-30-30-10 Budget: A Quick Example

To bring the 30-30-30-10 budget to life, let’s walk through a real-world example.

We will use the average monthly income in the U.S. as of 2023 to show how to allocate your funds across the different categories. This example not only outlines the basic distribution but also guides you on what to do with any leftover money.

Step 1: Net Income

- Monthly income = $4,295 net of taxes

Step 2: Expenses

- Housing = $4,295 x 30% = $1,288

- Rent: $1,225

- Renters’ insurance: $25

- Total: $1,250

- Since these costs are fixed, you can apply the remaining $38 to another category.

- Needs = $4,295 x 30% = $1,288

- Groceries: $550

- Gasoline: $125

- Car Payment: $250

- Car Insurance: $75

- Cell Phone: $75

- Utility Bills: $150

- Total: $1,225

- This leaves $63 to $101 monthly for things like car maintenance, doctor’s visits, and necessary clothing.

- Wants = $4,295 x 10% = $430

- Dining out: $150

- Netflix: $20

- Movie night: $75

- Starbucks: $60

- Total: $305

- This leaves $125 for gifts, impulse purchases, and miscellaneous expenses.

Step 3: Financial Goals

- Financial Goals = $4,295 x 30% = $1,288

- 401K contributions: $450

- Extra car payments: $100

- Savings: $300

- IRA contributions: $200

- Saving for vacation: $238

- Total: $1,288

Benefits Of The 30-30-30-10 Budget

The 30-30-30-10 budget isn’t just a formula — it’s a blueprint for financial empowerment. Here are the key reasons that it can be a game-changer for your finances:

- Simple to set up and use: With only four primary categories, this budget is easy to understand, implement, and stick to. It’s great for both beginners and budget pros.

- Reach your financial goals faster: Almost one-third of your after-tax income is allocated to debt reduction and savings. This emphasis puts you in the fast lane toward financial freedom.

- Breaks out housing and needs: By keeping these categories separate, it is easier to identify where you might be able to reduce expenses.

- Increases financial discipline: This budget controls impulse buying by bringing awareness to your discretionary spending habits.

- Easy to adjust: You can always tweak the categories by a few percentage points to better fit your personal financial situation. This makes it an effective plan for practically everyone.

- Teaches you how to live within your means: By allocating a specific amount for each category, the 30-30-30-10 budget helps you make adjustments and cut back on areas where you may be overspending.

- Reduces FOMO: With a clear plan for your money, you can feel more confident in your financial decisions and less pressure to keep up with others. In turn, this helps to prevent lifestyle inflation.

Who Should Use The 30-30-30-10 Budget?

The 30-30-30-10 budget is a versatile tool, but it’s particularly beneficial for certain groups of people. Here are five groups who may find this plan especially useful:

- Budgeting Beginners: If you’re new to budgeting, this plan is a fantastic starting point. Its straightforward structure provides a clear roadmap, making it easier to understand and implement financial management.

- People Seeking Financial Structure: If you regularly tap your credit cards to make ends meet, this budget provides a well-defined framework to curb your spending without being overly restrictive.

- Individuals with Consistent Income: People with variable income may still find it useful, but this budget works best for those with a regular, predictable income.

- Goal-Oriented Savers: If you have clear financial goals, such as saving for a home, paying off debt, or building an emergency fund, the 30-30-30-10 budget can help accelerate your progress.

- Those Looking for a Balanced Lifestyle: This budget is ideal for those who want to enjoy life now while also planning for the future. It ensures you can still have fun while steadily working towards long-term financial stability.

Who Should NOT Use The 30-30-30-10 Budget?

While the 30-30-30-10 budget is a fantastic tool for many, it’s not a one-size-fits-all solution. Here are some situations where this budget might not be the best fit:

- High-Cost-Of-Living Areas: If you live in an area with exceptionally high living costs, such as San Francisco or New York City, it may be difficult to keep your housing under 30%. In that case, consider increasing your housing expense to 35% and reducing your “needs” category by 5%.

- Irregular Income Earners: For freelancers, gig workers, or anyone with a highly fluctuating income, this budget can be challenging to maintain.

- High Debt Levels: Those with significant debt loads may need to take a more aggressive approach toward debt repayment than the 30% allocated in this plan.

- Extreme Savers or Investors: If you’re pursuing aggressive financial goals like Fat FIRE, you may find the 30% allocation for financial goals too conservative.

- Minimalist Lifestyles: If you generally spend a lot less than you earn, the percentages for necessities and wants in the 30-30-30-10 budget might be more permissive than you need. In that case, a budget that maximizes savings and investments may be a better fit.

Although these cases may not be the ideal fit for 30-30-30-10, the beauty of this budget is its flexibility. Feel free to use it as a rule of thumb, and then tweak the categories to fit your financial situation.

The only rule is to stay within your limits once you establish them.

Tips And Tricks To Unlock Your Budget’s Full Potential

Think you got the 30-30-30-10 budget all figured out?

Well, hang on because we are about to take it to the next level. Get ready to discover four insider secrets that can turn this simple budget plan into a financial powerhouse.

- Negotiate Regular Expenses: Don’t accept bills as they are. Whether it’s your internet, phone bill, or insurance, apps like Truebill can negotiate with your providers on your behalf to get better rates.

- Embrace Frugality in Fun Ways: Find creative ways to enjoy life within the 10% “having fun” allocation. This could mean exploring free community events, learning new cooking skills for home-based entertainment, or taking up fun, low-cost hobbies.

- Use Cashback Apps and Credit Cards: Maximize your spending by using cashback apps (like Rakuten) and credit cards for your purchases. This way, every expense can contribute a small rebate back into your budget.

- Adopt a ‘Use-it-Up’ Week: Once a month, challenge yourself to a ‘Use-it-Up’ week, where you avoid buying anything new and get creative with what you already have. This could mean crafting meals from remaining pantry items or finding entertainment from forgotten hobbies or books at home. It’s a fun and resourceful way to stretch your budget and ignite creativity.

For even more creative ways to save money, check out these 13 Fun Budget Challenges To Supercharge Your Savings.

Pro Tip: Instead of looking for ways to cut your spending, consider upping your income. If you have a hobby or interest, you can turn it into a profitable side hustle. This extra cash can then be funneled into any of your budget categories, especially financial goals.

Common Mistakes To Avoid

While the 30-30-30-10 budget is pretty straightforward, there are a few pitfalls to be aware of. Avoiding these six common mistakes can make the difference between a budget that works and one that falls flat:

- Not Tracking Small Purchases: Those daily coffees or impromptu online checkouts can really add up. Failing to account for these minor expenses can throw your budget off balance.

- Forgetting Irregular Expenses: Annual insurance premiums, holiday spending, or unexpected car repairs can disrupt your budget if you haven’t planned for them.

- Being Too Rigid with Percentages: Life’s unpredictable twists mean that sticking too strictly to the 30-30-30-10 rule might not always be feasible. Adapt your budget as your circumstances change.

- Underprioritizing Debt Repayment: If debt is eating into your finances, consider allocating more towards paying it off (especially high-interest debt). Letting debt spiral out of control can undermine your financial health.

- Not Having An Emergency Fund: An emergency fund isn’t just a good idea — it’s essential. Without it, unplanned expenses can seriously derail your financial goals.

- Neglecting Regular Budget Reviews: Life changes, and so should your budget. Every few months, review your budget allocations. If you’ve had a salary change, a shift in living expenses, or any other significant financial adjustment, tweak your budget to keep it relevant and up to date.

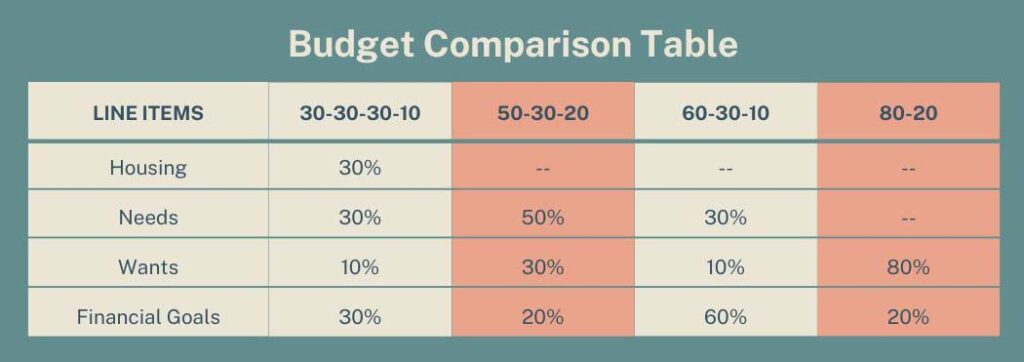

Other Popular Budgeting Ideas

There is no perfect budget. So if the 30-30-30-10 budget plan isn’t for you, here are a few more percentage-based plans worth considering:

30-30-30-10 vs. 50-30-20 Budget

Popularized by Senator Elizabeth Warren and her daughter in their book, All Your Worth: The Ultimate Lifetime Money Plan, this budget is built on the same principle as the 30-30-30-10 budget.

However, in this case, you only need to divide your income into three categories.

- 50% for needs (including housing)

- 30% for wants

- 20% for financial goals

This budget is more restrictive on needs (50% instead of 60%). It is also more flexible on financial goals (20% instead of 30%). These changes allow for more spending on wants, fun, and entertainment.

Due to this more relaxed approach to financial goals, the 50-30-20 budget is probably most appropriate for those without debt or dreams of FIRE.

30-30-30-10 vs. 60-30-10 Budget

You may never look at budgeting the same way again!

In this budget, a whopping 60% of your take-home pay goes toward your financial goals. Then, 30% is allocated to your needs (including housing) and 10% is for having fun.

This budget is all about achieving financial independence — and right now!

However, the 60-30-10 plan is probably out of reach for most families. Saving 60% of your income is only feasible for high-income earners with relatively minimal housing expenses.

30-30-30-10 vs. 80-20 Budget

A simplified version of the 50-30-20 plan, this budget divides your income into two categories: savings and everything else.

- 20% for savings

- 80% for everything else

The theory with this budget is that as long as you pay yourself first, it doesn’t matter where the rest of your money goes. No calculations. No categories. Quick and easy.

This budget appeals to folks who want to spend less time pouring through their finances. Or those who prefer the month-to-month flexibility to decide where to spend their money.

However, if you lack the discipline to consistently set aside 20% of your monthly income before paying your other bills and spending elsewhere, this plan may not be the best choice.

Final Thoughts

If you’re ready to get off the financial roller coaster and start making real progress toward your goals, the 30-30-30-10 budget is certainly worth a try.

In less time than it takes to watch an episode of Friends, you can have your budget set up and ready to go. After all, everyone talks about financial independence. Won’t it feel great to actually have a plan to get there?

And don’t worry if you don’t quite hit the 30-30-30-10 mark right away. Lifestyle and spending habits take time to change.

Just keep taking little steps in the right direction. Because with every step, you are that much closer to making your financial dreams a reality.

Frequently Asked Questions

Setting up automatic transfers can help you boost your savings with the 30-30-30-10 budget. These make savings a priority by setting aside money before it can be spent.

Also, making regular reviews of your spending can help to cut down unnecessary expenses and free up even more funds for savings.

Finally, embracing frugal living choices and seeking additional income sources can boost your savings as well.

Adjusting the 30-30-30-10 budget for irregular or variable income requires a bit of flexibility and planning. Start by calculating your average monthly income based on what you made last year. Then, allocate your budget percentages based on that average. In months where you earn more, contribute the extra to a buffer fund to cover those months with lower income. That way, you can stay consistent even when your income isn’t.

The 30-30-30-10 budget differs from traditional budgeting in its simplicity and percentage-based spending. Most traditional budgets require tracking multiple expense categories. However, this budget simplifies things by dividing spending into just four categories: housing, necessities, financial goals, and wants.

Traditional budgets also use fixed dollar amounts instead of percentages. However, the 30-30-30-10 budget can adjust with income changes, offering greater adaptability.

The 30-30-30-10 budget can be challenging if you live in a high-cost area. In cases where your housing expense exceeds 30%, you can reduce the remaining percentages proportionally to offset this increase. This flexibility allows the budget to remain practical and effective, even if you live in a more expensive locale.

Yes! Whether it’s building a robust retirement fund or turbo-charging your savings, the 30% allocation towards savings and investments helps you achieve those future financial milestones faster than most other budgeting plans.