Have you ever noticed that as your paycheck gets fatter, so do your expenses? That’s lifestyle inflation in action.

Lifestyle inflation is the silent enemy of financial wellness, creeping up with every raise and sabotaging your savings progress. Unfortunately, it’s a widespread and culturally accepted habit. After all, who doesn’t deserve a little splurge after getting a promotion?

But if you’re not careful, those little splurges can add up. Before you know it, that celebratory dinner, weekend getaway, and new car payment can wipe out the entire raise (and then some).

In this article, we are tackling lifestyle inflation head-on. We uncover why it happens, how to spot it, and most importantly, how to outsmart it. If you want to boost your financial well-being, read on and learn how you can kick lifestyle inflation for good.

What Is Lifestyle Inflation?

Lifestyle inflation, also known as lifestyle creep, is a phenomenon where an individual’s spending habits increase as their income increases. When they receive a raise, bonus, or any other windfall, they quickly spend it rather than improving their savings rate.

As a result, those who experience lifestyle inflation are never able to get ahead. With more discretionary income, they should be able to repay debt, build an emergency fund, or invest more meaningfully.

Instead, they put on those golden handcuffs — shackling themselves to work and preventing themselves from ever reaching financial independence.

Unfortunately, lifestyle inflation is a fairly natural response that the “treat yourself” movement has only exacerbated. And it affects everyone across all socioeconomic classes. But make no mistake — it is a trap.

How Lifestyle Inflation Rears Its Ugly Head

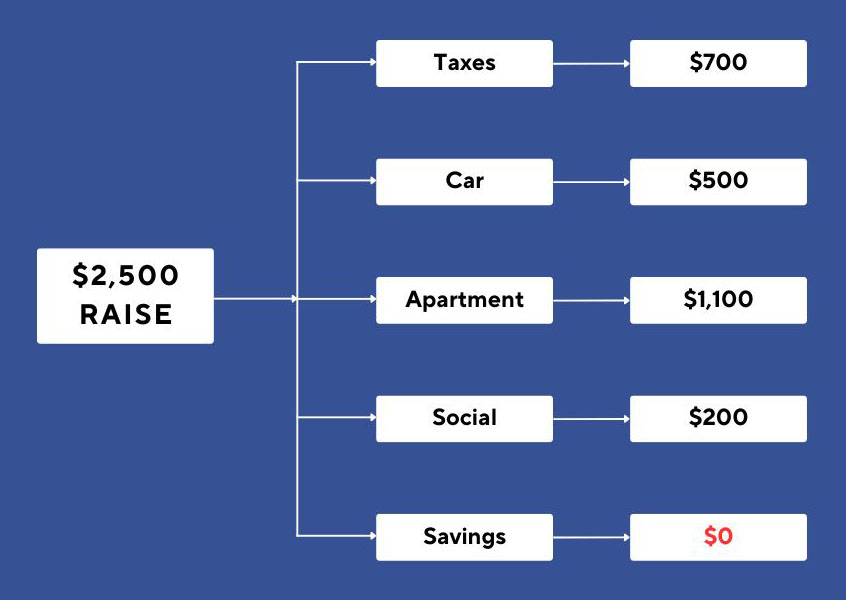

Let’s say you have pulled in $60,000 per year for the past six years. But after teaching yourself a new high-income skill, you land a fantastic job making $90,000 per year. Incredible! That’s a cause for celebration, right?

But here’s where lifestyle inflation often sneaks in:

The Car Upgrade

Perhaps you have been driving around an old beater and you decide it’s time for something better. The new Nissan Maxima looks nice, and hey, it’s not a BMW — you’re not going wild. So you trade in your old vehicle, fork over a downpayment of $3,000, and take out a 7-year car loan at $500 per month.

The Apartment Move

Next, you excitedly start apartment hunting. After all, you hate your noisy neighbors. And how can you be a high performer if you can’t get the sleep you need? So you move out of your $1,500 per month studio and move into a swanky new $2,600 one-bedroom.

You know it’s a little steep, but you convince yourself that you deserve it. Plus, it comes with a gym, a pool, a sauna, and a nice clubroom.

You Celebrate (A Lot!)

Finally, you decide to go out with your friends to celebrate the huge changes you have made in your life. They are happy to see you enjoying your financial success, so you have more drinks and appetizers than you normally would. It feels good to enjoy your new raise and not have to worry about money, so you make it a regular occurrence.

Fast forward a few months, and a reality check hits. Your bank account isn’t reflecting that 50% pay raise. Why? Your new lifestyle has gobbled up the extra income. Although each spending decision seemed reasonable at the time, you are no closer to financial freedom than you were before.

Stop Keeping Up With The Joneses

Everyone wants to keep up with the Joneses’ but no one wants to foot the bill. And social media has only exacerbated this problem, challenging our financial wellness.

People often make the mistake of trying to look rich without actually being rich. From renting luxury cars to staying at expensive resorts, it has become much easier to dress up your lifestyle and put on a front.

Whether it is to fit in, get likes, or look successful, the pressure to live the way others do (or the way they pretend to) is significant. But this rarely leads to lasting happiness and satisfaction.

Suze Orman relates how she learned this lesson the hard way early in her career:

“There was a time that I was in a relationship with a very, very wealthy person, and I wanted to impress this person, and I didn’t have any money yet. So I went out and leased a new 750iL BWM, and the lease payments were like $800 per month. It was the stupidest thing I ever did with my money because the truth of the matter is that later on, I didn’t even like this person. And here I am spending all this money.”

So don’t let your personal relationships or social media feeds influence your purchasing decisions. Instead, focus on avoiding lifestyle creep and pursuing your long-term financial goals.

The Dangers Of Lifestyle Inflation

A few impulse purchases here and there might not seem like the end of the world. But lifestyle creep can slowly but surely chip away at your financial security. Here are a few of the key dangers to watch out for:

More Money Does Not Always Equal More Progress

You would think that a bigger paycheck would automatically bring you closer to your financial dreams. But if you let lifestyle inflation eat up your extra earnings, you will be no closer than you were before.

Whether you want to avoid lifestyle inflation entirely or just minimize its impact, develop a plan to monitor your spending and stay on track with your financial goals. This will ensure that lifestyle creep doesn’t derail your progress toward getting out of debt, building an emergency fund, or investing for retirement.

The Real Price Of Living Large

The sticker price is rarely the total cost. Maintenance costs, insurance, and upgrades can significantly inflate the actual cost of living large.

A bigger house means more furniture, higher utility bills, and increased property taxes. A luxury car comes with expensive repairs and premium fuel requirements. The allure of high-end items often masks these hidden ongoing expenses.

The reality is that once people get a taste of the finer things, they rarely reign it back in. The things they previously enjoyed become less satisfactory and what was once a treat is now an expectation. That’s why the “just this once” mentality is a fallacy.

As a result, the true cost of lifestyle inflation is not just the one-time cost of a purchase. It’s the aggregate cost of all the subsequent spending, which is much harder to calculate and keep track of.

When “Just This Once” Becomes A Habit

Lifestyle inflation is often likened to a hedonic treadmill. Because no matter how fast you run, you will never reach your destination.

There is always a new car model, a nicer neighborhood, and a fancier restaurant. So as long as your goals are external, and not internal, you will continue chasing a moving target.

As your income increases, so will your expenses, and you will find yourself living paycheck to paycheck. Even if you make six figures.

3 Warning Signs Of Lifestyle Creep

Spotting lifestyle inflation can be tricky. However, there are a few telltale signs that your spending habits are heading in the wrong direction.

1) Your Income Increases, But Your Savings Don’t

If you notice that your bank balance isn’t growing (even though your paychecks are getting bigger), you are experiencing lifestyle creep. This indicates that your money is going out just as fast as it is coming in.

2) You Have Credit Card Debt

If you aren’t making progress on your credit card balances despite earning more, this is another red flag! The existence of credit card debt is a clear sign that your spending needs to be reined in.

3) You Spend To Project An Image

If you find yourself splurging on high-end gadgets or designer labels just to turn heads, that’s a classic lifestyle inflation move. Spending to impress others can keep you broke and living paycheck to paycheck.

How To Avoid Lifestyle Inflation: 6 Tips

Avoiding lifestyle inflation is not rocket science. These 6 tips will help you establish good habits to keep lifestyle creep at bay and your long-term savings plan on track.

Tip 1: Be Conscious Of Your Spending

The number one way to avoid lifestyle inflation is to be more conscious of your spending. There’s no way around it. If you want to save more money, you need to pay close attention to where it’s going.

Start by setting up a budget planner and allocating a portion of your income to your fixed costs, discretionary spending, and savings goals. This way, you can enjoy certain luxuries while protecting your financial health.

If you find this budget hard to enforce on a day-to-day basis, consider testing cash envelopes. A cash-based system is much more rigid and ensures you don’t overspend or accidentally tap into your savings.

Tip 2: Set Up Automatic Savings

Any time your income increases, decide what percentage you would like to save versus spend. If your annual income grows by $5,000, for example, you may choose to contribute $2,500 to your savings goals and the other $2,500 toward new experiences.

Then, open up a high-interest savings account and create a monthly recurring transfer.

This fixed amount will be set aside automatically each month before you are even tempted to spend it. Consider this your minimum savings rate. The rest can be spent on lifestyle choices as long as you adhere to the spending limit.

Tip 3: Find Cheaper Alternatives

Avoiding lifestyle inflation doesn’t have to mean skipping out on entertainment altogether. You just have to find more affordable alternatives.

For instance, instead of going to a fancy restaurant, you can recreate the same experience at home with a candle-lit dinner and a few special ingredients. And rather than staying at an all-inclusive resort when you travel, you can find an Airbnb off the beaten path and try more authentic activities.

Tip 4: Do It Yourself

Another way to reduce your spending is to DIY whenever possible. This can be anything from home improvements and gardening to haircuts and clothing repairs.

Oftentimes, after a little research and a few YouTube tutorials, DIY projects can be surprisingly easy. Plus, you get to feel the satisfaction of tackling something yourself. And once you pick up a new skill, you will benefit from the savings again and again over time.

Tip 5: Avoid Debt

Bad debt, like credit cards and personal loans, can fuel lifestyle inflation without you even realizing it. These forms of debt are notorious for their high interest rates which can quickly turn a bad decision into a full-blown financial crisis.

So if you must borrow money, only use it to acquire assets, not fund expenses. Investments, businesses, and real estate can all be legitimate reasons to take on new debt. Shopping sprees, vacations, and lifestyle upgrades are not.

Tip 6: Delay Gratification

To prevent lifestyle inflation, practice delayed gratification. Instead of buying everything you want right away, slow the process down.

Start by making a list of items you want and prioritize them. Wait a few weeks and if you still want the item at the top of the list, go ahead and buy it. Then, a few weeks later, if you still want the second most important item, go ahead and buy that one too.

By simply delaying the rate at which you spend money, you will end up spending less and saving more. So don’t think that you have to sacrifice everything you want in life — you just have to be patient.

How To Combat Lifestyle Inflation

If it’s too late to prevent lifestyle creep because you already live paycheck to paycheck, all hope is not lost. Just follow this simple 3-step formula to reduce your spending and pad your savings account.

1) Write Out A List Of Expenses

If you are barely making ends meet despite a recent increase in income, start by making a budget. Take this opportunity to review your expenses and identify where there have been spending increases. This will help you pinpoint exactly where your money is going.

Categorize your spending into categories like:

- Rent or mortgage

- Car payment

- Groceries

- Utilities

- Phone bill

- Insurance

- Streaming services

- Entertainment

2) Cut Out Anything Unnecessary

Next, take a step back. Ask yourself if your spending on any of these categories surprises you. Are any expenses unnecessary or easy to scale back on?

If you think you can live without something, give it up for just 30 days or one billing cycle. By the end of the month, you will have more savings and a clearer view of how important that expense is to you. Then, either revert or cancel it permanently.

From your gym membership to streaming services, this process will help you save money by eliminating everything that you don’t need.

3) Adjust Your Financial Goals

As you move through life, your goals are likely to evolve. This isn’t necessarily a bad thing — it’s the inevitable result of having more context and perspective.

Perhaps you make more money than you did previously, but you also have three children and a dog. If this wasn’t factored into your original plan, you may need to revisit your goals.

But don’t just accept defeat. Update your previous assumptions and look at your budget with a critical eye. Brainstorm how you would use any extra money for the future if you had it today. Remember your answer and hold yourself accountable to this goal after your next raise.

Related reading: 21 Personal Finance Ratios That Will Boost Your Financial IQ

Final Thoughts

Left unchecked, lifestyle inflation can wreak havoc on your finances regardless of your income. It can prevent you from saving more money, leveling up in life, and reaching your financial goals.

To avoid falling victim to lifestyle inflation, use the 6 tips outlined above to balance your financial and lifestyle goals. They can help steer you in the right direction toward financial security.

If you have already fallen into the trap of lifestyle inflation, the 3-step budgeting plan can help you right the ship. Just take it one step at a time and remember that sustainability is more important than speed.

Lifestyle inflation is dangerous, but it doesn’t have to be permanent. No matter how far you’ve gotten off track, you can always turn your financial situation around with the right strategy.

Lifestyle Inflation FAQs

Lifestyle inflation is rooted in the mistaken belief that more stuff leads to more happiness. Unfortunately, the sense of excitement we get when we buy a fancy new toy is short-lived. So before long, we are left wanting more.

Social media has only made this problem worse. We are flooded with a highlight reel of extravagant vacations, luxury gifts, and designer clothing. So, we keep chasing these status symbols rather than making real progress toward our financial goals.

The best way to prevent lifestyle inflation is by following the 80/20 rule. Every time you receive a bump in income, devote 80% toward savings and investments and 20% toward whatever else you want.

If this seems too restrictive, consider the more relaxed 30/30/30/10 budgeting rule. In this system, only 30% of your newfound income goes towards savings and investments. Either way, the goal is to find a sweet spot between enjoying life today and securing your financial future.

When lifestyle inflation kicks in, your long-term savings plans keep getting pushed further and further into the future. Instead of benefiting from the magic of compound interest, you find yourself playing financial catch-up. Then, you are then left facing the tough task of having to save an even bigger chunk of your future earnings to reach your retirement goals.