A poor credit score can feel like a major barrier to achieving your financial goals, whether you want to qualify for a new credit card, take out a car loan, or apply for the best mortgage rates.

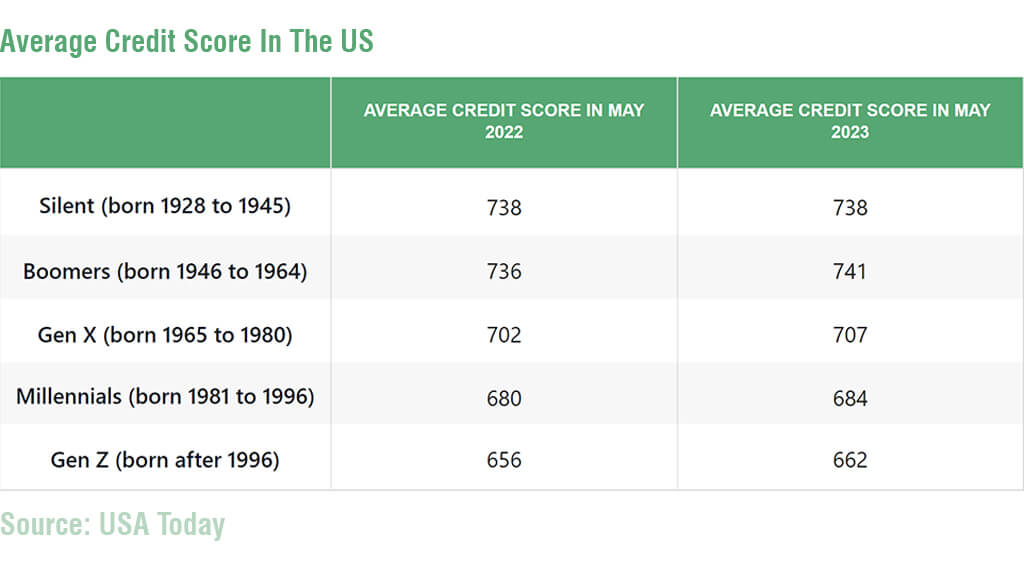

As of May 2023, the average VantageScore 4.0 credit score in the U.S. was 702, up from 697 in 2022. But if you find yourself below this mark, you’re not alone.

The good news?

No matter your starting number, there are tangible steps you can take to give your credit score a boost — sometimes a dramatic one — in relatively short order.

By implementing just a few of these battle-tested tactics, you will be well on your way to adding a few extra points to your score each week. Read on to discover simple strategies for credit repair and optimization, and to set yourself up for success when it comes time for your next big financial decision.

How Are Credit Scores Calculated?

What is a credit score in the first place?

Your credit score is a measure of your creditworthiness. It’s based on a handful of financial metrics developed by Fair Isaac Corporation, commonly known as FICO. The highest possible credit score that you can receive is 850, but FICO scores range anywhere from 300 to 850.

Lenders use your credit score to decide whether to approve you for loans, credit cards, and other forms of credit. It can also affect the interest rates you qualify for.

The FICO model of credit scoring puts credit scores into six categories:

- Very Poor: 300-579

- Poor: 580-669

- Fair: 601-660

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

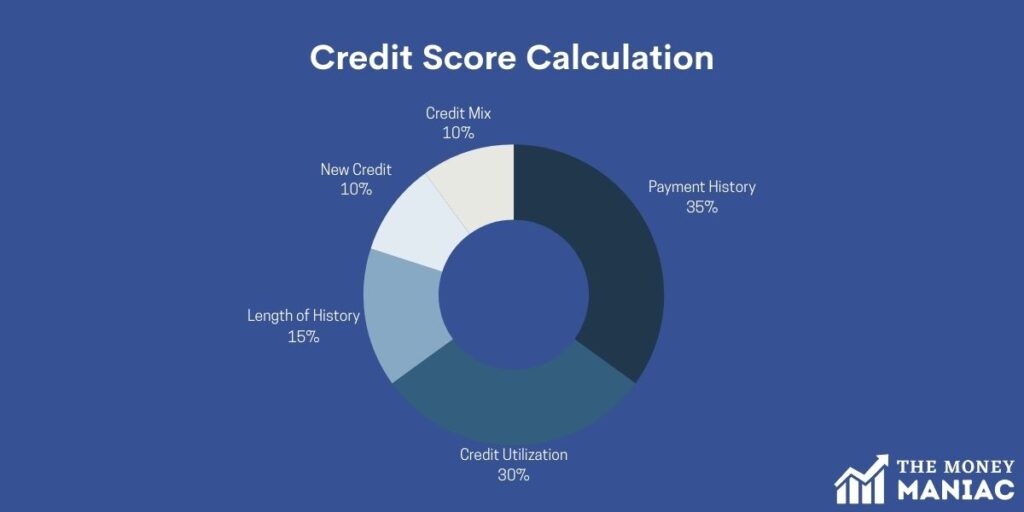

The calculation of your credit score incorporates five major components, each with varying levels of importance:

- Payment History (35%): This is the most important factor in your credit score. It reflects whether you make payments on time, how often you miss payments, how many days past the due date you pay your bills, and how recently payments have been missed. (Payments made over 30 days late will typically be reported by your lender and lower your credit scores.)

- Amounts Owed or Credit Utilization (30%): This is the percentage of your available credit that you are using. A lower credit utilization ratio is better for your credit score. For instance, if you have a credit limit of $2,000 and you have used $400 of it, your credit utilization ratio is 20%. A lower ratio is better for your credit score as it shows you’re not heavily reliant on your credit.

- Length of Credit History (15%): This reflects how long you have had open credit accounts. The longer your credit history, the better your credit score.

- New Credit (10%): This takes into account how many new accounts you’ve recently opened. A credit inquiry is a hard inquiry that is made on your credit report when you apply for new credit. Too many hard inquiries in a short period of time can damage your credit score.

- Credit Mix (10%): The different types of credit you have, such as credit cards, loans, and mortgages, can also affect your credit score. Having a mix of different types of credit can be beneficial.

How To Improve Your Credit Score

Whether you are a student, a parent, or an entrepreneur, anyone who wants to effectively manage their personal finances can apply these tips.

This list includes only practical, reliable ways for fast credit score improvement. The goal of each is to target key scoring factors like payment history, credit mix, utilization, and disputes.

Here are the 7 most influential levers for fast, fool-proof credit score upgrades:

1) Pay Down Revolving Balances & Debt

According to fool.com, only 38% of consumers pay off their credit card bills in full each month.

Carrying excessive revolving debt (like credit card balances) is not only expensive but also bad for your credit.

The #1 fastest way to optimize your credit rating is simply to pay down your revolving account balances as quickly and aggressively as possible.

Paying down balances on credit cards, lines of credit, and other revolving accounts delivers the quickest score improvements possible. As you lower your credit utilization ratio — how much of your total credit limit is used — your creditworthiness increases in the eyes of scoring models.

Scoring models love to see consumers using very low portions of their available revolving credit — ideally less than 30%. As you pay down your balances, your utilization ratio falls, and your credit scores quickly rise in response.

There are two powerful strategies to accelerate paying off credit card and line of credit balances faster:

- Pay more than the minimum amount due every month, targeting cards charging the highest interest rates first. By sending extra funds beyond the payment minimums, you attack balances more quickly and reduce costly interest fees.

- Consolidate multiple high-rate balances with low-rate balance transfer cards. This simplifies your debt so you only have to manage one monthly payment. Plus, it will slash interest costs during the 0% intro APR period. Similarly, refinancing a car loan can potentially lower your monthly payments, allowing you to allocate more funds toward paying off other high-interest debts.

2) Become An Authorized User

Piggyback off someone else’s established positive credit history by having them add you as an authorized user on a long-held credit card. This immediately boosts your credit mix, account diversity, and perceived trustworthiness.

The key is to find a friend or family member who has stellar credit card habits. They should have at least one major credit card open for many years without ever missing a payment. Strong candidates also keep their balances extremely low relative to their credit limits.

Ask to be added as an authorized user on their top-performing, longest-held card. Confirm the card provider reports authorized user activity to credit bureaus before submitting the request.

Once added, the primary user’s flawless track record gets linked to your credit profile. Scoring models will have no way to distinguish their good habits from yours! This can immediately boost your score — by up to 100 points.

Just be certain whomever you team up with continues their responsible credit behavior. Any missteps, like late payments, will unfortunately ding your credit too. Maintain open communication about card usage and help them keep the account in perfect standing.

3) Ask For Credit Limit Increases

Asking issuers to raise your credit card limits every 6 to 12 months is an important yet often overlooked tactic for fast credit optimization.

Higher limits directly reduce your credit utilization ratios since you suddenly have more available credit. Even with balances staying constant, your used-to-available ratio decreases as limits rise. This immediately lifts your scores, and really is a no-brainer!

When To Request Increases:

- After 6 to 12 months of responsible card usage (keeping balances low, paying on time, etc.)

- When your income goes up

- Anytime you have a major purchase approaching current limits

How To Ask:

- Call the number on each card and politely request higher limits

- Provide updated income and employment info if asked

- Alternatively, request through your online account portal

- Accept any automatic increase offers that pop-up

What To Know:

- Don’t request during applications for new credit

- Repeated requests won’t hurt scores if done properly

- Hard inquiries may result in temporarily lower scores

Be persistent in seeking higher limits to keep pushing utilization down. Any concession from issuers — even $500 more — makes an impact.

READ: How To Start Affiliate Marketing With No Money [7 Easy Steps]

4) Keep Your Credit Utilization Ratio Low

After paying your balances down, the next most critical tactic for improving your credit score is keeping your credit utilization rates low moving forward. This requires both proactive balance management and seeking higher revolving limits.

Utilization ratios track how much of your total available revolving credit you currently have tapped. So pay down balances consistently and try to keep your individual and overall revolving utilization under 30%.

If you can, aim for an even lower ratio (like under 10%). Here are a few ways to do so:

- Make extra payments early in billing cycles to reduce reported balances

- Set spending alerts before approaching 30% on any card

- Pay in full each month and avoid carrying balances

- Ask issuers for automatic credit line increases

Also, consider opening new credit cards because higher overall limits help lower your utilization rate. This low utilization demonstrates financial restraint which is rewarded by credit scoring models.

Pro Tip: Consider opening no-fee cards with sign-up bonuses instead of store cards to reduce the chance of a credit check.

5) Add To Your Credit Mix

Having a diverse mix of credit types on your reports signals financial maturity to scoring models. This diversity contributes to higher scores independent of just having a robust credit history.

There are two primary types of credit — revolving (credit cards) and installment loans (mortgages, auto, student, personal, etc.). Most consumers start building profiles with just cards since they are the easiest to obtain.

As your profile ages, proactively add installment variety to continue optimizing your credit mix:

- Open a new card every 6 to 12 months for higher combined limits

- Finance a major purchase like a car or appliance over time

- Consider taking out a small personal loan and paying it off quickly

Because of the importance of credit mix, an installment loan can count for more than an additional card. Avoid department store cards, on the other hand, as they provide less “mix” benefits.

Don’t apply for too many new accounts at once, as this will temporarily drop your scores. Space out applications to maximize your score and your odds of approval.

Once approved, your total available credit will increase. Then, just be sure to maintain low balances across all cards and loans. Developing this habit is one small but important step towards reaching financial independence.

6) Pay Bills On Time (Or Set Up Autopay)

Payment history carries the heaviest weight in credit scoring models. Just one 30+ day late payment can drop your scores by over 100 points. Several delinquencies can damage your profile for years.

So set up automatic payments on every credit account to guarantee perfect on-time payment history. Autopay will automatically debit your checking accounts on the billing due dates for the minimum, full balance, or custom amount. This guarantees no human error in forgetting payments.

However, you can also send manual payments days before the due date as a backup. Consider weekly or bi-weekly card payments to achieve dramatic utilization reductions.

7) Don’t Close Old Accounts

Closing old credit cards or loans prematurely erases their positive history and cripples a key factor in scoring models — the average age of accounts. This measures how long your accounts have remained open on average.

Longer average ages signal greater responsibility for managing lines of credit over time. Scoring algorithms award higher marks for consumers who retain accounts for years or decades without issues.

Sudden closures slash average age, particularly if you lack other aged accounts to offset the impact. This can significantly impact your credit score.

Here are a few tactics to preserve account longevity:

- Use old cards at least once per year to avoid automatic closure

- Convert unused cards into new ones rather than closing them

- Keep inactive cards open by requesting that issuers remove their annual fee

While frustrating, a disciplined “no closure” philosophy guarantees constantly rising scores as accounts naturally age year after year. So keep your oldest credit cards open forever by putting occasional small charges on them (and paying them off). This signals better credit management to scoring models.

Also, try converting old cards offering no benefits into ones with more lucrative rewards instead of opening all new accounts.

Bonus: Negotiate Lower Interest Rates

Having savvy negotiation skills, confidence, and a little persistence can lead to big interest savings. After all, the worst they can do is say no.

Credit card and lending companies want to retain reliable customers, so more often than not they will work with you on interest rates if asked.

- Check your credit score. A score of 700+ gives you more leverage to negotiate. If your score is under 650, work on improving it before asking for better rates.

- Research current average APRs for your credit tier. Sites like Bankrate provide averages, which can help you know what rates to expect.

- Call the credit card company or lender and politely ask about lowering your interest rates. Mention average rates you’ve researched for your credit level and ask them if they can match or beat those offers.

- If they say no, politely escalate to a supervisor. Key phrases like “I’ve been a loyal customer for X years” or “What options are available to retain me as a customer?” can work.

- Be prepared to negotiate. If they won’t budge on APR, ask for other perks like late fee waivers, increased credit limits, or reversing recent fees. Any concession is a win

READ: How to Make Money Online for Beginners (Start Earning Fast)

Check Your Credit Score For Free

You have the right to request one free official copy of your credit report each year.

However, there are many ways to monitor your score more regularly:

- AnnualCreditReport.com: Authorized by the federal government, this website allows you to get a free copy of your official credit report from each of the three major credit bureaus once per year.

- CreditWise by Capital One: You can check your credit score for free using CreditWise. It uses a soft inquiry to check your credit, which will not affect your credit score.

- Credit Karma: A free credit monitoring service that provides you with access to your Experian and TransUnion credit reports. They also provide you with a credit score and other helpful information, such as credit utilization and payment history.

- Credit Sesame: Another free credit monitoring service that provides you with access to your TransUnion and Equifax credit reports. They also provide you with a credit score and other helpful information, such as credit utilization and payment history.

- Your Bank or Credit Card Company: Some banks and credit card companies offer their customers free credit monitoring services. Check with your bank or credit card company to see if they offer this service.

Previously, we ranked CreditWise by Capital One number one in our best credit score apps review. However, myFICO is another popular option.

5 Credit Score Myths

Myth 1: “Checking your credit score will lower it.”

Fact: Checking your credit score regularly will not lower it. There are two types of credit inquiries:

- Soft inquiries

- Hard inquiries

Soft inquiries, such as when you or a creditor check your credit report, do not affect your credit score.

Hard inquiries, on the other hand, occur when you apply for new credit. These can temporarily lower your credit score, but the impact is typically minimal and short-lived.

Myth 2: “You can pay companies to quickly fix your credit.”

Fact: There is no legitimate company that can quickly fix your credit. Credit repair companies cannot remove accurate negative information from your credit report, and they often charge hefty fees for services that you can do yourself.

The best way to improve your credit score is to follow the 7 steps outlined above.

Myth 3: “Closing unused credit cards will improve your credit score.”

Fact: Closing unused credit cards can actually hurt your credit score, especially if they are old accounts. The length of your credit history is an important factor in your credit score, and closing old accounts will likely shorten your overall credit history.

Myth 4: “You need to carry a balance on your credit cards to build credit.”

Fact: You do not need to carry a balance on your credit cards to build credit. In fact, carrying a balance will reduce your credit score because it increases your credit utilization ratio.

Myth 5: “Once you have a bad credit score, you are done for.”

Fact: It may take some time to improve your credit score, but it is not impossible. The most important factors are to make consistent payments on time and reduce your balances.

Other factors, such as keeping your credit utilization low and disputing any errors on your credit report, can also help improve your credit score.

Final Thoughts

Bad credit is not a life sentence. Thankfully, anyone can rebuild their credit by prioritizing the key inputs used in credit scoring models.

The most effective ways to increase credit scores include reducing revolving utilization, responsibly adding a diverse credit mix, retaining the length of credit histories, leveraging authorized user accounts, pursuing higher limits, and never missing payments.