In today’s world, it is more important than ever to have a good credit score. This number can affect everything from your interest rate on a car loan to the amount of rent you can negotiate on an apartment. That’s why it is so important to monitor and improve your credit score as much as possible. To learn more about credit scores, read our guide on what a credit score is and how your score is determined.

In this article, we search for the best credit score app available in 2024 and discuss how it can help you achieve your financial goals!

What Is the Best Credit Score App?

Our overall winner for best credit score app is CreditWise by Capital One because of the wide array of free services that it includes.

CreditWise provides your credit score from TransUnion, alerts for your Transunion and Experian credit reports, and customized tips to improve your credit score. You can even see how your score has evolved over time.

What distinguishes CreditWise from other free apps like Credit Karma is that it provides a regular dark web scan which is an incredible security measure for identity protection. The CreditWise Simulator also allows you to predict how your score will change if you make certain financial decisions. Overall, CreditWise is the best credit score app we have seen on the market.

Keep in mind that credit score calculations vary from country to country. While this article focuses on the U.S. market, the personal finance site PiggyBank has all the details you need to learn more about Canadian credit scores.

Credit Score App Reviews

After reviewing more than a dozen different services, here are our top 7 best credit score apps for 2024:

1) CreditWise by Capital One

Overview

CreditWise is the best credit score app on the market and it is available to everyone, not just Capital One customers.

CreditWise uses the Vantage Score 3.0 credit scoring model, which has become one of the most popular scoring models used by lenders today. CreditWise gives you access to your Transunion credit report and calculates the personalized factors that are affecting your credit score. Plus the app’s credit simulator can help you evaluate how various actions like paying down a debt or opening a new credit card may affect your credit scores.

Credit Wise also provides a credit monitoring service that alerts you to any meaningful changes on your Transunion or Experian credit reports. Lastly, Credit Wise offers continuous dark web surveillance and SSN tracking to prevent identity theft.

What We Like

- Everyone can access CreditWise’s best credit monitoring services

- Includes credit alerts for passive credit monitoring of two bureaus

- Protects against identity theft by monitoring the dark web for your personal information

- The credit score simulator is an awesome tool that gives insight into how your financial decisions will impact your credit reports

Price

Free

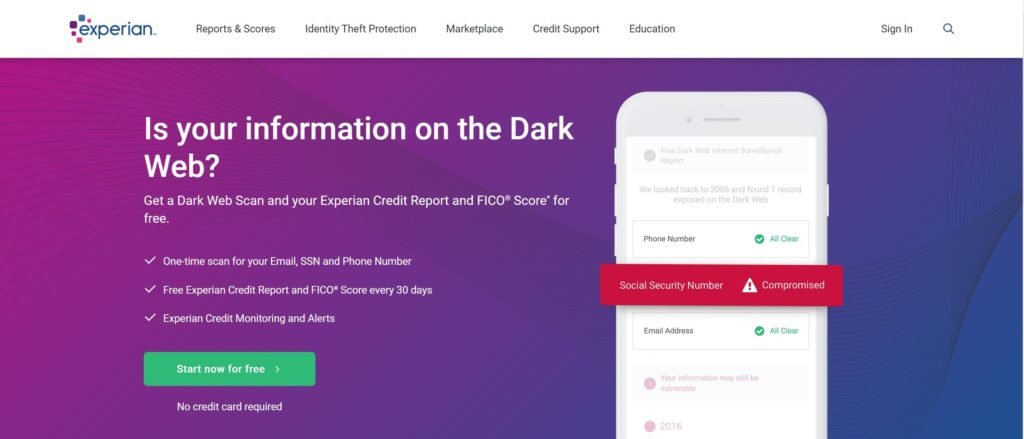

2) Experian CreditWorks

Overview

Experian CreditWorks is a great credit monitoring service that helps you manage and improve your credit. CreditWorks enables real-time alerts for changes to your Experian credit report and offers an online dispute portal where you can easily correct any inaccuracies. The free service also includes Experian Boost, which can raise your FICO score instantly by giving you credit for the bills you already pay including Verizon, AT&T, Netflix, Hulu, and more.

What We Like

- Free FICO score monitoring with the interactive tracker

- Instantly improve your credit score with Experian Boost

- Simple credit dispute portal for resolving issues on the Experian credit file

- Real-time alerts for any changes made to your personal information

- One-time dark web scan of over 600,000 web pages

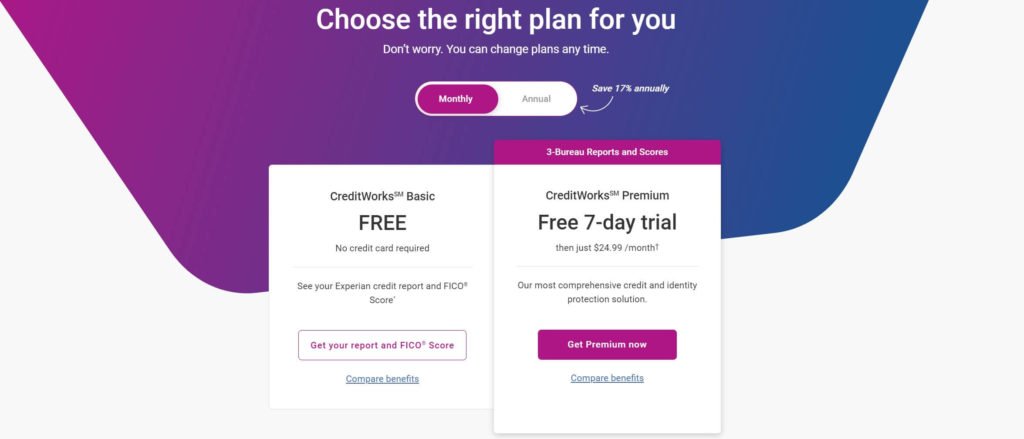

Price

- Basic: Free – Monitors Experian credit report

- Premium: $24.99/month – Monitors all three credit bureaus and includes additional identity protection tools

3) Credit Karma

Overview

Credit Karma is a free credit score monitoring app that gives you access to TransUnion and Equifax credit reports. However, it does not include the Experian credit bureau, which makes it a great match for use with the CreditWorks Basic plan.

Credit Karma updates your Vantage 3.0 score daily, and your credit report information weekly. Credit Karma also offers alerts for unusual or suspicious activity and personalized tips on how to improve your credit score.

What We Like

- Completely free service with no paid plans

- Popular app with more than 100+ million Credit Karma users

- Free credit reports for two of the three bureaus

- Offers other personal finance tools like spending tracking

Price

Free

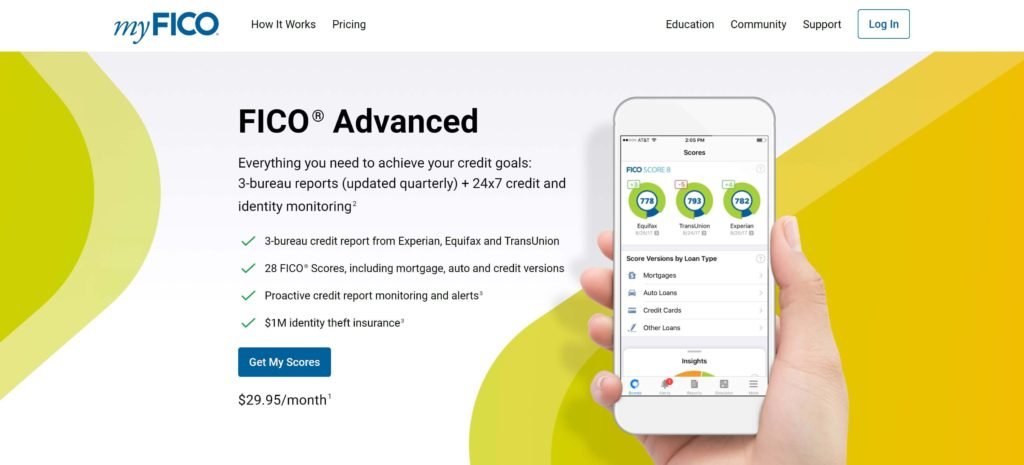

4) myFICO

Overview

If you’re looking for a more thorough understanding of your credit score, myFICO offers one-time reports and paid subscriptions that calculate up to 28 versions of your FICO score. With the premium service, myFICO provides access to your three-bureau credit report, along with an in-depth analysis of what factors are impacting your score and a credit monitoring service.

MyFICO is the best credit score app for those who want to make a significant change to their credit scores or have a large financing event in the near future.

What We Like

- Official FICO credit score app

- Ideal for people who want to see and improve their comprehensive credit file

- Includes $1 million in identity theft insurance

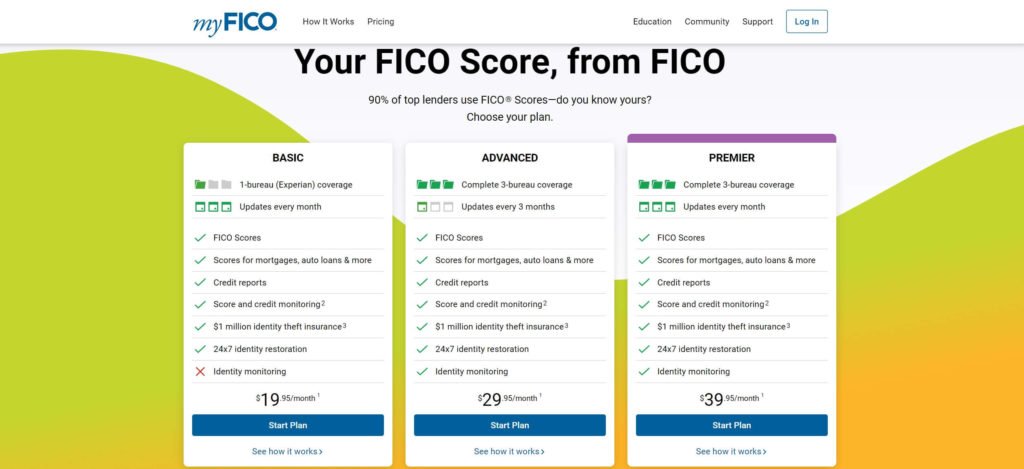

Price

- Basic: $19.95/month – Experian credit score only

- Advanced: $29.95/month – 3 bureau coverage and includes identity monitoring

- Premier: $39.95/month – 3 bureau coverage and includes identity monitoring

5) TransUnion

Overview

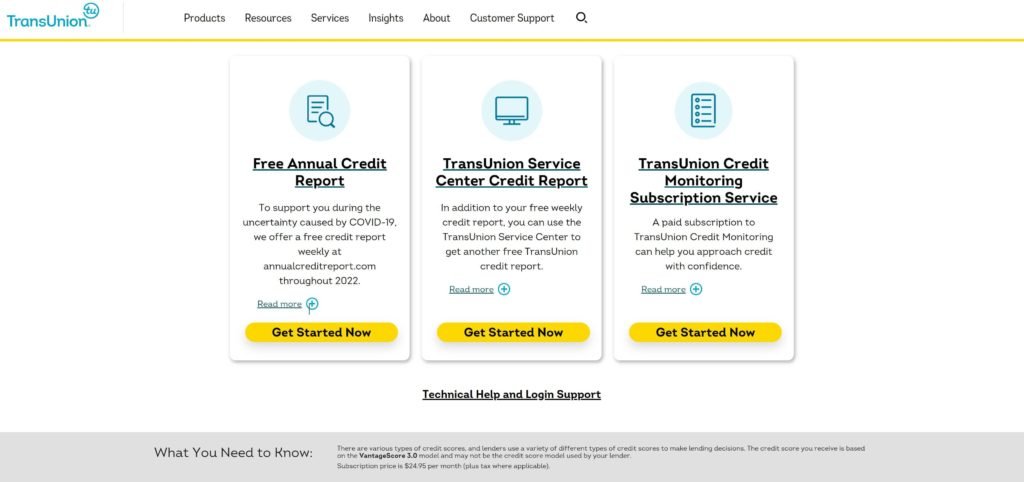

The TransUnion agency offers its own credit monitoring service as well as a free annual credit report. The TransUnion Credit Score app, available on both iPhone and Android, enables you to dispute inaccuracies on your credit report and set up fraud alerts.

The free “annual” credit report includes all three agencies and is typically only accessible one time per year. However, throughout 2022 TransUnion is offering this service free on a weekly basis at annualcreditreport.com.

The paid subscription includes daily credit-score updates, alerts to changes from all three bureaus, identity protection, and identity theft insurance.

What We Like

- Free credit reports from all three credit reporting agencies

- Comprehensive solution that includes identity theft protection on paid plans

Price

- Basic: Free – Annual credit report, freeze report, dispute report, fraud alerts

- Premium: $24.95/month – Comprehensive credit monitoring services

6) Credit Sesame

Overview

Credit Sesame offers totally free credit monitoring and does not require a credit card to sign up. Credit Sesame provides a free credit score report card, monitors your Transunion credit report, and enables real-time alerts to prevent fraudulent activity. The app also offers personalized recommendations to help you improve your credit health.

Credit Sesame’s premium subscription service includes daily credit-score updates, monthly credit reports from all three bureaus, enhanced identity protection, and more.

What We Like

- Monthly credit score updates

- Easy-to-use credit monitoring services

- Excellent Credit Sesame app reviews on both the App Store and Google Play

- Tools to restore your identity if you were a victim of identity theft

Price

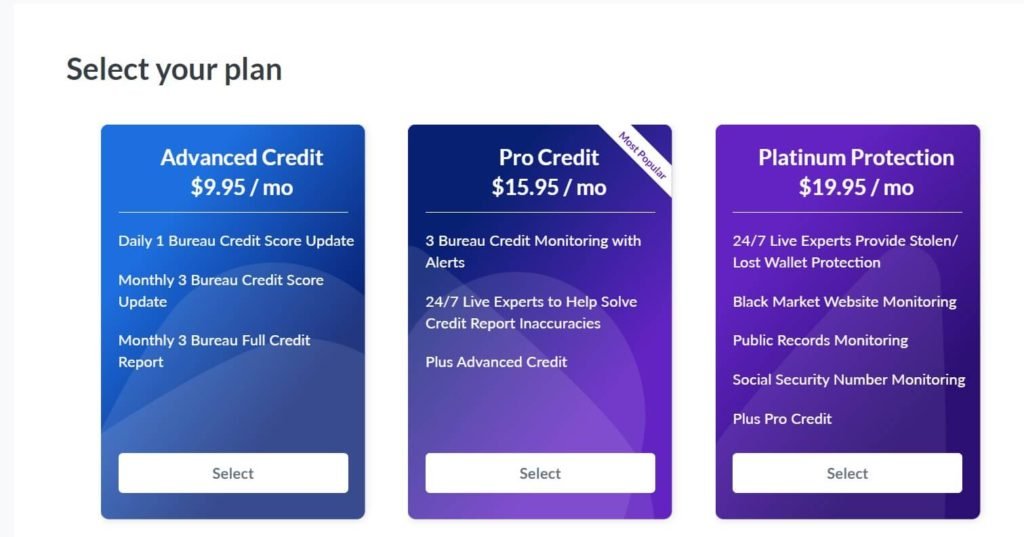

- Basic: Free – Monthly credit score updates from 1 bureau

- Advanced Credit: $9.95/month – Monthly credit score updates from 3 bureaus

- Pro Credit: $15.95/month – Monthly credit score updates from 3 bureaus and alerts

- Platinum Protection: $19.95/month – Monthly credit score updates from 3 bureaus, alerts, and dark web monitoring

7) Mint

Overview

Mint is one of the best overall personal finance apps since it is also popular for budgeting, spend tracking, and money management. While Mint was not made specifically for credit score monitoring, it does include a free credit score in the app. Mint offers tailored credit score and credit card recommendations but does not have credit score alerts available.

What We Like

- Free credit score access for simple monitoring

- Tools for tracking, categorizing, and visualizing your spend

- Offers a budget planner that helps you stay consistent with your financial goals

- Best for people who want to manage their finances and keep an eye on their credit score in one app

Price

Free

Honorable Mentions

- Credit Scorecard by Discover

- MyCredit Guide by American Express

- WalletHub

- Credit.com

How do you choose the best credit score app?

If you want to find the best credit score app on the market, there are a handful of factors to consider. When creating the rankings above we evaluated pricing, services offered, the number of credit bureaus monitored, and timeliness of updates.

For most people’s needs, a free credit monitoring service will suffice. While free services usually only monitor one or two credit scores, that’s enough to keep an eye on the trajectory of your credit. But if you’re planning a significant credit turnaround or have a financing event coming up, you may consider a paid solution like CreditWorks that monitors all three credit bureaus.

When choosing between services, also take a look at which apps refresh your credit score frequently. The more quickly you see updates and get feedback on your payment history and credit utilization, the faster you can make changes and take charge of your credit.

Finally, decide how important related services and products are to you. Mint includes budgeting and spend tracking. CreditWise includes dark web scanning for personal information like your SSN. Paid services like myFICO offer identity protection and identity theft insurance.

How do credit monitoring services differ from credit score apps?

Credit monitoring services and credit score apps both offer ways to keep track of changes to your credit score. However, there are some key differences between the two types of services.

Credit monitoring services typically provide more comprehensive coverage than credit score apps. They may offer features such as alerts when new accounts or inquiries appear on your credit report or when your credit score changes. Credit monitoring services also usually include a monthly credit report and score so you can track your progress over time. Credit score apps may not offer all of these features, and they may only provide updates to your score on a weekly or monthly basis.

Credit monitoring apps usually cost more than credit score apps. While most credit score apps are free, many credit monitoring apps cost between $10 and $30 per month.

Credit score apps generally just provide access to your credit score without any other tools or features. While this can help keep an eye on your credit score, it doesn’t give you the same level of protection or insight as a credit monitoring service.

Credit Score App FAQs

How can I check my credit for free?

There are a few ways to check your credit for free. You can get your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – once per year. You can also use CreditWise, named our best credit score app of 2024. Their credit monitoring service allows you to stay on top of your credit score and credit history. Finally, you can always contact your lender or credit card issuer directly to inquire about your credit score or account status.

How do credit score apps work?

There are a few different types of credit score apps, but the most popular ones simply provide users with access to their credit score and credit history information. This information is typically sourced from the same three major credit bureaus – Experian, Equifax, and TransUnion – that provide free annual credit reports.

Credit score apps often also offer some sort of credit monitoring service, which can alert users to changes in their credit score or account status. Some apps even include additional features like budgeting tools and identity protection.

Does checking your credit report hurt your credit score?

No, checking your own credit report will not hurt your credit scores. In fact, it’s actually a good idea to check your credit scores on a regular basis – at least once per year – to make sure everything is accurate. If you do find any inaccuracies, you can take steps to correct them and improve your credit score. Checking your own credit score is considered a “soft inquiry” and won’t affect your credit score. However, when you apply for new credit, that’s considered a “hard inquiry” and can temporarily lower your score.

Which credit score app is most accurate?

It is difficult to determine which credit score app is most accurate because there is no single correct credit score. Each credit bureau has a different data set of information about your financial history. Further, there is a wide range of models used to convert this information into a numerical score. Oftentimes, a single financial institution will use several different models depending on the type of credit that is being considered.

That being said, credit scores that come directly from the credit bureaus have less room for discrepancy. If you’re concerned about accuracy, consider using Experian or TransUnion.

How can I check my credit report at all three credit bureaus?

You can get your annual credit report from each of the three major credit bureaus once per year. The three main credit bureaus are Experian, Equifax, and TransUnion. To do so, simply visit www.annualcreditreport.com or call 1-877-322-8228.

Or you can use one of the credit score apps we have recommended that provides a credit report from all three credit bureaus. You will need to provide some basic personal information to verify your identity, but the process is quick and easy. Once you have your reports, be sure to check them carefully for any errors or discrepancies.

Why do credit reports matter?

Credit reports matter because they provide a snapshot of your creditworthiness at a given moment in time. Lenders use credit reports and credit scores along with other factors like income, employment history, and debt-to-income ratio to determine loan eligibility.

If you have a strong credit report, you’re more likely to be approved for a loan with favorable terms. Conversely, if you have a weak credit report, you may be offered higher interest rates or denied a loan altogether. Credit reports are what make or break your ability to borrow money at affordable rates.