Car prices have skyrocketed in recent years. And the cost to finance these cars? Yeah, that’s not doing us any favors either.

But why? In short, it’s the ongoing economic impact of the pandemic.

According to the St. Louis Fed, auto sales were roughly 17 million units per month before the pandemic. Then, in the spring of 2020, this figure plummeted as workers were laid off and consumers feared the uncertainty of the future.

As a result of reduced demand and supply shortages, auto manufacturers around the world slowed or temporarily halted production. They did not expect that just one year later, auto sales would recover and eventually surpass their pre-pandemic level…

This supply and demand imbalance has put tremendous pressure on the price of automobiles. And unfortunately, interest rates aren’t helping — they are also up more than 3% in the past few years.

But if you have purchased a car with an expensive loan, not all hope is lost! You may be able to refinance the loan and save yourself some money on your monthly bill. This article will discuss the pros and cons of refinancing a car. Then, we will lay out a framework for deciding when it makes sense to do so. Let’s get into it!

Refinancing a Car: The Basics

Automobiles tend to be among the most expensive purchases that people make in their lifetimes.

While some people can afford to pay for a new vehicle with cash, many choose to finance the purchase by taking out a loan.

Car loans allow you to drive a car off the lot now, with a promise to pay the loan back (plus interest) over some agreed-upon period. Oftentimes, these loans are offered for 3 to 7 years.

There are three main components of an auto loan that impact both your monthly payment and the total amount you will pay over the duration of the loan:

- Loan value: The total amount of money you are borrowing on day one to purchase the car.

- Annual percentage rate (APR): The effective annual interest rate you pay on the loan, including any fees and loan costs.

- Loan term: The amount of time it will take to pay the loan off.

But even after signing a contract to purchase your car, there is still one way to reduce your monthly payment. And that, my friends, is refinancing.

Auto refinancing means replacing your current car loan with a new one, typically from a different lender.

This can be a sensible option if the current loan terms are better than your original loan terms. This could mean a lower APR or a longer term so that your monthly payments are more manageable. You can use these savings to cover other expenses, boost your savings account, or invest more heavily.

But before assuming the move is right for you, let’s reflect on the pros and cons of refinancing a car.

Related reading: How To Save $10,000 In A Year On Any Income

The Pros of Refinancing a Car

Many potential benefits can come from refinancing the loan on your vehicle. Here are a few of the most important ones:

- Lower interest rates: Taking advantage of lower interest rates can help you save money on the overall cost of the loan. A popular rule of thumb is to consider refinancing if you can reduce your interest rate by at least 1%.

- Lower monthly payments: Refinancing your auto loan can help you reduce your monthly payments by lowering the rate, extending the loan term, or both. But keep in mind that if you lengthen the life of your loan, it may result in more interest paid over time even if your monthly payment goes down.

- Shorter loan terms: Refinancing to shorten your loan term can help you pay off the loan more quickly, saving you money on interest over the long run. Or, you could always refinance a loan to lower your interest rate but maintain your current monthly payment to pay off the loan faster.

- Change loan terms: If you want to switch from a variable-rate loan to a fixed-rate loan or vice versa, refinancing is an opportunity to do so.

- Remove or add a co-signer: While refinancing, you can remove a co-signer if no longer needed or add one to the loan if that would help you qualify for a better interest rate.

Example:

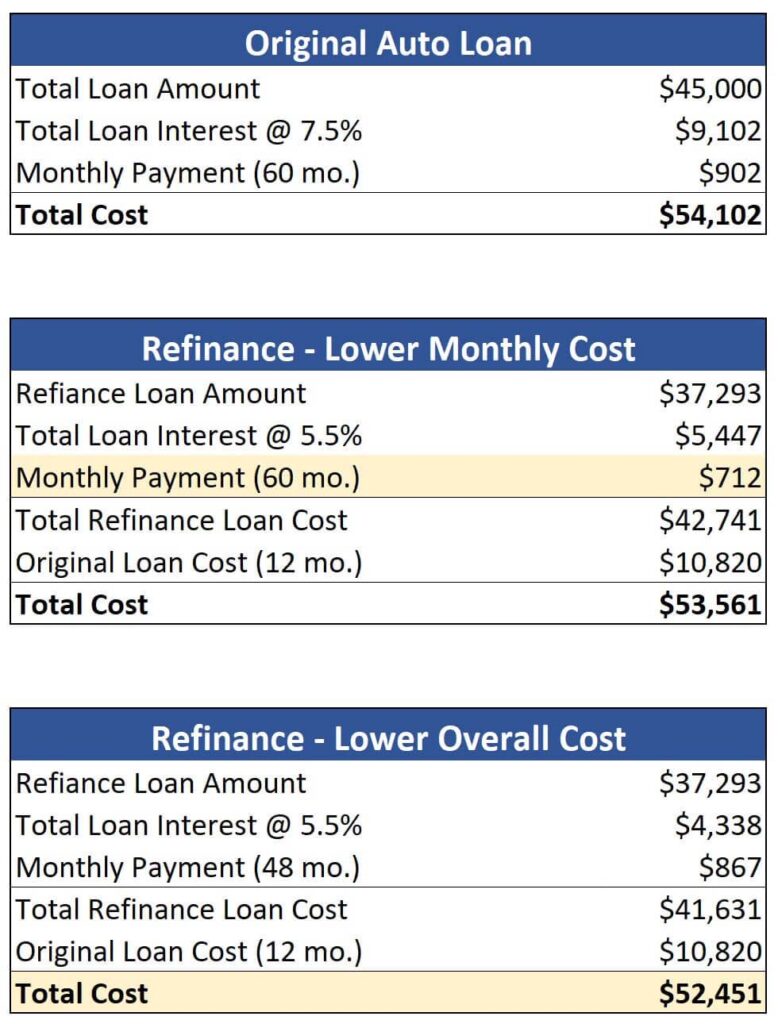

Let’s say you purchased a car recently for $50,000 by paying $5,000 cash upfront and financing the remaining $45,000 at an interest rate of 7.5% APR for 60 months. Then, within 12 months, market rates drop down to 5.5%.

You could either:

- Lock in a significantly lower monthly payment by refinancing and extending your loan term by a year

- Refinance at the lower rate, but maintain your monthly payment to save several thousand over the life of the loan

The Cons of Refinancing a Car

While the potential savings from refinancing a car loan are attractive, there are drawbacks to consider as well. Here are the main considerations:

- Fees: Before refinancing your car, you should be aware of several types of fees, including prepayment penalties (for paying your loan off early), application or origination fees (from the potential new lender), and title or re-registration fees (with your state). Be sure to factor the total cost of these fees in your analysis when determining how much you could save from refinancing.

- Loan duration & total cost: If you reduce your interest rate but extend the loan duration, you might not end up saving money at all. Sure, you will lower your monthly payment but the additional months of interest you have to pay will eat up these savings in the long run.

- Owing more than the car’s market value: An upside-down car loan happens when you owe more than the vehicle is worth. Vehicles lose a significant amount of their value in the first year or two, so this situation is actually not that uncommon. If you refinance the term of your loan, you could find yourself upside-down at some point. And if this happens, you could end up owing the lender money even after you sell or trade in the car.

Even when interest rates drop, refinancing your loan isn’t always the best choice. The circumstances above could make it a wash or even a losing proposition. Make sure to consider all of the pros and cons of refinancing a car before pulling the trigger.

Related reading: 10 Secrets That Fiscally Responsible People Live By

The Step-by-Step Process to Refinance Your Car

Refinancing your auto loan is a reasonably straightforward process. Simply follow the steps below to get started:

1) Decide if refinancing makes sense

Refinancing your car may be the right choice if you can lower your monthly payment, interest rate, or overall cost. Factors that will come into play in this decision include:

- Your overall credit score

- Your debt-to-income ratio (This metric compares how much you owe each month to how much you earn, so lower is better)

- The current value of the vehicle (Consider getting an appraisal or using an estimator like Kelly’s Blue Book)

- The specific details of your existing loan

- Your loan-to-value ratio (Especially if the value of your loan exceeds the vehicle’s value)

2) Research your options

Compare auto loan rates from several lenders to ensure you find the best rate possible. Consider prequalifying with a lender before submitting a complete application to save time and avoid hard inquiries on your credit report.

3) Gather your documents

Once you find the loan that suits your needs, you’ll need to supply the lender with some basic documentation. This may include a valid driver’s license, Social Security number, proof of income, insurance, vehicle registration, and the original terms of your loan.

4) Apply

When you are ready to apply, complete and submit a loan application with your chosen lender. This lender will conduct an appraisal of the car and run a credit check. Be aware that this will count as a “hard” inquiry and could lower your credit score by a few points.

Upon approval, you will sign the loan paperwork provided by the lender. These documents will contain important details like the terms of your loan and the total cost. Be sure to read them thoroughly (before signing) to ensure you know what you are agreeing to. You should have a clear understanding of your monthly payment, loan term, interest rate, and any potential fees.

5) Finalize the loan

Upon receipt of the signed documents, the lender will pay off your existing loan and take possession of the vehicle’s title. The process is complete and you are now free to make your first monthly payment to the new lender.

How to Decide When to Refinance Your Car

It’s always best to fully understand the process and weigh the pros and cons of refinancing a car before taking action. So here are a few questions to ask yourself to determine if you will get the most mileage out of a potential refinance:

- Has your financial situation changed? Auto refinancing can be advantageous if your income has increased or you have paid off other debts. In either event, you will now have a lower debt-to-income ratio, which could help you qualify for more favorable loan terms. Similarly, if your credit score has recently improved, you might be able to land a better interest rate.

- Have interest rates dropped? When interest rates fall, lenders (eventually) offer lower rates to their customers. So anytime you have outstanding debt, keep an eye on lender rate ranges to see if they have dropped enough to warrant taking action.

- Do you want to lower your monthly payment? Life happens. Sometimes we want or need to reduce our expenses. If you wish to lower your monthly payment to free up money for other things, refinancing to extend your loan team could do the trick. Or, you could consider one of our other creative ways to save money when you are in a pinch.

- Do you want a new lender? People often finance their auto loans through a dealership because it’s convenient and accessible. But if you end up with a problematic lender or want to consolidate your loans with a local bank, refinancing can be a way to accomplish this.

Related reading: Is A 5/5 ARM The Right Choice For Your Home Loan?

A Roadmap to Savings

Refinancing can be a smart choice if you are looking to get better terms and reduce the total cost of your car loan. By improving your credit, shopping around, or waiting until market conditions improve, you may find a lower interest rate or be able to extend the loan’s term length.

Fortunately, the process of refinancing a car isn’t too time-consuming. So as long as the associated fees don’t offset the savings, it’s often a great way to reduce your monthly expenses and balance your budget.

If you weigh the pros and cons of refinancing a car and decide to move forward, be purposeful with the additional funds. Use them for investing in assets, tackling more expensive debt, or building an emergency fund. This will help you keep your finances in check and stay on track to reach financial freedom. Now that’s a roadmap to savings!

Frequently Asked Questions

Depending on the age of your car and the interest rate associated with a new loan, you may be able to save money, improve your credit rating, and better manage your monthly payments by refinancing.

The ideal time to refinance a car is when interest rates have dropped by at least 1%. However, car loans are typically locked in for 12 months or longer. So you should check the terms of your original loan to see if you would incur any fees by refinancing. Also, your credit can be temporarily affected when you shop for a loan, so be sure that you aren’t still seeing a ding from your original loan.

No. Refinancing means replacing an existing loan with a new loan and new terms. You can refinance for lower interest rates, lower monthly payments, or both. The key is shopping around for the best loan terms and finding a lender that meets your needs.

Many lenders allow you to refinance your car loan up to three times. However, this limitation varies from lender to lender based on how much you owe, your credit score, and the value of your car.

If you are content with your current lender, there is nothing wrong with exploring refinancing options with them. However, you may find that another lender can offer you better rates, so be sure to compare multiple lenders and read the fine print of any loan agreement before making a final decision.