Hey there, homebuyers! We’re in the thick of it now – the Federal Reserve has kicked up interest rates faster than we’ve seen in the last 40 years. So if you’re on the hunt for a new home, you’ve probably felt the sting of those soaring mortgage rates.

But don’t worry, there’s a glimmer of hope — and it’s called the adjustable-rate mortgage (ARM). In particular, there’s a new kid on the block that’s got everyone talking: the 5/5 ARM.

Now, these ARMs can be pretty sweet, at least at first. You’ll see lower interest payments compared to traditional fixed-rate mortgages. But, like anything else, they come with their own set of challenges as well. It’s a bit like dating – everything seems perfect until you dig a bit deeper and know what you’re signing up for!

Before you jump on the ARM bandwagon, you’ve got to understand the nitty-gritty:

- How do they work?

- Is a 5/5 ARM the right fit for you?

- What about other ARM structures?

We’ll cover all of that and more in this comprehensive guide. So, buckle up, folks! Let’s dive into the world of ARMs and see if they’re the answer to your home-buying dilemma.

What Is An ARM, And How Does It Work?

Before we can fully appreciate what a 5/5 ARM is and how it works, let’s review the basics.

There are two primary types of mortgages: fixed-rate and adjustable-rate (ARMs).

Fixed-rate mortgages have the same interest rate for the entire life of the loan. This means that every single month, your mortgage payment is the same. These loans are stable and predictable and typically range from 10 years to 30 years. So it’s no wonder that the most common mortgage product in the U.S. is a 30-year fixed-rate mortgage.

In contrast, an adjustable-rate mortgage (ARM) has the freedom to change interest rates according to market conditions. These mortgages are usually 15 or 30-year loans, and they offer a fixed interest rate for an initial period. After that, however, the interest rate adjusts at the end of each adjustment period.

ARMs are quoted with two numbers. The first represents the length of the initial fixed-rate period, while the second indicates how often the rate adjusts after that initial period.

For example, a 5/1 ARM has a fixed interest rate for the first five years, after which the rate adjusts once each year.

Now, let’s get to know the 5/5 ARM.

The 5/5 ARM is a type of adjustable-rate mortgage where the interest rate is fixed for the first five years (hence the first ‘5’), and then adjusts every five years after that (the second ‘5’). This means that the rate could change three times in a 15-year period, or six times over a 30-year loan.

How do these rates change, you ask?

When the loan is originated, the lender will lay out the index and the margin.

The index will be a benchmark used to reflect general market conditions. This could be one of several different indexes, such as the London Interbank Offered Rate (LIBOR) or the U.S. Prime Rate.

The margin, on the other hand, is a fixed percentage that the lender adds to the index to determine the interest rate. This margin remains constant throughout the loan term, while the index can fluctuate.

So, once the initial fixed-rate period ends, the new rate is calculated by adding the margin to the current index. For example, an index rate of 4% and a margin of 2.5% would mean you are charged a 6.5% interest rate on the loan for the period.

But fear not! Most ARMs, including the 5/5 ARM, come with protective caps. These caps limit how much your interest rate can increase at each adjustment period (periodic cap) and over the life of the loan (lifetime cap).

Related reading: How To Save $10,000 In A Year On Any Income

The Pros Of A 5/5 Arm

Now that we’ve unpacked the mechanics of a 5/5 ARM, let’s shift gears and delve into the benefits this unique mortgage option can offer.

- Lower initial interest rates: One of the primary benefits of an ARM (compared to a fixed-rate mortgage) is that they generally offer a lower interest rate, at least at the beginning of the contract.

- Lower monthly payments: Lower initial interest rates translate to lower monthly payments. And lower payments can mean more money in your pocket or the ability to qualify for a larger loan.

- Rates can decrease: When your mortgage reaches the adjustment period, your interest rate can decrease if the prevailing market rates are lower. This, in turn, will lower your monthly payment and save you some extra money. These savings require no intervention on your part, and no refinancing fees to benefit from the change.

- Flexibility: With its lower initial rates, a 5/5 ARM can be particularly attractive if you’re planning to sell or refinance your home within the first five years. This way, you can take advantage of the lower rates without worrying about the potential interest rate hikes in the future.

The Cons Of A 5/5 Arm

The 5/5 ARM isn’t perfect. It comes with its own set of drawbacks that you need to consider before making your decision. Let’s walk through them together.

- Rates can increase: One of the primary potential drawbacks of a 5/5 ARM is that your interest rate can increase after the initial fixed-rate period. If market interest rates rise, so too will your mortgage rate and monthly payment. Depending on the terms of your loan and the extent of rate increases, these changes could be substantial. However, there is usually a cap on each adjustment (e.g., 2% per adjustment) and over the life of the loan (e.g., a 5% lifetime adjustment cap).

- Complexity: ARMs are a more sophisticated financial product, and they require more attention to detail than traditional fixed-rate mortgages. Now, it’s not rocket science. But there is a learning curve to understand the structure, risks, and fees.

- Payment uncertainty: Unlike a fixed-rate mortgage, which offers stability and predictability in terms of monthly payments, the amount you owe each month with a 5/5 ARM could change over time. This can make budgeting more challenging, especially if your income isn’t equally flexible.

- Costly to refinance: If you decide to refinance your ARM into a fixed-rate loan to avoid potential rate increases, be aware that refinancing comes with its own costs. These include appraisal fees, origination fees, and closing costs, which can add up to several thousand dollars.

- Potential for prepayment penalties: While not common, some ARMs may have prepayment penalties if you decide to pay off the loan early, refinance, or sell the house. It’s essential to review the terms of your loan agreement carefully before signing.

How To Determine If A 5/5 ARM Is Right For You

Ready to weigh your options? Let’s put the 5/5 ARM under the microscope and help you evaluate if this flexible mortgage route aligns with your financial goals and lifestyle needs.

- Analyze your financial position: Some people prefer to buy a home with cash. But for most people, this isn’t an option. And that means borrowing money is a necessity. Before doing so, analyze your spending capacity and credit. Review your budget closely to know what kind of down payment and monthly payments you can afford. And ensure you optimize your credit score so you qualify for an affordable loan.

- Evaluate market conditions: A 5/5 ARM changes interest rates (and monthly payments) more often than a 30-year fixed mortgage, but less often than a 5/1 ARM. This makes it a better choice than the 5/1 ARM in a rising rate environment, but a worse choice in a declining rate environment. And a better choice than a 30-year fixed loan in a declining rate environment, and a worse choice in a rising rate environment.

- Assess your goals and objectives: A home is usually the biggest purchase and investment in your life. That’s why it is critical to think about how borrowing money for real estate fits into your path to financial independence.

- Consider your time horizon: If you expect to move or sell your home within the first five years (before the adjustment period of the loan), a 5/5 ARM can be an affordable option.

- Determine your flexibility: If you are not planning on moving or selling your home, assess your capacity to take on extra costs. For example, if rates rise ahead of the adjustment period, you could get stuck with higher monthly payments. If you have the flexibility to stomach an increase in your payments while still maintaining your savings and investment plans, then a 5/5 ARM may work for you. But if not, you should look elsewhere to be safe.

Related reading: The Pros and Cons of Refinancing a Car: A Roadmap to Savings

Comparing A 5/5 ARM To Other Mortgage Products

The 5/5 ARM isn’t the only mortgage product out there. Let’s stack it up against two other popular mortgage options so you can see how it compares.

5/5 ARM vs. 30-year fixed-rate mortgage

A 30-year fixed-rate mortgage is the standard among borrowers. Still, a 5/5 ARM can be a compelling alternative for the right person, especially if they have the flexibility and want to increase their savings in the loan’s early years.

Example:

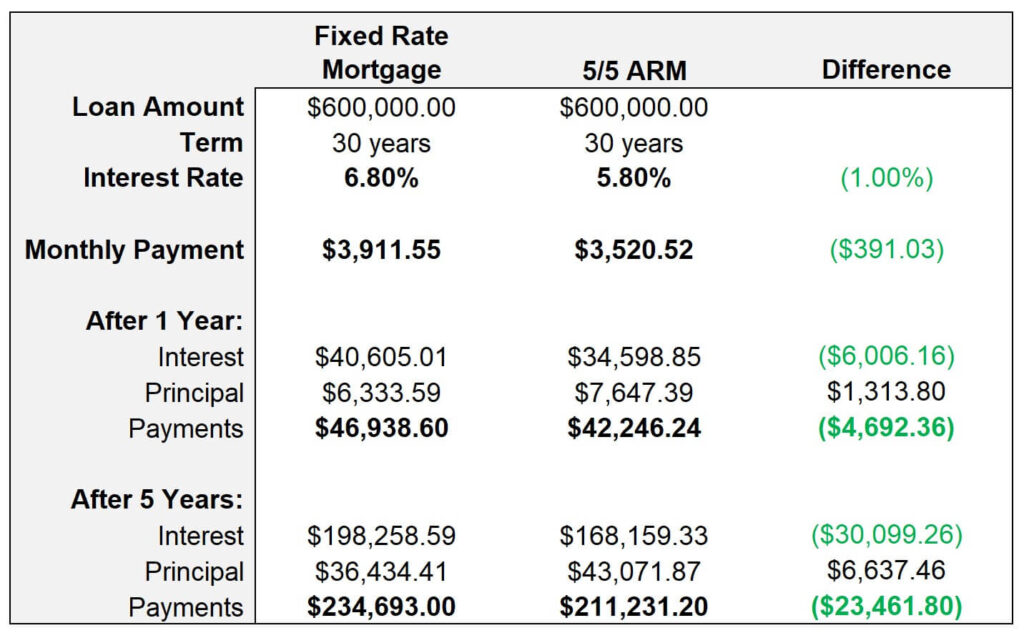

Let’s say you want to borrow $600,000 to buy a house. After speaking with your mortgage broker, you are faced with two options:

- A 30-year fixed mortgage at 6.8%

- A 5/5 ARM at 5.8% (with a 2% cap at each adjustment and a 5% lifetime adjustment cap)

Since we can’t know what interest rates will be after 5 years (at the end of the initial period), let’s look at your costs up until that point.

With the 5/5 ARM, your mortgage will be $391 cheaper per month. Over five years, that adds up to $23,462 in savings! Plus, you will have paid down an extra $6,637 in principal, meaning you will have more equity in your home.

5/5 ARM vs. 5/1 ARM

Another popular adjustable-rate mortgage is the 5/1 ARM. This loan offers a 5-year initial period with annual rate adjustments after that.

Beyond the adjustment period, the main difference between the 5/1 ARM and 5/5 ARM is the benchmark index used to determine their rates.

The benchmark index for the 5/1 ARM is typically the 1-year Treasury Bill, while the 5/5 ARM is often indexed to the 5-year Treasury Note. This is important to be aware of because the 1-year Treasury Bill tends to be more volatile. As a result, this can mean even less predictability in your monthly payments.

As a result, some homebuyers appreciate the 5/5 ARM because it balances the savings of an adjustable-rate mortgage with a little more stability for budget planning.

Tips For Navigating The ARM Loan Process

To get the best mortgage for your unique financial circumstances, consider these tips:

- Understand the basics: Make sure you are comfortable with the ARM terminology, including loan term (length of the loan), product and loan type (fixed vs. variable rate), principle (the amount you borrowed), interest (what the lender charges you for lending the money), index, and margin. If you’re tripped up by any of these definitions, consult the Consumer Financial Protection Bureau’s Loan Estimate Explainer.

- Shop around and explore your options: According to Freddie Mac research, borrowers who got five or more quotes saved an average of ~$3,000 over the life of the loan. So don’t be afraid to shop around and get quotes from different lenders. It’s worth contacting credit unions, online lenders, banks, and mortgage brokers, as each may offer different rates and terms.

- Read the fine print: Lenders will give you an “ARM program disclosure” when you request a loan application. This document will contain information about fees, the index and margin, conversion options, and potential “teaser” rates that can lower your initial payment. And there may even be an opportunity to pay points to reduce your interest rate. Just make sure to compare the upfront cost of paying points to the total amount you will save by paying a lower rate for the life of the loan.

- Monitor your situation: If you take out an ARM, keep track of your budget and your ability to handle changes in monthly payments. And you may want to monitor the benchmark index as well, especially as the adjustment period draws near. This can help give you time to prepare for a change or look at refinancing options, if necessary.

- Have a plan for the future: Whether rates go up or down, you should have a game plan in mind ahead of time. Don’t get caught off guard when the fixed-rate period ends and the variable-rate period begins. If you plan to stay in your home for a long time, you might consider refinancing to a fixed-rate loan before the adjustment period. And if you plan to move within a few years, the lower initial rate of the 5/5 ARM might serve you well.

Related reading: 10 Secrets That Fiscally Responsible People Live By

Final Thoughts

There you have it — the inside scoop on the 5/5 ARM! It’s a pretty nifty option for flexible borrowers looking to purchase or refinance a home loan.

When played right, it offers some serious savings on interest and monthly payments. But like anything else, consider all the pros and cons carefully to make sure it’s the right fit for you.

And remember, it’s not just about today’s rates — if you choose an ARM, you’ve got to be ready to roll with the punches if rates rise or fall.

So, to wrap it up, with a sprinkle of caution and a good measure of planning, the 5/5 ARM could potentially be your ticket to lower rates, more manageable payments, and extra flexibility. Let’s hear it for savvy borrowing!