Cryptocurrencies are becoming more and more popular every day. As their prices continue to rise, an increasing number of people are looking to invest in them. This also means that an increasing number of people will need to pay taxes on their cryptocurrency investments.

In this article, we compare and review the 13 best crypto tax software solutions available in 2024. We have considered the benefits, considerations, and prices of each piece of software in order to recommend the best one for your needs!

What Is the Best Crypto Tax Software?

If you are looking for the best crypto tax software on the market, Koinly is the clear choice. Here are four reasons why:

- Koinly is easy to use

- Koinly supports all major cryptocurrencies

- Koinly integrates with all major exchanges

- Koinly offers a free trial, so you can try before you buy

Koinly is designed to be as user-friendly as possible. The interface is clean and intuitive, and the entire process can be completed in a few simple steps. Even if you have no prior experience with crypto taxes and crypto tax reports, you will be able to use Koinly with no problem.

Koinly supports all major cryptocurrencies, so you can be sure that your taxes are calculated correctly no matter which coins you hold. The software also integrates with all major exchanges, so you can import your trade history with ease.

Finally, Koinly offers a free trial so you can begin your crypto taxes before committing to a subscription. This is a great way to make sure that Koinly is the right fit for you. So if you are looking for the best crypto tax software on the market, Koinly is the way to go. It’s hard to beat their free trial, competitive pricing, and straightforward onboarding process.

Crypto Tax Software Reviews

Koinly

Koinly is the best crypto tax software for those who want to save time and money on their taxes. It is easy to use and it can track up to 10,000 transactions directly from your preferred crypto exchange on a free plan.

Highlights

- Works with more than 17,000+ cryptocurrencies

- Works with more than 350 crypto exchanges

- Automated data import

- Smart transfer matching

- Easy to use

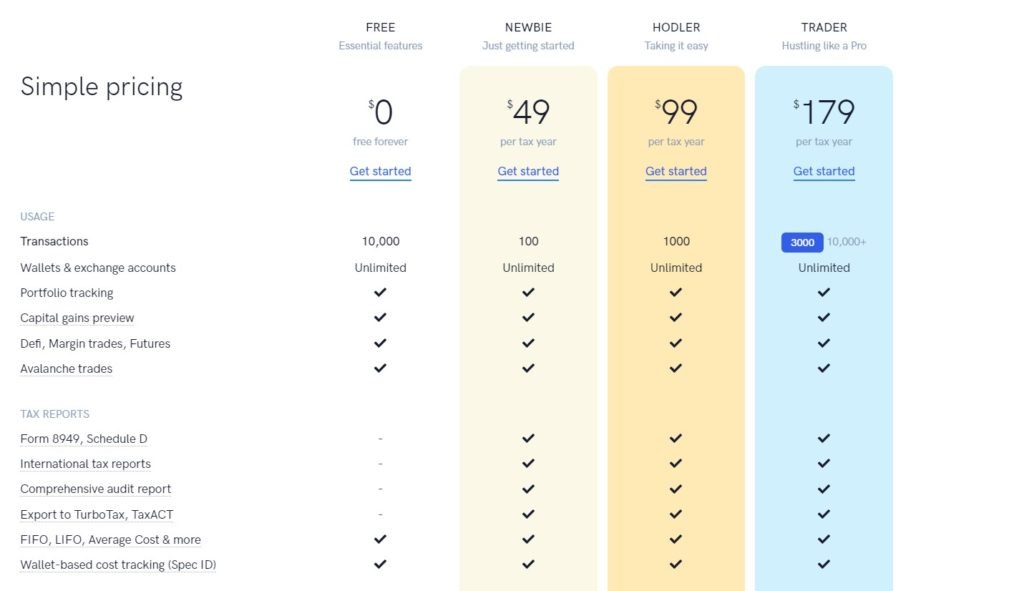

Pricing

- Free – $0 – Up to 10,000 transactions, but no Form 8949 or international tax reports are included

- Newbie – $49 – Up to 100 transactions with all features included

- Holder – $99 – Up to 1000 transactions with all features included

- Trader – $179 – Up to 3000 transactions with all features included

Bottom Line

Koinly is a feature-rich crypto tax software that makes it easy to complete your own crypto tax reports. It includes support for over 17,000 different cryptocurrencies and 350+ exchanges, making it one of the most comprehensive solutions on the market. The software is also very user-friendly, with an intuitive interface that makes it easy to get started. Overall, Koinly is a great choice for anyone looking for a DIY solution to their crypto taxes.

Accointing

Accointing is a crypto tax software that allows you to monitor your cryptocurrency portfolio and calculate your taxes. It is very user-friendly and has a wide range of features, making it a great choice for those who are looking for a comprehensive solution for their crypto tax needs.

Highlights

- Easy to use crypto tracker, both on desktop and mobile

- Informative cryptocurrency tax blog with step-by-step guides

- Calculators are available for multiple countries and their local regulations (US, UK, Germany, Austria, Australia, Switzerland)

- Integrates with more than 300 exchanges

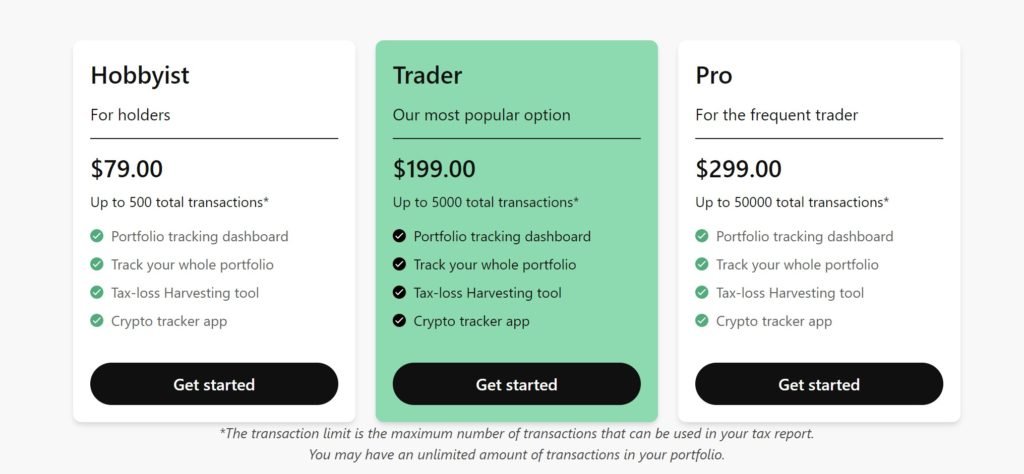

Pricing

- Hobbyist – $79 – Up to 500 total transactions

- Trader – $199 – Up to 5,000 total transactions

- Pro – $299 – Up to 50,000 total transactions

Bottom Line

If you’re looking for a cryptocurrency tax software that guides you through the entire process, Accointing is for you. Accointing offers responsive customer support and one of the most popular cryptocurrency tax blogs around. It has a well-connected API integration and many handy portfolio tracking features like price alerts and market trends.

Token Tax

TokenTax is one of the leading crypto tax software solutions on the market. It works in every country in the world, and it makes tracking your trades and generating your tax reports simple with an easy-to-understand dashboard.

Here’s what TokenTax can do for you:

- Automatically import and track all of your cryptocurrency trades. This includes data from all major exchanges, such as Coinbase, Binance, and Kraken.

- Calculate your taxes, including unrealized gains and losses, using your trading data. It then provides detailed tax reports that you can use to file.

- Keep you up-to-date and compliant with the constantly evolving tax laws surrounding cryptocurrency.

Highlights

- Supports and directly integrates with every crypto exchange

- DeFi and NFT support

- Futures and margin trading support

- Offers a tax loss harvesting tool

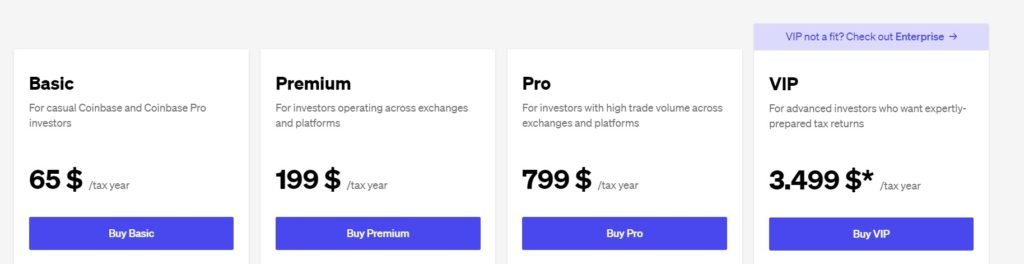

Pricing

- Basic – $65 – For casual Coinbase investors

- Premium – $199 – For investors who use multiple exchanges

- Pro – $799 – For investors with high trade volumes

- VIP – $3,499 – For advanced investors and professionals who want expert support

Bottom Line

If you’re looking for a crypto tax software that can make the filing process easier, TokenTax is an excellent option. It is a global solution, and it is the only platform we reviewed that accurately supports margin trades. Plus, its tax loss harvesting feature can generate significant tax savings when the crypto markets are down.

Zen Ledger

ZenLedger is a popular cryptocurrency tax software that helps users calculate their capital gains and losses from cryptocurrency transactions. The software is easy to use and offers a variety of features, making it a great choice for those looking for a comprehensive solution for their crypto tax needs.

Some of ZenLedger’s key features include:

- Support for 400+ major cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others.

- Advanced algorithms that accurately calculate your capital gains and losses to ensure you don’t overpay or underpay your taxes.

- Two-factor authentication and encrypted storage protect your data from hackers and give you peace of mind that your information is safe.

Highlights

- Transactions from multiple wallets are able to be seen in one easy-to-use spreadsheet

- The free plan covers up to 25 transactions if you want to test the tax software

- Integrates directly with TurboTax

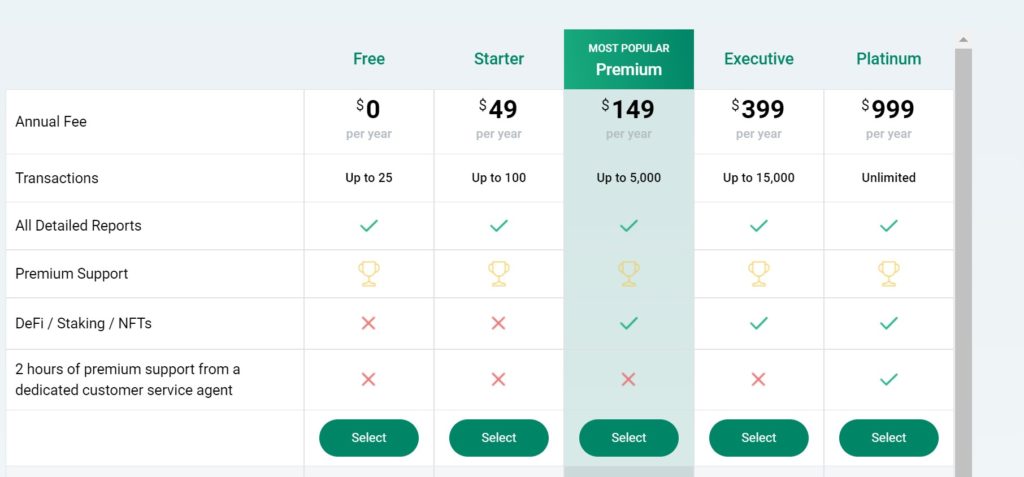

Pricing

- Free – $0 – Up to 25 transactions

- Starter – $49 – Up to 100 transactions

- Premium – $149 – Up to 5000 transactions and support for DeFi and NFTs

- Executive – $399 – Up to 15,000 transactions and support for DeFi and NFTs

- Platinum – $999 – Unlimited transactions, support for DeFi and NFTs, and priority customer service

Bottom Line

Overall, ZenLedger is a good choice for those looking for a comprehensive solution for their cryptocurrency tax needs. The software supports three cost basis methods, tracks a variety of taxable crypto income, and works with 30+ DeFi protocols. While the free plan is quite limited, ZenLedger’s more expensive plans are a great choice for active individual traders and DeFi enthusiasts.

Tax Bit

Crypto tax software TaxBit is one of the most popular new options on the market due to its backing by PayPal Ventures. Like PayPal, the platform emphasizes security with an easy-to-use interface which makes it a great choice for first-time filers of crypto tax reports. Plus, with its competitive pricing, TaxBit is also a good option for those on a budget.

Highlights

- The free plan offers unlimited transactions

- Easy to use dashboard that was designed by CPAs & tax attorneys

- Offers a tax loss harvesting tool

- Shows your asset balance, unrealized gains/losses, and your tax position

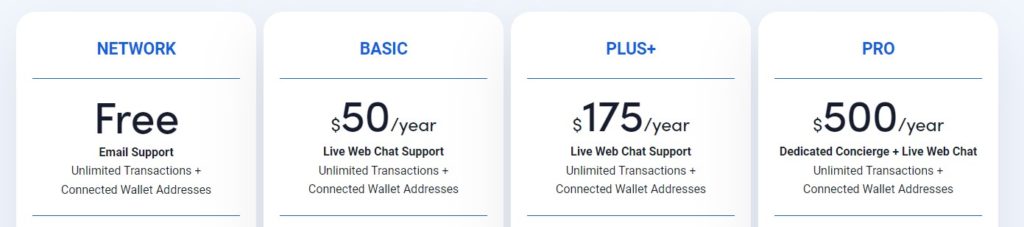

Pricing

- Free – $0 – Unlimited transactions for supported companies

- Basic – $50 – Unlimited transactions, live web chat support, and DeFi and NFT support

- Plus+ – $175 – Unlimited transactions, live web chat support, DeFi and NFT support, and tax loss harvesting

- Pro – $500 – Unlimited transactions, live web chat support, DeFi and NFT support, tax loss harvesting, and a full CPA review

Bottom Line

In terms of features, TaxBit offers everything you need to file your crypto taxes. The platform supports all major exchanges and wallets and provides detailed transaction histories to help you calculate your gains and losses. You can also generate IRS-compliant tax forms with just a few clicks, and access 24/7 customer support at any time. Plus, their tax loss harvesting tool is a great addition that many competitors do not provide.

Coin Tracking

If you’re looking for a hassle-free way to keep track of your cryptocurrency taxes, CoinTracking is a popular choice with over 1 million active users. This cryptocurrency tax software makes it easy to see how much you owe in taxes on your digital currency holdings, and it can even generate detailed tax reports using 13 different tax methods.

Highlights

- Tax reports for more than 100 countries

- Data import for more than 100 exchanges

- Tax reviews by a full-service team

- Self-service video tutorials

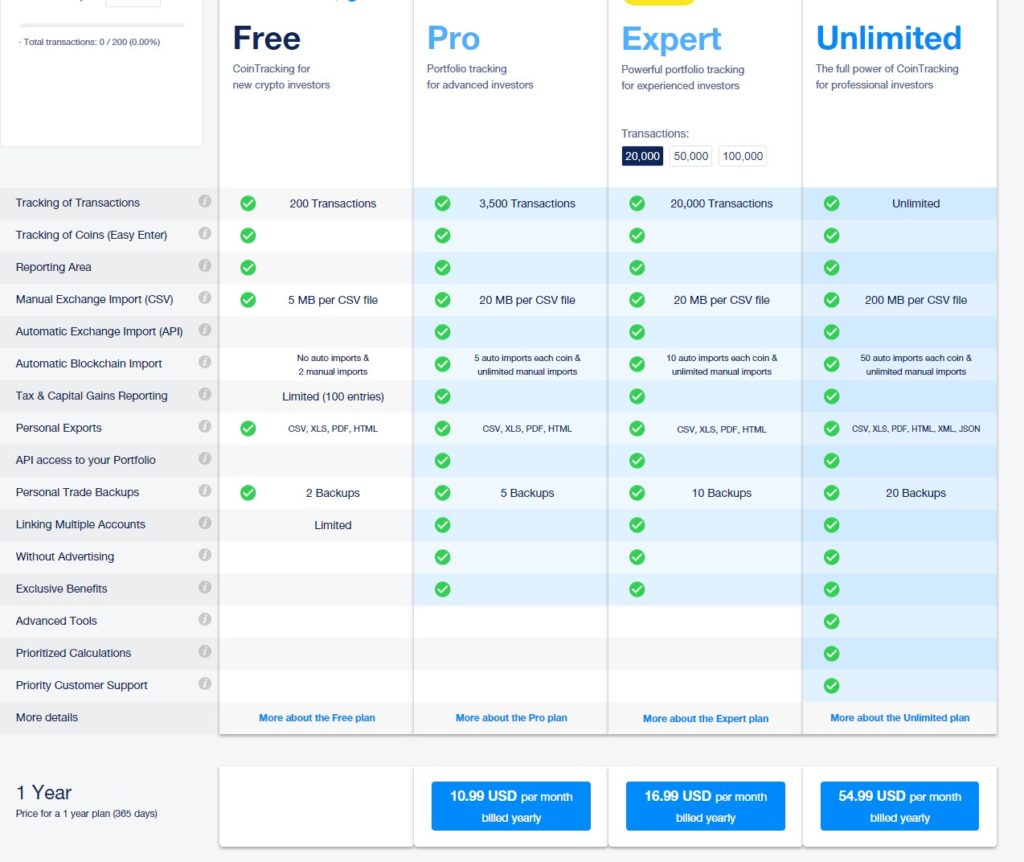

Pricing

- Free – $0/month – Up to 200 transactions

- Pro – $10.99/month – Up to 3,500 transactions and automatic exchange and blockchain imports

- Expert – $16.99/month – Up to 20,000 transactions and automatic exchange and blockchain imports

- Unlimited – $54.99/month – Unlimited transactions, automatic exchange and blockchain imports, and priority customer service

Bottom Line

If you’re looking for a comprehensive and user-friendly cryptocurrency tax software, CoinTracking is definitely worth checking out. It’s one of the most popular options on the market, and for a good reason – it’s packed with features and supports an impressive range of cryptocurrencies. Good for more than just tax reporting, Coin Tracking also boasts 25 customizable crypto reports to improve your trading.

Bitcoin Taxes

Bitcoin Taxes is a tax software that helps you track your gains and losses from trading cryptocurrencies. It connects to all major exchanges and wallets, so you can see your complete transaction history, calculate your capital gains and losses for each tax year, and easily file your tax reports.

Highlights

- Comprehensive knowledge base

- Affordable service, especially compared to competitors

- Offers an Audit-Defense service

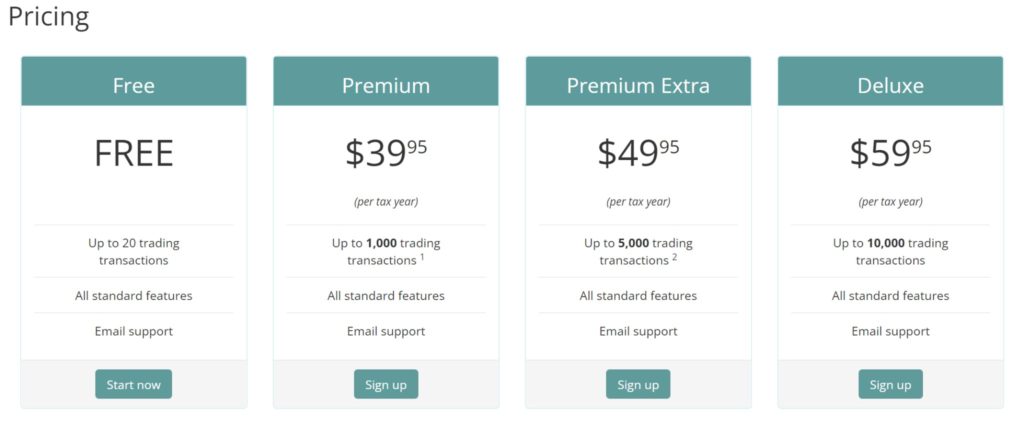

Pricing

- Free – $0 – Up to 20 transactions

- Premium – $39.95 – Up to 1,000 transactions

- Premium Extra – $49.95 – Up to 5,000 transactions

- Deluxe – $59.95 – Up to 10,000 transactions

Bottom Line

Bitcoin Taxes is an affordable tax software for both retail traders and professionals. You can file your crypto taxes with their self-service product, or you can put them in the hands of a professional. Bitcoin Taxes offers a full tax preparation service as well as an audit defense service, making them perfect for newbies and high volume traders alike.

Bear.Tax

Bear.Tax is an easy-to-use crypto tax software for individuals who do want to file their crypto taxes efficiently. In three short steps, users can import their trades, review the results, and download tax documents. The user-friendly interface offers an audit helper and autogenerated documents to complete your tax reports quickly and accurately.

Highlights

- Imports data from most crypto exchanges around the world

- Built by accounting and tax professionals

- 24/7 customer support

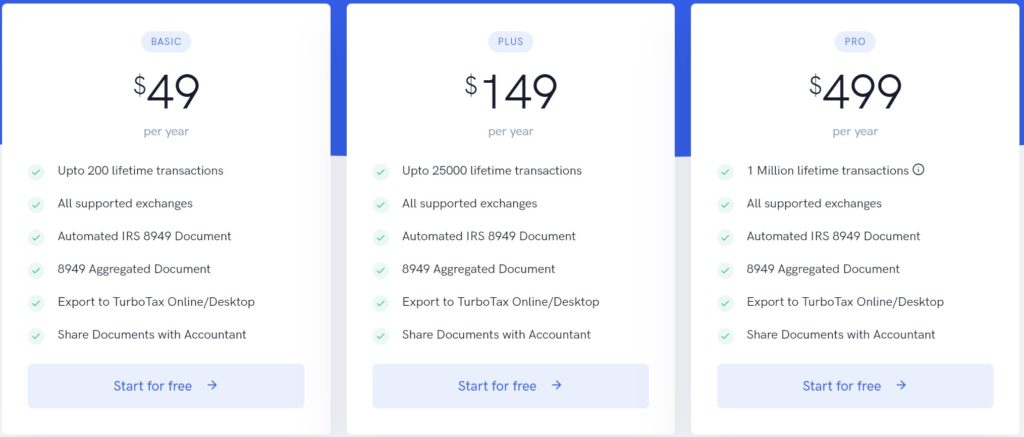

Pricing

- Basic – $49 – Up to 200 lifetime transactions

- Plus – $149 – Up to 25,000 lifetime transactions

- Pro – $499 – Up to 1 million lifetime transactions

Bottom Line

If you’re looking for a comprehensive crypto tax software that boasts professional accounting help, Bear.Tax is the best crypto tax software for you. With a 100% customer satisfaction rating and over 100 million crypto transactions processed, Bear.Tax is quickly becoming a go-to solution for filing crypto taxes.

CryptoTrader.Tax (rebranding to Coin Ledger)

CryptoTrader.Tax is easy to use, and it integrates with major cryptocurrency exchanges so you can automatically import your transaction data. The software also provides detailed reports that can be helpful for filing and in the event of an audit.

Highlights

- Integrates with more than 100 crypto exchanges

- Offers a tax loss harvesting feature

- Free test calculator

- Complete audit support

- Supports numerous currencies around the world

- Most “premium” services are cheaper than competitors

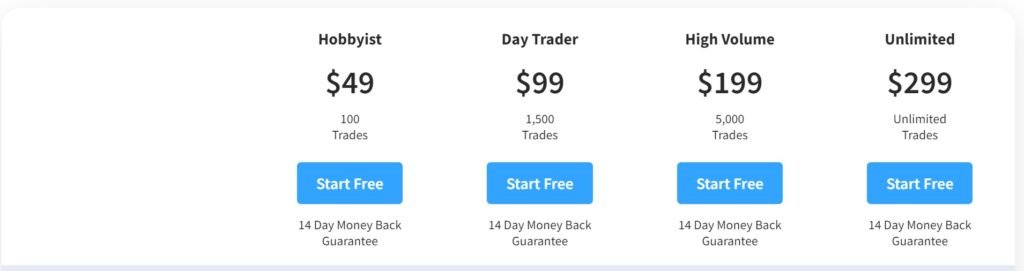

Pricing

- Hobbyist – $49 – Up to 100 trades

- Day Trader – $99 – Up to 1,500 trades

- High Volume – $199 – Up to 5,000 trades

- Unlimited – $299 – Unlimited trades

Bottom Line

CryptoTrader.Tax is a great option at a reasonable price point for most traditional cryptocurrency traders. Also, it offers a growing number of DeFi integrations and a crypto tax app is reportedly coming soon.

Crypto Tax Calculator

Crypto Tax Calculator is a web-based software that allows users to upload their transaction data and generate capital gains tax reports. The software supports 500+ exchanges and wallets, making it one of the most comprehensive crypto tax solutions on the market.

One of the best things about Crypto Tax Calculator is that it’s very user-friendly. The interface is clean and easy to navigate, and the software does a great job of walking users through each step of the tax filing process.

Highlights

- Integrates with all major exchanges

- Calculates staking and mining earnings

- Widely supported outside the US

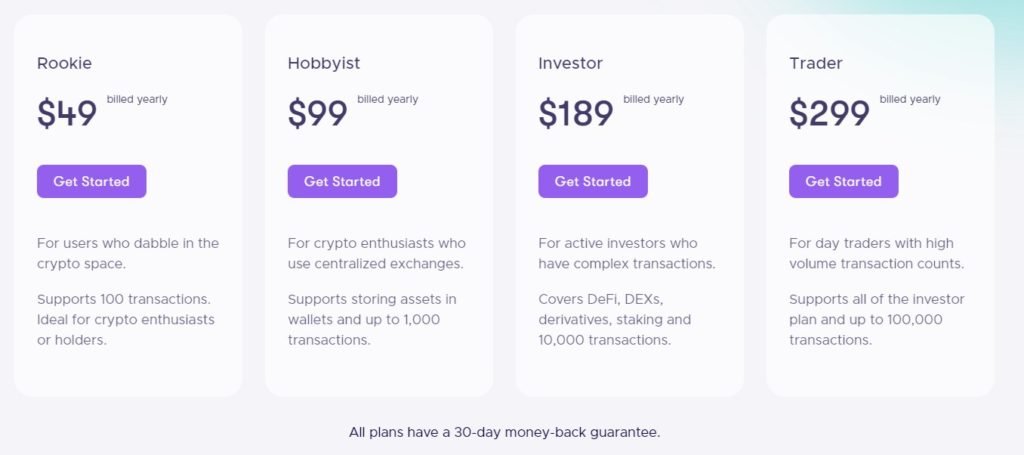

Pricing

- Rookie – $49 – Up to 100 transactions

- Hobbyist – $99 – Up to 1000 transactions

- Investor – $189 – Up to 10,000 transactions, and supports DeFi transactions

- Trader – $299 – Up to 100,000 transactions, and supports DeFi transactions

Bottom Line

Crypto Tax Calculator is the right choice for diversified crypto investors who earn in a variety of ways. With support for staking, mining, and trading transactions, it’s a well-rounded platform that makes filing your tax reports simple.

Coin Tracker

Coin Tracker offers a wide range of features and supports major exchanges, making it ideal for those who trade frequently or have complex portfolios. One of the standout features of Coin Tracker is its automated transaction and portfolio tracking. The software continuously monitors and updates your assets and tax liability, saving you a lot of time and hassle.

Highlights

- Available on a mobile app

- Supports over 10,000 crypto assets

- Integrates with TurboTax and H&R Block

- Offers a tax loss harvesting tool

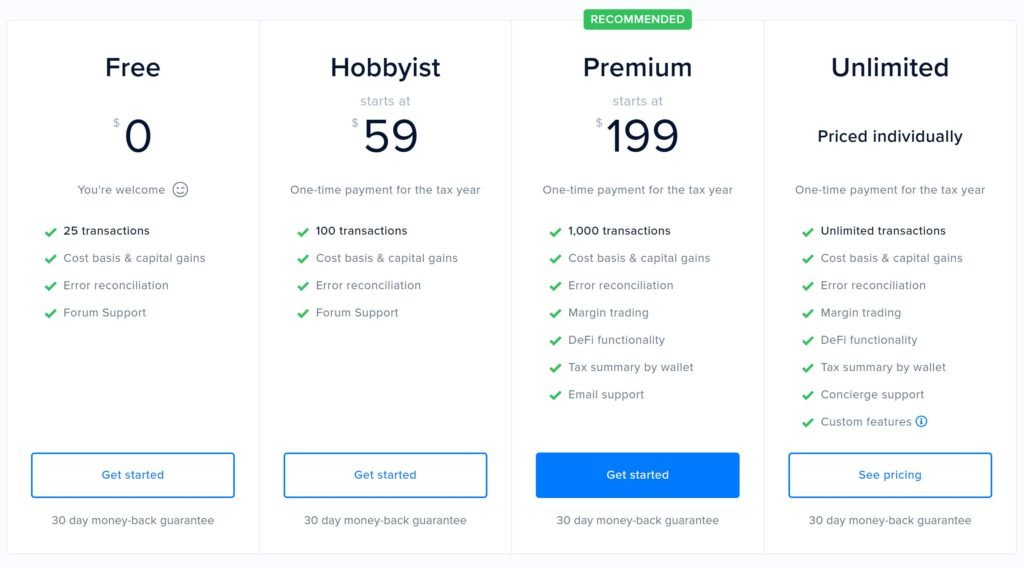

Pricing

- Free – $0 – Up to 25 transactions

- Hobbyist – $59 – Up to 100 transactions

- Premium – $199 – Up to 1,000 transactions, and includes DeFi support

- Unlimited – Priced individually – Unlimited transactions

Bottom Line

Coin Tracker’s user-friendly platform is already trusted by over 1 million users. Although it’s on the pricier side, Coin Tracker does offer both automated error reconciliation and DeFi support unlike many competitors.

Cointelli

Cointelli offers very competitive pricing and covers all transaction types including DeFi, staking, NFTs, and more. For up to 100,000 transactions at one flat rate, you can calculate your crypto taxes and generate tax reports with the help of 50+ video tutorials.

Highlights

- Flat rate pricing for up to 100,000 transactions

- Supports over 100 wallets and exchanges

- Built by CPAs and tech experts

- Informative blog and self-help video resources

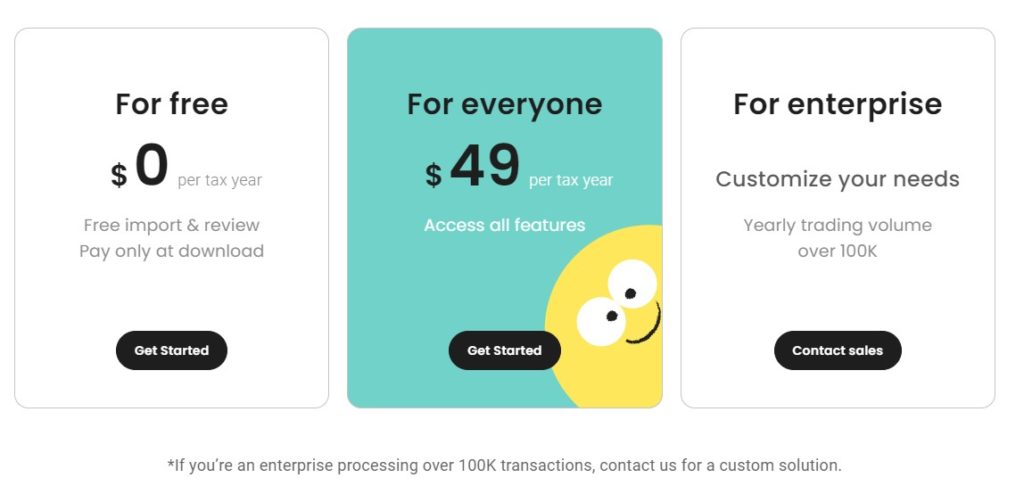

Pricing

- For Free – $0 – Free to import transactions and review your tax report

- For Everyone – $49 – Access all features

- For Enterprise – Priced individually – For enterprises with a yearly trading volume of over 100,000 transactions

Bottom Line

Cointelli is the new kid on the block, but they offer a price that cannot be beaten. Although they offer fewer integrations than some competitors, they do have every major exchange and wallet covered. For many crypto traders, Cointelli’s easy-to-use software offers a great way to save money this tax season.

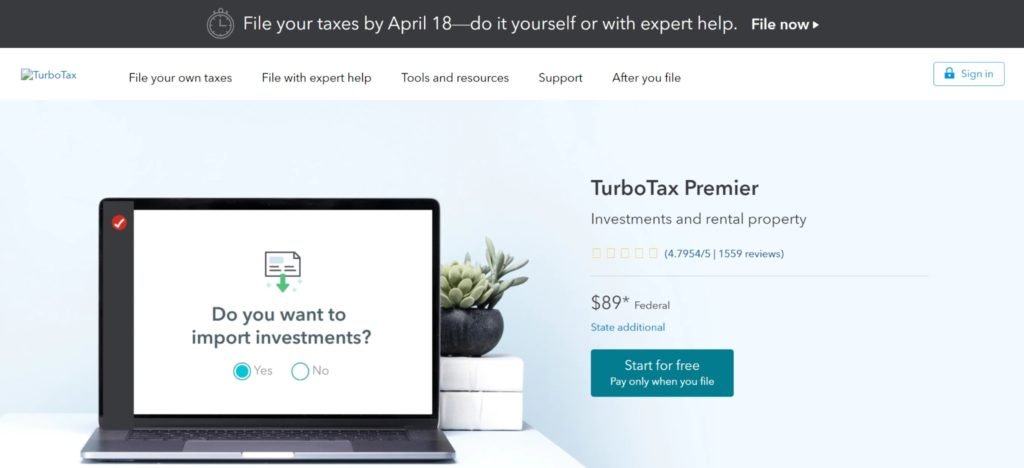

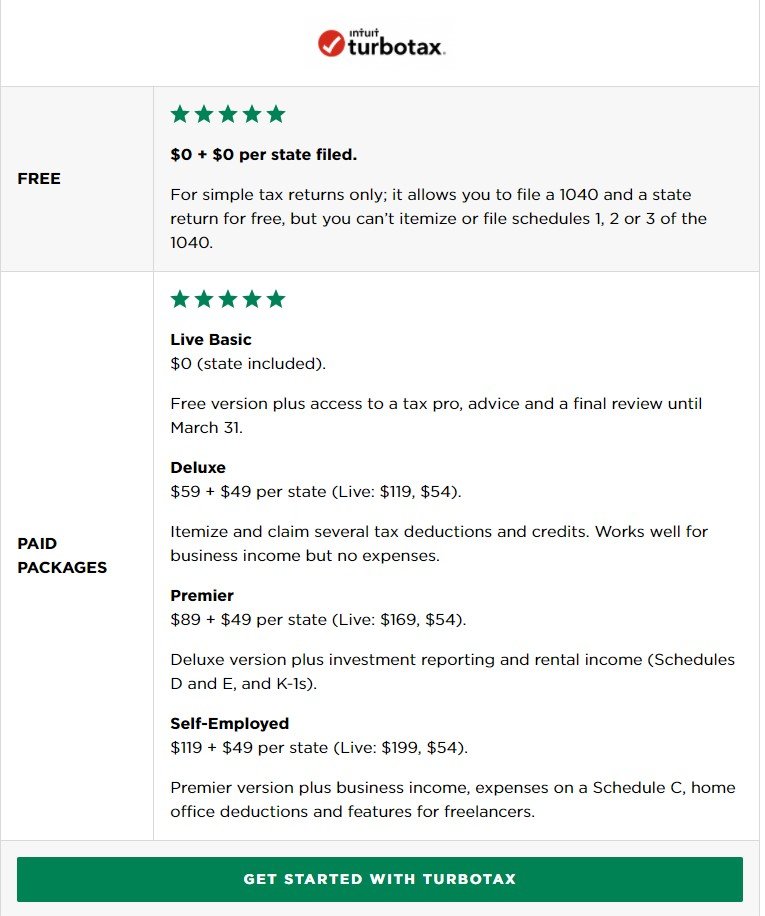

Turbo Tax

TurboTax is a well-known tax service, but not everyone realizes that they offer crypto tax software as well. For infrequent traders, the software might be a little pricier than others but it does include a full-service tax solution and the option to speak with certified professionals one-on-one.

Highlights

- Easy to use interface

- One-on-one help from certified professionals

- Includes rental property taxes

- Enables you to switch over easily from another provider

Pricing

- Live Basic – $0 – Currently offered free version for simple tax returns only

- Premier – $89 – Covers investment reporting and rental income, which includes up to 4,000 cryptocurrency transactions

Bottom Line

TurboTax is a good solution for first-time crypto tax filers and those who already use a TurboTax product. While the service is not crypto-specific, TurboTax is capable of importing up to 4,000 transactions from most exchanges and offers an in-depth Crypto Tax Guide.

What is crypto tax software?

Crypto tax software is a tool that helps you calculate your cryptocurrency taxes. This software takes into account all of your trading activity over the course of a tax year and calculates your total capital gain or loss. This information can then be used to generate and file the appropriate tax reports for your jurisdiction.

Cryptocurrency tax software is an essential tool for anyone who trades digital assets. The software makes it easy to track your activity and calculate your tax liability. Without it, you would have to manually calculate the gain or loss associated with each individual crypto transaction, which could be extremely time-consuming and more prone to errors.

What should you look for in crypto tax software?

When it comes to crypto tax software, there are a few key features you should look for. First and foremost, the software should be straightforward and easy to use. After completing the import process, you will want to sanity-check your results and feel confident that your tax reports have been completed correctly.

Also, the best crypto tax software for you is the one that’s tailored to your needs. Whether you’re an active trader, a miner, or DeFi investor, you want a software that supports and guides you through all of the exchanges, currencies, and types of transactions you use.

Finally, consider all of the provider’s pricing tiers. Continuing to use the same tax software in future tax years is much easier than frequently migrating, so take a look at how many transactions you processed this year and how many you’re likely to process in coming years. Look at features you use now and features you’re likely to use in the future. These considerations may help you determine which is the best crypto tax software for you.

Crypto Tax Software FAQ:

How does crypto tax software work?

Crypto tax software works by importing all of your crypto transactions from exchanges and wallets, calculating your realized gains and losses, and helping you to determine your tax liability.

Some software may also offer tax loss harvesting tools and other advanced features. When selecting the best crypto tax software for your needs, it’s important to consider your specific circumstances. For example, U.S. taxpayers need a solution that supports Form 8949.

Is crypto tax software safe?

In general, crypto tax software is safe as it aggregates data that is already publicly available on blockchains. However, there are a few things you should keep in mind before using any program.

First of all, make sure that you only use a reputable and well-reviewed program. There are many scams in the cryptocurrency ecosystem, so it’s important to remain vigilant. Secondly, remember that even the best crypto tax software can make mistakes. So, be sure to double-check your calculations and ensure that the final result passes the smell test before sending any money to the IRS.

And finally, don’t forget that you’re ultimately responsible for the accuracy of your tax return. It’s always best to consult with a tax professional if you have any concerns with your crypto taxes.

Do I have to pay taxes on my crypto?

The short answer is: it depends. You do need to pay taxes on your crypto earnings as the IRS has classified cryptocurrencies as property. This makes cryptocurrency taxable under the law.

However, this only applies to realized gains or losses. Unrealized gains are not taxed, which means that simply buying and holding cryptocurrencies will not subject you to any taxes.

If you do owe taxes on your crypto earnings, you will first need to calculate your total tax liability from all crypto transactions. Then you must report these crypto earnings (or losses) to the IRS using Form 8949. We recommend using Koinly, the overall best crypto tax software we’ve reviewed.

Which crypto transactions are taxable?

Not all crypto transactions are taxable. Buying crypto, gifting crypto, and transferring like-for-like assets between exchanges are non-taxable events.

On the other hand, selling crypto for cash, trading one cryptocurrency for another, or using crypto as a means of payment are transactions that all taxable as property. Further, mining or staking crypto, receiving airdrops, and getting paid in crypto is taxable as income.

Is transferring crypto from wallet to wallet taxable?

Transferring crypto from one wallet to another wallet is not taxable if you own or control both wallets. Transferring crypto from your own wallet to a merchant’s wallet with the goal of payment, however, is a taxable event.

What is FIFO vs LIFO vs HIFO?

FIFO, LIFO, and HIFO are three different ways to determine the tax basis of your cryptocurrency holdings. FIFO stands for “first in, first out,” meaning that your oldest purchases are considered sold first. LIFO stands for “last in, first out,” meaning that your most recent purchases are considered sold first. HIFO stands for “highest in, first out,” meaning that your highest priced purchases are considered sold first.

These three calculation methods typically result in different tax liabilities. Once you determine the method you’d like to use, be sure to apply it consistently going forward.

Do I have to pay taxes on bitcoin?

No, you do not have to pay taxes on bitcoin alone per se. Buying and holding bitcoin is an excellent long-term accumulation strategy that incurs no taxes. However, if you profit from selling bitcoin, you may be subject to capital gains taxes. Also, if you earn money by lending, staking, or mining bitcoin, you will have to calculate and report your earnings.

Depending on your crypto strategy and how many crypto transactions you have processed, the guide above can help determine the best crypto tax software for you.

How is bitcoin taxed?

The latest IRS guidance treats bitcoin and other cryptocurrencies like property, rather than currency, for tax purposes. This means that any gains or losses from transacting in bitcoin are subject to taxation.

However, not all cryptocurrency transactions are considered taxable. If you’re unsure about your crypto taxes, consider testing the free trial with Koinly. We consider them the best crypto tax software in 2024 and they can help determine if you have a crypto tax liability.